-

SUI demand gets tested as price pushes into resistance zone.

Evaluating the likelihood of price pushing above the $1.

As a seasoned researcher with years of experience tracking the crypto markets, I find myself intrigued by the current trajectory of SUI. The recent surge following Grayscale’s announcement has been nothing short of impressive, reminding me of the unpredictable yet exciting nature of this space.

It’s almost a week since Grayscale announced the launch of a new Sui [SUI] Fund. The market reacted positively to the announcement, resulting in a bullish uptick for the cryptocurrency.

The development certainly created a lot of excitement judging by SUI price action. The cryptocurrency has so far rallied by over 100% from its bottom range in July.

Enthusiastic outlooks are leading to an increase in high-risk long investments, which could potentially cause problems in the near future. New data shows a significant rise in the termination of these long positions, totaling approximately $19.52 million.

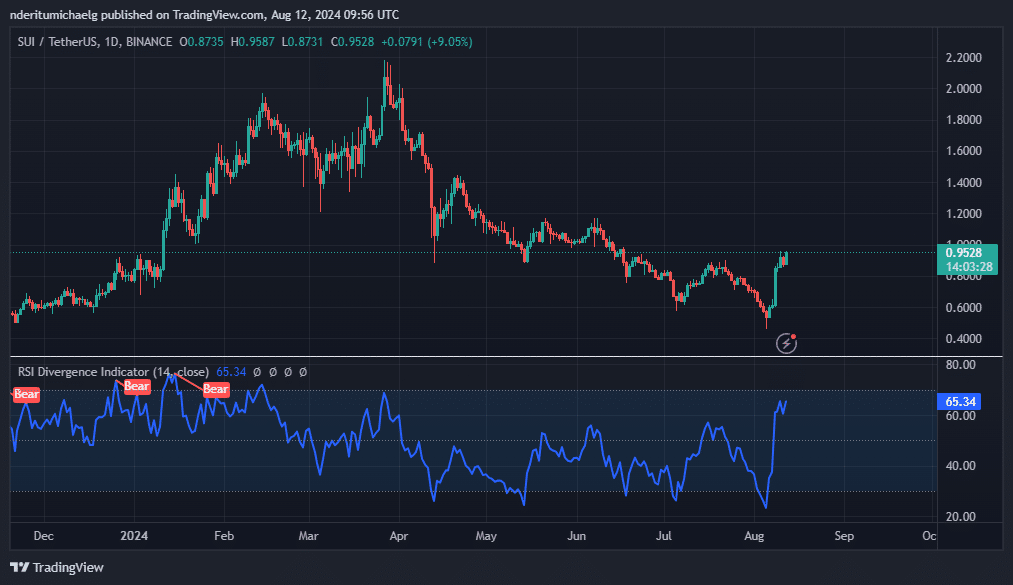

Suisse Federal Railways (SUI) has been aiming for a $1 price point, but it’s currently encountering obstacles around the range of $0.95 to $0.96.

With prolonged liquidations and the potential to break the $1 mark, it seems challenging and may even provoke profit-taking. This is because the cryptocurrency has reached a significant resistance level in its history.

Even with this newly developed opposition, SUI‘s bulls might yet achieve their objective. The Relative Strength Index (RSI) still has some room for movement before it reaches the oversold zone.

If the bulls manage to gather sufficient power during this week, it could lead to a prolonged bullish trend. If so, the potential resistance level we might encounter lies around the $1.17 price region.

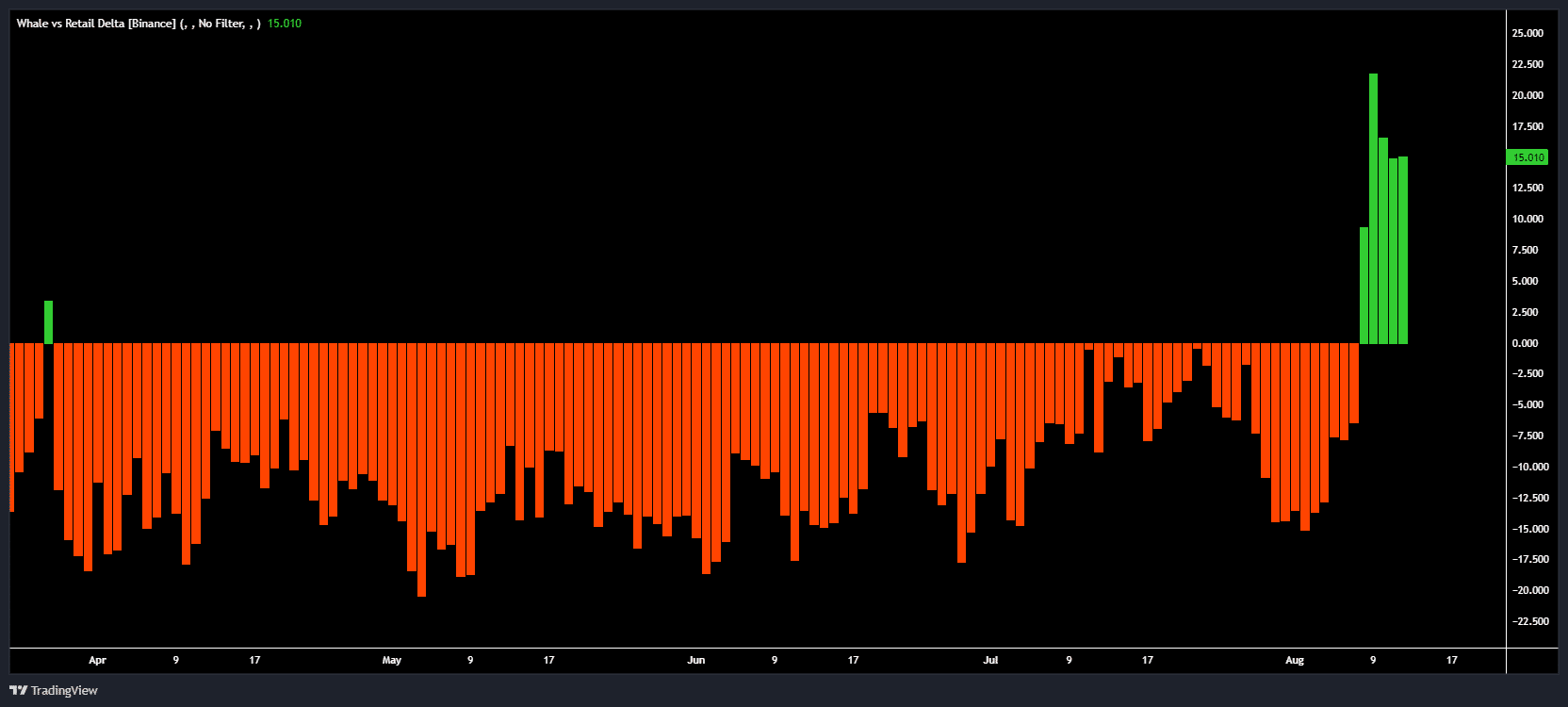

At the observed time, the effects of the liquidations didn’t suggest heavy selling pressure from institutional investors (whales), which aligns with the Whale vs Retail Delta (WRD) metric. Remarkably, the WRD has remained positive for the past five days, indicating that retail investors were more active compared to institutional ones during this period.

In the past 24 hours, the WRD earned 15 points. This implies that there is a higher amount of prolonged investment by whales at present. This could be the reason behind the price holding firm and resisting falls on the downside over the last three days.

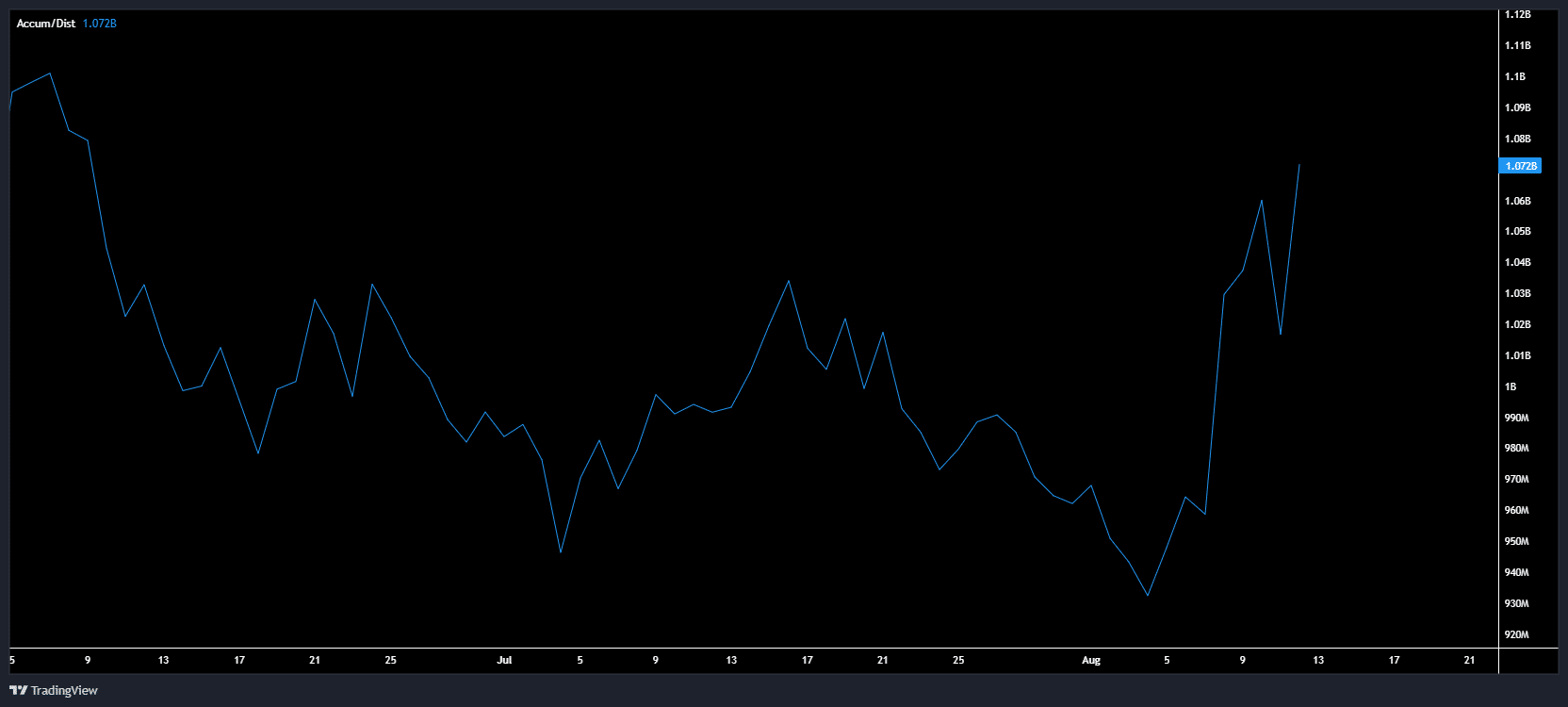

A significant finding that reinforced the potential for further growth was the rise in the Accumulation/Distribution Indicator. At the current moment, it reached a high of approximately 1.05 billion, implying that the SUI market remains predominantly controlled by the bulls.

Given our recent research results, it appears likely that SUI will surpass the $1 mark shortly due to its strong current performance. This positive trend can be attributed to the buzz generated by the Grayscale announcement.

Realistic or not, here’s SUI market cap in BTC’s terms

Nevertheless, there are interesting potential outcomes to note.

If the general crypto market feeling stays unfavorable, there could be a pause or reversal in SUI‘s ongoing rally due to investors taking profits. But, if the market mood brightens up, the supporters of SUI (bulls) might prolong their control.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Masters Toronto 2025: Everything You Need to Know

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-08-13 01:13