-

Sui’s TVL surpassed $1.03 billion, signaling growing liquidity and increased trust in the network.

With rising active addresses and market activity, SUI is positioned to break the $1.38 resistance.

As a researcher with years of experience in the cryptocurrency market, I must say that Sui [SUI] has shown impressive growth and resilience in recent times. With its TVL surpassing $1.03 billion, it’s evident that the network is gaining traction and trust among investors and developers. The rising active addresses and market activity are strong indicators of growing user participation and interest in Sui’s ecosystem.

As a crypto investor, I’m thrilled to share that on September 19, Sui [SUI] hit a major stride as its Total Value Locked (TVL) surpassed an impressive $1.03 billion. This milestone underscores the increasing trust and capital investment flowing into the blockchain’s Decentralized Finance (DeFi) ecosystem, signaling strong potential for growth in the future.

Currently priced at $1.34 after a 14.84% surge within the past 24 hours, there’s speculation whether this significant growth might ignite a positive trend, potentially driving the value of SUI even higher than its current level of $1.38.

TVL growth: A Catalyst for momentum

Sui’s swift increase from $802 million to $1.03 billion in Total Value Locked (TVL) over a short period demonstrates growing trust in its platform. The graph illustrates that Sui’s TVL has been steadily climbing, especially during 2024, reaching this $1 billion milestone as the pinnacle of its growth trend.

TVL is a key metric in DeFi, as it reflects the total capital locked in smart contracts, driving liquidity and attracting developers to the platform.

Achieving a $1 billion valuation isn’t merely a symbolic hurdle; it cements Sui’s standing amongst leading Decentralized Finance (DeFi) protocols. This increased liquidity could attract even more users and investors, potentially escalating the network’s popularity and long-term potential.

Rising active addresses: Growing user participation

Sui’s daily active addresses have climbed significantly, rising from 1.47 million to 1.66 million – that’s a 12.93% jump in a single day. This dramatic spike suggests a growing interest among users in utilizing the platform’s decentralized apps and services.

As a crypto investor, I’ve noticed that an expanding user base typically means more assets are getting secured within smart contracts. This trend, in turn, could bolster Sui’s Total Value Locked (TVL) and potentially influence its future price fluctuations.

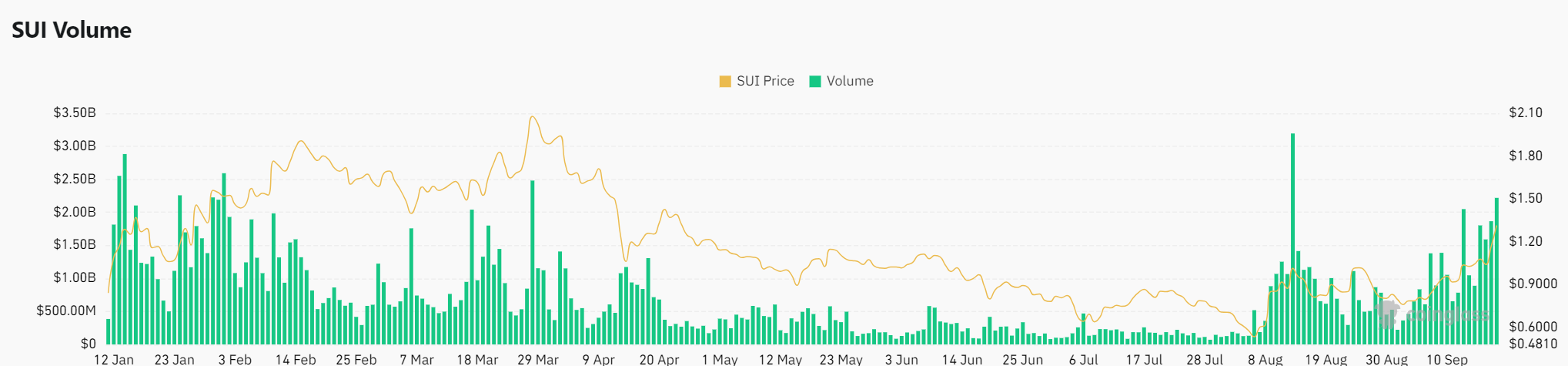

Volume and liquidity: signs of a bullish outlook

At the moment of press, Sui’s derivatives trading volume had surged by 35.57%, reaching an impressive $2.49 billion, indicating a heightened level of market engagement and activity.

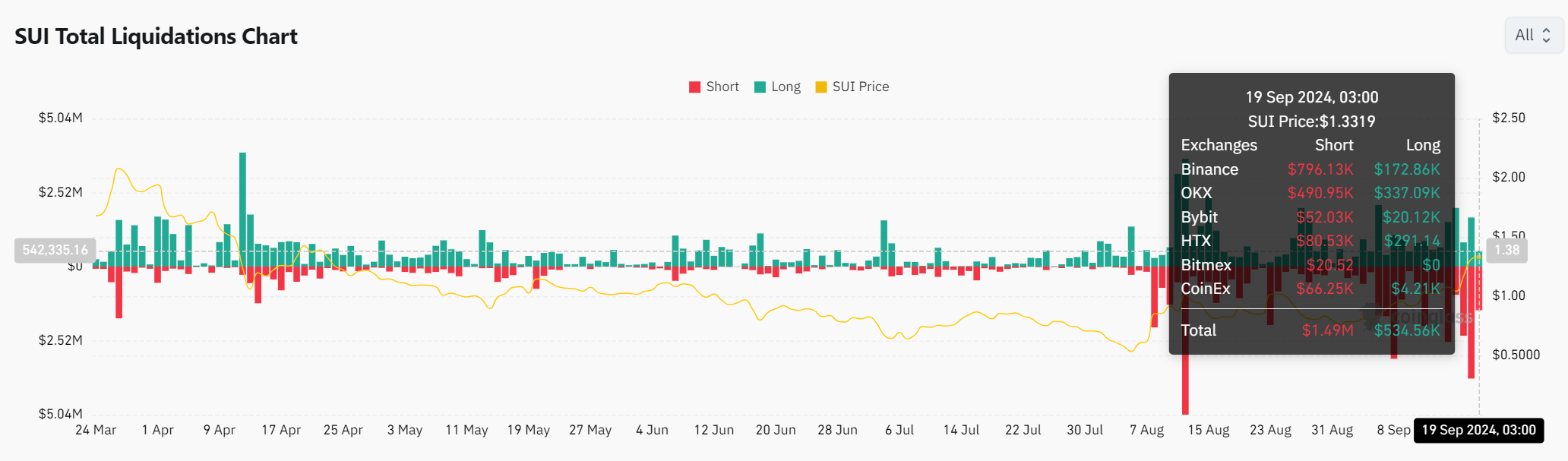

Furthermore, the liquidation graph indicates that there were $1.49 million worth of short positions being closed compared to only $534,560 in long positions being liquidated. This implies a change in investor sentiment, with the heavy closing of short positions possibly indicating that shorts are facing pressure.

This indicates potential bullish momentum, especially as trading volumes rise alongside TVL growth.

Can SUI break through $1.38?

With an increasing Total Value Locked, heightened user engagement, and robust trading figures, Sui seems poised for a possible surge or significant growth spurt.

Read Sui [SUI] Price Prediction 2024-2025

The $1.38 price level is a critical resistance, and if Sui can surpass this, it could signal the start of a sustained bullish rally.

Investors will be closely monitoring whether this momentum can drive prices higher.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- Disney’s Animal Kingdom Says Goodbye to ‘It’s Tough to Be a Bug’ for Zootopia Show

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

2024-09-19 22:15