-

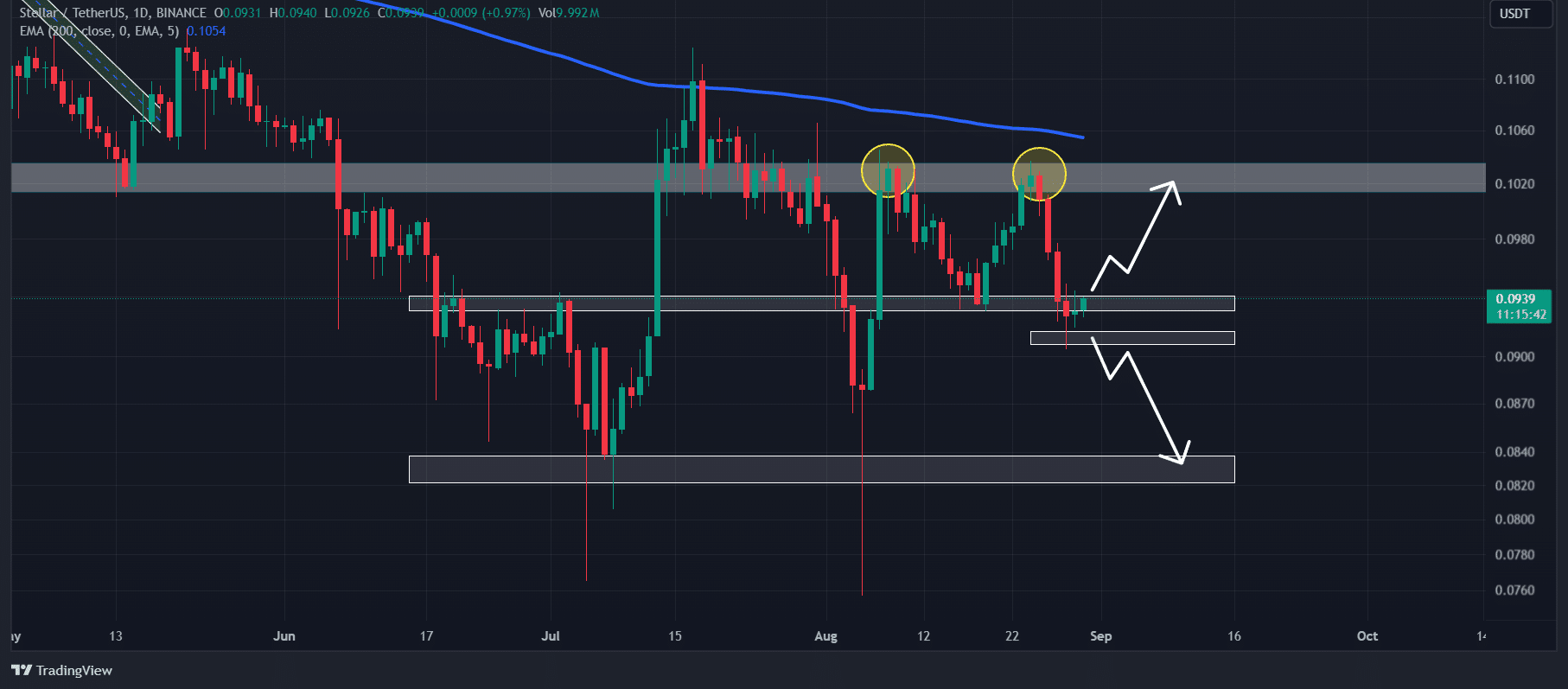

XLM was trading below the 200 Exponential Moving Average (EMA) on the daily timeframe

XLM’s price could decline by 12% to $0.083 if it closes a daily candle below $0.0915

As a seasoned crypto investor with battle-tested nerves and a knack for recognizing bearish patterns, I find myself cautiously eying Stellar (XLM) at this juncture. The double-top breakdown coupled with its trading below the 200 EMA on the daily timeframe paints a grim picture indeed. It’s like watching the Jaws movie for the umpteenth time, knowing the shark is lurking just around the corner but hoping against hope that this time, it might be a harmless dolphin instead.

As a crypto investor, I’m observing Stellar (XLM) at the moment, and it appears to be readying for a possible downturn following its break below a double-top price pattern. Given the current bearish climate in the crypto market, this development is particularly noteworthy. Notably, top cryptocurrencies have been experiencing substantial selling pressure lately.

Double-top breakdown signals a bearish outlook

According to price movements and technical examination, a double top pattern indicates a bearish trend that might lead to a sudden drop in price once it falls below its connecting line (neckline).

Beyond the pessimistic stance suggested by the price action, XLM is also trading beneath its 200-day Exponential Moving Average (EMA), suggesting a persistent downward trend on a daily scale.

Due to several influencing factors, it’s likely that the value of XLM might drop around 12%, reaching approximately $0.083 within the near future. But, traders are advised to hold off on making any moves until the day ends and the price dips below $0.0915.

If this happens, it would confirm a successful breakdown.

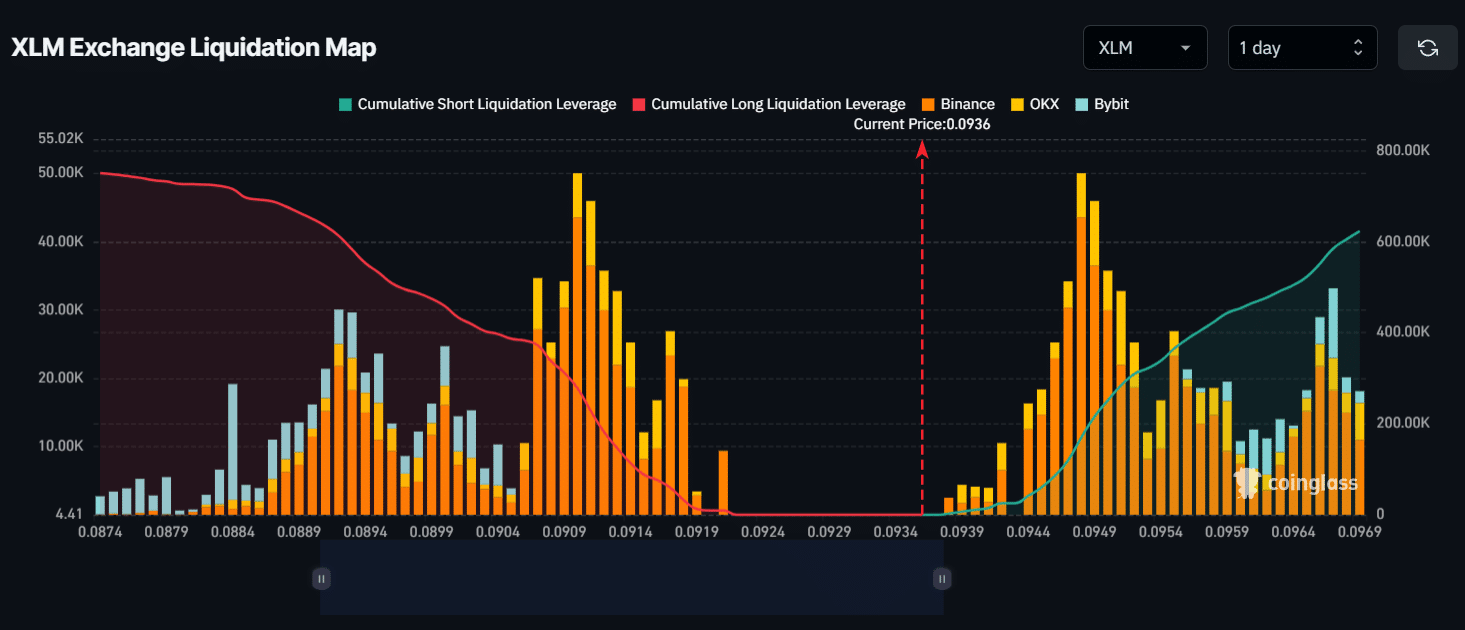

Liquidation levels and market sentiment

Currently, significant selling points are found around the $0.091 mark at the bottom, while buying levels are close to $0.0948, as per data from the blockchain analysis company CoinGlass.

In fact, this data also indicated that traders are over-leveraged at these levels.

If the market sentiment remains unchanged and XLM falls to the $0.091-level, nearly $280,000 worth of long positions will be liquidated. Conversely, if the sentiment shifts and the price jumps to the $0.0948-level, $170,000 worth of short positions will be liquidated.

On-chain metrics and XLM price analysis

Furthermore, the liquidation map from CoinGloss indicates that buyers have been more active recently compared to sellers. This shift could potentially lead to a price reversal for XLM, even though it has experienced a significant downturn.

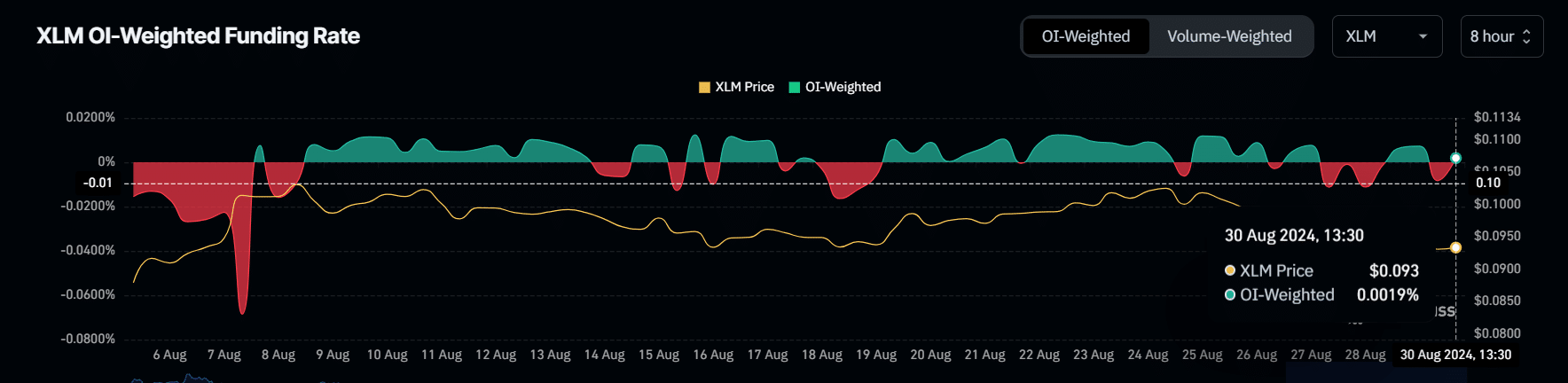

In this context, it’s beneficial to examine another metric based on blockchain, known as the OI-weighted funding rate. This tool assists in gauging market sentiment and predicting possible price increases for an asset. As per CoinGlass, the OI-weighted funding rate for XLM currently stands at 0.0019%.

As I analyze the current market trends and price movements of XLM, it appears challenging to accurately predict its direction in the near future. Nevertheless, if XLM manages to close the day’s trading below the $0.0915 mark, this could potentially shift the outlook for the days ahead.

Currently, XLM is close to the $0.0938 mark following a minimal decrease of 0.2% in value over the last day. Simultaneously, the Open Interest decreased by 2.3%, suggesting a drop in trader engagement as the market experiences a downturn.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Solo Leveling Arise Tawata Kanae Guide

2024-08-31 05:11