-

SUI has outperformed most coins, securing the weekly top gainer spot.

Consequently, it might challenge LTC’s market positioning if the trend holds – what are the odds?

As a seasoned crypto investor with a knack for spotting potential winners and learning from past market lessons, I find myself intrigued by SUI‘s recent performance. The coin has indeed outperformed most of its peers, securing the weekly top gainer spot – a feat not easily achieved in this volatile market.

Sui [SUI] ended the week as the top gainer among the top 25 tokens, surging 49% to $1.62. Now in 21st place, SUI’s rise has analysts speculating about its potential to replace Litecoin, which gained 8% to $68.49.

As SUI moves closer to reaching its all-time high in March of $2.09, the possibility of surpassing Litecoin in the top 20 cryptocurrencies is becoming increasingly likely.

SUI is defying the odds but there is a catch

Source : Coinalyze

Looking at its daily price chart, SUI has consistently displayed upward-pointing candles (or “green candles”) since early September. This trend began with a bullish start in September and has continued, even amidst the wider market’s volatility. Remarkably, SUI’s value has increased by more than 100% during this period.

Currently, attempts at LTC breakouts above $65K have been unsuccessful due to resistance from Long-Term Contract (LTC) bears, who have blocked its ascent. Yet, after a surge in Bitcoin‘s price, LTC bulls have renewed their efforts to breach the $68K ceiling.

As a crypto investor, I’ve noticed an interesting pattern: Litecoin (LTC) seems to be influenced by Bitcoin’s fluctuations, whereas Suisei (SUI) has been consistently performing well. This trend implies that SUI could potentially offer more promising returns for investors in the future.

Despite a rise in SUI during September, what drove this increase was a significant trading volume. This surge pushed the RSI into an overbought state, indicating accumulation. In a similar fashion, the CMF has also surpassed its previous resistance level. This rate of growth is more rapid than when SUI previously reached its all-time high (ATH).

When investor enthusiasm for SUI was particularly high, it happened around the same time as Bitcoin reaching the $64K mark again, which made SUI seem like an even more appealing investment choice compared to Bitcoin.

If that’s the case, it brings up doubts about SUI‘s future growth, potentially contradicting the idea of it surpassing LTC in the long run. Therefore, could the 49% increase have been merely a temporary spike?

The chart hints at possible accumulation

Previously noted, SUI has climbed to the number one spot among gainers due to its strong performance over the last week. Interestingly, this rise was coupled with a larger amount of SUI being transferred to exchanges.

Source : Coinglass

Essentially, what this means is that the stability of SUI wasn’t completely immune to Bitcoin’s price fluctuations. Yet, the build-up by owners, as evidenced by the indicators provided, served as a barrier against a significant drop in value.

Although accumulation suggests a positive trend for the altcoin, it might cause issues over time because many traders may decide to sell once they’ve made their profits, as was the case when SUI reached its all-time high (ATH) in mid-March, coinciding with BTC‘s own peak. This could lead to a large number of sellers exiting the market.

Following a sharp decline in Bitcoin, Switcheo USD (SUI) dipped even further to $1.06 within merely two weeks. After that, the price of SUI has been on a downward trend for approximately 180 days, with its negative momentum intensifying over this period.

If the current pattern persists, Shiba Inu (SUI) could be on the brink of a substantial pullback within just a few days. But if buyers manage to keep SUI’s price above the $1.70 resistance level and aim for the all-time high (ATH), the likelihood of SUI outperforming Litecoin (LTC) will grow – Why?

The rate of growth matters

For approximately a month now, Litecoin (LTC), ranked as the 20th largest cryptocurrency by market capitalization, has been holding steady within a price range of around $60,000 to $70,000. Conversely, Suisei (SUI) has seen a substantial surge in value during this period.

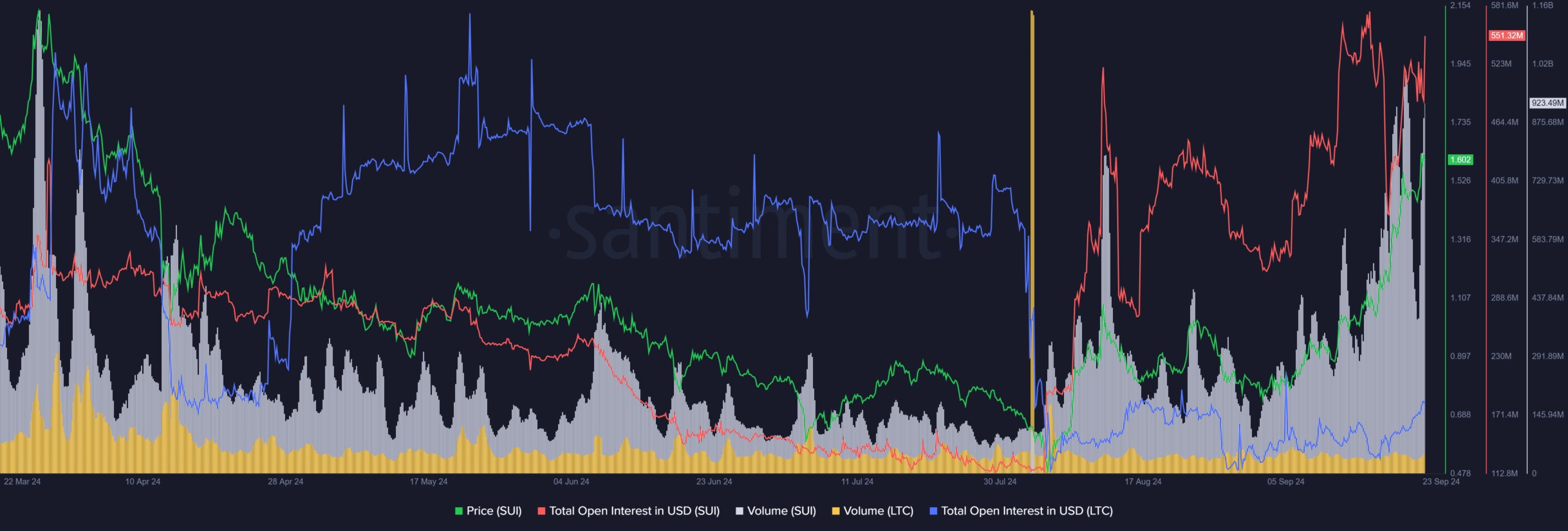

As a crypto investor, I’ve noticed that despite Litecoin (LTC) boasting high transaction volumes and low fees, there haven’t been any significant positive results as of late. In fact, the transaction volume has plummeted from over $1 billion in April to just $246 million at this current moment. Furthermore, the open interest in USD has also been cut in half.

Source : Santiment

On the flip side, SUI has seen a significant increase in both trading activity and Open Interest (OI). The Open Interest has surpassed the half-billion dollar mark, while the total trading volume is fast approaching the $1 billion threshold.

AMBCrypto points out that although these figures suggest expansion, they don’t guarantee future profits. Instead, the emphasis is on the speed at which SUI is garnering attention in contrast to LTC.

Read Sui’s [SUI] Price Prediction 2024-25

The result is clear – SUI has risen through market lows to secure the top spot, gaining traction from holders. Its growth rate has significantly outpaced LTC.

If bulls manage to preserve their liquidity and defend the $1.70 level, Shiba Inu (SUI) could potentially surpass Litecoin (LTC) in terms of market capitalization rank, aiming for an all-time high in the process.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2024-09-23 17:12