- Sui has a bullish daily market structure and notable buying pressure.

- The Fib levels and the bearish divergence contributed to the rejection.

As a seasoned crypto investor with years of market navigation under my belt, I find myself intrigued by Sui’s [SUI] current trajectory. The daily bullish structure and robust buying pressure are hard to ignore, but the Fib levels and bearish divergence have certainly caught my attention.

As an analyst, I’ve observed a robust upward trajectory in SUI, with a staggering 131% growth since September 1st. However, the broader market volatility has somewhat clouded this bullish trend, leaving us to navigate through these turbulent waters. Despite this, SUI has continued to display a resilient bullish stance on its daily chart.

In simpler terms, the trading activity exceeded normal levels, and it appeared that prices might continue to rise further. However, there was a potential hurdle on the path to reaching bullish goals worth $2 or more.

Steady buying volume and firm accumulation trends

Since September 15th, the market trend has been predominantly upward (bullish). After a temporary drop to $0.8, there was a robust rebound, indicating a strong recovery. The trading activity in September significantly outpaced that of mid-July and late August, suggesting a prevailing bullish sentiment among traders.

In simpler terms, even though the buyers persisted in their conviction, pushing prices up, they couldn’t go beyond $2 due to intense selling activity that followed a decline in Bitcoin‘s price from $66,500.

In simpler terms, the Cumulative Moving Average (CMF) stood at 0.06, while the Advance-Decline (A/D) line surpassed the high points from March and April. This combination suggested that the market had experienced significant buying pressure in recent times, and that the accumulation patterns seen in September were supportive of a bullish trend.

The Fibonacci retracement levels stall SUI bulls

On October 2nd, the Relative Strength Index (RSI) exhibited a bearish pattern in its daily readings. This development contrasted with the token’s price reaching the $1.81 resistance point, which is also the 78.6% retracement level derived from the downtrend Sui experienced since April.

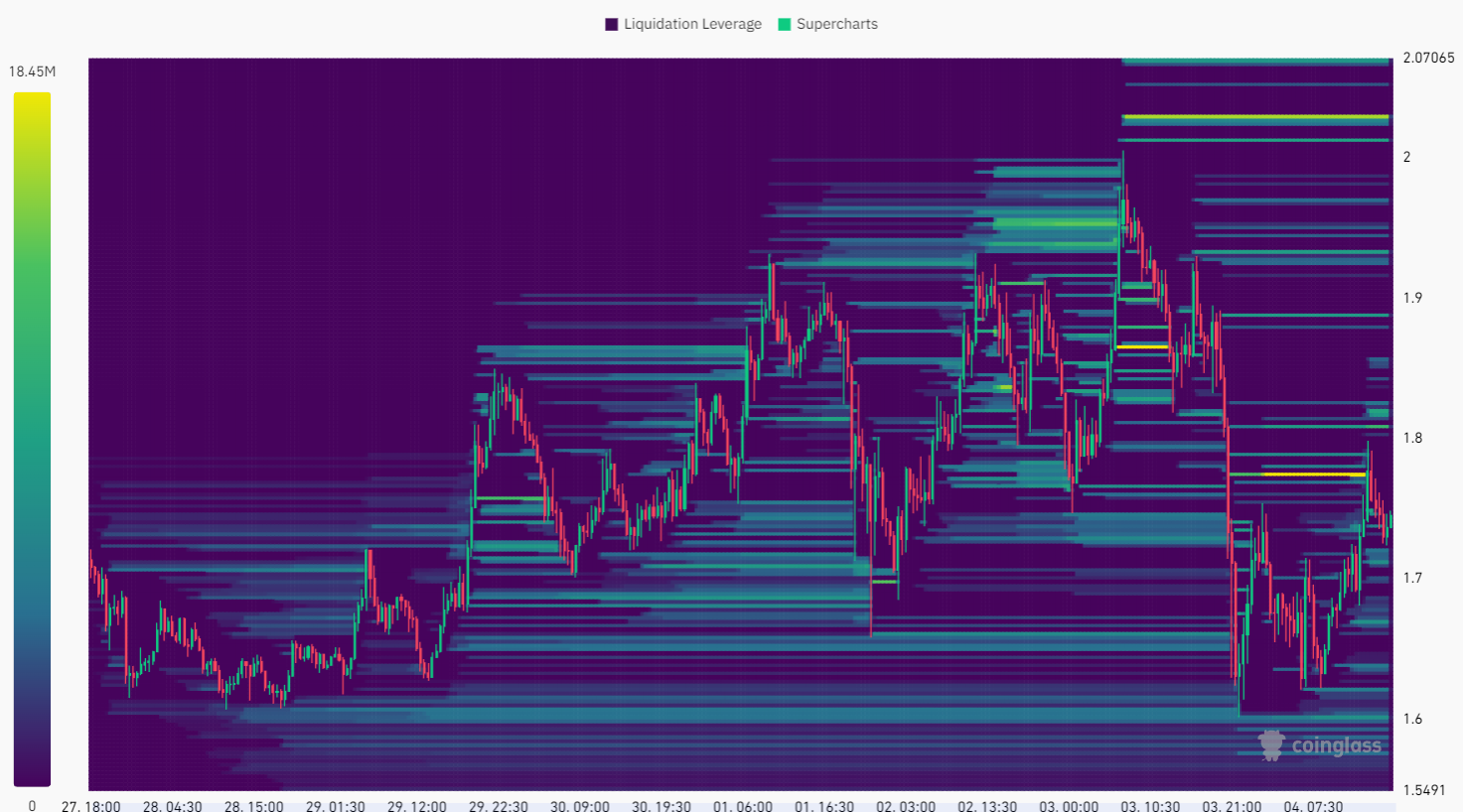

In simpler terms, the data shows that the $1.77 area has a lot of buyers and sellers ready to transact (high liquidity). Recently, prices have risen, pushing past the $2 psychological barrier, but they’ve now dropped again, falling below the Fib level once more.

Is your portfolio green? Check the Sui Profit Calculator

As a researcher examining the token’s price action, I observe a strongly optimistic formation in the daily chart. However, the significant resistance at $1.81 holds considerable importance. Should the bearish forces persist in holding this level, it could potentially erode bullish sentiment and compel prices to slide downwards.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

2024-10-05 07:03