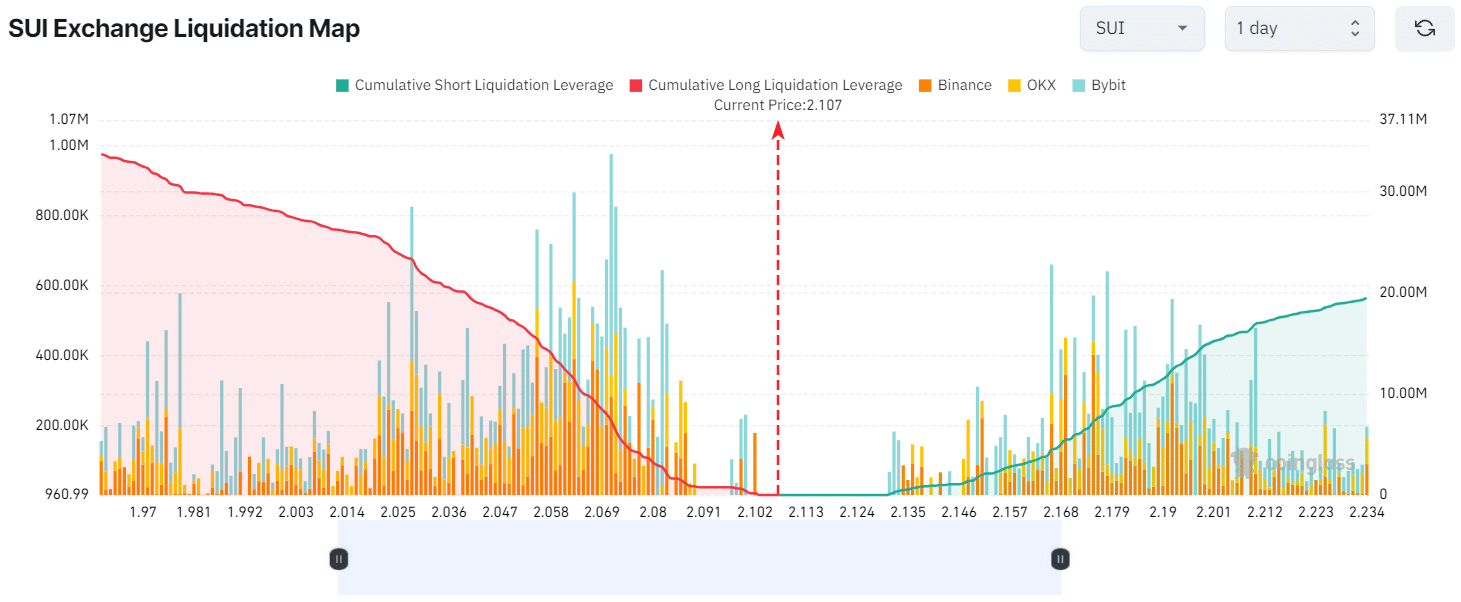

- In the past 24 hours, SUI bulls’ long positions were significantly higher than bears’ short positions.

- Traders over-leveraged at $2.07 on the lower side and $2.166 on the upper side.

As a seasoned crypto investor with battle-hardened resolve and an ever-growing appetite for digital gold, I find myself intrigued by the latest developments surrounding Sui [SUI]. The past 24 hours have been a rollercoaster ride, but the resilience of this Layer-1 token is nothing short of impressive.

Following a strong bounce back in cryptocurrency values overall, significant digital currencies experienced a price adjustment or decrease.

In the current situation, the Layer-1 token SUI (SUI) has managed to revisit its breakout zone and seems ready for a substantial upward price surge.

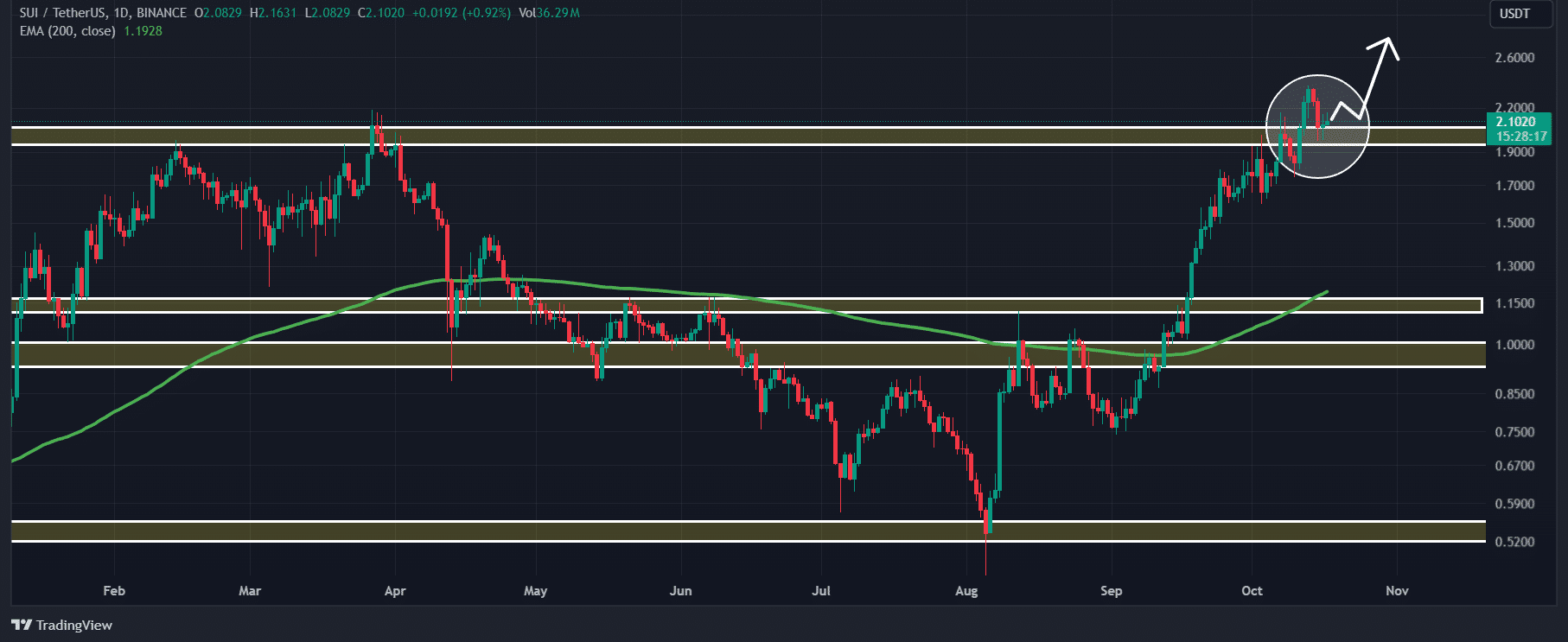

SUI: Assessing key levels

Based on technical analysis by AMBCrypto, the price of SUI showed signs of optimism as it successfully broke through a robust resistance point at $2.05, forming a distinctive three-white-shoulder candlestick configuration in the daily chart.

After the recent spike, the price of SUI increased by almost 20%. Yet, during this period of price adjustment, SUI has returned to that previous level but is currently trending upwards again.

If the past trend of SUI’s price movement indicates anything, it means that if SUI manages to stay above the $1.80 mark, it might potentially surge by approximately 20%, reaching around $2.50 over the next few days.

If SUI doesn’t manage to hold the $1.80 mark, there could be a substantial drop in its price down to around $1.40.

As an analyst, I’m observing a positive market sentiment surrounding SUI, which seems likely to keep it above the resistance level for the near future. I anticipate a substantial increase in its value within the upcoming days.

According to the analysis from Coinglass, a firm specializing in blockchain data, there’s a strong optimism surrounding SUI. This is due to the fact that its Long/Short Ratio stands at 1.02 currently, suggesting that more traders are betting on an increase in the price of SUI rather than a decrease, signaling a bullish trend.

Furthermore, there was a 4.1% increase in open interest for Futures within the last 24 hours. This indicates that more positions were established during this period compared to the preceding day. Such an increase is typically viewed as a favorable sign.

Major liquidation levels

At this moment, significant selling points are approximately $2.07 (lower) and $2.166 (higher), as suggested by Coinglass. Traders seem excessively invested or ‘over-leveraged’ at these price points.

If the market feelings stay the same and the price ascends to around $2.166, approximately $4.52 million in short positions will be closed out.

Read Sui’s [SUI] Price Prediction 2024–2025

If the sentiment reverses and the price drops to around $2.07, it’s estimated that roughly $7.35 million in long positions would need to be closed.

This data suggests that bulls’ long positions are significantly higher than bears’ short positions.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Quick Guide: Finding Garlic in Oblivion Remastered

- BLUR PREDICTION. BLUR cryptocurrency

- Elon Musk’s Wild Blockchain Adventure: Is He the Next Digital Wizard?

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

2024-10-17 21:43