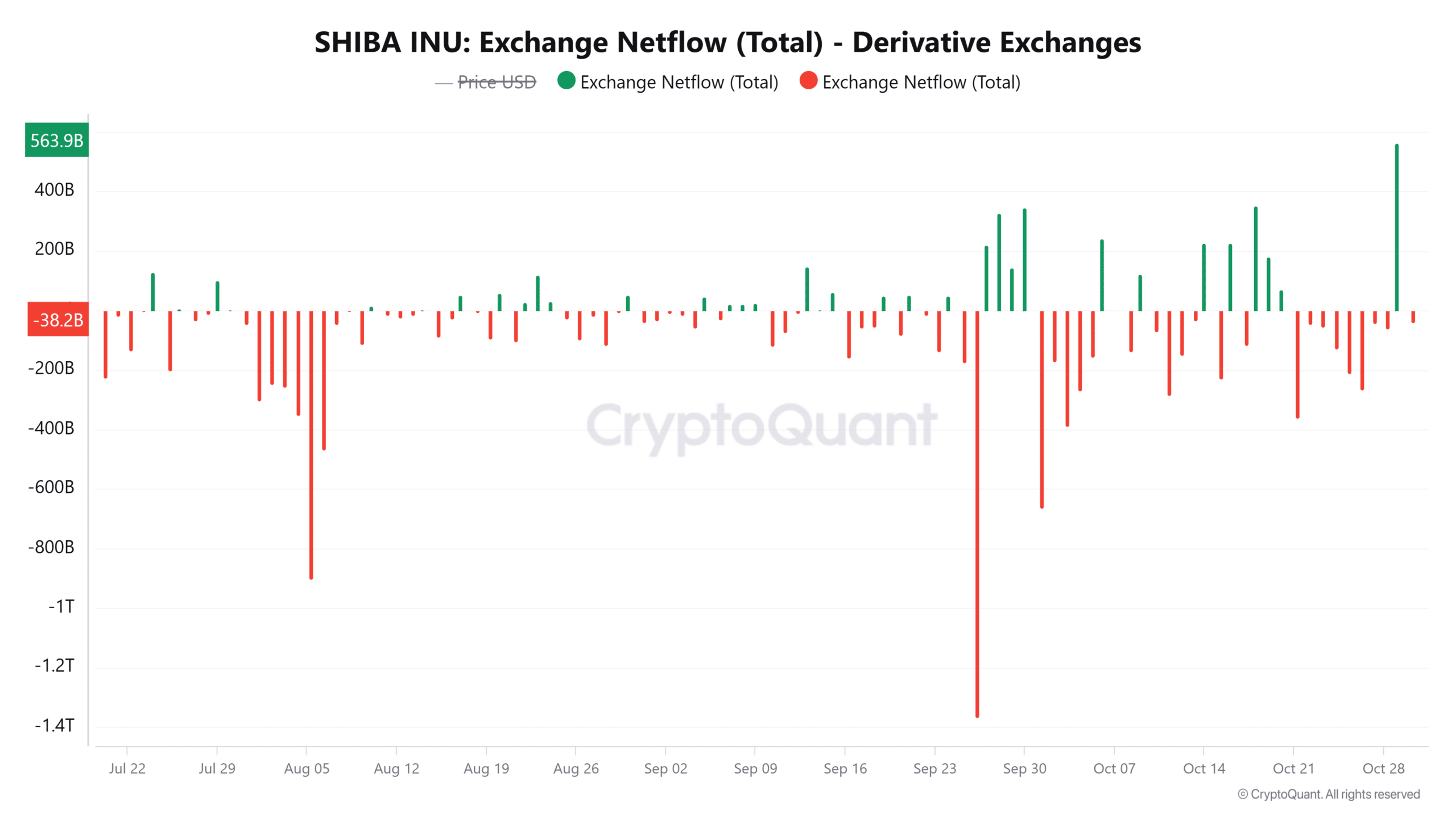

- Shiba Inu inflows to derivative exchanges have surged to a three-month high amid rising leverage.

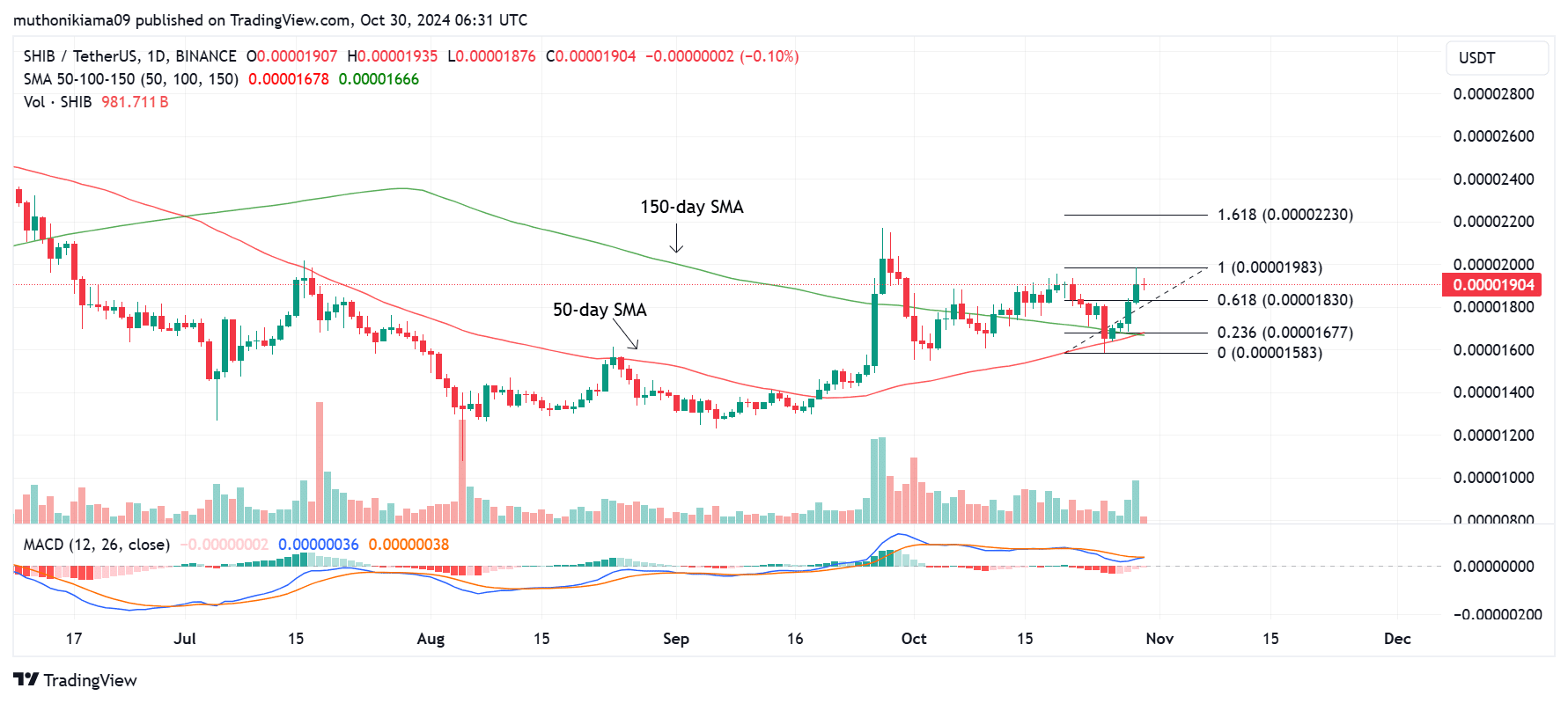

- SHIB also made a bullish crossover on the one-day chart after the 50-day SMA moved above the 150-day SMA.

As a researcher with years of experience in the cryptocurrency market, I find myself intrigued by the recent developments surrounding Shiba Inu (SHIB). The surge in inflows to derivative exchanges and the bullish crossover on the one-day chart are indicators that SHIB might be gearing up for more gains.

At the moment of writing, I find myself analyzing Shiba Inu [SHIB], trading at a price point of $0.000019, marking a 4.8% increase over the past 24 hours. This surge in value can be attributed to many altcoins mirroring Bitcoin‘s [BTC] performance, as it edges closer to its record highs.

Lately, the increase in value occurred at the same time as an increase in funds moving into derivatives trading platforms. On October 29th, the inflow of Shiba Inu (SHIB) to derivative exchanges hit a three-month peak of approximately 563 billion.

In contrast to direct trading platforms where an increase in incoming funds often suggests sellers are active, an uptick in funds going into derivatives exchanges typically means traders are boosting their leveraged positions.

Based on the data, it seems like derivative traders might be initiating fresh positions related to SHIB. According to Coinglass, this increase in inflows happened at the same time as a surge in open interest and funding rates, which indicates that traders are indeed taking on long positions.

An increase in long positions often reflects a positive outlook (bullish sentiment). Furthermore, technical indicators hint that Shiba Inu (SHIB) could see further price increases.

SHIB portrays bullish signs

The one-day graph for Shiba Inus exhibits numerous positive indicators following the 50-day Simple Moving Average (SMA) surpassing the 150-day SMA, suggesting a bullish trend.

This blend implies a surge in temporary bullish power, possibly sustaining the upward trend’s progression.

As a researcher analyzing the cryptocurrency market, I’ve noticed an intriguing pattern in Shiba Inu (SHIB). The technical indicators indicate a strengthening of the bulls, not just through moving averages but also other key factors. Specifically, the Moving Average Convergence Divergence (MACD) line is converging with the signal line, which implies that the downtrend could be losing its momentum. This potentially signals a shift in market sentiment towards SHIB, making it an interesting coin to keep an eye on.

The MACD (Moving Average Convergence Divergence) lines on the chart are becoming narrower and less distinct, indicating that the selling pressure is decreasing.

If the Moving Average Convergence Divergence (MACD) line surpasses the signal line, this could potentially trigger another buy signal. This might lead Shiba Inu (SHIB) prices to experience a 17% increase, reaching approximately 0.0000223, based on the 1.618 Fibonacci level.

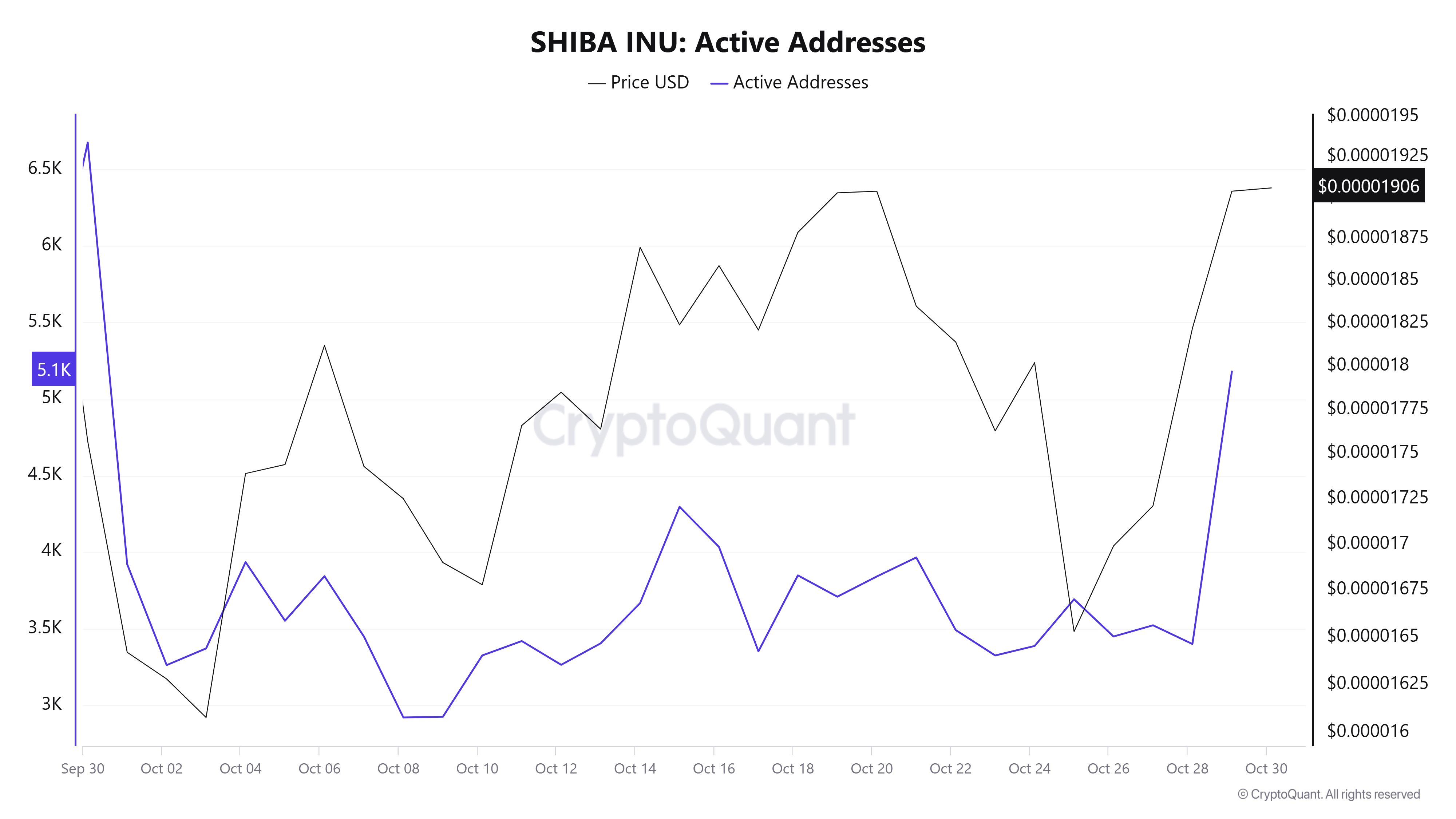

Spike in active addresses

An increase in the number of active Shiba Inu addresses is contributing to a positive outlook on its price trend. Over the past day, the daily active addresses rose from 3,400 to a three-week peak of 5,200, suggesting growing user interest and high demand for Shiba Inu, leading to increased engagement.

In addition to seeing a rise in the number of daily active wallets, transactions involving Shiba Inu (SHIB) tokens surged to approximately 7.6 trillion coins. Remarkably, this represented a seven-time jump over a span of only three days, according to IntotheBlock.

Read Shiba Inu [SHIB] Price Prediction 2024-2025

An ongoing rise in the number of active wallets and transactions might contribute to Shiba Inu’s upward trend. Yet, the longevity of this bullish movement hinges upon market attitudes.

According to Market Prophit’s data, the general public (crowd) appears optimistic (bullish) about Shiba Inu (SHIB), while more experienced investors (smart money) seem pessimistic (bearish).

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-10-30 18:16