- SUI’s price breakout above $4.27 signaled bullish momentum, backed by strong technical indicators.

- Social dominance and positive funding rates reinforced optimism despite minor price corrections.

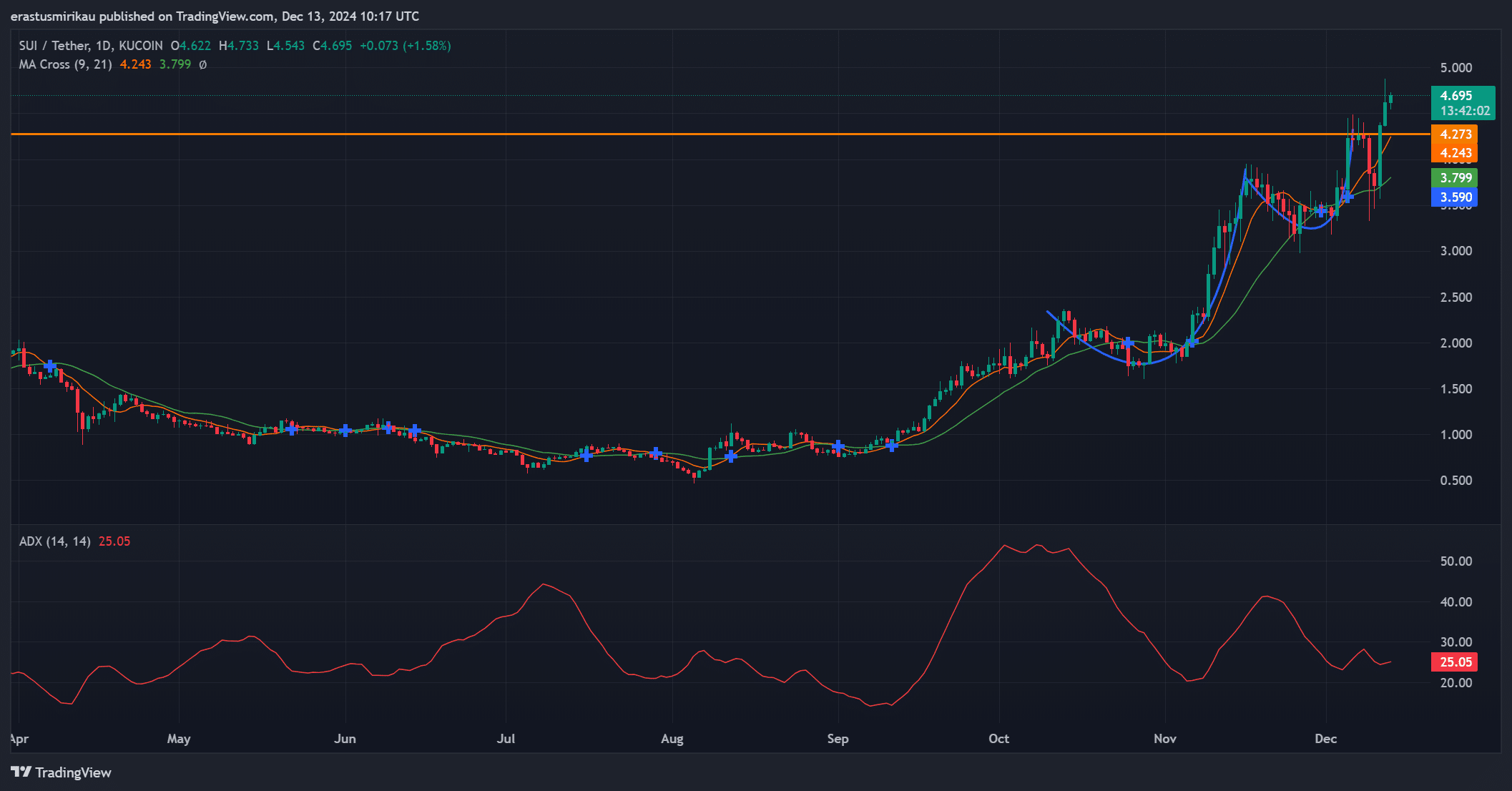

As a seasoned crypto investor with over a decade of experience navigating bull markets, bear markets, and everything in between, I must admit that Sui [SUI] has piqued my interest. The recent breakout above $4.27, backed by strong technical indicators, is reminiscent of the early days of Ethereum or Cardano, projects that have since become household names in the crypto world.

Since the 2nd of December, SUI’s decentralized exchange ecosystem has experienced impressive advancements, as its Total Value Locked (TVL) has grown from $1.51 billion to $1.87 billion. This substantial growth suggests robust user interaction and rising interest in its DeFi services, indicating a strong network and growing adoption of its offerings.

At the moment of writing, I observed that the coin was valued at approximately $4.67, representing a decrease of 1.65%. This drop leaves me wondering about SUI’s future trajectory. Will this digital asset be able to sustain its upward trend and establish itself among the leading DeFi platforms?

SUI’s price action reflects key bullish signals

The current rise in Sui’s price indicates a positive trajectory, as it has surpassed the significant barrier at $4.27. This breakout, along with the Moving Average (MA) convergence between the 9-day and 21-day lines, shows robust bullish energy.

On the other hand, with an Average Directional Index (ADX) of 25.05, we’re looking at a moderate level of trend strength, which might hint towards a brief period of price action stabilization or consolidation in the near term.

Consequently, maintaining the price above $4.27 is crucial to continue this rise and generate more positive momentum.

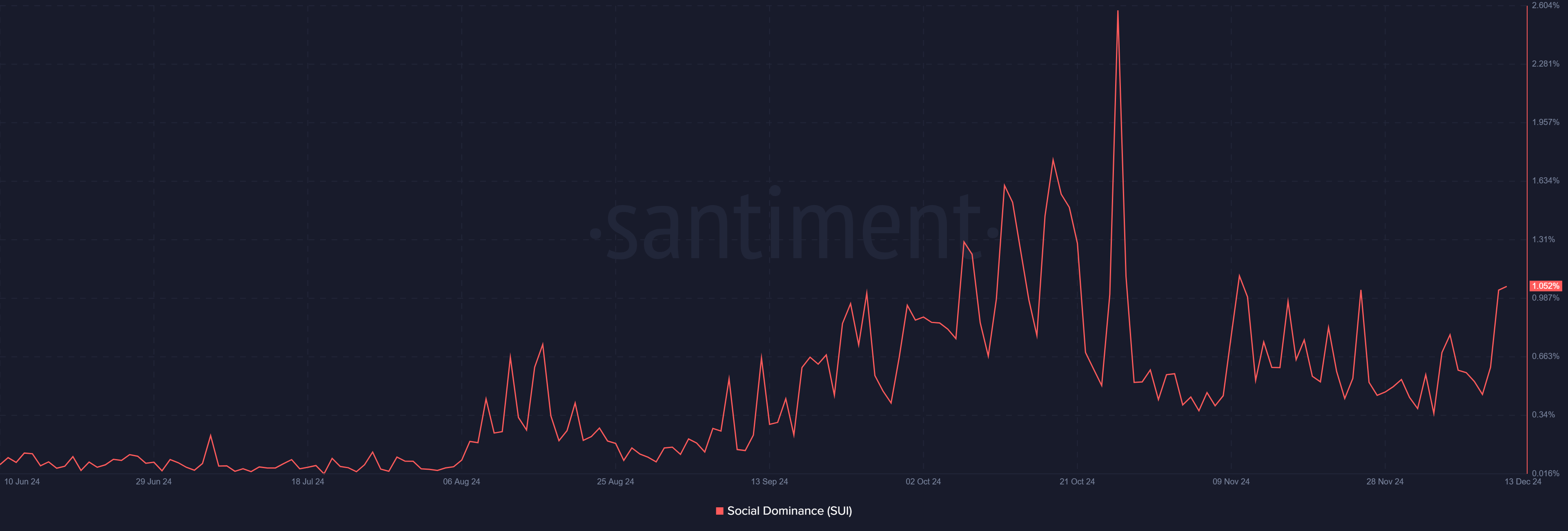

Social dominance underscores the growing interest

Moreover, the growing influence within society indicates a surge in community involvement, surpassing the 1% mark. This increased visibility through more frequent mentions and debates tends to boost investor trust, thereby strengthening optimistic market perceptions.

It’s expected that Sui’s increasing involvement in online discussions will continue to spark curiosity and boost user adoption even more.

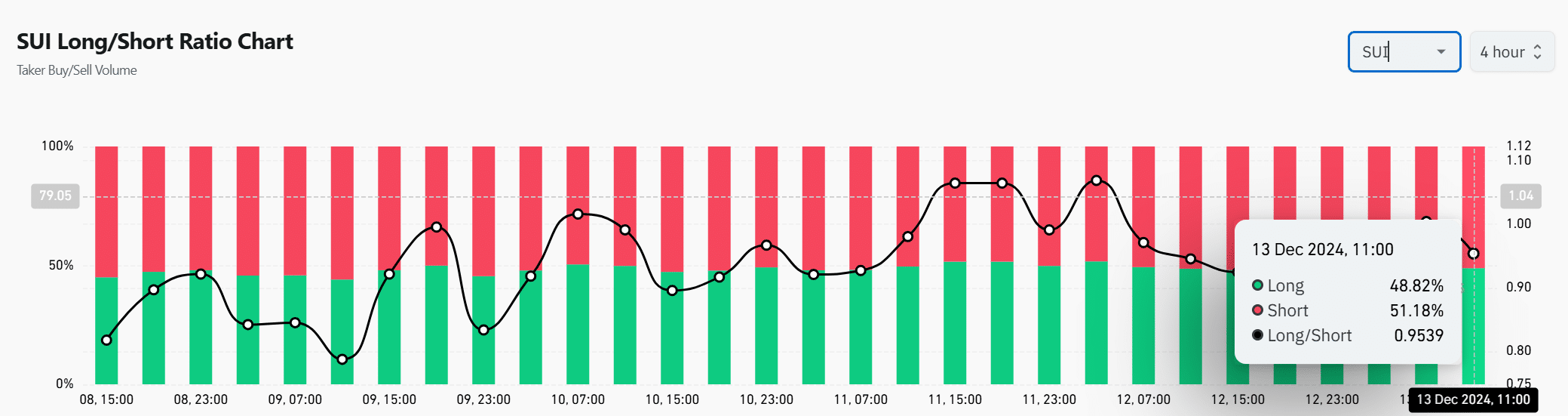

The Long/Short Ratio suggests cautious optimism

Approximately half of the positions (48.82%) were taken as long positions, while slightly more than half (51.18%) were short positions, indicating a nearly equal balance in market sentiment.

This suggests a mix of cautious hopefulness and preparedness among traders, as they’re readying themselves for potential adjustments, yet remain aware of the possibility of continued growth. In essence, this equilibrium signifies both prospective opportunities and necessary caution in the short term.

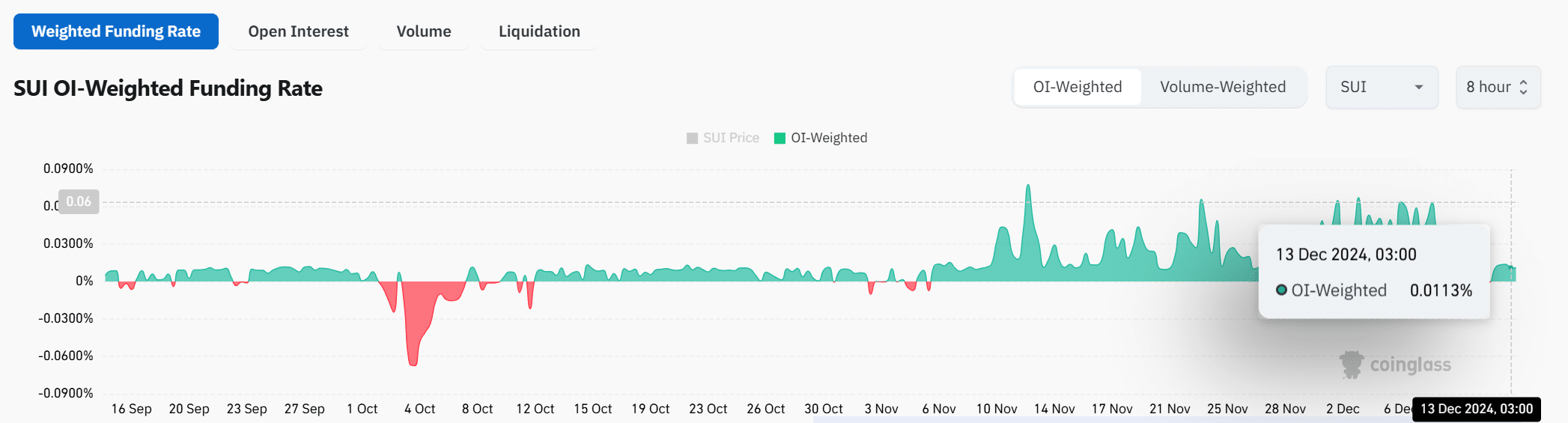

Positive funding rates reflect bullish sentiment

0.0113% Weighted Open Interest (OI) in the Funding Rate signaled market optimism, demonstrating that traders are prepared to pay extra costs for maintaining long positions.

Based on my years of experience in the financial markets, I can confidently say that this development aligns with Sui’s continuous growth trend. It seems that even amid recent minor setbacks, derivative traders are still optimistic about the project’s long-term potential. I have seen numerous projects falter under such circumstances, but Sui appears to be resilient and steadfast in its pursuit of success. The fact that these traders continue to invest despite the temporary pullbacks speaks volumes about their belief in the project’s future prospects.

Read Sui’s [SUI] Price Prediction 2024-25

To summarize, Sui’s strong technical abilities, increasing social interactions, and favorable funding trends suggest that it is primed for continued expansion.

Maintaining crucial backing and utilizing its strong community engagement could help Sui strengthen its position within the Decentralized Finance (DeFi) sector, potentially reaching even more significant achievements.

Read More

2024-12-14 08:07