-

SUI has returned to the $1.7 price range at press time.

The last time it traded in this range was in April.

As a seasoned crypto investor with a keen eye for promising projects and a knack for spotting trends, I must admit that SUI has caught my attention recently. Having closely followed its progress since April, I’ve witnessed its impressive surge from the $1.7 price range back then to the current level. The recent uptrend, coupled with increasing investor interest and social engagement, is nothing short of remarkable.

In recent times, SUI (SUI) has been gaining significant attention, as suggested by its price showing noticeable upward movements during the last few weeks.

This positive momentum is boosting both the Total Value Staked (TVS) and trading activity, suggesting a rising level of investor engagement.

Sui’s increased attention

Data from Santiment revealed that Sui’s social interaction has soared to an all-time high.

From the 16th of September onwards, we’ve observed a series of increases, peaking on the 25th of September with a social media volume of 197.

Despite dropping slightly to approximately 121 at the close of the previous trading day, this downward movement suggests a growing interest in SUI from the market.

Sui’s price grows over 130%

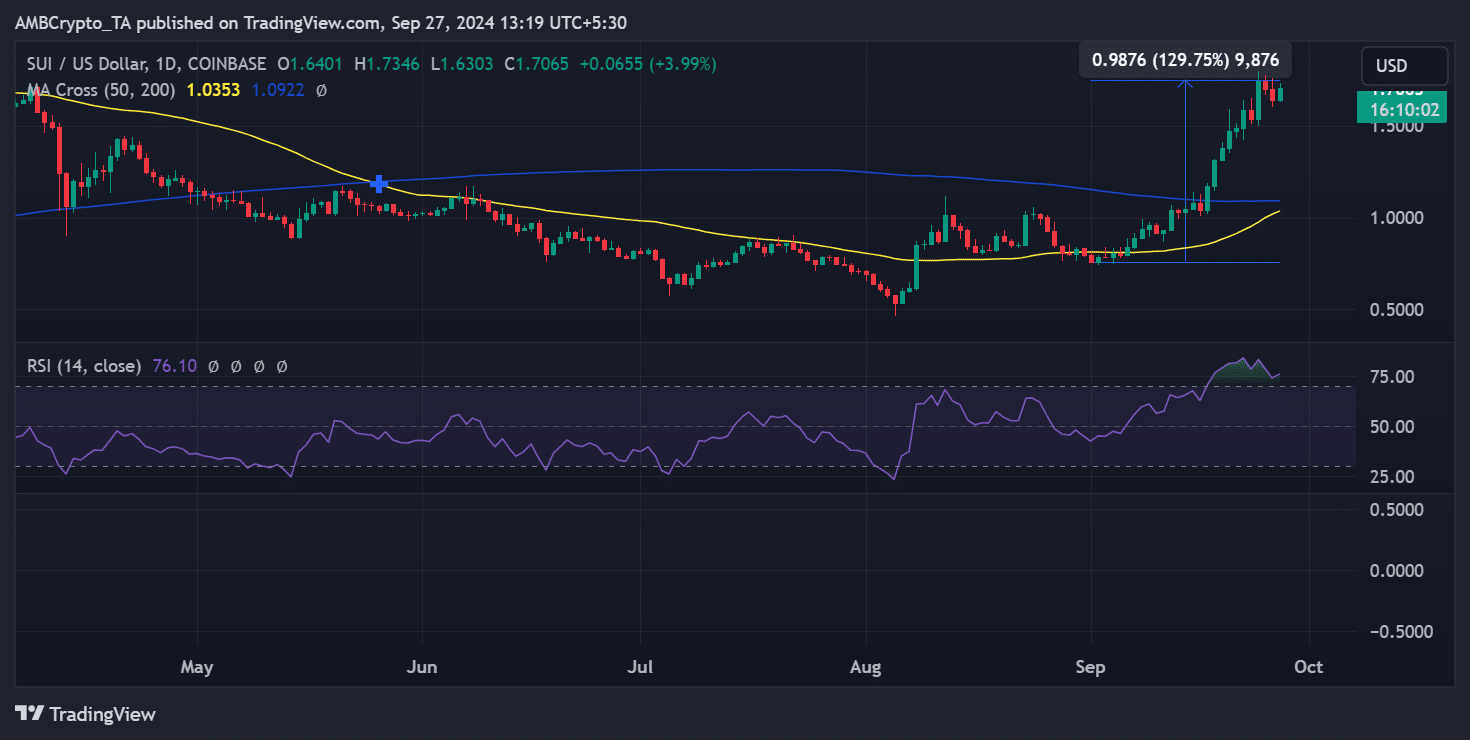

As social interest in SUI increases, its value has significantly spiked. According to reports from AMBCrypto, SUI has experienced an impressive jump of approximately 130% this month.

On September 24th, the price experienced a significant spike, surpassing 13.5% and reaching around $1.70.

Regardless of falling below it later on, the Swiss Franc (SUI) has recovered, now hovering near $1.70 and experiencing a roughly 4% rise.

In addition, the technical signs point towards more growth opportunities ahead. The overlapping yellow and blue lines are getting ready to create what’s known as a ‘golden cross’, a pattern that frequently indicates sustained positive trending.

Yet, with a Relative Strength Index (RSI) at approximately 75, SUI was significantly within the overbought zone. This might suggest an impending brief reversal or correction in its short-term pricing.

TVL reaches an all-time high

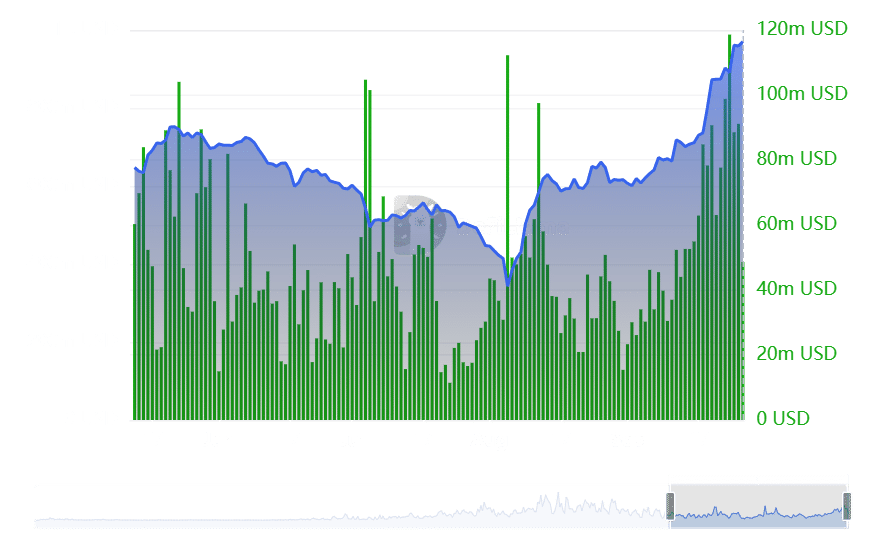

In recent times, the rising prices have noticeably boosted the amount of value locked within the Sui network, reaching an all-time high of over $970 million as per DefiLlama’s latest data.

Alongside Total Value Locked (TVL), the trading volume of our network has experienced significant expansion as well. Although it hasn’t reached the record level of the TVL, the volume surged close to $119 million, which is the highest it’s been in several months.

During the previous trading day’s closing, the trading volume stayed strong, exceeding $91 million – one of the top figures seen in recent times.

Realistic or not, here’s SUI market cap in BTC’s terms

Conclusion

Sui’s rising popularity and cost are indicative of expanding investor trust and trading excitement.

As a researcher, I’m observing a surge in social engagement surrounding Sui, with technical indicators suggesting further expansion might be on the horizon. Yet, the overbought signals hint at a potential brief correction in the near future.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-09-27 19:03