- While the token’s price increased, its trading volume dropped last week.

- Market indicators and metrics suggested that selling pressure was rising.

As a seasoned analyst with over two decades of market experience under my belt, I’ve seen bull rallies come and go, and I must admit, SUI‘s recent surge has been quite impressive. However, my gut feeling tells me that we might be witnessing the early signs of a correction. The drop in trading volume coupled with rising selling pressure is a red flag that I can’t ignore.

Last week, SUI [SUI] saw significant growth with double-digit increases, largely led by its bulls. However, a potential halt in the token’s upward trend might occur in the near future as a significant signal suggests selling. Will this signal mark the end of SUI’s bullish momentum or merely a temporary pullback?

SUI’s latest sell signal

Last week, the token generated profits for investors as it significantly increased in worth, surpassing a growth of 19%. Despite a slight decrease in bullish force, the token still left its daily chart displaying a vibrant green color.

According to AMBCrypto’s report, as the token’s price rose significantly, there was a substantial surge in its open interest. This significant rise laid the groundwork for the bullish trend that followed.

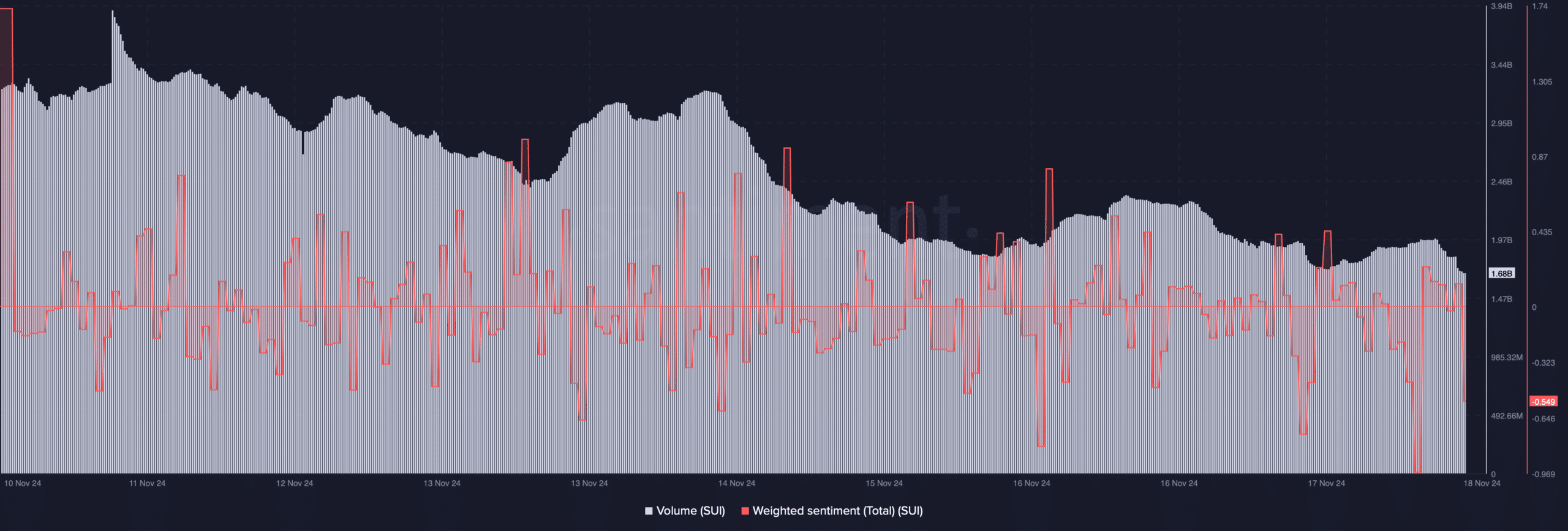

On the other hand, it seems that the current upward trend in the token’s price might switch to a downtrend soon. Analysis from Santiment shows that while the token’s price increased significantly, its trading volume decreased, suggesting an impending reversal. Furthermore, the weighted sentiment towards SUI has dropped sharply, indicating a growing sense of pessimism among traders.

In his latest tweet, well-known cryptocurrency expert Ali signaled a significant change. According to his post, the token’s TD sequential indicator showed a sell signal, which typically indicates a potential decrease in price.

The tool used for analysis is generally reliable, as it correctly predicted a surge of more than 112% in SUI following its buy signal. However, it’s crucial to stay vigilant because a potential price adjustment could be imminent.

Is selling pressure rising?

On November 17th, there was an upward trend in selling activity, as the sell volume exceeded 70, which is typically associated with significant selling pressure. In simpler terms, when the sell volume approaches or surpasses 100, it signifies a high level of selling pressure.

A rise in selling pressure often acts as a catalyst for a price correction.

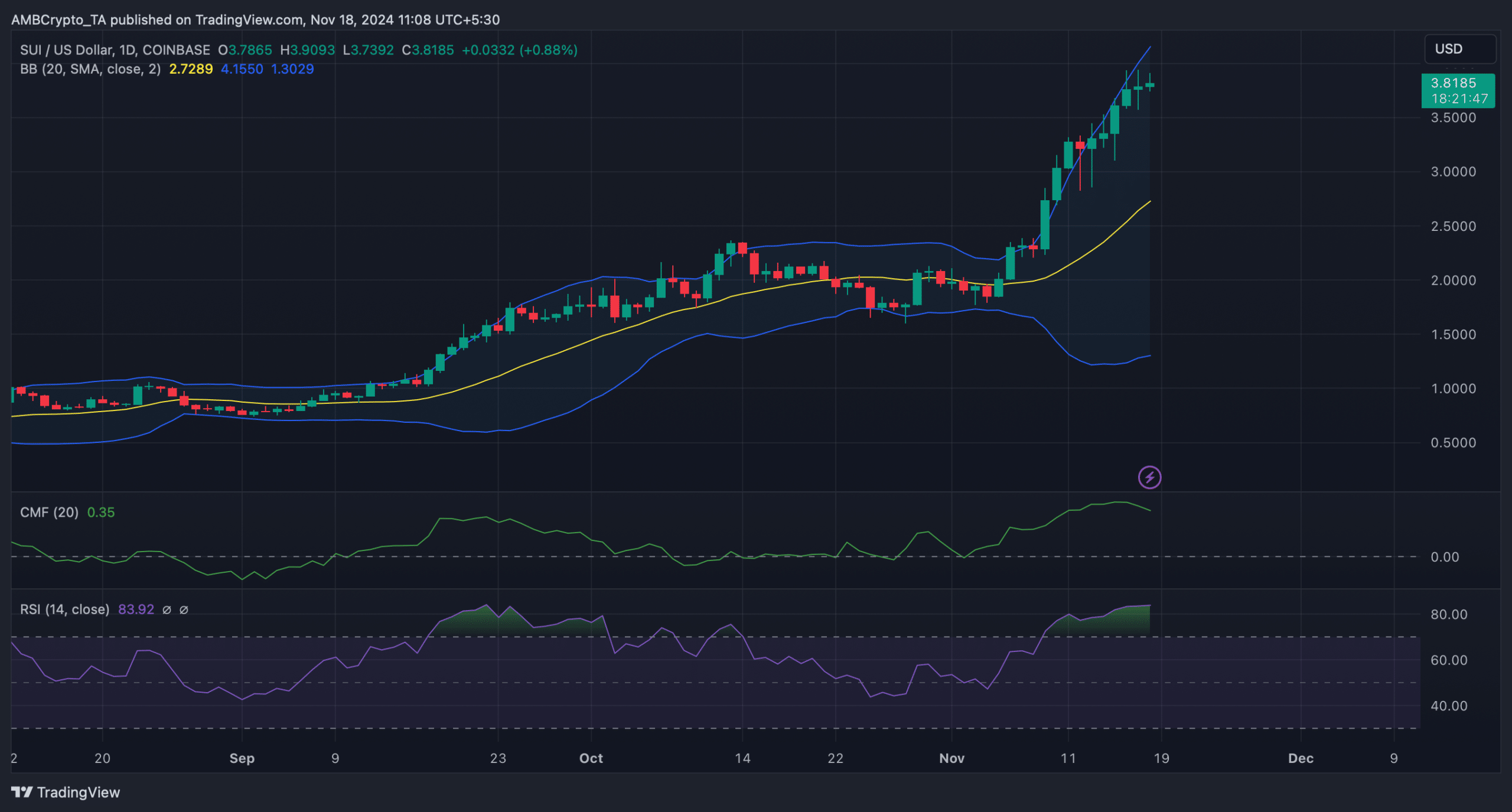

Additionally, some other technical signals suggested that there was significant selling activity. For example, the Chaikin Money Flow (CMF) showed a decrease, which typically indicates a negative trend or outflow of funds from a security.

Beyond that, the Relative Strength Index (RSI) of SUI stood at 84, indicating it was in the overbought region. This could potentially trigger fear among traders and encourage them to offload their investments, which could lead to a decrease in the token’s price.

Realistic or not, here’s SUI’s market cap in BTC’s terms

When the token’s price reached the highest point within the Bollinger Bands, it often triggers a correction, meaning the price will likely decrease.

Whenever the price dips, I’d expect SUI to potentially find some stability around its 20-day Simple Moving Average (SMA). This could provide a good chance for the coin to bounce back and regain momentum.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2024-11-18 13:11