- SUI’s price increased by more than 20% in the last seven days alone.

- Whale exposure dropped, but most other metrics remained bullish.

As an analyst with years of experience in the volatile world of cryptocurrencies, I’ve seen my fair share of market swings that would make even the sturdiest of ships rock. But when it comes to SUI, I can’t help but feel a sense of optimism.

Last week, SUI demonstrated exceptional performance by surging over ten percent when many other cryptocurrencies faced difficulties. However, the bearish sentiment has returned to the market within the last day.

Does this mean investors should expect SUI’s bull rally to end in the coming days? Let’s find out.

Bullish pattern on SUI’s chart

According to CoinMarketCap’s data, investors of SUI saw gains over the past week as the token’s value increased by a substantial 18%, peaking at $0.98. Yet, in the last day, the market trend seems to have shifted towards the bears, causing the token to dip by 2%.

Currently, as I’m typing this, SUI is being exchanged for approximately $0.9067 per unit. Its market value exceeds $2.4 billion, positioning it as the 31st most significant cryptocurrency by size.

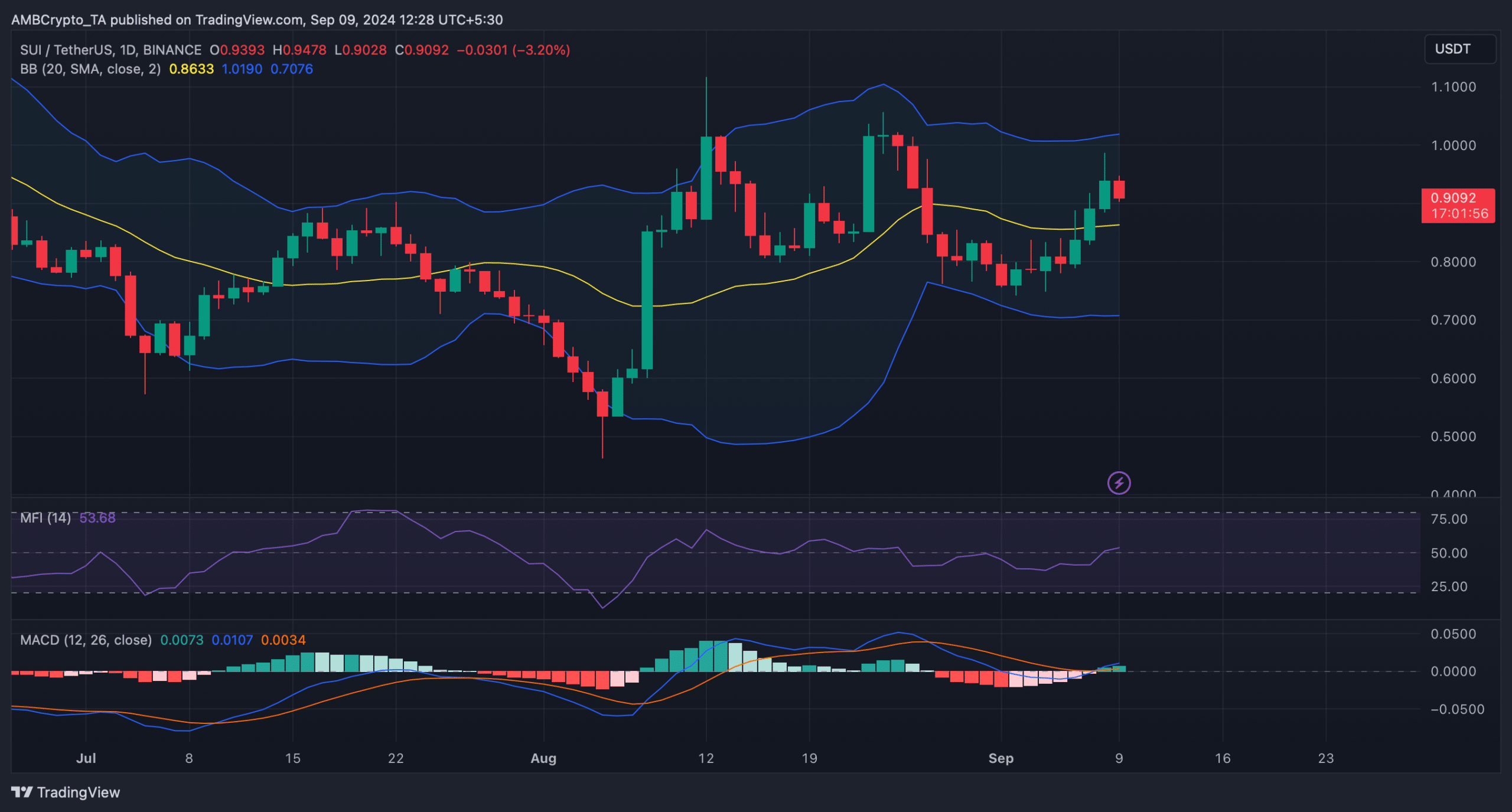

Despite the recent downturn, it could simply be a temporary dip preceding a significant surge. Analyzing the daily chart for SUI by AMBCrypto suggests the token is consolidating within a bullish symmetrical triangle formation.

The pattern first emerged in August, and since then the token has been consolidating inside it.

As we speak, the digital token is almost concluding its pattern, suggesting a potential bullish surge. If this surge occurs, it’s possible that SUI could experience a 50% increase and recover to around $1.4 within the next few days or weeks.

Is a 50% surge inevitable for SUI crypto?

After that, AMBCrypto examined the token’s on-chain statistics to determine if there were signs suggesting a potential bullish surge in the near future.

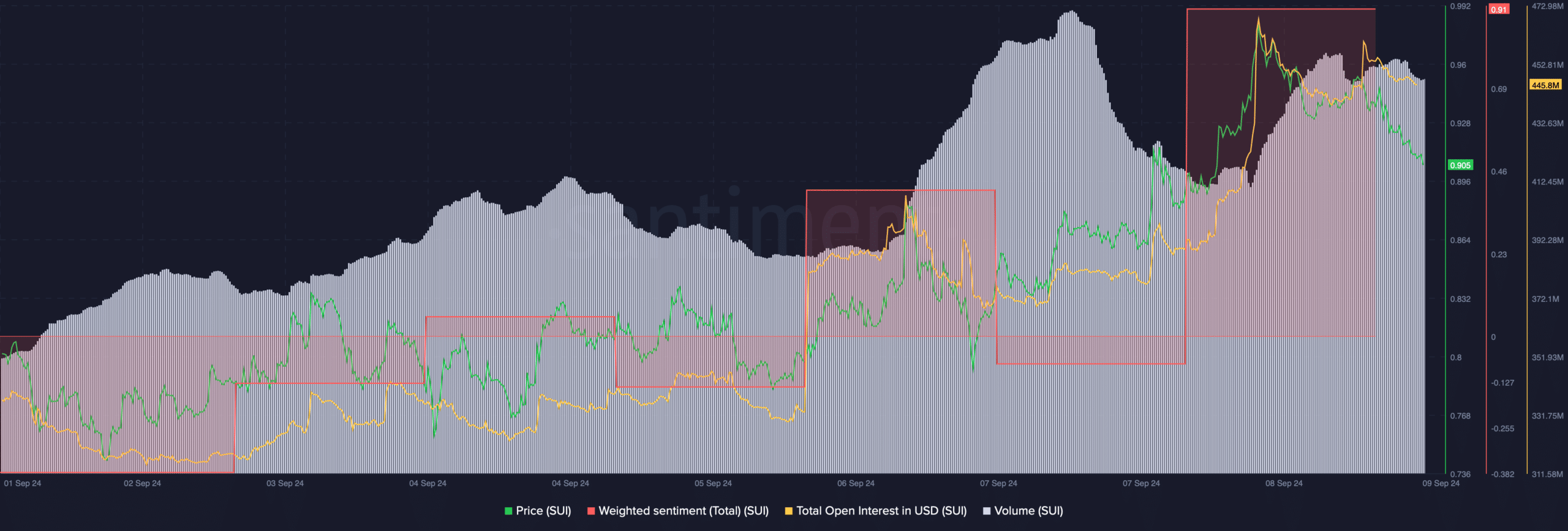

Our analysis of Santiment’s data revealed that, after a sharp rise, SUI’s open interest fell in the past 24 hours along with its price. Generally, a decline in the metric hints at a change in the on-going price trend.

The token’s trading volume spiked while its price surged, which acts as a foundation for a bull run. Additionally, the token’s weighted sentiment also increased sharply.

This meant that bullish sentiment around the token was dominant in the market.

Conversely, our analysis at Hyblock Capital unveiled a bearish indicator concerning SUI. The gap between whale and retail participation narrowed significantly, decreasing from 100 to 9.6. This trend implies that large investors, or ‘whales,’ are reducing their market involvement.

After that, we examined the day-to-day graph for the token. Notably, the majority of the indicators suggested a bullish trend. The token’s price had managed to surpass its 20-day Simple Moving Average (SMA), as indicated by the Bollinger Bands.

Realistic or not, here’s SUI market cap in BTC’s terms

The technical indicator MACD displayed a bullish crossover.

Additionally, the Money Flow Index (MFI) has shown a rise, indicating that SUI could potentially surpass its bullish trend in the near future.

Read More

2024-09-09 19:03