- STX forms a bullish pennant pattern, signaling a potential 20-25% price surge if it breaks $2.00 resistance.

- Technical indicators and moderate social volume support the likelihood of a bullish breakout above key levels.

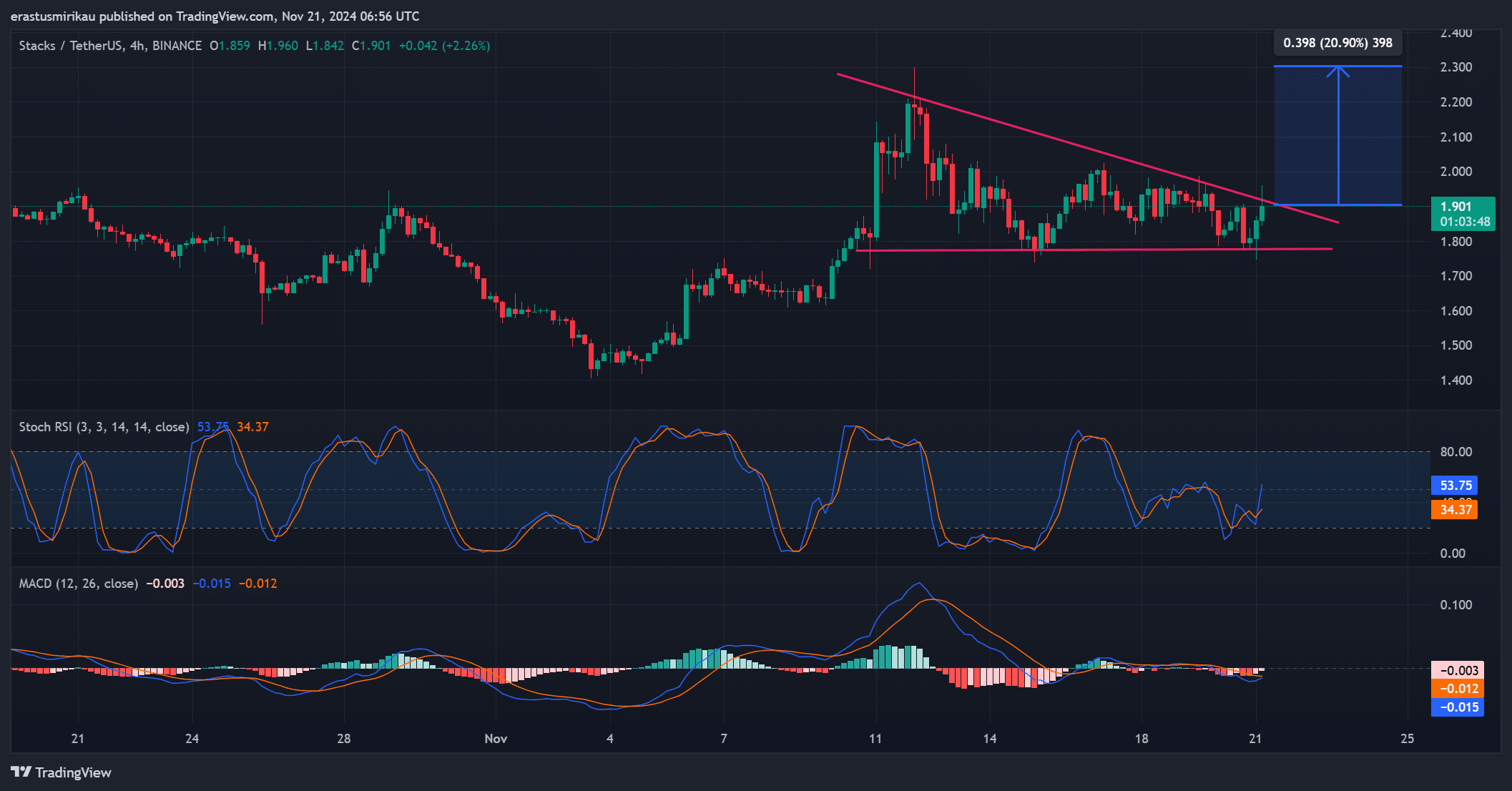

As a seasoned researcher who has spent countless hours poring over charts and studying market trends, I must say that the current position of Stacks (STX) presents an exciting opportunity for investors. The bullish pennant pattern indicates a potential 20-25% surge if STX manages to break its $2.00 resistance level – which, let’s face it, is no small feat given this coin’s historical behavior!

After a phase of holding steady, the STX cryptocurrency appears to be shaping a bullish flag formation, suggesting it might be ready for an upward surge. Over the past few weeks, it has been preparing for a possible price increase.

Currently, STX is priced at $1.91, marking a 4.08% increase as we speak. But the pivotal point to consider is: will STX manage to surpass its significant resistance level, potentially setting off a new wave of bullish activity?

Bullish pennant breakout targets $2 resistance

Recently, Stacks has taken the shape of a traditional pennant pattern, a technical configuration that frequently signals impending substantial price changes. Following a phase of consolidation, it seems like STX is gearing up for a potential breakout.

This flag-like pattern suggests a potential increase in price once it peaks. Consequently, numerous market players are watching STX closely to determine if it breaks through its resistance points and initiates an uptrend.

At approximately $2.00, STX faces its strongest resistance – a price level that has historically hindered the coin’s progression. If STX manages to surpass this level, it would suggest a potential breakout is underway.

Traders expect a rise of approximately 20% to 25% in the cryptocurrency’s price after the breakout. If this happens, the price might reach around $2.40, according to predictions derived from the breakout’s projected targets.

Over the forthcoming days, I find myself on the edge of my seat, eagerly anticipating whether STX can successfully breach this resistance level and solidify its upward trend.

The technical signals, such as STOCH RSI and MACD, are hinting at an upcoming rise in the market. Specifically, the STOCH RSI is now at 53.75, implying that the STX stock may be in a neutral-to-bullish phase.

Furthermore, the Moving Average Convergence Divergence (MACD) is hinting at a minor bullish overlap, adding credence to the prediction of an approaching price jump. As a result, these signals suggest that Shutterstock (STX) might be gearing up for an upward trend.

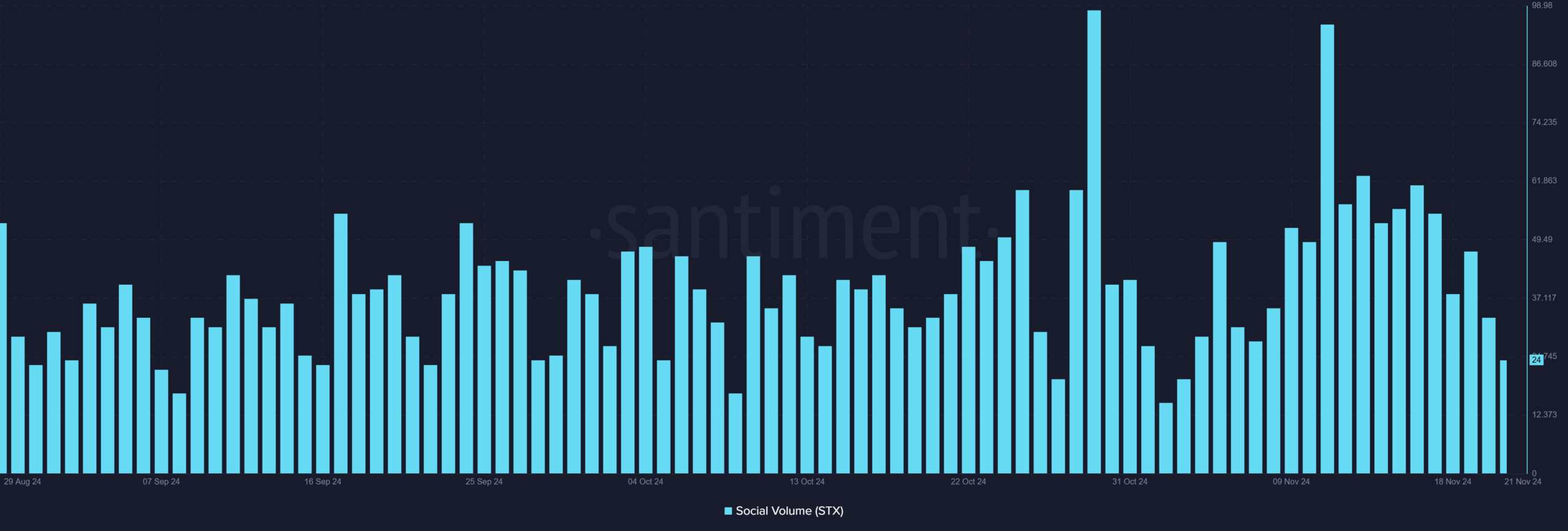

What role does social volume play in this breakout?

Recently, the social activity related to STX has shown a modest increase, currently sitting at 24. This number suggests a growing curiosity about this particular asset.

Nonetheless, the current level remains significantly below the highs recorded in late October, during which social activity spiked over 70.

Even though the current level of activity is relatively low, if social buzz persists and intensifies, it may serve as a trigger for the imminent surge, offering the push required to propel the price upward.

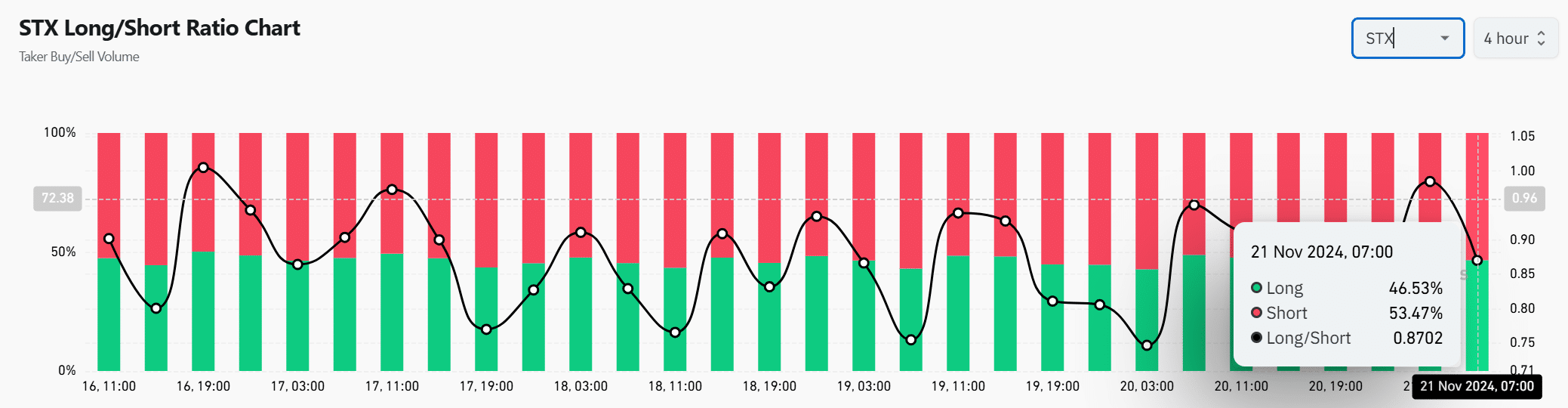

How does the long/short ratio impact the price outlook?

Approximately 46.53% of investors in STX are holding long positions, compared to 53.47% who have short positions. This small difference suggests a degree of caution or hesitancy in the market.

As an analyst, I find myself on the lookout for potential changes in market dynamics. A bullish breakout could drastically alter the long/short ratio by prompting a surge in long positions, thereby amplifying the upward trend. If the price breaches resistance levels, this shift might occur swiftly.

Read Stacks [STX] Price Prediction 2024-25

Is STX set to break out?

It seems that STX is about to burst into a bullish trend, as a pennant formation suggests a possible increase of around 20-25%. If this digital currency manages to surpass the $2.00 barrier, it might escalate to roughly $2.40.

Based on technical analysis, there appears to be strong signs suggesting potential substantial price changes for STX. This could indicate an upcoming bullish surge.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-11-21 18:32