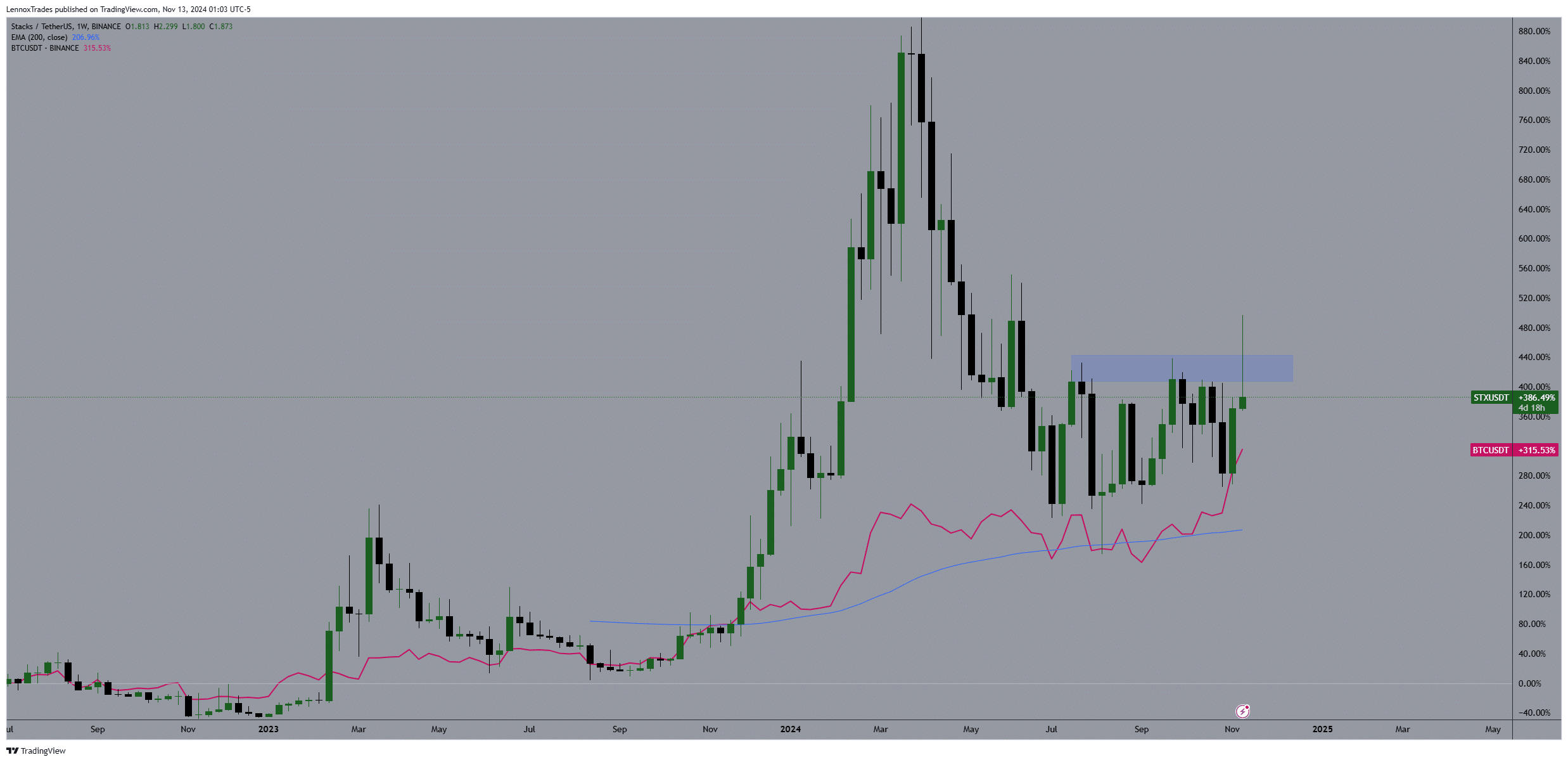

- Stacks strong correlation with Bitcoin suggested a possible rally.

- STX trading above the 200 EMA but has broken back in a 4-month resistance.

As a seasoned crypto investor with a knack for recognizing market trends, I find myself intrigued by the current state of Stacks (STX). The strong correlation between STX and Bitcoin, combined with its high-beta play within the BTC ecosystem, presents an enticing investment opportunity.

The relationship between Stacks (STX) and Bitcoin (BTC) prices is quite significant, with a correlation strength indicator of 0.86. Essentially, Stacks functioned like a stock with heightened sensitivity to Bitcoin’s movements, offering amplified exposure to the Bitcoin market.

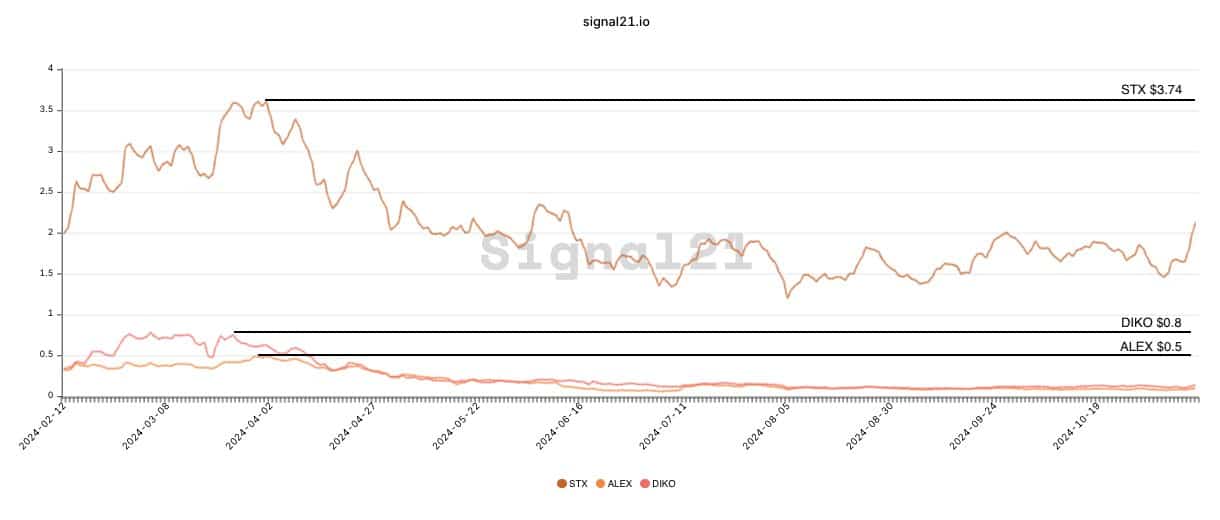

Similarly, two prominent DeFi protocols on the Stacks network, ALEXLabBTC (ALEX) and Arkadiko Finance (DIKO), presented more risky investment opportunities that were associated with STX.

This created a multi-layered investment potential within the growing Bitcoin ecosystem. However, STX, ALEX, and DIKO remained well below their March highs from earlier this year.

This scenery provides a context for evaluating Stacks’ potential behavior, based on the anticipated shifts in Bitcoin’s trajectory.

STX trades above 200 EMA

On a weekly basis, it appears that Stacks’ price momentarily surged past a barrier it had been holding for four months, only to retreat back into this same range. This could potentially signal a misleading breakout.

Regardless of the recent withdrawal (retraction), STX’s trading price exceeded its 200-day moving average, indicating a generally optimistic long-term trajectory. The prominent green candlestick, which overcame resistance, followed by a red one, signifies market volatility and uncertainty around the breakout point.

From my perspective as an analyst, holding a position above the Exponential Moving Average (EMA) of 200 on a weekly basis offers a reassuring viewpoint, suggesting possible future growth.

Analyzing the percentage increases of STX relative to Bitcoin’s performance reveals a similarity in their price trends, as STX tends to follow Bitcoin’s overall market patterns.

If Bitcoin’s growth pattern persists, it may very well push Stx towards a $4 price point. Keeping an eye on Bitcoin’s path is essential for forecasting Stx’s fluctuations, as it appears to mimic Bitcoin quite closely.

Open interests and premium index

With Stacks exiting its consolidation phase within a predetermined price range, there was a significant increase in open interest, indicating that traders are actively purchasing STX. This could be a sign that they are preparing for a potential surge towards the $4 mark.

At the same time, the Total Price (or Aggregated Premium) experienced a significant surge, suggesting that traders were prepared to pay more for futures contracts as they anticipated price rises in the future.

As the volume indicators displayed heightened trading activity, this strengthens the optimistic outlook on STX, suggesting a bullish trend.

Read Stacks [STX] Price Prediction 2024-25

As Bitcoin prices continue to climb and traditional finance shows greater interest, it’s reasonable to expect that companies within the Bitcoin environment, such as STX, may experience benefits.

An increase in open interest, along with growing prices for these tokens and higher trading volumes, might drive this token to reach unprecedented heights, given the overall optimistic trend in the crypto market, which is closely tied to Bitcoin’s performance.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-11-14 01:11