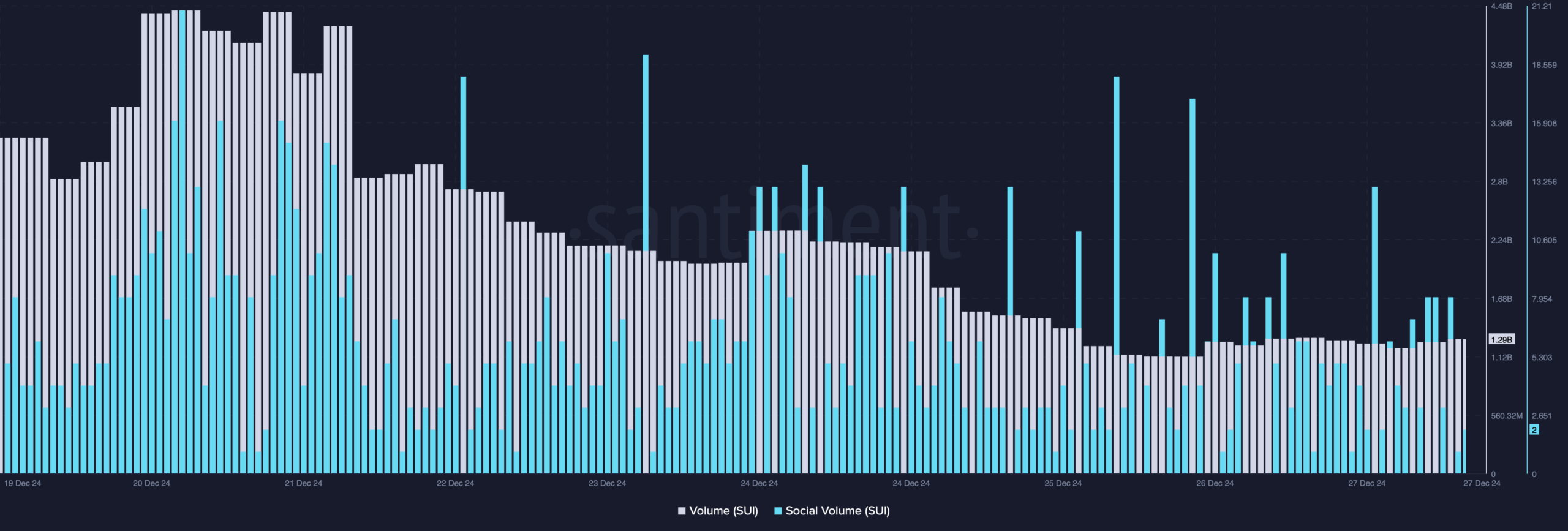

- SUI’s Social Volume declined sharply in the last few days.

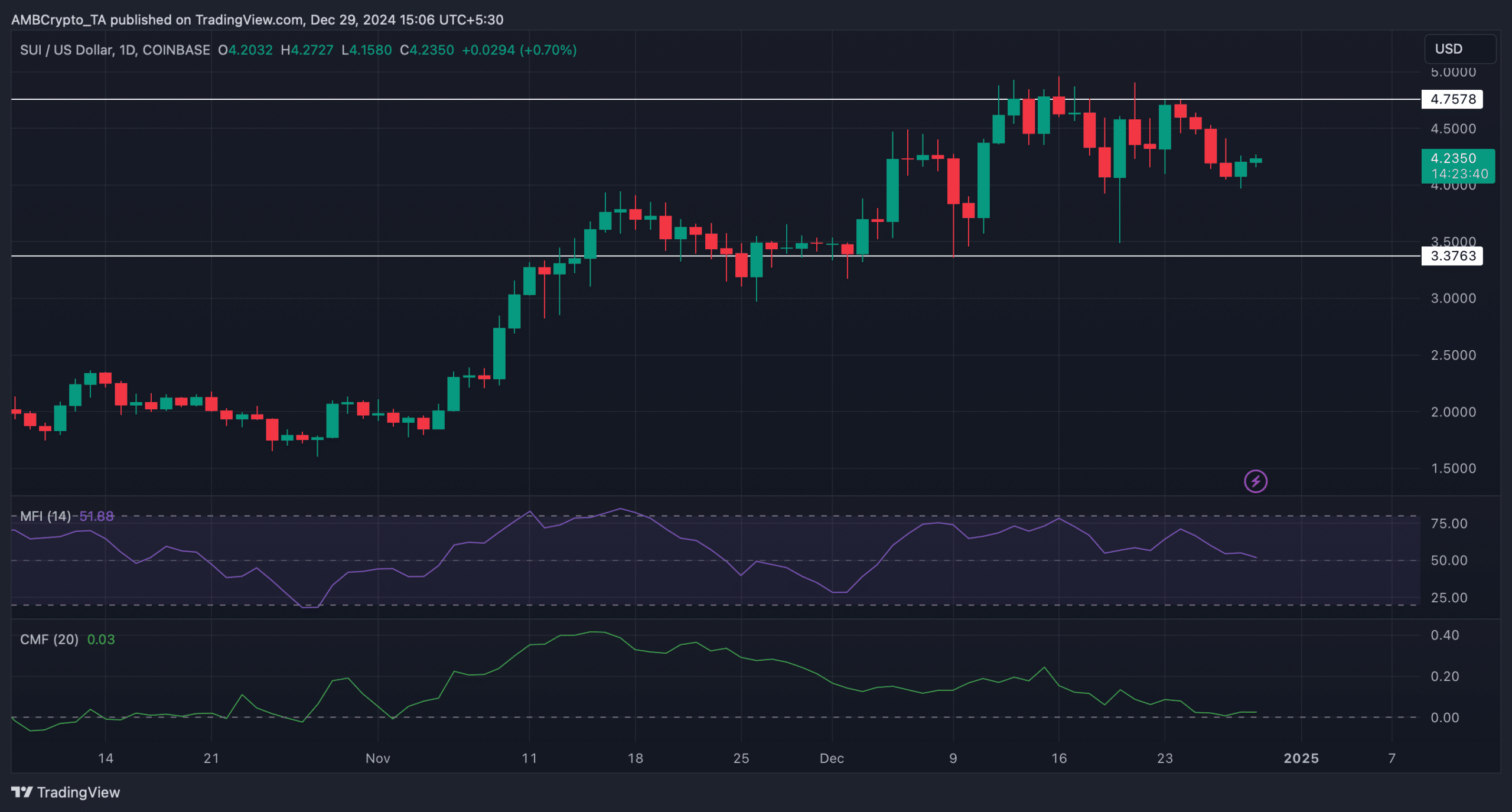

- Market indicators hinted at a price drop towards $3.37.

As a seasoned researcher with years of experience in the tumultuous world of cryptocurrencies, I must say that SUI’s behavior is as unpredictable as a rollercoaster ride at an amusement park. The last 24 hours have been a wild ride indeed, with the token’s price surging by more than 5%, only to see its trading volume and social volume plummet.

The bulls might have had a momentary victory, but the bears are not giving up easily. Data suggests that there are more short positions in the market compared to long ones, a sign of rising bearish sentiments. Technical indicators also point towards a possible price correction in the coming days.

However, as they say in this crazy crypto world, “bulls make money, bears make stories.” So, if SUI manages to maintain its bullish momentum, we might just see it reclaiming $4.7 by the end of this year. But if it drops to $3.37 due to a price correction, well, that’s just another day in crypto for us!

In the meantime, I’ll be here, holding on tight and enjoying the ride! After all, isn’t that what makes this wild world of cryptos so exciting?

Just like many other digital currencies, SUI experienced a challenging week with its value decreasing. However, the latest 24 hours have shown promising signs for investors as the token’s price has risen.

Latest data suggested that investors are expecting the coin’s price to go up further.

What is SUI up to?

As someone who has been closely following the crypto market for several years now, I must admit that SUI’s recent surge of more than 5% within the past 24 hours caught my attention. Having witnessed many ups and downs in this volatile world of digital assets, I can confidently say that a rise like this is always worth taking note of. At the moment, the token is trading at $4.23 with a market capitalization of over $12.38 billion, which speaks volumes about its potential for growth. While I don’t make investment decisions based on short-term fluctuations, I do keep an eye on such promising movements as they could potentially signal a long-term trend. So, while I can’t predict the future, I am certainly excited to see where SUI goes from here and how it may impact the broader crypto landscape in the months ahead.

For now, well-known crypto expert Ali Martinez shared on Twitter an intriguing update.

According to a recent tweet, about 77% of active traders on the dYdX platform are speculating that the price of SUI Futures will rise!

Consequently, AMBCrypto examined other data sources to ascertain if the market’s sentiment mirrored the content of the tweet. Interestingly, even though the token experienced an increase in price recently, its trading volume decreased significantly, suggesting a potential bear rally.

Furthermore, the Social Volume saw a decrease too, indicating a potential price reduction since it dipped during an uptrend or bull market.

SUI in the coming year

In the future, our analysis using Coinglass’ data revealed that the token’s Long-to-Short Ratio dropped. This indicated a higher number of investors holding short positions relative to those with long positions on the market.

Engaging in a hike (increasing) your short positions in the market indicates growing pessimism among traders, typically leading to adjustments (price corrections) in the market value.

Indicators such as the Money Flow Index (MFI) suggested that there might be a price adjustment approaching, as it showed a decrease.

Additionally, the Chaikin Money Flow displayed a comparable pattern, indicating that the selling pressure was increasing. This is an important signal suggesting an impending adjustment or correction in the price.

If a price adjustment occurs, SUI could potentially fall to $3.37. But if the token sustains its upward trend, it may keep climbing and attempt to regain the $4.7 mark before the end of this year.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-12-30 07:03