- Sui bulls are likely to defend the $3.2 support zone in the event of a retest.

- The liquidation heatmap highlighted two short-term support zones that could be visited before SUI pushes for a new ATH.

As a seasoned researcher with years of experience in the cryptocurrency market, I have witnessed numerous bull runs and bear markets. The current trend of Sui [SUI] has been particularly intriguing, given its resilience amid pullbacks.

For about a month now, starting from early August, SUI has generally moved upward in its daily chart. Shallow corrections like the one around late October weren’t especially pronounced.

In simpler terms, we expect the positive market trend from recent months to persist, yet there might be some fluctuations in the short term.

SUI consolidates under all-time high

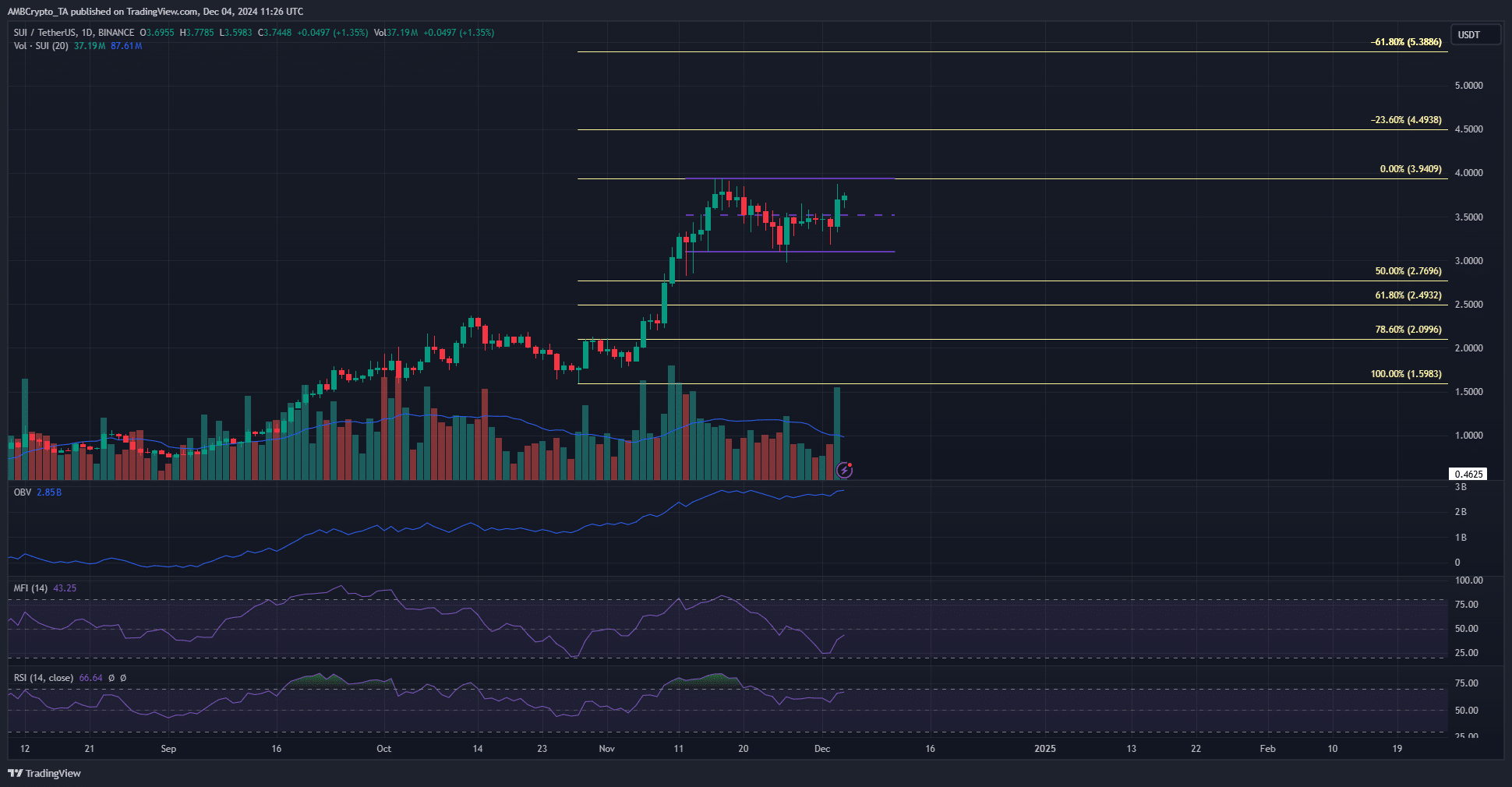

On a daily basis, the market trend remains optimistic. Two successive higher bottoms have been established at $2.82 and subsequently at $2.97. If the market closes below $2.97 in a single day, it would signal a break in the market structure. A more significant fall after such a break would suggest an increase in bearish sentiments.

Over the last month, the Relative Strength Index (RSI) stayed above 50 and peaked at 60, suggesting a strong upward movement in the market, or a bullish trend. This aligns with the price’s bullish behavior, although Swiss Units (SUI) have been fluctuating within a specific range over the past ten days.

The price span spanned between $3.1 and $3.94, with the middle being at $3.52. In recent times, this middle point served as resistance, but it has now been broken. The buyers are aiming for the upper bounds of the range and a new record high.

Over the past period, the OBV exhibited a continuous upward trajectory and substantial buying activity. However, in contrast to this, the MFT experienced a decline over the last ten days. This period of consolidation weakened the MFI, but with SUI currently above $3.52, further growth may be on the horizon.

Spot CVD in support of the MFI misgivings

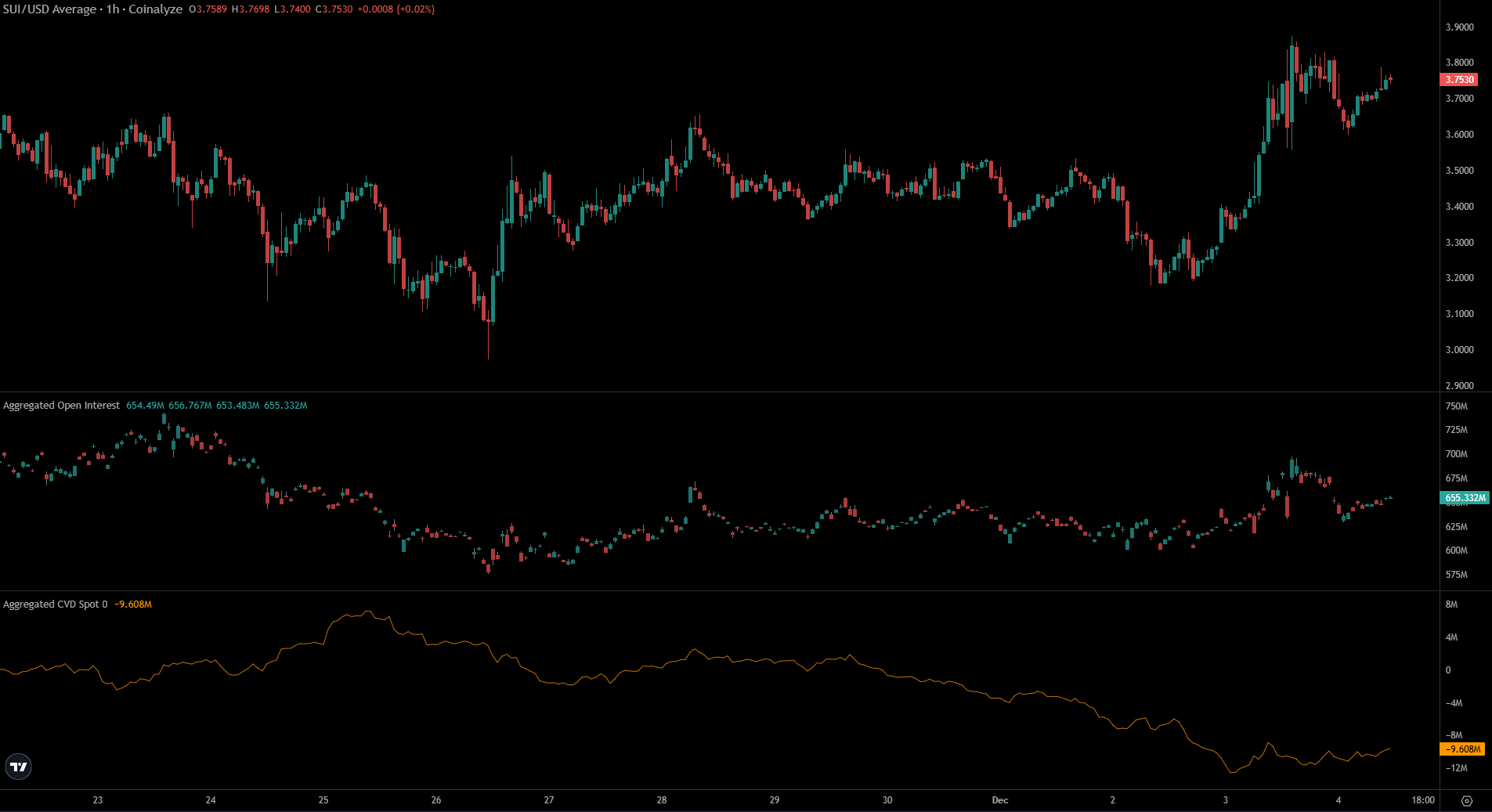

On the 3rd of December, both the value of SUI and its Open Interest surged significantly. However, within the last 20 hours, the Open Interest has dropped by approximately $45 million, suggesting that some optimistic traders may have cashed out their gains.

When the specific location (CVD) failed to start a rising trend, this indicated a low level of demand in the immediate market. This observation supported the Market Field Indicator’s conclusions about insufficient purchasing activity, suggesting that a breakout from the current price range might occur later.

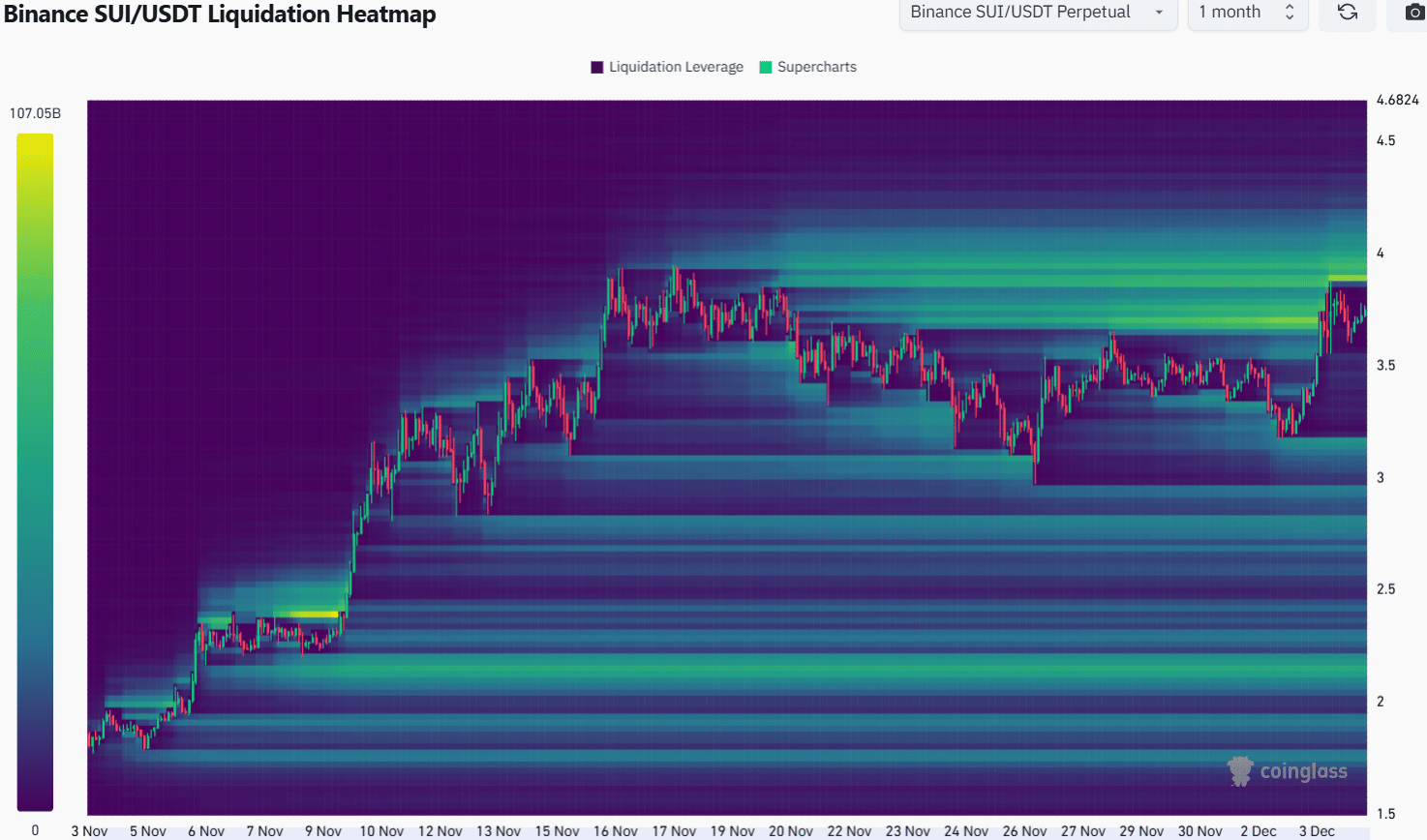

The past month’s liquidation heatmap displayed a significant concentration of liquidity at $4. Moving southward, the next concentration of liquidity could be found at $3.17, slightly above the bottom limits of the local price range.

Read Sui’s [SUI] Price Prediction 2024-25

It’s possible that the price will first gather liquidity towards lower levels before surging upwards. Typically, when prices break out of a range, they dip below significant local support levels to clear out excessive long positions before moving higher.

Traders should be prepared for a price dip toward $3.5 and $3.2 in the coming days.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-12-05 09:11