-

Zurich Cantonal Bank (ZBK) is the latest bank to offer ETH and BTC trading

Will ZBK’s move tip rival banks to follow suit and drive accelerated crypto adoption?

As a seasoned researcher with a keen interest in the intersection of traditional finance and cryptocurrencies, I find the move by Zurich Cantonal Bank (ZBK) to offer ETH and BTC trading through its mobile app an intriguing development. With my decade-long career in the financial sector, I’ve witnessed the slow but steady shift of traditional banks towards embracing digital assets.

The Swiss bank, Zurich Cantonal Bank (ZBK), which manages approximately $290 billion in assets and ranks as the fourth largest within Switzerland, has joined the growing trend of traditional finance institutions by introducing cryptocurrency services.

Through the bank’s mobile application, the offer exclusively applies to Bitcoin (BTC) and Ethereum (ETH) transactions for continuous trading around the clock, as per the bank’s recent announcement.

“Our service allows you to conveniently purchase, sell, and securely save Bitcoin and Ethereum. You can make transactions in these cryptocurrencies at any time through your online banking or mobile banking application provided by ZKB.”

It appears that the bank is said to have teamed up with Crypto Finance AG, which is owned by Deutsche Börse, for brokerage services. Additionally, they have developed a custodial service of their own. This new development will allow them to safeguard users’ cryptocurrency holdings.

Swiss TradFi welcomes BTC and ETH

Following the U.S.’s endorsement of spot Bitcoin and Ethereum ETFs, there has been a surge in attention from traditional financial institutions towards these top digital currencies.

ZBK’s action mirrors Switzerland’s stance on Bitcoin and Ethereum, thereby making it an appealing option for cryptocurrency users within the nation.

Despite some sectors having different regulations, ZBK’s decision solidifies Switzerland as a leading European hub for cryptocurrency due to its favorable rules.

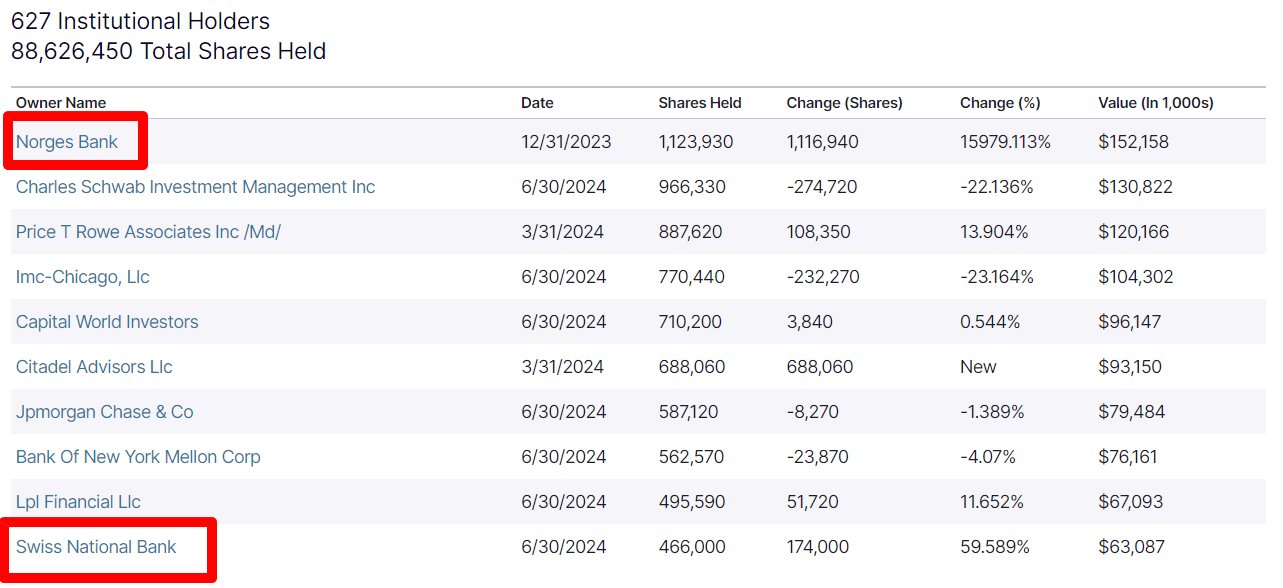

It came to light in August that the Swiss National Bank owned MicroStrategy shares, suggesting they had an indirect tie to Bitcoin. As reported by Sunny Decree, a Swiss Bitcoin expert and investor, the Swiss National Bank was also known to have approximately 500 Bitcoins as of June.

The Swiss National Bank holds an indirect investment in Bitcoin, as it owns shares in MicroStrategy (MSTR), which possesses around 500 Bitcoins.

As the regulatory environment becomes more supportive and more banks invest in Bitcoin, it may motivate competing banks to offer cryptocurrency services not just in Switzerland, but also across wider Europe. This situation could ignite a sense of “institutional fear of missing out” (FOMO) among these banks, potentially leading to a rapid increase in adoption.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Rick and Morty Season 8: Release Date SHOCK!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

2024-09-06 08:07