-

SYS joins the list of top gainers after a sharp breakout from its falling wedge pattern.

Can SYS sustain this new-found momentum?

As an analyst with over two decades of experience in the volatile and unpredictable world of cryptocurrencies, I must admit that Syscoin’s (SYS) recent rally has caught my attention. It’s not every day we see a 200% surge in just three days!

As a seasoned cryptocurrency investor with over five years of experience under my belt, I have seen countless coins surge and crash without warning. However, Syscoin (SYS) has caught my attention this week due to its impressive rally that has placed it among the top gainers. Having closely followed its development since its inception, I must admit that its technology is truly innovative and could potentially revolutionize the blockchain industry.

The secondary layer of Bitcoin‘s infrastructure is gaining momentum, and Syscoin is among the projects attracting attention at the moment.

As a seasoned crypto investor with years of experience under my belt, I must say that SYS has been one of the most profitable investments I’ve made this week. In just three short days, it has skyrocketed by an astounding 200%, leaving me quite impressed and eager to see where it goes next. The returns on this token have definitely caught my attention and I can’t help but feel optimistic about its potential for further growth.

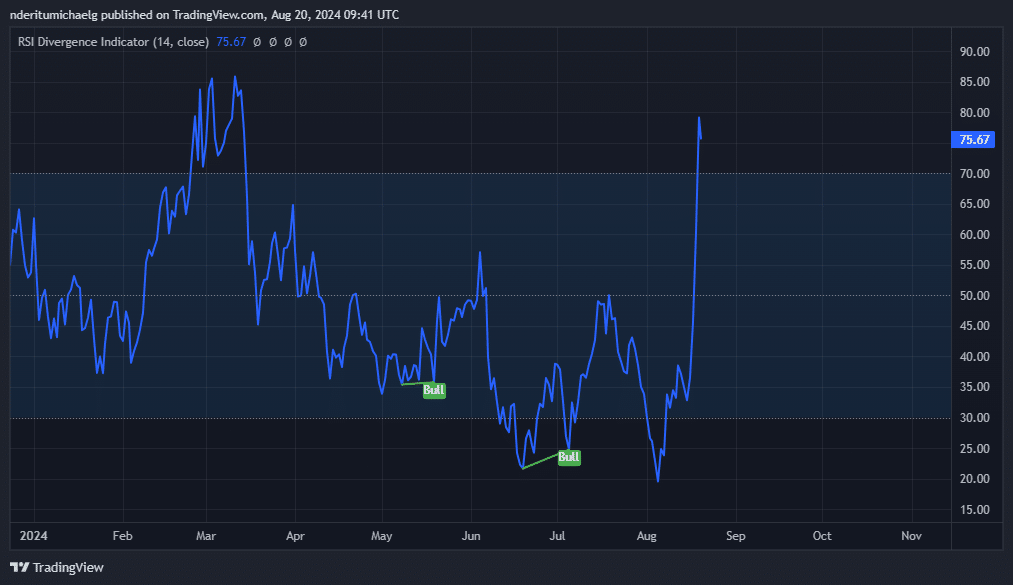

The surge in the SYS rally is due to a powerful breakout that took place. Prior to this, the price had been trading within a descending triangle formed from its March peak of $0.38. It entered this narrow range within the triangle pattern earlier this year, and then experienced a breakout over the weekend.

According to the charts, SYS crypto traded as low as $0.0691 on Friday, before breaking out of the descending resistance the next day. Its bullish momentum peaked at $0.21 on Tuesday, resulting in a 202% rally from the weekend lows.

As a crypto investor, I’ve noticed that SYS has retreated to a current price of $0.154, following a minor correction. This move seems to be due to traders cashing out their profits after buying near the recent price lows.

A short lived rally or the start of its recovery trend?

Looking at the broader perspective of the SYS chart shows that it’s quite far from reaching its previous record high of $1.32. Interestingly, its recent surge can be seen as its initial effort to recuperate from its all-time historical low.

Although SYS has recently shown signs of improvement, it remains within the lower price bracket that it has maintained since May 22, 2021, up until February 2024.

SYS made an effort to recover from its lowest point during February and March of this year. Unfortunately, this recovery didn’t last long and was followed by a return to a downtrend, resulting in a new all-time low that it has recently reached.

Even though Sys is currently selling at a reduced price given the recent growth, it’s important to mention that its Relative Strength Index (RSI) suggests it’s overbought. This could be the reason behind the noticeable selling pressure or profit-taking in the last day.

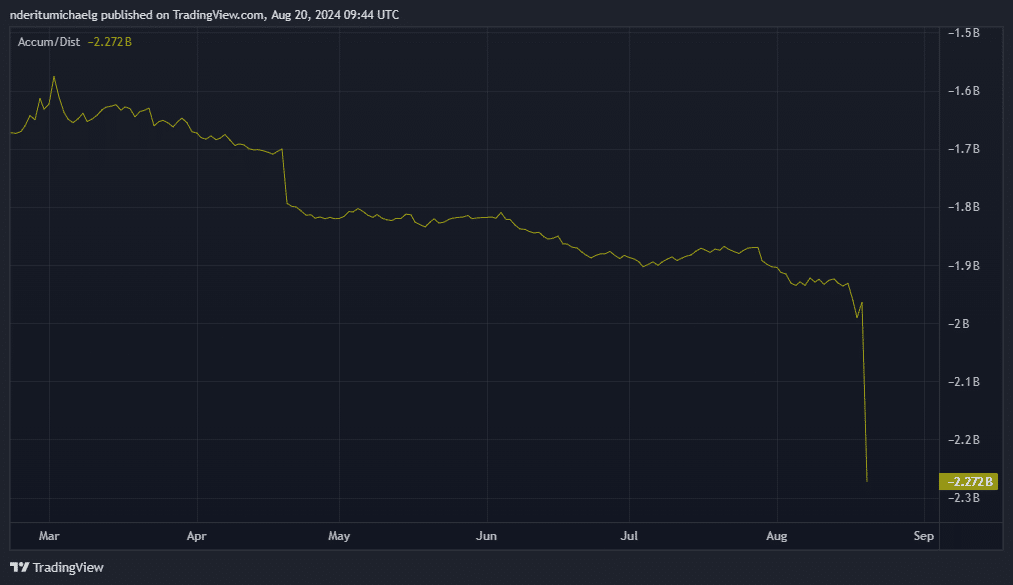

As a crypto investor, I’ve noticed a sudden and significant dip in my portfolio – this could be a sign of intense selling pressure. Such a pullback might make any further recovery attempts challenging. Moreover, it might hint that the recent surge in prices was potentially manipulated by ‘whales’, attempting to trigger a rally for their own gain.

Moreover, the trend of this accumulation/distribution indicator continued to drop following a short-lived bullish reversal.

Based on my years of experience in the financial markets, it appears that this observation could signal insufficient liquidity to support continued growth. However, I still see potential for profitable opportunities with SYS. That said, it’s crucial to exercise caution as further gains are not a certainty. I learned this lesson the hard way when I invested in a similar situation without fully assessing the risks and ended up facing losses. So, always remember to do your due diligence before making any investment decisions.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-08-20 23:36