- Stellar’s $0.39 support aligns with key Fibonacci levels, signaling oversold conditions and rebound potential.

- XLM Long/Short Ratios show bullish trader confidence despite declining trading volume and heightened market volatility.

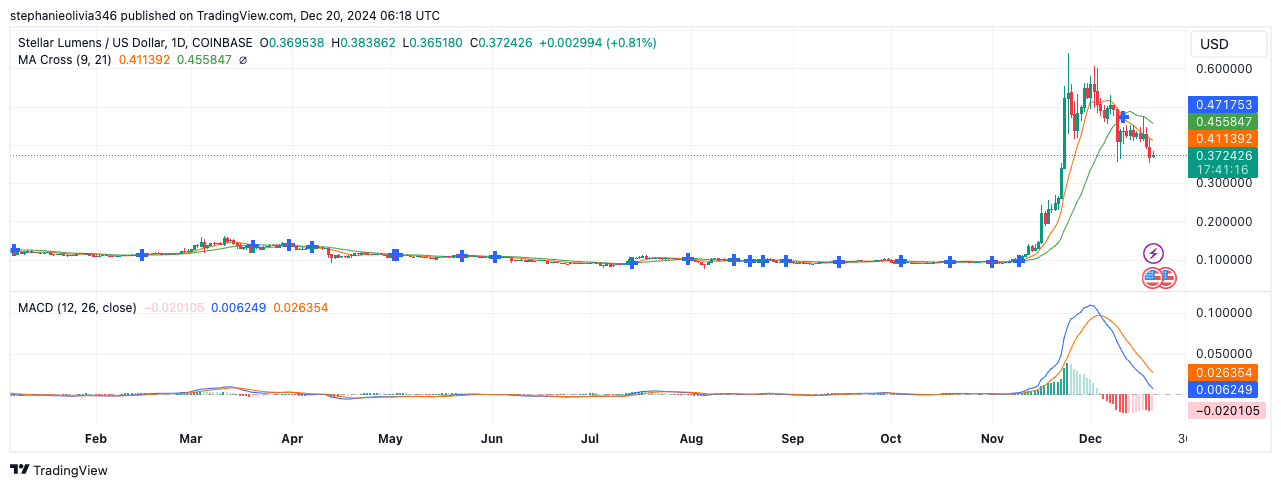

As a seasoned analyst with over a decade of market observation under my belt, I find the current state of Stellar (XLM) intriguing. The $0.39 support aligning with key Fibonacci levels and the oversold conditions it signifies point to a potential rebound in the near future. However, the cryptocurrency’s 8.28% dip in the last 24 hours and the 10.36% decrease over the past week is a reminder that even the most calculated predictions can be swayed by market volatility.

At the moment of reporting, Stellar’s XLM was being exchanged for approximately $0.3728. Over the last 24 hours, this digital currency experienced a decrease of around 8.28%. Additionally, its value has decreased by roughly 10.36% over the past week.

Even though there are temporary setbacks, experts believe that the digital currency is getting close to an essential support point at around $0.3851. This potential level might trigger a robust recovery.

As a crypto investor, I’ve noticed that this particular support level has historically piqued buyer interest, as highlighted in my recent analysis. The potential upside targets, based on past trends, are at $0.6396 and $0.8278. If the current downtrend reverses, these levels could present significant growth opportunities.

Maintaining the $0.3851 level will be critical for any bullish recovery to materialize.

Technical indicators suggest oversold conditions

The current drop in prices is occurring within a larger downward correction, which started after a strong surge in late November.

The Fibonacci retracement analysis indicates that a potential support level at $0.3851 lines up with the 0.786 retracement level, often suggesting that the market may be overbought or undervalued, in this case, possibly oversold.

Furthermore, the MACD (12, 26) chart pattern shows a downward cross, where the MACD line dips beneath the signal line. This is reinforced by the histogram displaying negative values, suggesting a brief period of downward price movement.

Technical analysts believe that if prices hold steady at their current low levels (support), it may trigger an upward trend (bullish reversal) in the coming days. This is likely to happen only if the technical indicators show a positive movement soon.

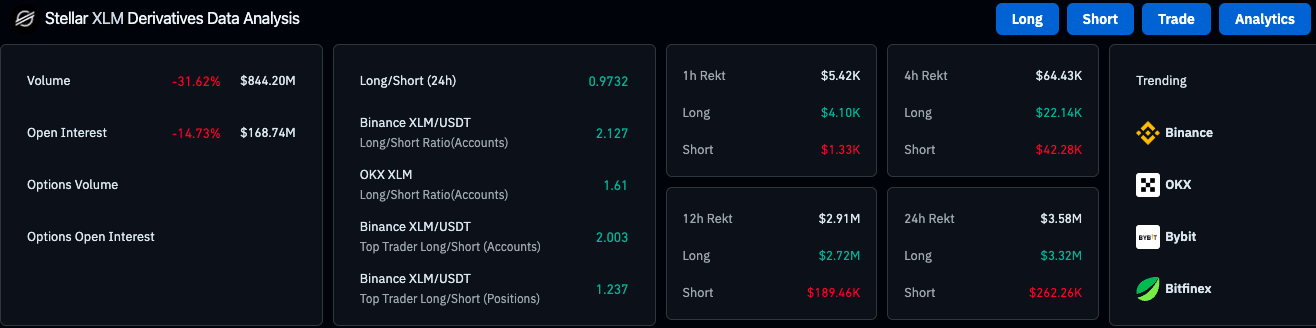

Derivatives data indicates bullish bias despite lower activity

The market for Stellar Lumens (XLM) derivative contracts has experienced a decrease in activity, as trading volume dropped approximately 31.62% to about $844.20 million and open interest tumbled by nearly 14.73% to around $168.74 million.

Even though there’s a decrease, the Long/Short Ratios on Binance and OKX suggest a predominantly bullish sentiment. On Binance, the ratios exceed 2.0, which means more traders are opting for long positions rather than short ones.

24-hour liquidation figures indicate an increase in market turbulence, as there were approximately $3.58 million worth of positions closed out. The majority of these liquidations affected long positions.

This imbalance indicates that traders are feeling confident, yet it’s a reminder to exercise caution since the market continues to be extremely sensitive or responsive.

On-chain data and broader ecosystem metrics

According to data provided by DeFiLlama, the current Total Value Locked (TVL) in Stellar is approximately $46.53 million. This figure represents a decrease of 4.21% compared to the previous 24-hour period.

The financial ecosystem built by Stellar showcases a market capitalization of $143.09M for its stablecoins, while also successfully raising $3M. This demonstrates the practicality of Stellar within the field of decentralized finance.

Read Stellar’s [XLM] Price Prediction 2024–2025

In the coming days, whether Stellar can sustain its position at around $0.3851 could significantly influence its future price direction.

Currently, the cryptocurrency boasts a circulating supply of approximately 30 billion XLM, which equates to a market capitalization exceeding $11.53 billion. If the projected recovery takes place, there’s room for this digital currency to grow further.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-12-20 15:04