-

The price of SuperRare crypto soared to yearly highs of above $0.34 on the 19th of August before a sharp downward correction.

RARE’s rally was influenced by a surge in volume and transactions on the NFT marketplace, alongside rising Open Interest.

As a seasoned researcher who has witnessed the rollercoaster ride of the crypto market for years now, I can’t help but feel a mix of exhilaration and trepidation when observing the performance of SuperRare [RARE]. The price surge to yearly highs on August 19th was nothing short of spectacular, reminding me of the unpredictable nature of this exciting market. However, the subsequent correction serves as a stark reminder that no coin ever moves in a straight line, especially one like RARE.

On August 19th, the crypto market showed some moderate fluctuations, as the majority of the leading altcoins remained quite stable and traded close to each other in a relatively small price band.

Nevertheless, the value of SuperRare [RARE] has experienced significant fluctuations. It surged to its highest point this year only to be followed by a swift decline.

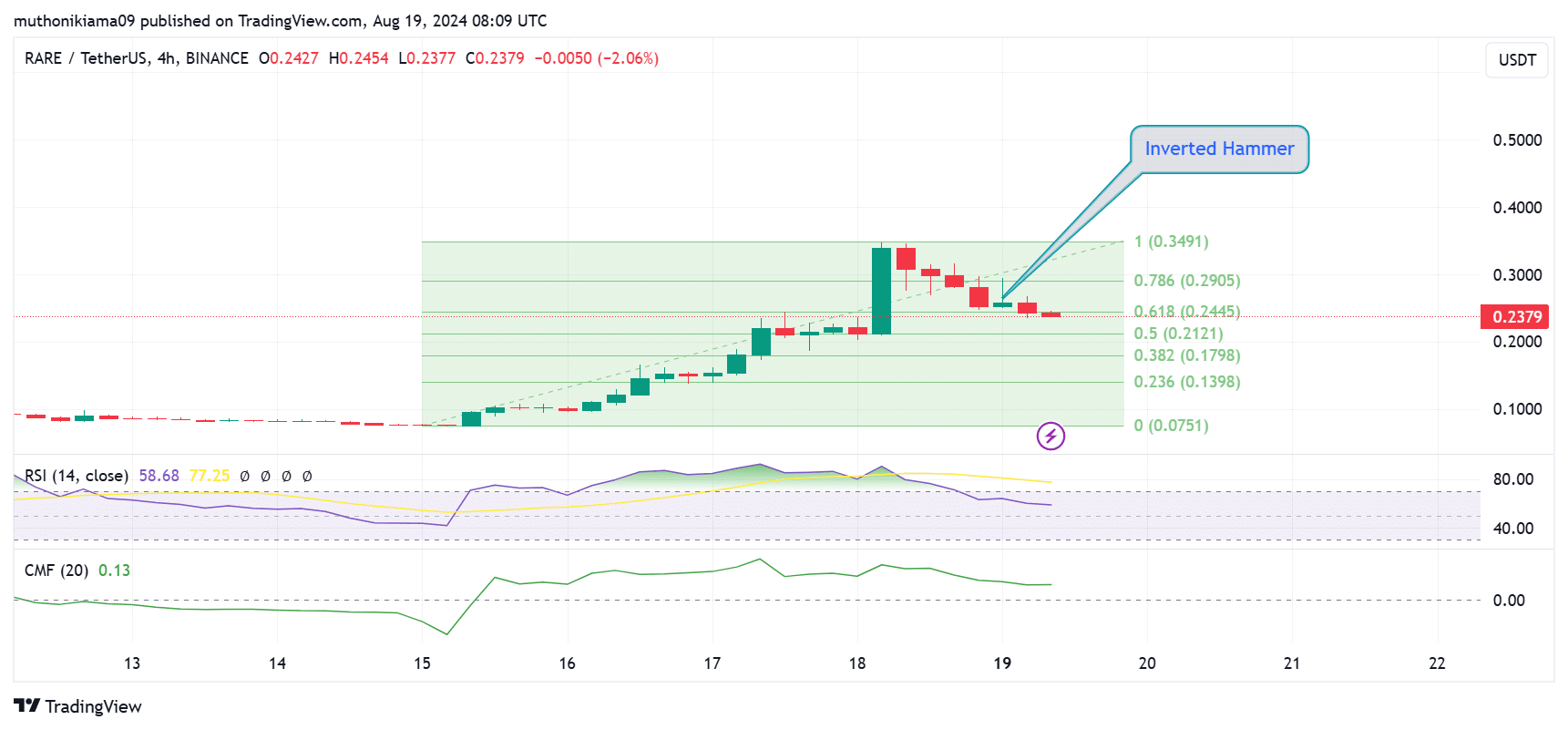

At the moment of this writing, RARE was priced at approximately $0.245. It appears that the upward trend may have slowed down following a surge in price that took the token into overbought territory.

SuperRare crypto loses momentum

Over the last week, SuperRare cryptocurrency has experienced significant fluctuations, ranging from $0.07 on August 15th to its current peak of $0.34, marking a high not seen since August 2022.

Thus, RARE’s price was up 175% in the last seven days.

Nevertheless, it seems the rally for SuperRare has begun to wane, as its price dropped by 25% at this moment. This decline comes after a significant surge in demand during the rally, which pushed the market beyond overbought conditions.

Currently, the technical indicators are pointing towards a significant shift in trend. Specifically, the Relative Strength Index (RSI) stands at 58 as of now, having surpassed the overbought threshold of 80 earlier, which often signals an impending bearish reversal.

The RSI line (Relative Strength Index) was indicating a downward trend as it dropped beneath the signal line, suggesting that the bullish push was losing its strength.

As an analyst, I’ve observed that the sellers seem to hold the upper hand in the market, as evidenced by the Chaikin Money Flow (CMF). Despite still showing a positive value at 0.13, the CMF has created a lower peak, suggesting a shift towards more selling pressure compared to buying pressure.

SuperRare also formed an inverted hammer on the four-hour chart, followed by two red candles.

As an analyst, I observed a pattern suggesting an upward attempt in the crypto price; however, sellers effectively thwarted this rising trend. The candle formation points towards a robust bearish sentiment, implying a potential for continued price decline.

If the 0.618 Fibonacci level (approximately $0.24) doesn’t maintain its position, RARE could encounter resistance at the 0.5 Fib ($0.21). Should this support level also fail, there’s a possibility of a price drop to around $0.13, potentially erasing much of the recent progress made in the market.

What stirred the rally?

One reason for the surge in SuperRare’s cryptocurrency is a rise in activities, such as buying and selling, occurring within their unique digital tokens (NFT) marketplace.

According to DappRadar’s latest findings, there’s been a significant jump of around 73% in the number of transactions over the past week. Furthermore, the data reveals a substantial rise of approximately 145% in platform volumes, with the total currently standing at $243,000 as we speak.

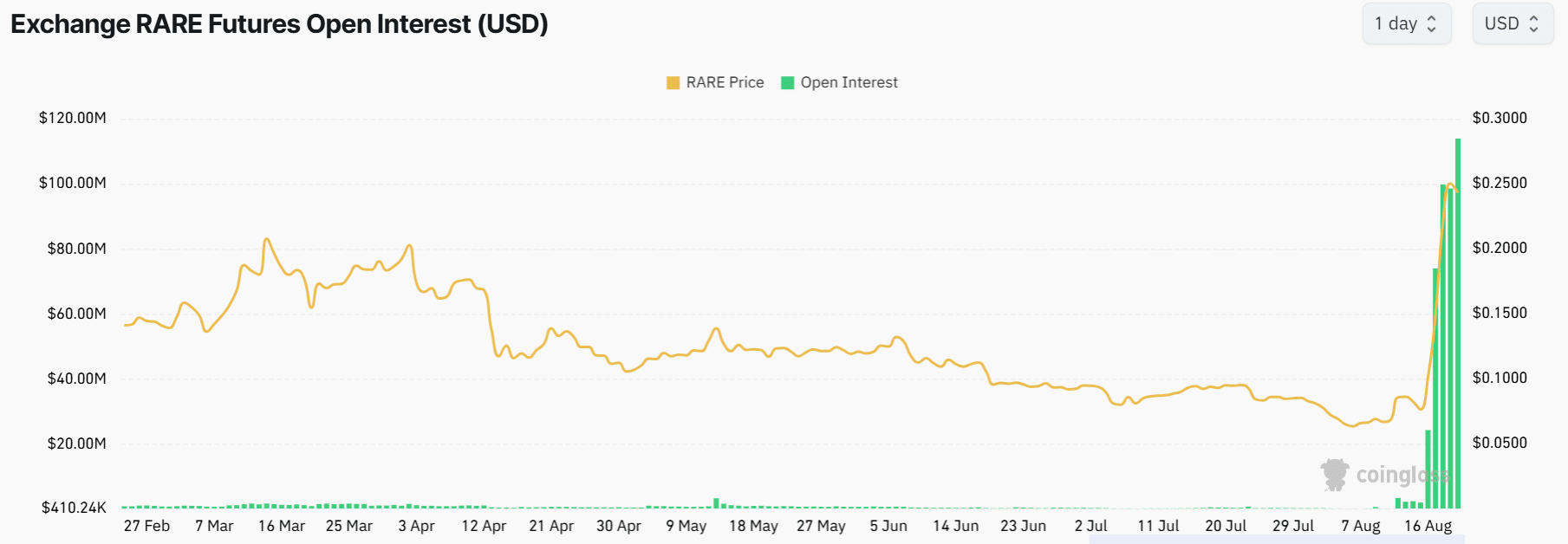

1. The surge in market attention fueled the upward trend of the SuperRare cryptocurrency. According to Coinglass, there was a prolonged phase of unusually low Open Interest for RARE. However, this metric spiked last week, aligning with the price rise.

Open Interest has climbed from around $3 million to $114 million at press time.

As an analyst, I’ve been observing the data from IntoTheBlock, and it appears that SuperRare is largely exhibiting bullish trends at present. Notably, a substantial number of wallets are currently profiting (i.e., “In The Money”) with SuperRare, which suggests optimistic sentiment among investors.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Peter Facinelli Reveals Surprising Parenting Lessons from His New Movie

- Viola Davis Is an Action Hero President in the ‘G20’ Trailer

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

2024-08-19 15:04