- Synthetix’s development activity underscores the network’s growing efforts towards attracting more users

- SNX’s bearish performance fueled by whales and institutional sell pressure though

As an analyst with years of experience navigating the volatile world of cryptocurrencies, I’ve seen my fair share of bull runs and bear markets. Synthetix was once a shining star during the 2021 bull run, but its struggle to maintain relevance in the DeFi segment is not uncommon.

During the 2021 cryptocurrency market surge, Synthetix was considered one of the most promising projects. Yet, as the Decentralized Finance (DeFi) sector becomes increasingly crowded, it’s having trouble maintaining attention. Similarly, its token, SNX, has been experiencing a downtrend lately.

As a researcher delving into the world of decentralized finance (DeFi), I find myself pondering the potential resurgence of Synthetix. Despite facing challenges, this protocol has shown remarkable tenacity in its quest to remain significant. Here’s an interesting observation: Synthetix has experienced a surge of development activity lately, placing it at the top of DeFi protocol rankings by Daily Active Addresses (DA) over the past 30 days.

A precursor to a big move for SNX?

The increase we’ve discussed could possibly be linked to some recent updates from the project. Most recently, the protocol unveiled a new integrator protocol named TLX, which facilitates margin trading. Intriguingly, TLX revealed only two days ago that it has handled over $400 million in leveraged tokens through trading.

According to reports, Synthetix might be developing a fresh Perpetual Protocol (Perps) Integrator. This development hints at an increased interest in SNX within the Synthetix network, suggesting a potential surge in its demand.

For approximately five months, the value of SNX has been trending downward (bearish). At the current moment, it’s priced at $1.29, which is a 75% reduction compared to its highest year-to-date (YTD) price of $5.28 reached in March.

Looking at the current price of SNX, I can’t help but notice it seems lower compared to past bear markets. The natural curiosity arises – could it potentially rebound? Delving into on-chain data, some intriguing insights about the SNX token have surfaced.

Whales and addresses and others…

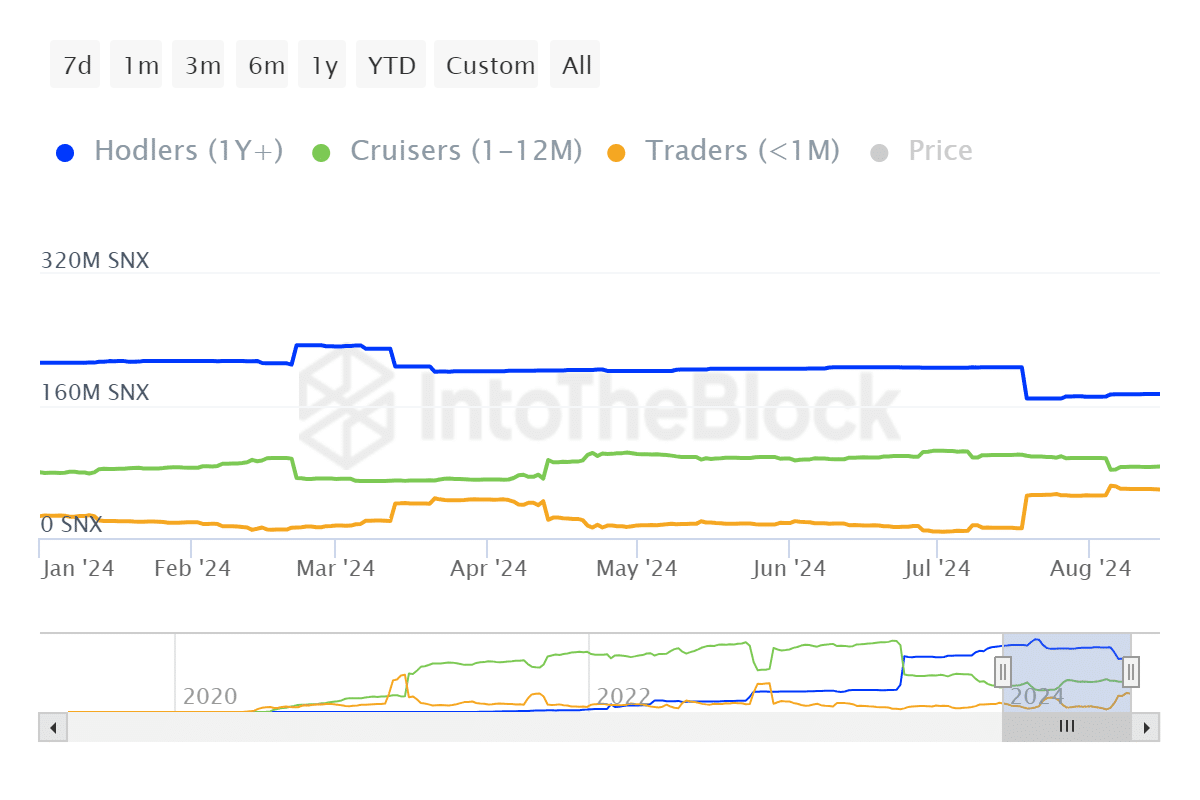

Approximately 98% of all SNX addresses were showing a loss at the moment of writing, whereas only 0.76% were profitable. This implies that there was minimal accumulation near the current price point. This observation aligns with the trend of declining HODLers over time, as the number of SNX holders decreased by approximately 37.83 million in the previous 8 months.

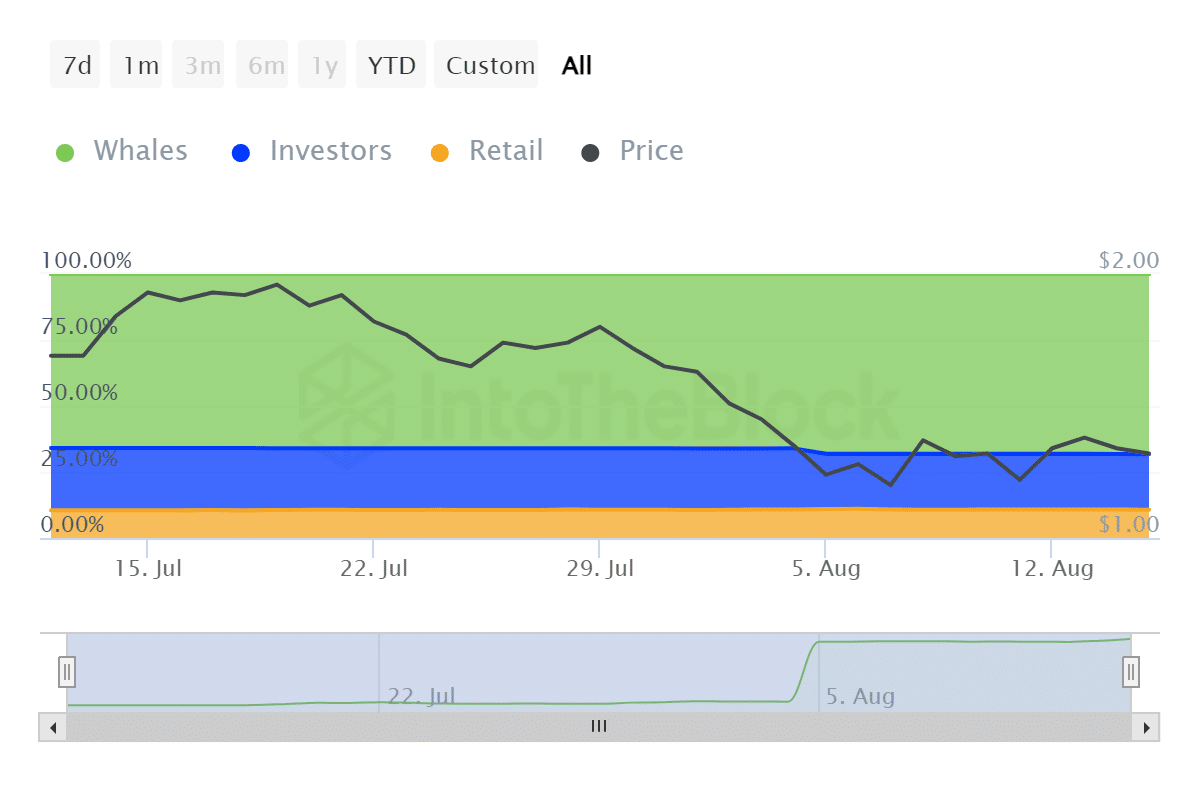

Over the past two months, there’s been an increase in the number of traders dealing with SNX, suggesting a preference for quick profit opportunities. This trend has, however, hindered SNX from maintaining a substantial upward movement. Simultaneously, data on ownership shows that large investors (whales) have been adding to selling pressure over the last 30 days.

Over the past four weeks, I’ve observed a significant shift in the Synthetix Network (SNX) balance across various whale, investor, and retail addresses. Specifically, the SNX balance in whale addresses has decreased by approximately 7.3 million tokens. Concurrently, investor addresses experienced a setback of roughly 7.78 million coins during this period. Interestingly, however, retail addresses displayed growth, with around 490,000 new SNX tokens being added to these accounts.

The acquisition by retail holders pointed to a possible sentiment shift.

In other words, it’s unlikely that retail buyers will significantly influence the market. The price of SNX might stay low unless there is a change indicating an increase in the holding of whales and investors who are accumulating rather than selling.

Read More

2024-08-17 07:03