- Stellar annual event triggered slight interest in its native token XLM.

- Will the September trend repeat and extend XLM’s recovery to 10%?

As a researcher with years of experience in the crypto space, I find myself intrigued by the recent performance of XLM following the Stellar Meridian 2024 conference. While it’s always exciting to see the blockchain community come together, the modest 8% jump in XLM seems to suggest that the September trend might not repeat this time around.

The Stellar blockchain, recognized for its efficient cross-border transaction capabilities, experienced a minor increase in its native currency, XLM, post the conclusion of the Meridian 2024 conference held in London, United Kingdom.

The annual event always showcases the chain’s development and new partnerships, especially in the payment ecosystem. However, despite the latest collaborations with MoneyGram, Paxos, and others, XLM only had a modest 8% jump.

Can XLM push forward?

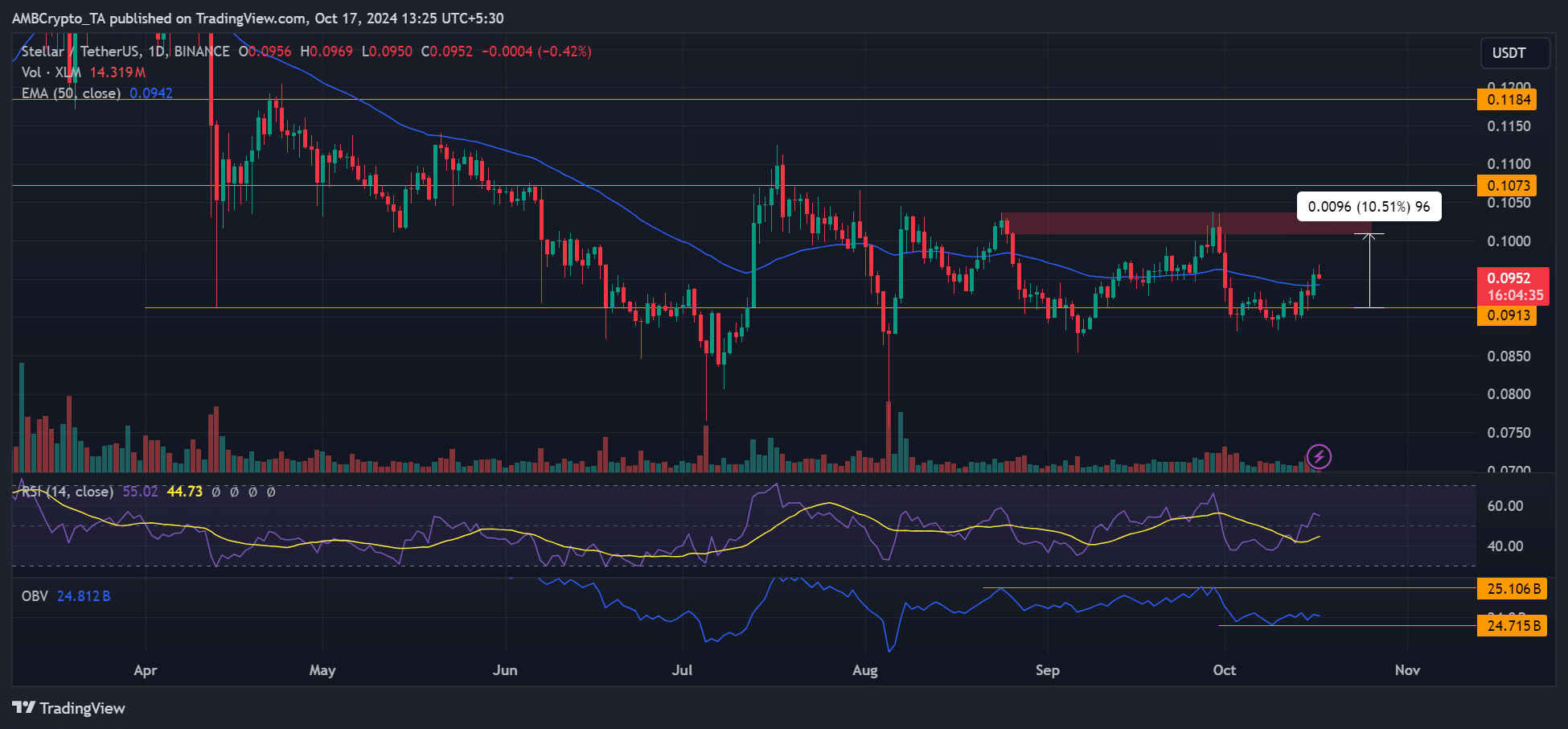

After the significant drop in price during August, XLM has remained relatively stable within a narrow band, spanning from approximately 0.09 to 0.10 USD. Notably, throughout this duration, the 0.10 level has functioned as a local area of high supply (indicated in red).

Currently, XLM has regained its 50-day Exponential Moving Average (EMA), a significant milestone last achieved in September. Since then, it held steady around this dynamic support level, eventually rising towards the current local resistance zone priced at approximately $0.1.

If the current pattern continues, XLM might maintain a position close to its 50-day Exponential Moving Average (EMA) before potentially increasing its October rebound by 11%. The RSI’s upward trajectory suggests gradual and persistent buying interest in the altcoin, lending credence to the bullish perspective.

Yet, the On-Balance Volume (OBV) remained relatively low and fell short of its September high, suggesting that a robust bullish momentum hadn’t fully materialized yet.

Stellar event impact

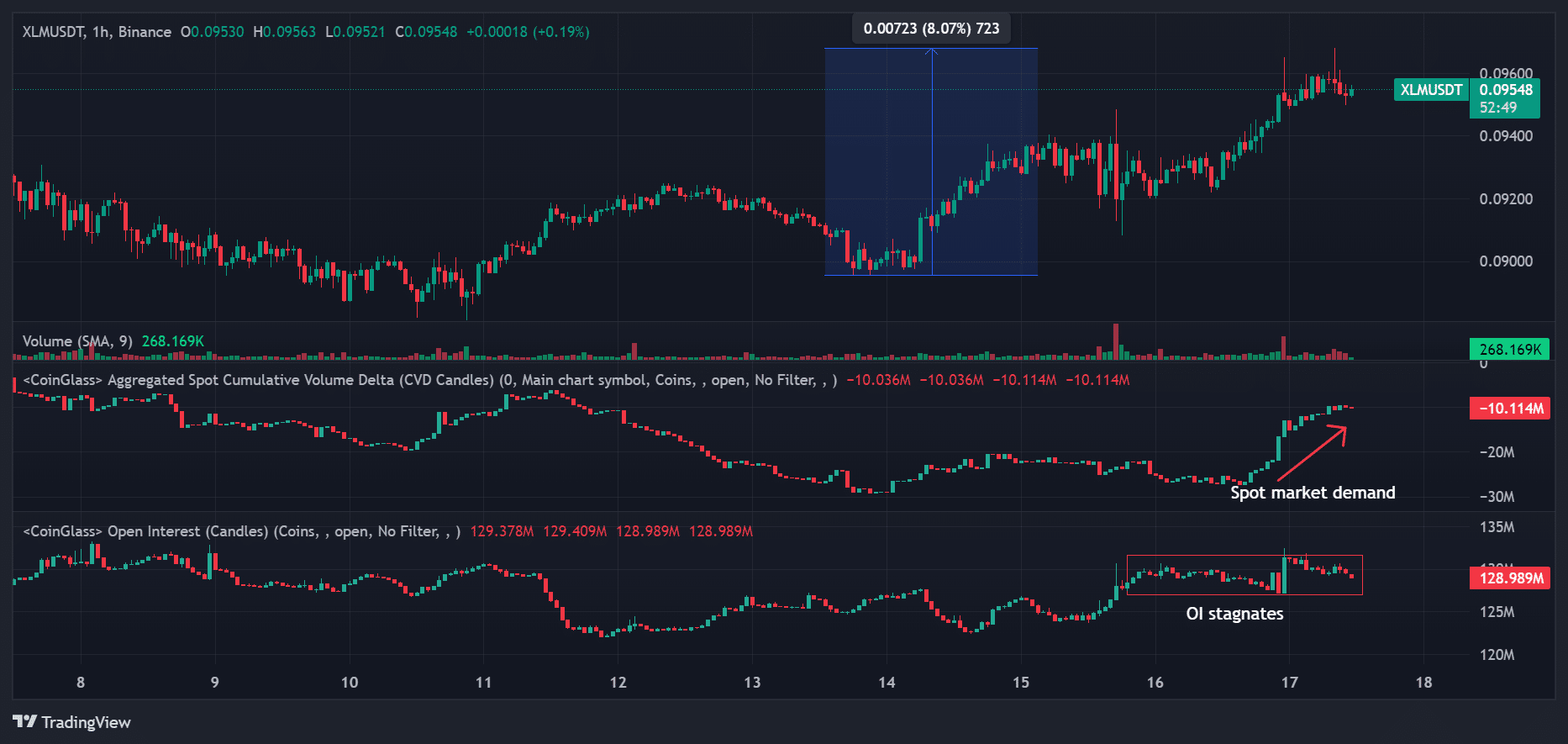

At the yearly Stellar conference, which took place from October 15th to 17th, there was a notable increase in the desire for XLM in the current market and a growing curiosity about the futures market.

The CVD (Cumulative Volume Delta) spiked, illustrating increased spot market demand.

Additionally, the open interest increased from $123 million to $132 million, suggesting that there’s significant enthusiasm among traders in the futures market regarding the asset. Consequently, it can be inferred that this development may have slightly stimulated the XLM market.

Read Stellar [XLM] Price Prediction 2024-2025

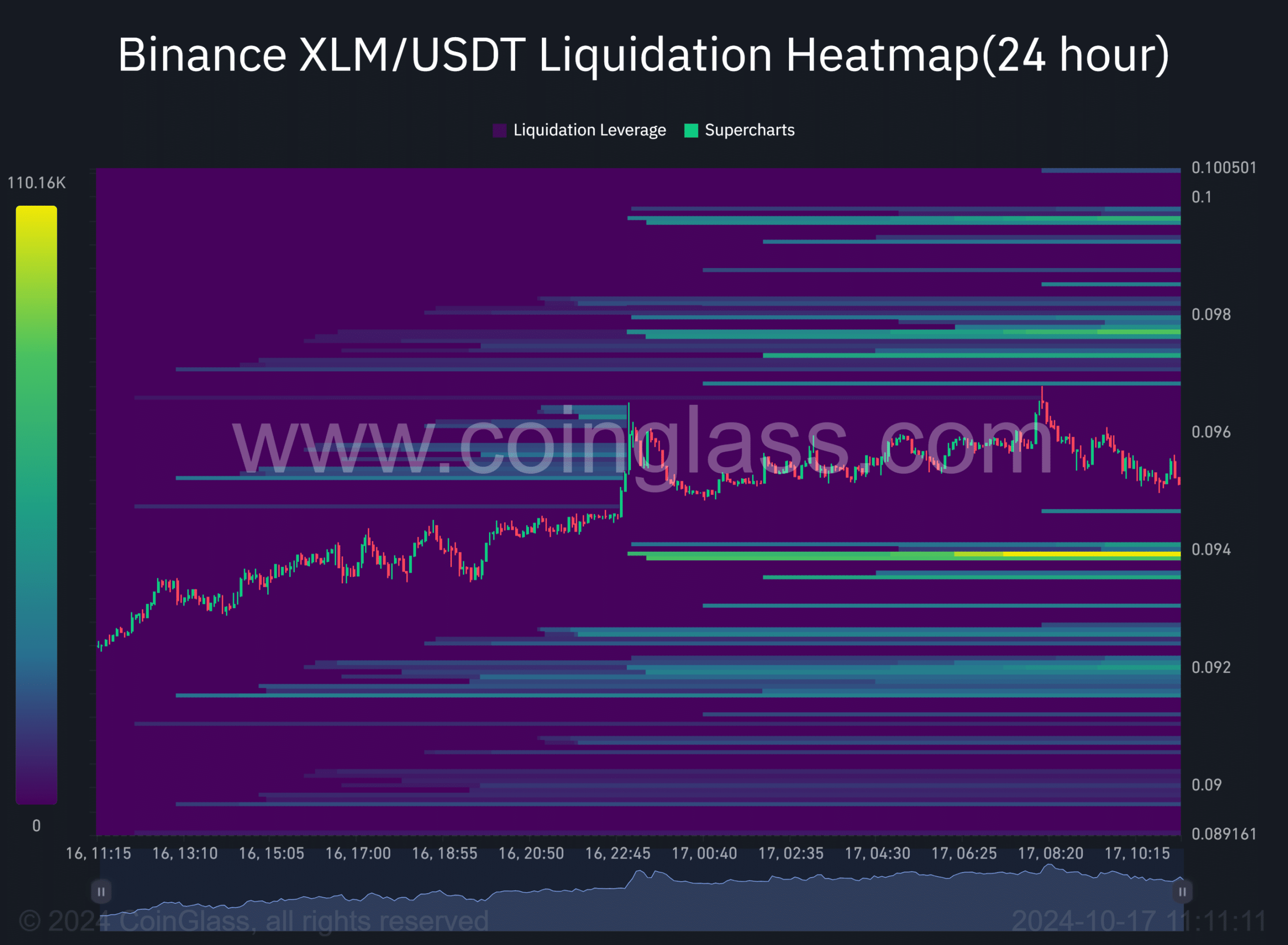

In summary, the XLM liquidation heatmap backed up the conclusions drawn from our price analysis. It’s worth mentioning that a large number of long positions (clearly visible cluster) were present at $0.094, which aligns with the 50-day Exponential Moving Average. Consequently, this level may potentially function as a short-term support.

In a similar fashion, there was an increase in short positions when the overhead levels reached $0.1 and $0.098. These levels coincided with the local supply zone, making them important points to monitor in the near future.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-10-17 19:03