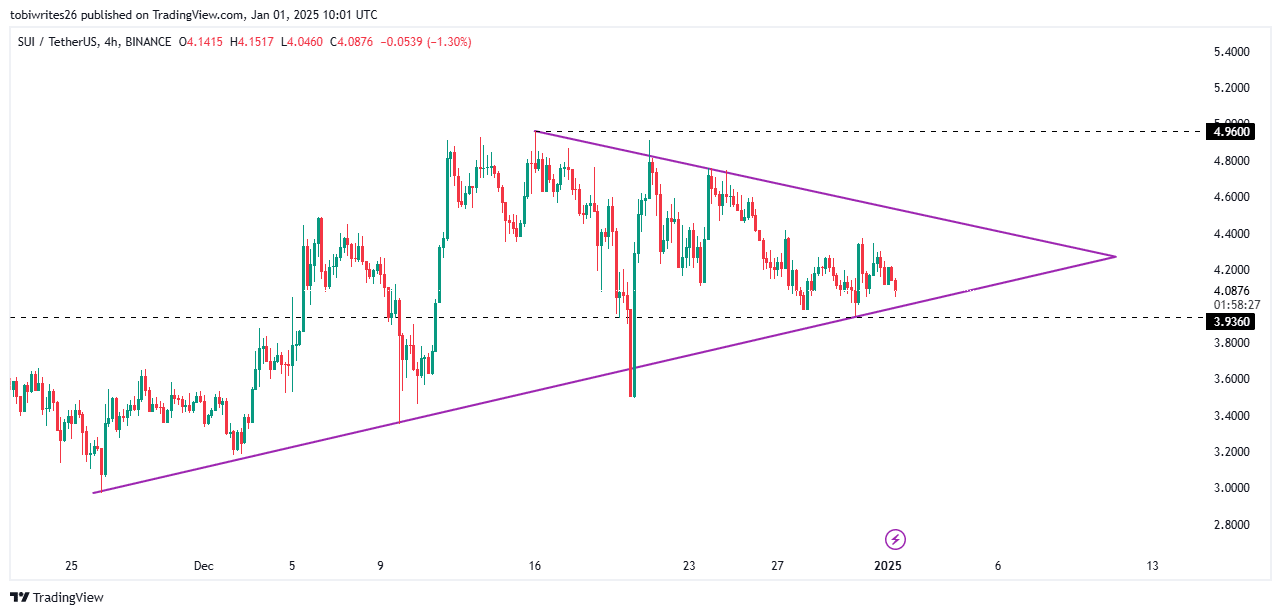

- SUI was trading within a symmetrical triangle pattern, with a key support level to provide a potential base for upward momentum.

- A slight dip remains possible as the coin sought stronger support before resuming its bullish trajectory.

As a seasoned trader with years of experience navigating the tumultuous seas of cryptocurrency markets, I have learned to appreciate the subtle signals that often precede significant market movements. After carefully analyzing SUI’s current technical and on-chain data, I am cautiously optimistic about its future performance.

Despite the recent 4.89% decline over the past 24 hours, SUI’s impressive monthly gain of 24.75% indicates a robust underlying bullish trend. The symmetrical triangle pattern on the 4-hour chart suggests an accumulation phase, which could lead to a bullish breakout in the near term.

However, I remain mindful of short-term downside risks as the coin seeks stronger support at key levels, such as the lower trendline or the historical level of $3.926. It’s always essential to stay vigilant when trading digital assets, as they can be unpredictable and volatile.

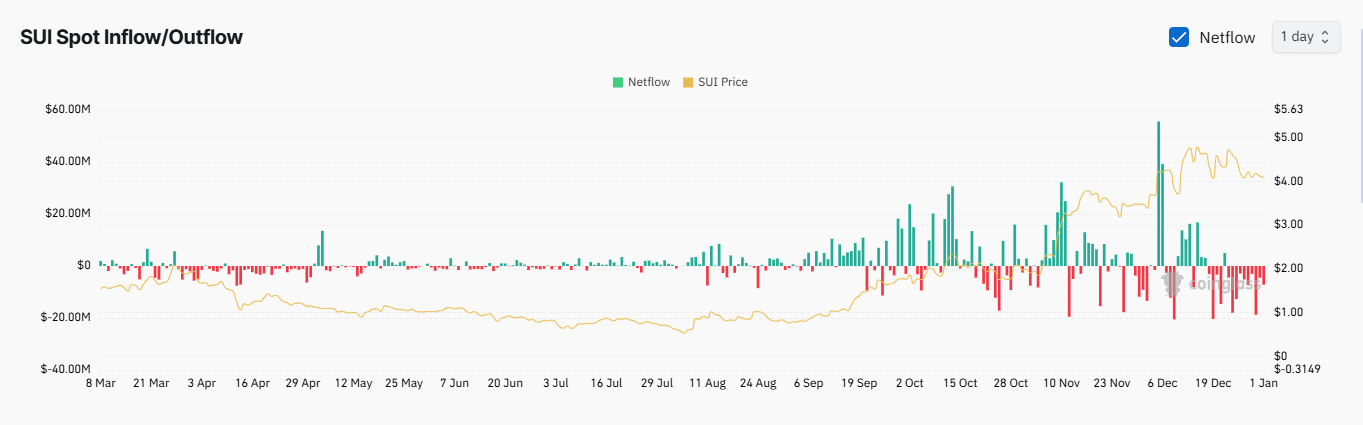

One thing that stands out in SUI’s chart is the continued negative net outflow, which often indicates a positive impact on the price. The recent withdrawal of approximately $26 million worth of SUI from exchanges is an encouraging sign, especially when considering the reduced trading volume and open interest.

That being said, I would not be surprised if we see a slight dip in the near term as market participants test support levels. But rest assured, if history repeats itself, the price will likely trend higher beyond $4.96 once sufficient support is established.

On a lighter note, I’ve always found it amusing how quickly the crypto market can turn on its head – one moment you’re chasing SHIB‘s tail, and the next, SUI surpasses it in market capitalization. It just goes to show that even the most unexpected events can have a significant impact on these rapidly evolving markets!

In the last day, SUI has dropped by 4.89%. This indicates a potential for more decreases in the immediate future. However, its impressive 24.75% increase over the past month underscores its overall positive trajectory.

According to technical analysis using indicators and blockchain data, it’s possible that the value of SUI could soon exceed its current limits and surge towards a more expensive region, possibly peaking at around $4.96 over the short term.

SUI trades within a symmetrical channel

According to the 4-hour chart analysis, Swiss Universal Investment (SUI) seems to be moving into a consolidation period, shaping up as a symmetrical triangle. This pattern implies that traders might be purchasing at relatively lower prices, potentially causing the market to climb upwards.

During this stage, we see two lines moving towards each other: one higher line acting as a potential barrier (resistance), while the other lower line serves as a base (support). In order for a rally in SUI to occur effectively, it may be necessary for the price to decrease and find strong support at two crucial points.

As a seasoned trader with over a decade of experience under my belt, I believe SUI could face some resistance at its lower trendline, but it might continue to slide down towards a historically significant level of 3.926. This potential drop could potentially trigger a move upwards towards the $4.96 price point. Moving beyond that, based on my observations and analysis, I predict that the overall trend for SUI will likely be upward. My advice to fellow traders would be to keep a close eye on these levels as they could present valuable opportunities in the market.

As a cryptocurrency investor, I’m observing a persistent trend of less crypto leaving exchanges than entering, as indicated by the Exchange Netflow metric on Coinglass. This negative net outflow usually contributes to an upward movement in prices since it suggests increased holding and reduced selling pressure.

Around $26 million of SUI has been taken out of exchanges, and about $7.11 million was withdrawn within the last 24 hours.

Despite the overall favorable market conditions for altcoins, AMBCrypto has pointed out additional factors indicating a potential short-term decline in its price.

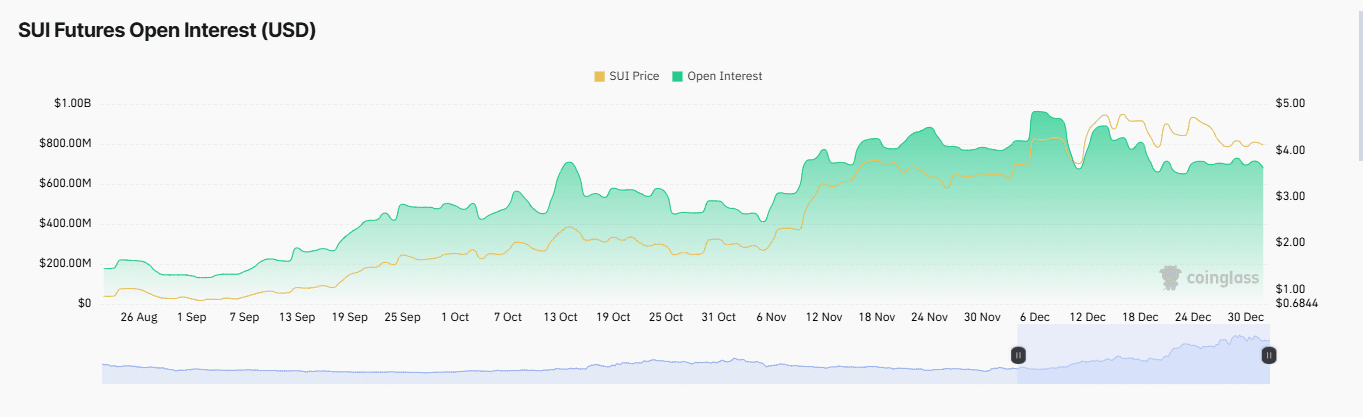

Open Interest declines

In the last day, the Open Interest (OI) held by SUI in the market decreased by approximately 5.68%, now standing at around $677.82 million.

A drop in Outstanding Interest (OI) usually signals a decrease in activity by market participants, as the number of open derivative contracts lessens.

The downward trajectory of this trend can also be attributed to a substantial decrease in trading activity. Specifically, the trading volume plummeted by approximately 48.84%, amounting to just $1.15 billion during the same timeframe.

As a seasoned trader with years of experience under my belt, I find myself closely monitoring the trading activity of SUI. The recent drop in trading volume and increased selling pressure has caught my attention. Based on my observations and analysis of current chart patterns, it appears that the price of SUI could continue to decline, potentially testing support at the $3.96 level.

I have seen similar market conditions before, and when this happens, it’s important to stay vigilant and adaptable. I would not be surprised if the price of SUI dips further given these factors. However, as always, it’s essential to keep a close eye on the market and be prepared for any sudden changes or unexpected events that could impact the price.

In my experience, it’s crucial to remain disciplined and follow a well-thought-out trading strategy when navigating volatile markets such as this one. I will continue to closely monitor SUI and make adjustments to my portfolio accordingly.

SUI surpasses SHIB in market capitalization

Currently, the market value of SUI surpasses that of SHIB, with a market capitalization of approximately 12.54 billion dollars, while SHIB is slightly lower at around 12.45 billion dollars.

Read Shiba Inu’s [SHIB] Price Prediction 2025–2026

As we anticipate a surge in the value of SUI, the difference between it and the other asset could expand even more, possibly causing SUI’s market capitalization to rise further.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- SOL PREDICTION. SOL cryptocurrency

- Upper Deck’s First DC Annual Trading Cards Are Finally Here

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- The Battle Royale That Started It All Has Never Been More Profitable

- EastEnders’ Balvinder Sopal hopes for Suki and Ash reconciliation: ‘Needs to happen’

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

2025-01-01 23:04