- Recent data revealed a sharp increase in chain netflows, placing SUI ahead of other prominent Layer 1 blockchains.

- Several key indicators and metrics added more to the tendency for the rally to the upside.

As a seasoned researcher with years of experience tracking the crypto market, I must say I’ve seldom seen such positive momentum for a blockchain as SUI has been experiencing lately. The recent surge in chain netflows, reaching an impressive $23.8 million, and the all-time high Open Interest at $858.43 million are clear indicators of growing demand and market activity.

Despite a 4.85% drop over the last seven days for SUI, it’s showing signs of improvement with a 0.69% increase observed within the past 24 hours.

This bounce contributes significantly to a robust monthly increase of 77.91%, suggesting a consistent trend moving higher.

The data from on-chain measurements and overall market feeling indicated a continuous surge. Based on AMBCrypto’s interpretation, this optimistic outlook suggests that the altcoin’s rise may continue for longer as long as the present tendencies remain unchanged.

SUI surges ahead with $23.8M netflow

Over the last day, as per Artemis’ data, SUI has noted a substantial inflow of approximately $23.8 million through its network.

Placing the coin at the forefront of prominent blockchains such as Arbitrum, Solana, Bitcoin, and Optimism indicates a spike in market action and increased trust among investors, suggesting heightened interest.

During this timeframe, a total sum of $23.8 million signifies the overall difference in funds entering and exiting SUI. This amount is derived by deducting the money going out from the money coming in.

As a crypto investor, I’ve noticed that a positive netflow, as demonstrated here, frequently hints at a bullish outlook. This suggests an increasing interest in the SUI ecosystem, which could potentially lead to price growth.

Recently, SUI unveiled a collaboration with Franklin Templeton, an investment company managing over a trillion dollars in assets.

Through this partnership, we anticipate that the ecosystem surrounding the digital currency will be reinforced, leading to more advancements and capturing attention from institutional investors.

Open Interest hits record high

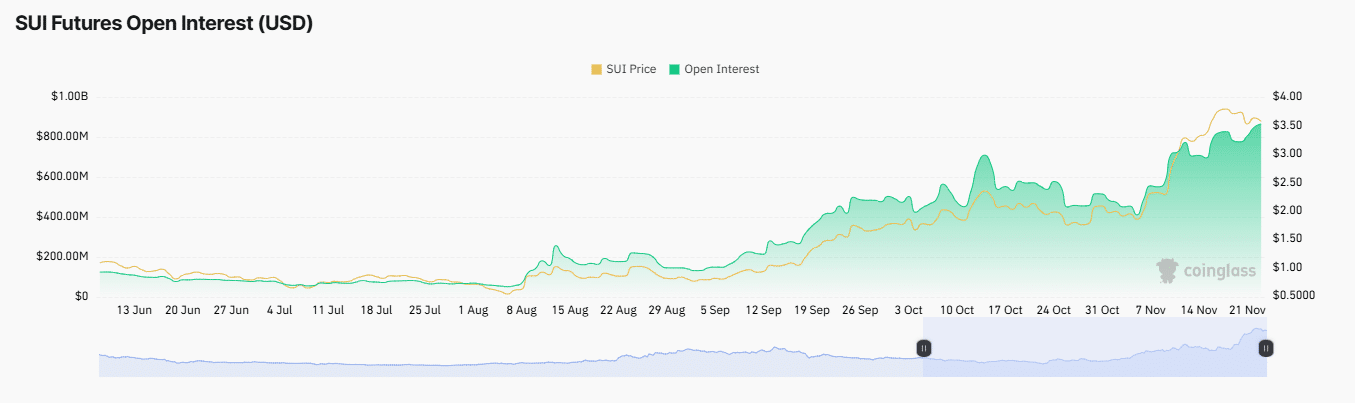

The Open Interest (OI) of SUI has soared to a record high of $858.43 million as we speak.

Reaching this milestone signifies an increase in the desire for the asset, reflecting increased trading actions and a rising curiosity about its futures trading market.

OI measures the total number of unsettled derivative contracts, providing insight into market sentiment and demand.

An elevated Open Interest (OI) figure, such as SUI’s 3.56% rise, frequently indicates a surge in market activity and investors’ faith in the asset’s potential growth.

Over the past day, there’s been a net outflow of $8.23 million from the exchange for this coin.

As a seasoned investor with years of experience in the volatile world of cryptocurrencies, I have noticed a trend that might be of interest to my fellow investors. Based on my observations, it appears that more SUI (the symbol for a particular cryptocurrency) has been withdrawn from trading platforms than deposited, leading to a decrease in the circulating supply available for trading.

Overall, the pattern tends to be favorable, suggesting a move towards investors keeping their assets for longer periods instead of feeling compelled to sell them.

With less SUI on exchanges, demand could rise further, potentially driving upward price momentum.

A slight pause before SUI’s next move

At the current moment, the predicted rise in value for this digital coin could potentially occur over a prolonged period, given that the Long-to-Short ratio stands at 0.9227, which is slightly less than one.

Based on my years of trading experience, I’ve learned that when there are more short positions than long ones, it can be a warning sign for potential market reversals. This pattern has often caught me off guard in the past, and I’ve had to adjust my strategy accordingly. In such situations, I tend to exercise caution and look for opportunities elsewhere, as the upward momentum may be limited due to the imbalance of positions.

Read Sui’s [SUI] Price Prediction 2024–2025

In simpler terms, there’s a growing pessimism among traders dealing with derivatives, as they are increasingly betting that the price will fall. This situation might lead to a temporary drop in price or halt an upward trend, much like what we observed with SUI.

If the overall market outlook stays optimistic, the alternative coin may continue to build speed and initiate an upsurge. This is particularly likely if crucial signals line up to reinforce favorable price movement.

Read More

2024-11-24 00:08