- SUI experienced a cooling effect with its network activity after a robust performance in the last two months.

- A recap of SUI’s latest price action, its pullback and where to expect the next support.

As a seasoned crypto investor who has witnessed the rise and fall of numerous digital assets, I must admit that SUI has been quite the rollercoaster ride these past few months. From its humble beginnings to its recent impressive growth spurt, it’s been an exciting journey indeed.

Over the past several weeks, the SUI network has proven to be among the most rapidly expanding networks. This is clearly demonstrated by the performance of its native cryptocurrency and, even more so, by the network’s significant growth indicators.

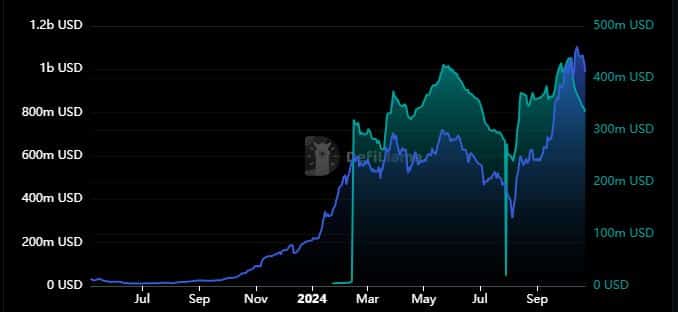

In summary, Sui saw a significant surge in its Total Value Locked (TVL) this year. At the beginning of 2024, its TVL was $211 million, but it reached and surpassed the $1 billion milestone for the first time on October 15th.

The market has since cooled down, causing the TVL to slid below the $1 billion level.

At the time of reporting, TVL (Total Value Locked) stood at approximately $987 million. However, the effects of the recent cooldown were more noticeable in the market capitalization of network-related stablecoins.

Moreover, it experienced a significant surge that reached its highest point of $437.5 million on the 5th of October. Since then, it has dropped back to $335.22 million.

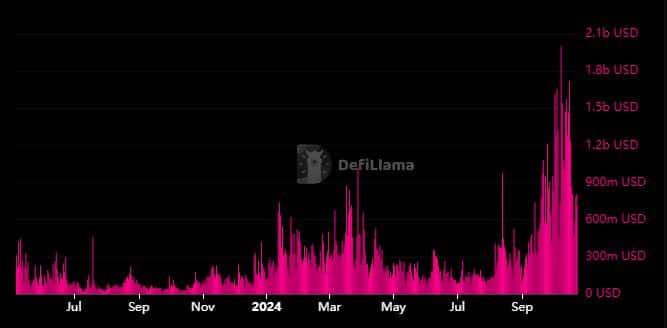

Over the past two months, it’s clear that the Sui blockchain has been exceptionally active. This is demonstrated by the significant increase in transaction volume seen from September to October.

On October 8th, the daily trading volume of SUI’s tokens reached an all-time high exceeding $2 billion, marking the largest single day volume the Sui network has ever experienced.

SUI’s on-chain volume recently dropped as low as $471 million earlier in the week. This was followed by a volume surge in the last three days.

From the data we’ve gathered, it seems the network’s pace and engagement have been decreasing. As a result, this reduction in activity may be impacting the popularity or usage of the SUI token.

Bearish momentum has been building up, aided by additional sell pressure as the overall market condition turns bearish.

SUI goes through an anticipated retracement

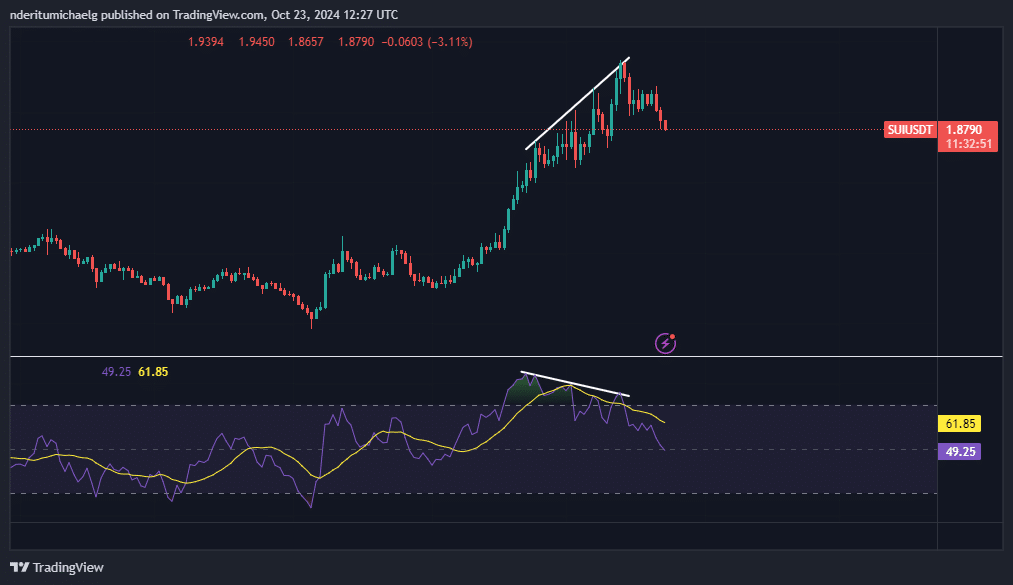

At the moment of writing, I observed SUI trading at roughly $1.87, marking a 20.69% decline since it reached its recent local high on the 13th of October. Prior to this dip, SUI had peaked at $2.36 around mid-October.

AMBCrypto anticipated the pullback based on a higher high and lower high price to RSI divergence.

Should SUI’s decline persist, it might find a potential floor within the $1.35 to $1.54 price band. This prediction is derived from the Fibonacci retracement pattern analysis.

Read Sui’s [SUI] Price Prediction 2024–2025

The network continues to demonstrate its resolve towards attracting more activity into its ecosystem. Its latest announcement revealed that it is now integrated with Google and Zettablock.

This result might enhance its attractiveness for developers, thereby possibly enabling Sui to continue its upward trend.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-10-23 21:43