Markets

What to know:

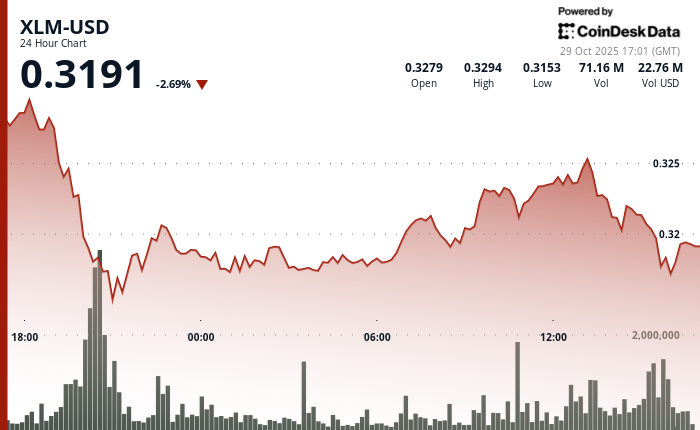

- XLM ascended like a determined pigeon, up 1.53% to $0.319 with trading volume eclipsing the 30-day average by 134%. 🐦💰

- Technical analysis unveils a dignified ballet of institutional buying, sans speculative gymnastics. 🕺🎭

- Expectation for the Protocol 24 upgrade and robust growth in RWA tokenization spark a glimmer of hope. 🌟

In the last 24 hours, Stellar Lumens (XLM) muscled its way up by 1.53%, shuffling from $0.3168 to $0.3177, all while trading volume did a happy dance 134% above its 30-day average. This skilled pricing waltz amidst hefty volume shouts institutional accumulation, leaving the retail crowd dazed and confused. 🍾🤷♂️

XLM has strut its stuff better than a mid-level rock band at a county fair, outperforming the broader crypto market by 1.23%. It cozied up between $0.315 and $0.325 after bouncing off a minor low of $0.3162. With short-term volume fading like yesterday’s news, it seems distribution is taking a break, and a solid support wall is forming above $0.32. Just in time for the much-anticipated Protocol 24 upgrade! 🎉

A surge in volume without the usual price rollercoaster suggests we’re in for a sustainable ride, courtesy of steady institutional buying. Meanwhile, Stellar’s domain grows larger, now boasting $639 million in tokenized assets-an impressive 26% increase this month, led by Franklin Templeton’s eye-popping $446 million tokenized treasury fund. Now that’s a generous helping of risotto! 🍚💸

XLM Technical Overview

- Support / Resistance

- Primary support: $0.316

- Immediate resistance: $0.325

- Broader range: $0.31 – $0.33

- Volume Analysis

- A staggering 134% leap above 30-day average volume

- All while modest price gains threw a party

- Whispers of institutional accumulation overshadowing the retail rollercoaster

- Chart Patterns

- Oh look, volume-price divergence has made an entrance!

- Indicates a meticulous buying activity, like a cat stalking its prey

- Might herald an expansion of volatility akin to bursting popcorn! 🍿

- Targets & Risk/Reward

- A breakout above $0.325 could send us to the alluring $0.35 – $0.40 range

- Downside risk comfortingly snug in the $0.31 support zone

Read More

- How to Get the Bloodfeather Set in Enshrouded

- The Best Members of the Flash Family

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Best Controller Settings for ARC Raiders

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- Duffer Brothers Discuss ‘Stranger Things’ Season 1 Vecna Theory

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Mini Review: Milano’s Odd Job Collection (PS5) – A Quirky PS1 Time Capsule Reopened

- Escape From Tarkov 1.0 Must Reward Its Players, or Lose Them

2025-10-29 22:09