Ah, the U.S. stock indices, those fickle friends, have decided to inch higher today, despite the ominous clouds of rising bond yields and the ever-looming specter of government debt. Who knew uncertainty could be so fashionable?

On this fine Thursday, May 22, the Dow Jones Industrial Average, that grand old dame of the market, has traded at a staggering 42,013 points, up a modest 153 points or 0.36 percent. Meanwhile, the S&P 500, in a fit of enthusiasm, rose 0.31 percent to 5,863 points, while the tech-savvy Nasdaq, ever the overachiever, gained 0.59 percent, reaching a dazzling 21,203 points. 🎈

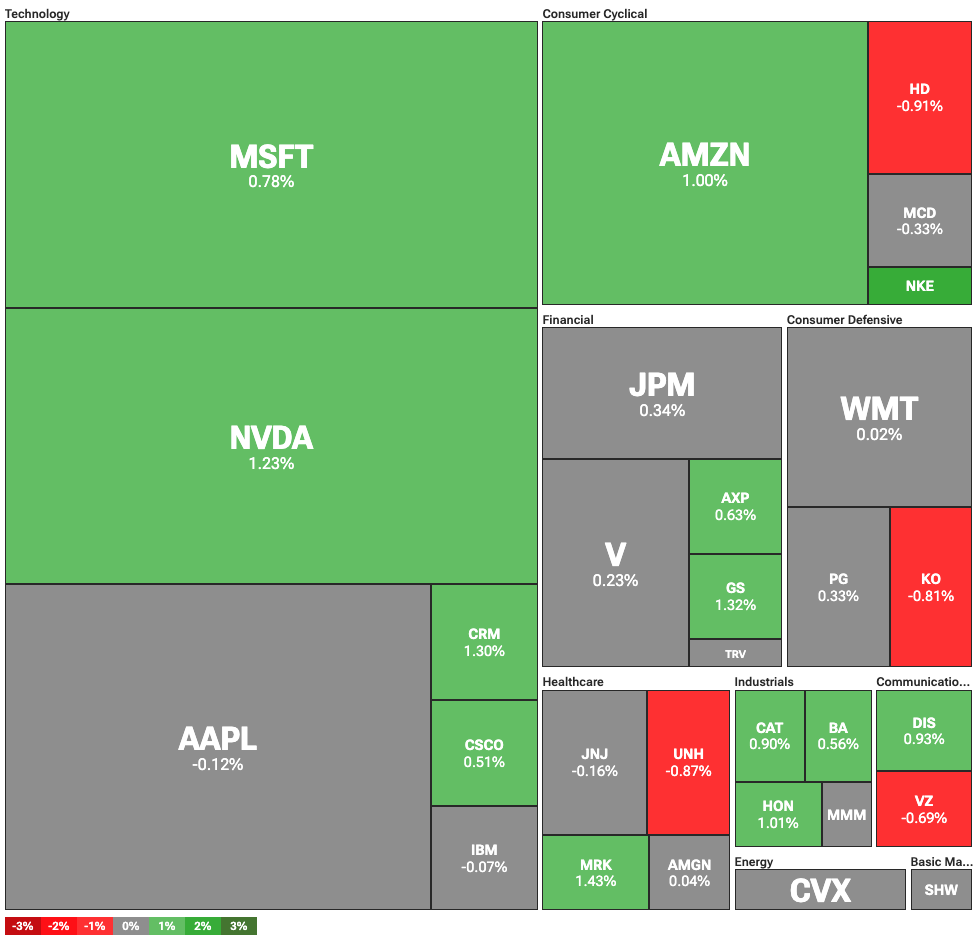

Leading this merry dance of numbers are the tech titans: Nvidia, Amazon, and Microsoft, strutting their stuff like peacocks, while poor Apple, bless its heart, has posted some modest losses. 🍏

But wait! The market’s cheerful ascent comes despite a rise in bond yields that have failed to entice investors. Long-term U.S. Treasury yields have crossed the 5 percent threshold, with the 30-year bond yielding a whopping 5.128 percent. Who knew bonds could be so… thrilling?

Typically, rising bond yields would send investors scurrying away from equities like mice from a cat. Yet, the allure of Treasuries seems to be waning, much like my enthusiasm for Monday mornings, thanks to growing concerns over U.S. dollar-denominated debt and the ever-expanding federal deficit. 📉

Are bonds, or Bitcoin, a safe haven? 🤔

As uncertainty around U.S. fiscal policy intensifies—thanks to former President Donald Trump’s proposed tax cuts, which are projected to balloon the national deficit—investors are left scratching their heads. With elevated Treasury yields, the cost of servicing government debt is expected to climb, leading some to reconsider bonds as a traditional safe haven. Who needs safety when you can have excitement, right?

And let’s not forget the mortgage rates! As of May 22, the average 30-year fixed mortgage has reached 6.86 percent, the highest level since February. This rise in borrowing costs could make housing as affordable as a luxury yacht, weighing heavily on consumer spending, especially for those poor souls with variable-rate loans. 🏠

In a twist of fate, more traders are turning to alternative assets like gold and Bitcoin (BTC). Bitcoin, in a fit of exuberance, rose 4 percent on May 22, reaching a new all-time high of 111,970 dollars. Gold, however, slipped 0.49 percent, trading at 3,298 dollars per ounce. Ah, the sweet taste of volatility! 🍫

Read More

2025-05-22 21:45