- Bitcoin struggled at $60K, but indicators suggested a potential bull run.

- Suze Orman highlighted Bitcoin’s future potential despite current price challenges.

As a seasoned researcher with over two decades of experience in the financial sector, I find myself intrigued by the ongoing debate surrounding Bitcoin (BTC). Having closely followed the evolution of this digital asset since its inception, it’s fascinating to see how opinions about its potential have shifted over time.

As a researcher studying the cryptocurrency market, I’ve noticed that Bitcoin [BTC] has been encountering hurdles in surpassing the $60K mark, even though it experienced a modest 1.21% increase over the past 24 hours. Currently, its value is reported at $55,224 by CoinMarketCap at this very moment.

Suze Orman believes in BTC’s potential

As a researcher delving into the intricacies of financial markets, I’ve encountered my fair share of challenges, but one piece of advice that has caught my attention comes from the esteemed financial advisor and “Women & Money” podcast host, Suze Orman. She underscores the significance of owning Bitcoin, a digital currency, in our current economic landscape.

In an interview with CNBC Make It, Orman highlighted how the next generation of investors could play a pivotal role in shaping the future of cryptocurrency.

She said,

It’s advisable for everyone to understand the concept of Bitcoin. However, it’s crucial to remember that investing in Bitcoin carries risk, and I may not always be correct in my assessments. Consequently, only invest an amount of money that you are prepared to potentially lose without significant financial impact.

It’s surprising, given that she’s one of the crypto skeptics.

Age-based Bitcoin ownership

Nevertheless, unlike numerous Bitcoin supporters who argue various justifications for holding it, such as viewing it as a store of value or a long-term protection against inflation, Orma maintains an opposing perspective.

She says,

With increasing earnings among the younger generation as they grow older, bitcoin is likely to become a preferred investment choice for them, leading to an increase in its value.

She further added,

I’m skeptical if it will become a currency or a form of savings, but given the younger generation’s enthusiasm for it and the growing interest, it might just ignite and gain widespread popularity.

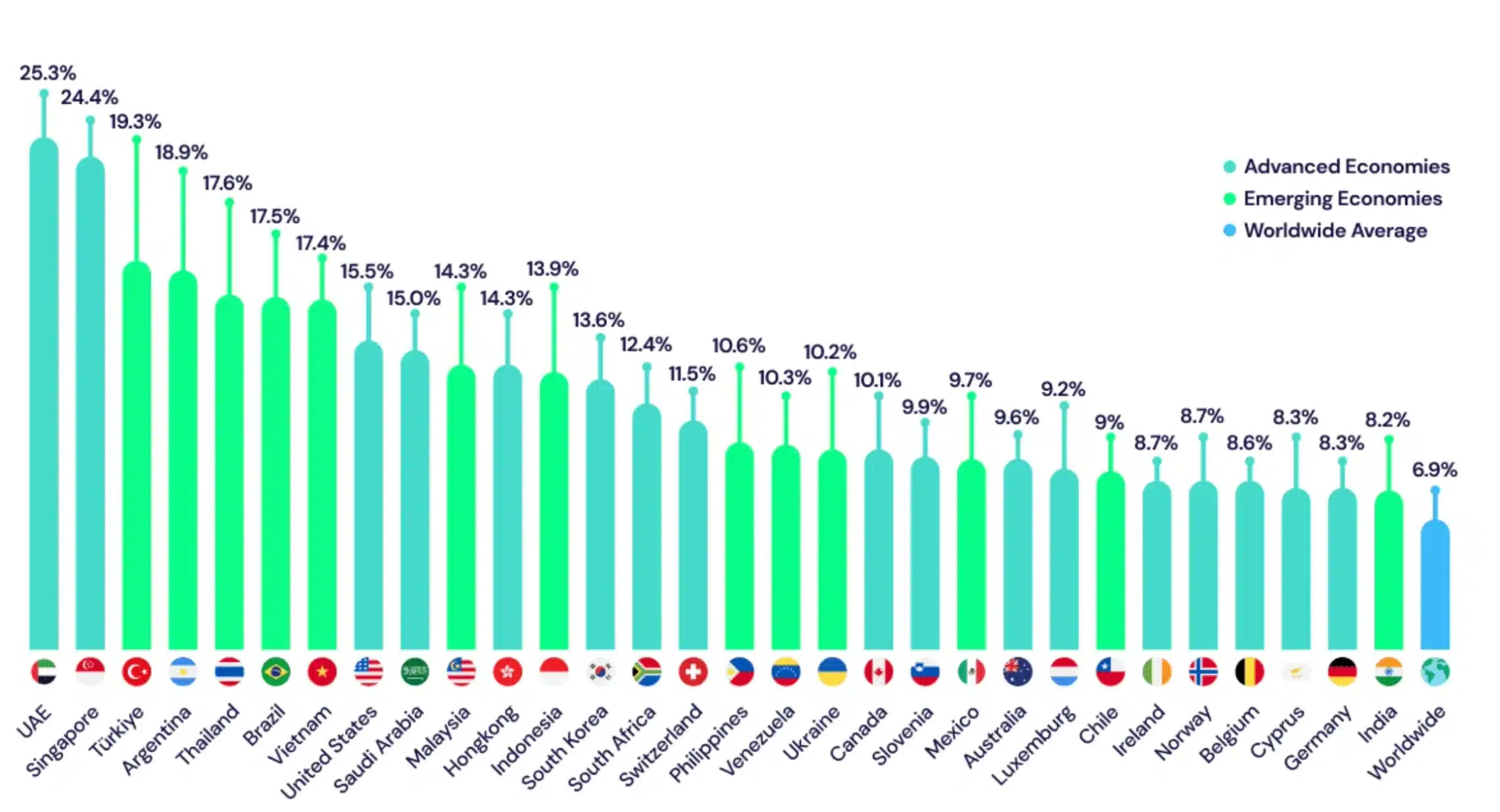

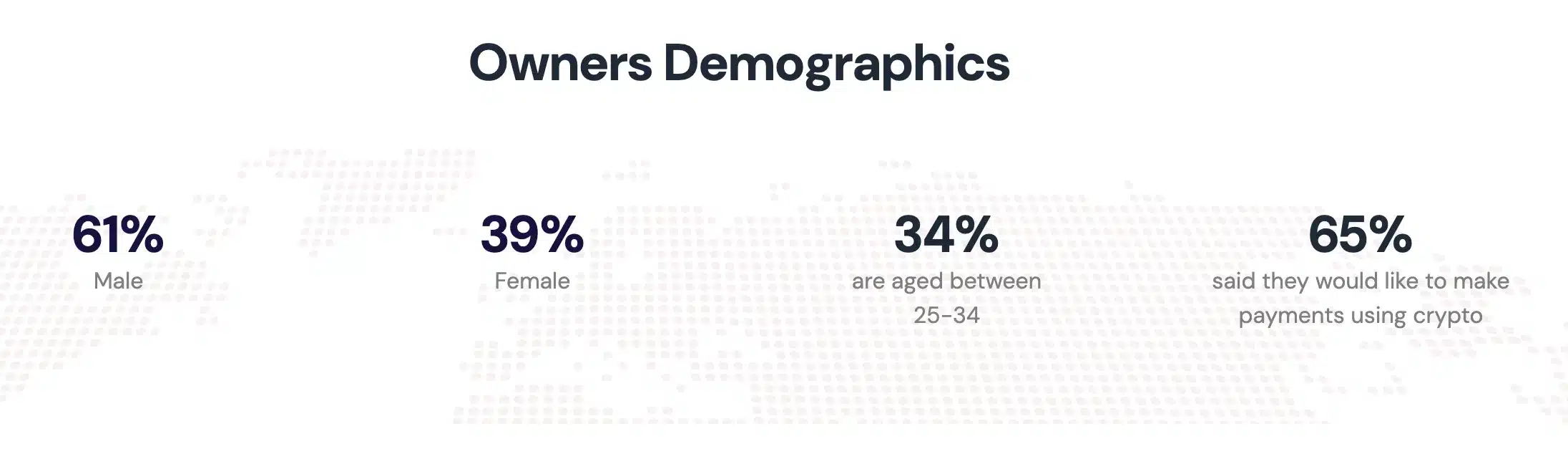

The finding from a recent survey by Triple.A reinforces this view, showing that more than half a billion individuals worldwide hold cryptocurrencies.

It was found through the survey that about one-third (34%) of cryptocurrency holders fall within the age range of 25 to 34 years old. Furthermore, approximately two out of three (65%) individuals worldwide have indicated an interest in utilizing cryptocurrencies for transactions.

Is Bitcoin’s bullish momentum possible?

Although Bitcoin’s current value is dropping, some signs point towards an upcoming rise in its price.

A significant sign is the expanding Bollinger Bands, implying an increase in market volatility potentially pushing the price upwards.

Despite Bitcoin currently hovering close to its lower boundary at the present moment, which typically indicates a downward trend, the same pattern was noticeable a month ago preceding a significant rise to $65K. This could potentially mean a recurrence of such a bullish surge.

The crypto community thinks so

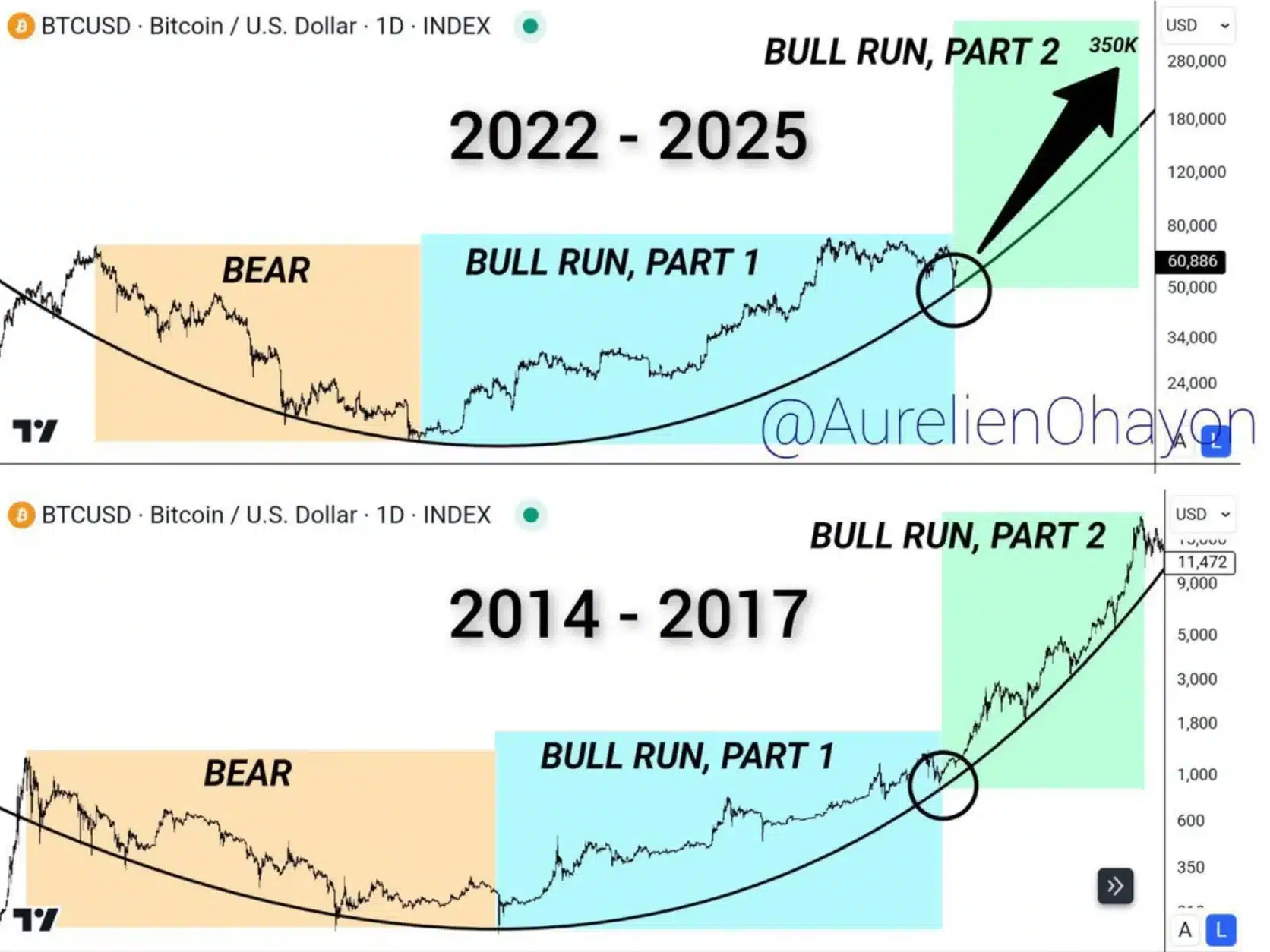

Moreover, Vivek, the creator of Bitgrow Lab, has noticed similarities in Bitcoin’s price movements from 2014 to 2017 and those seen since 2022 up until 2025.

He believed that these historical patterns indicate Bitcoin is poised for an upcoming bull run.

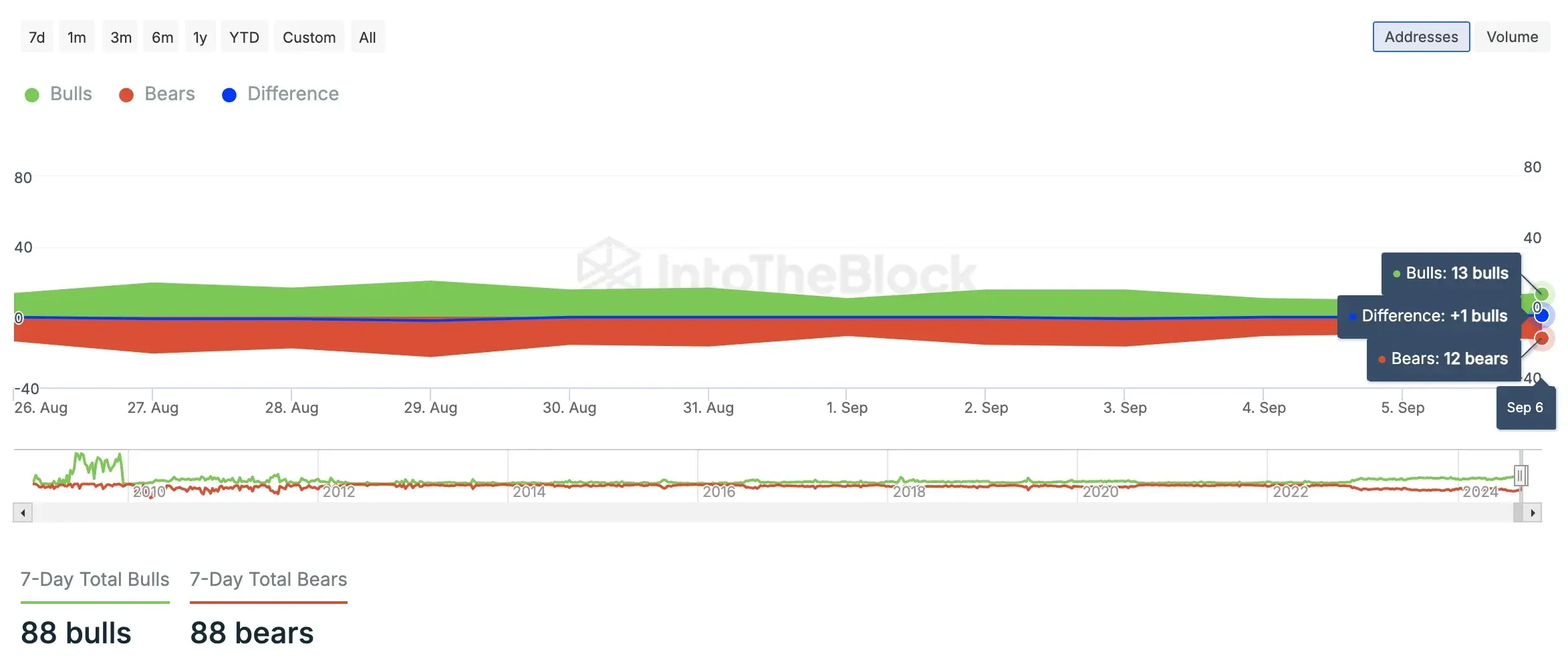

Moreover, an examination by AMBCrypto of IntoTheBlock’s market sentiment data revealed a predominance of bullish signals, numbering 13, over bearish signals, which totaled 12. This suggests that the overall trend is leaning bullishly.

Should Bitcoin manage to surpass the resistance at approximately $59,993, this potential milestone might be indicative of an impending bull market trend, as observed from my research perspective.

In the words of “The Bitcoin Energy Standard,”

“In the matrix of finance, #Bitcoin is the only real choice.”

Read More

2024-09-10 00:40