- Stellar’s golden cross and $0.33 support suggest potential recovery to $0.45 and beyond.

- Historical 3,162% XLM gains fuel $2.19 price target as investors withdraw $3.37 million from exchanges.

As a seasoned crypto investor with over a decade of experience in navigating the ever-changing landscape of digital currencies, I find myself intrigued by the latest analysis surrounding Stellar (XLM). While short-term fluctuations can be unnerving for many, the technical indicators and historical performance data suggest that XLM may be poised for a comeback.

At this moment, Stellar (XLM) has pulled back from some of its earlier advancements, currently trading at $0.4255. This decrease translates to a 0.96% drop within the last day and a more substantial 9.09% fall over the past week.

Currently, Stellar Lumens (XLM) has a total circulating amount of about 30 billion coins. This, combined with its current market price, gives it a total market capitalization of approximately $12.79 billion.

Although there’s a temporary dip, experts suggest keeping a close eye on this asset due to its past trends and current technical signals.

Technical indicators point to potential upside

In simpler terms, the 13-day trend line for Stellar has crossed above its 49-day trend line, which is referred to as a “golden cross” in technical analysis.

It’s generally considered that this trend indicates a possible surge in value, but unfortunately, the price of XLM has pulled back from its peak in November at $0.60 and is currently hovering around $0.42, suggesting a period of stability rather than immediate upward movement.

There appears to be strong backing for the asset around the $0.33 mark, which is close to its 49-day moving average. If the price declines further, potential buyers could enter the market. The Relative Strength Index (RSI) was at 52.40, indicating a balanced movement in either direction.

After the RSI dropped from excessively high levels in November, buyers continue to stay active. Some analysts believe that if XLM maintains its position above the range of $0.33 to $0.42, there might be a possibility for a recovery toward $0.45 or even higher prices.

Historical data fuels optimism for future growth

Looking at Stellar’s (XLM) past performance can give us an idea of its possible future price trend. For instance, during the bull run between 2020 and 2021, Stellar increased significantly from around $0.025 to a high of $0.79, which translates to a staggering increase of over 3,162.88%.

Experts suggest there could be a rise towards $2.19 or even $2.27 in the future prices. However, whether we reach these levels will hinge upon overall market trends and investor attitudes.

Crypto analyst EGRAG CRYPTO has compared this potential rally to past price movements, stating,

“We’ve just touched the Mouse’s Moustache, and now it’s time to build momentum!”

EGRAG emphasized the significance of reassessing crucial Exponential Moving Averages (EMAs) since XLM aims to surpass significant resistance points.

Market sentiment shows mixed signals

The latest Coinglass figures show a decline of approximately 30.20% in trading volume, currently standing at about $614.82 million, as well as a dip of 4.89% in open interest, signaling less market engagement.

Regardless, the long/short ratios on Binance and OKX indicate a predominantly optimistic outlook among traders. On Binance, the leading traders are more inclined towards long positions, holding them at a ratio of approximately 2.34 times that of short positions.

In the last 24 hours, information on liquidations shows that a total of approximately $621,130 was wiped out, and most of it ($552,630) came from long positions. This suggests potential dangers related to over-leveraging in these positions.

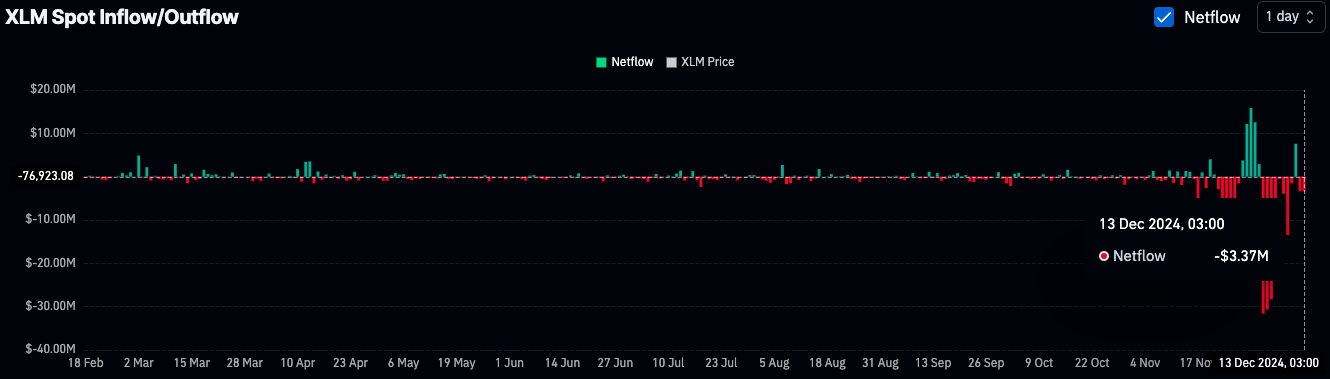

On the 13th of December, figures from the spot market indicate a total withdrawal of approximately $3.37 million, with funds continuing to exit exchanges.

Read Stellar’s [XLM] Price Prediction 2024–2025

Such outflows often suggest accumulation by investors, potentially reducing sell pressure on XLM.

Despite a recent drop in XLM’s price, historical data, technical signals, and persistent buying patterns hint at the possibility of a resurgence in its momentum.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

- Quick Guide: Finding Garlic in Oblivion Remastered

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

2024-12-14 07:04