-

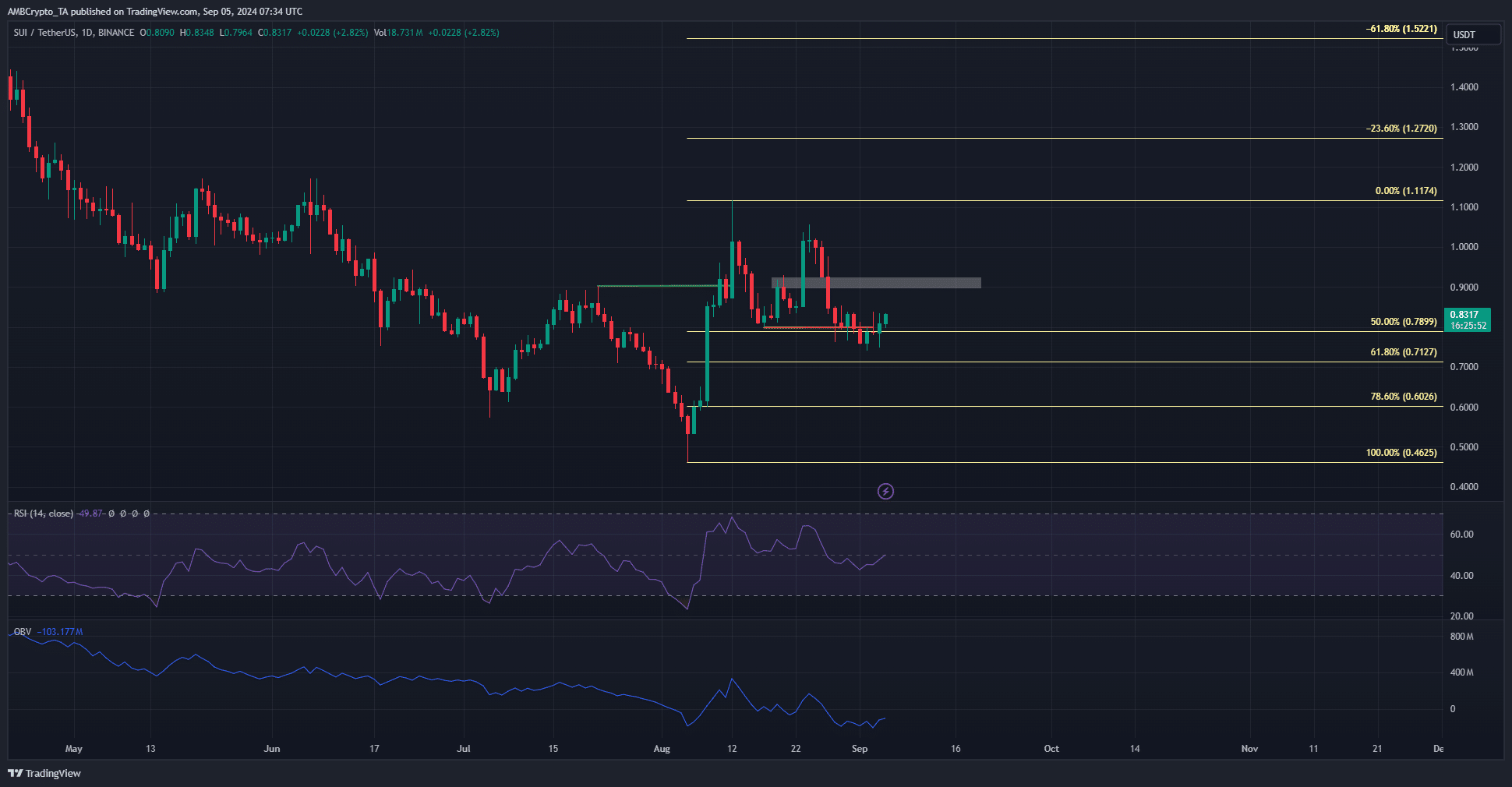

The daily market structure has shifted recently.

The retracement phase could take a few weeks to play out if SUI can’t reclaim $1.

As a seasoned crypto investor with a knack for spotting trends and reading market structures, I find myself cautiously optimistic about SUI‘s current trajectory. The recent bullish signals are undeniably promising, with the network’s TVL growth and high transaction speed pointing towards a bright future. However, my years in this volatile market have taught me to never underestimate the potential for a retracement.

In this case, the following analysis was performed:

Users on the network may find themselves excited by the rapid transaction speeds and increasing token prices, which indicate a growing faith in the token. Nevertheless, there are potential obstacles that long-term investors should be aware of

Bearish structure break promises a partial retracement

On August 10th, the market setup on the daily graph transitioned positively as SUI surpassed $0.902, leading to a rise that approached, but didn’t quite reach, the resistance area from May. However, since then, there has been a pullback for the token

On August 31st, the market experienced a significant shift towards bearish trends, indicating that a temporary pullback might occur. The range between $0.9 and $0.93 serves as a potential short-term goal before potential additional declines

In simpler terms, the Relative Strength Index (RSI) value was approximately 49.9, suggesting that the momentum was neither bullish nor bearish. However, as the market structure weakened, the RSI trended downward, becoming more negative. On the other hand, the On-Balance Volume (OBV) failed to sustain its high levels, which it had reached in August

It appears that traders lacked conviction in a prolonged uptrend, as they focused on the potential price targets of $0.6 and $0.712, according to Fibonacci retracement levels

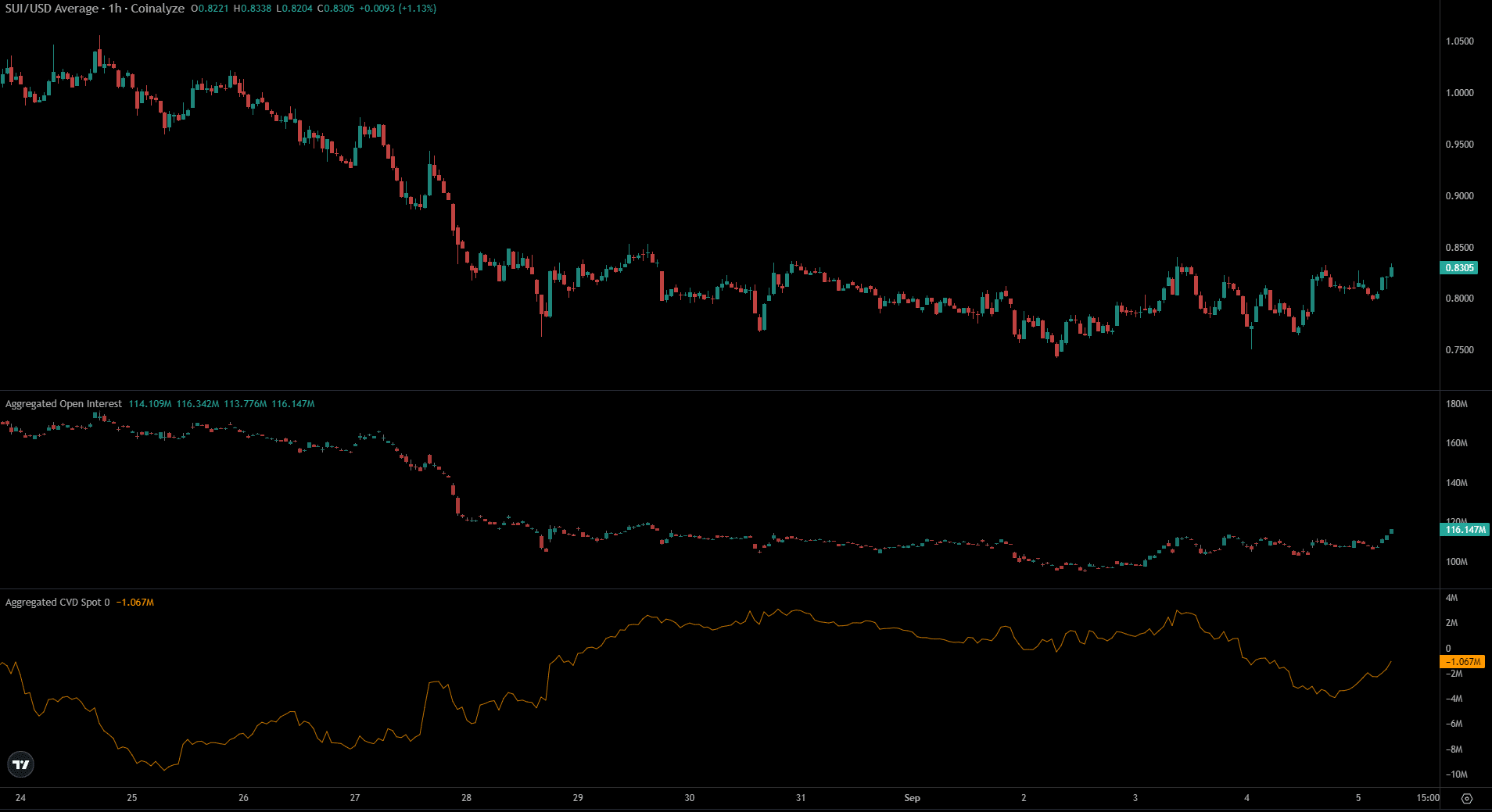

Spot CVD uptick supports the idea of a price bounce

For the last two days, a jump in price from $0.75 to $0.83 coincided with an approximately $20 million boost in Open Interest

Is your portfolio green? Check the Sui Profit Calculator

This showed that speculators were willing to go long on SUI, expecting profits.

Over the last 24 hours, the price of CVD has been rising significantly. It seems plausible that it might reach the nearby resistance at $0.9. However, whether the bulls will encounter a rejection at this point is yet to be determined

Read More

- OM PREDICTION. OM cryptocurrency

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Serena Williams’ Husband Fires Back at Critics

- Christina Haack and Ant Anstead Team Up Again—Awkward or Heartwarming?

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- WWE’s Braun Strowman Suffers Bloody Beatdown on Saturday Night’s Main Event

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

2024-09-05 22:07