- XLM’s breakout above $0.1236 signaled a potential trend reversal.

- Rising Open Interest and $975K in short liquidations highlighted growing bullish momentum.

As a seasoned researcher who has weathered countless market storms and watched countless coins rise and fall, I must say that Stellar’s [XLM] sudden surge is nothing short of exhilarating. The breakout from its long-standing descending channel has left me with a renewed sense of optimism, much like a phoenix reborn from the ashes.

In just the past day, the digital currency Stellar (XLM) has sparked excitement within the market, witnessing a significant increase of 24.08%. Currently, the value of one unit stands at approximately $0.2533.

This unexpected surge in price has broken through the previous downward trend line, sparking optimism about a prolonged uptrend.

Observers are keenly observing whether this could be the start of a significant surge for Stellar, its next notable upswing.

XLM breaks free from descending channel

For quite some time, the value of XLM had been confined in a falling trend line, causing apprehension among investors. But once it surpassed the vital $0.1236 barrier, this move suggested a notable change of direction.

The price has soared to $0.2533, more than doubling its channel lows.

By examining the technical indicators, we noticed a positive crossover in the MACD chart. Specifically, the MACD line was around 0.0140, while the signal line was slightly lower at 0.0139, suggesting a potential upward trend.

The Bollinger Bands have expanded noticeably, placing the upper band approximately at $0.2125, the lower band roughly at $0.0347, while the moving average (midline) hovers around $0.1236.

At the current moment, the price stands at $0.2533, significantly higher than the upper limit, clearly indicating a robust upward trend fueling the market surge.

Social volume drop raises questions

It’s intriguing to note that despite a significant increase in XLM’s price, there’s been a substantial drop in its social volume from 142 to 49 over the past day. This decrease indicates that the recent surge might not be fueled by broad retail excitement just yet.

Consequently, it’s likely that institutional or larger traders are driving the breakout.

Paying attention to the discrepancy between market movements and public chatter can signal a need for caution, since increased retail participation tends to bolster upward trends.

If social activity picks up again, it might strengthen this positive trend and attract more participants to the market.

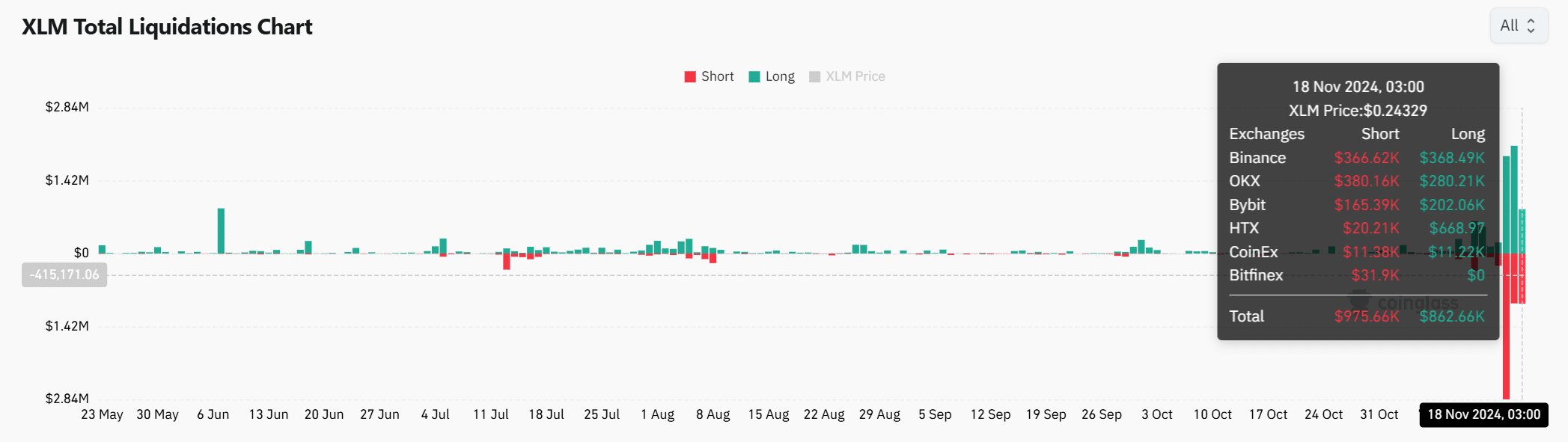

Short and long position impact

The recent rally caused a total of $1.837 million in liquidations, with $975,000 in shorts and $862,000 in longs being wiped out.

The lopsided situation indicates that aggressive bearish traders were taken aback by the sudden breakout. As a result, compulsory repurchases by short sellers played a significant role in driving the market’s strong uptrend.

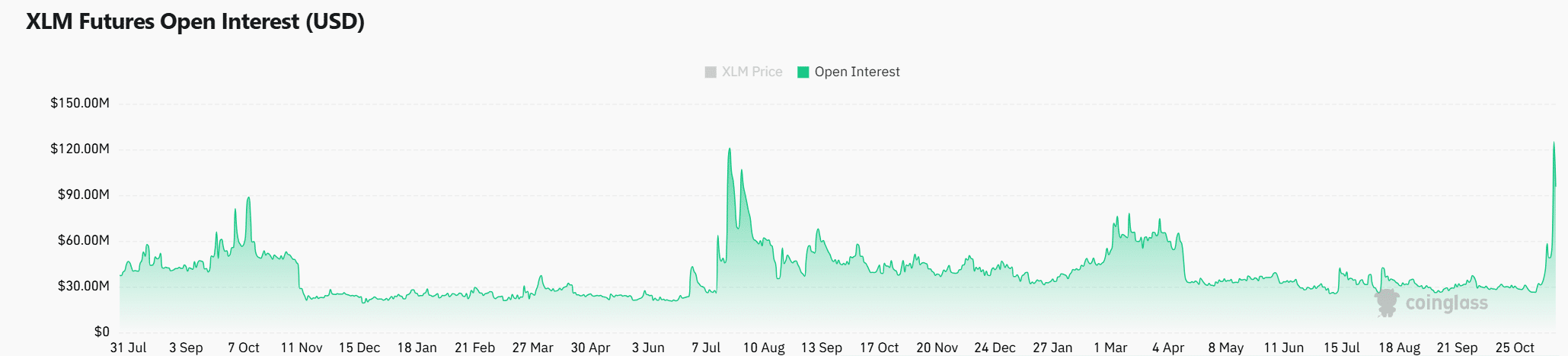

Open Interest climbs to $121.44 million

Furthermore, there was a 13.40% increase in Open Interest, taking it up to $121.44 million, suggesting that traders’ enthusiasm has been rekindled.

This rise highlighted a surge in trading on the derivatives market, indicating an increasing belief in the positive trend of XLM.

A rise in Open Interest tends to be associated with greater market volatility, indicating potential for further price fluctuations in the short run.

Conclusion: Is this XLM’s moment?

A mix of a downward breakout from a channel, robust technical signals, and an increase in trading volume strongly suggests that the upward trend for Stellar might persist further.

Realistic or not, here’s XLM’s market cap in BTC’s terms

However, the decline in social volume hinted at a cautious rally driven by institutional investors.

Should XLM sustain its value above $0.25 and attract more mainstream investor interest, it may mark the start of a prolonged upward price movement.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

2024-11-18 17:44