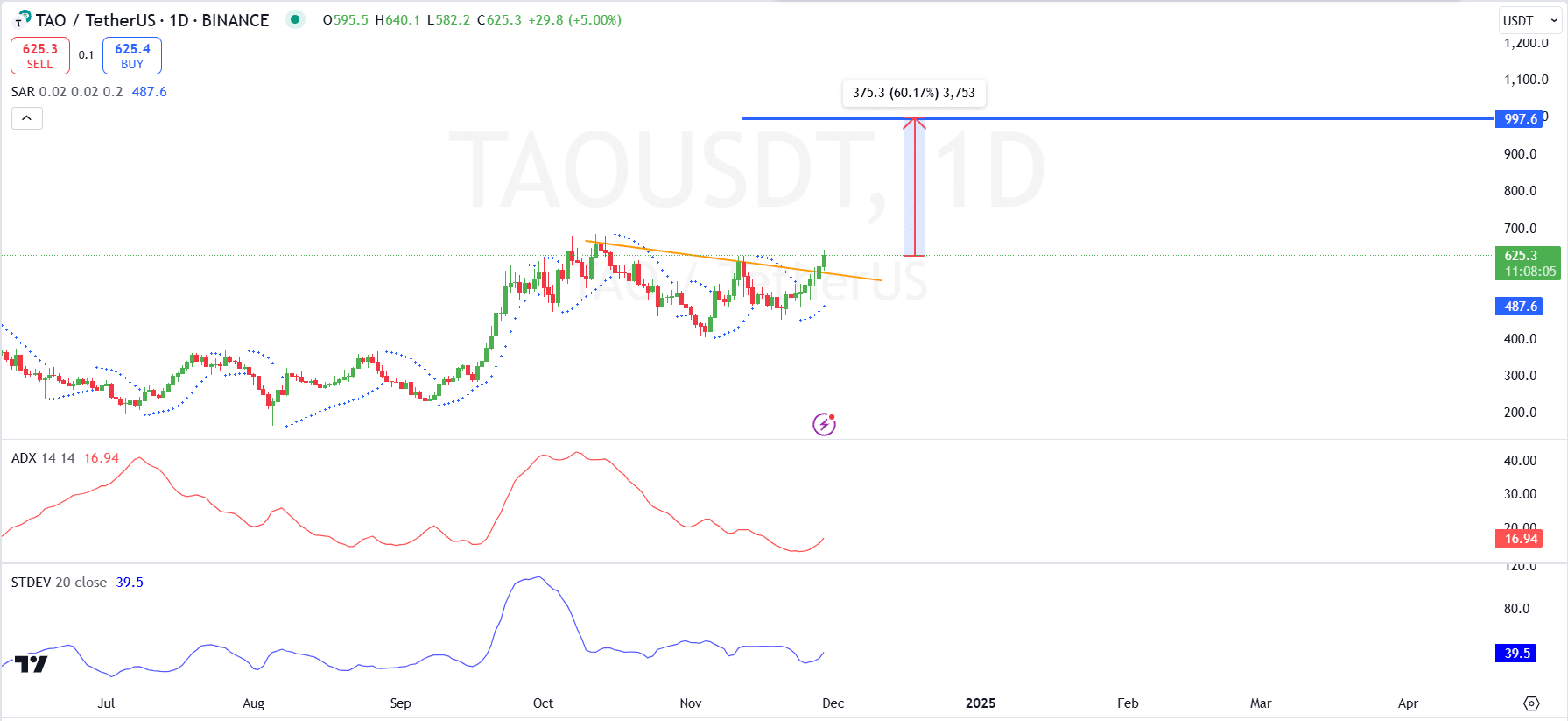

- TAO’s price breached its trendline resistance on the daily chart

- A 60% rally could push TAO to the $1000 psychological level

As a seasoned crypto investor with a knack for spotting trends and understanding market dynamics, I find myself intrigued by the recent surge of Bittensor (TAO). With my years of experience under my belt, I’ve learned to read between the lines of chart patterns and technical indicators. The breakout above the descending resistance trendline on TAO’s daily chart, coupled with its impressive 20% surge in a day, has my attention.

Currently, Bittensor (TAO) is valued at $623.78 per token, marking an increase of 9.80% over the past 24 hours. This surge in price appears to be mirrored by a significant rise in trading volume as well, with it jumping up to approximately $470.79 million – an impressive 40.24% growth within the same period.

Additionally, it’s worth noting that the daily trading range for TAO is quite dynamic, fluctuating from around $551.98 to $638.58, indicating a high level of market turbulence.

Currently, I find myself holding an altcoin that’s approximately 17% off from its peak at $767.68 – its all-time high. The question on my mind is: Will this altcoin’s recent surge in momentum be strong enough to propel it back towards reaching its all-time high again?

AI tokens lead rally with Bittensor (TAO)

Recently, the value of alternative cryptocurrencies (altcoins) has significantly risen, leading to a 7.9% increase in their total market value. This growth can be attributed to a decrease in Bitcoin‘s dominance, now standing at 57.0%. Essentially, Bitcoin’s lack of price movement has allowed altcoins to seize the spotlight and boost investor interest, thereby enhancing their individual market performances.

Among the front-runners, AI-related stocks are taking the lead, and it’s Bittensor that’s making headlines after a 20% increase. Much of its significant growth can be traced back to TAO becoming compatible with the Ethereum Virtual Machine (EVM).

For Bittensor, this integration represents a major step forward. Particularly since it allows the network to utilize Ethereum’s underlying system, thereby improving its capacity to handle larger volumes of data, increasing its speed, and boosting its overall capabilities.

Parabolic SAR confirms TAO’s breakout

According to TAO’s daily analysis, there was a powerful surge in price that surpassed the falling trendline, indicating an increase in bullish energy. This breakout suggests the potential for the price to ascend towards the next significant resistance at $1000, which could result in approximately a 60.17% price increase from its current value.

The Parabolic Stop and Reverse (SAR) indicator also supported this bullish trend by placing its markers under the price bars.

In simpler terms, the ADX reading of 16.94 indicates that the market trend is still not very strong, but it has become more pronounced after the breakout. Additionally, the Standard Deviation at 39.5 suggests an increase in market volatility, which aligns with the movement following the breakout.

Collectively, these measurements indicated a growing trend towards positive market momentum, suggesting an increase in optimistic trading behavior, as evident from the chart patterns.

Maintain watch over these support points: The level previously acting as resistance at $450 could now function as support. Should the positive trend persist, we might witness the price reaching new peak values.

If the price doesn’t maintain itself above $450, it might result in another test at previously established lower support zones, which could potentially undermine the optimistic outlook we have now.

TAO’s token unlocks

According to DeFiLlama’s representation, the distribution of TAO’s tokens follows a gradual and well-managed pattern. A notable increase in token emission starts from 2025 and persists till 2027.

The project’s reach is still relatively small at this point, mirroring its initial stage, which provides a controlled environment for organic growth in the ecosystem, preventing an excessive influx of supply that might overload the market.

Indeed, the token release pattern indicates a notable surge starting from 2025, implying that a substantial amount of tokens are expected to become available for circulation within the next two years.

This increase coincides with key achievements and advancements within the Bittensor network, all geared towards increasing adoption, recognizing contributors, and enhancing operational capacity.

It’s important to point out that this emission approach reduces rapid increases in the money supply initially, but permits a gradual increase in the total amount circulating over time – thereby fostering long-term financial stability.

TAO buyers dominate as long positions exceed 1.10 ratio

Regarding the long/short ratio, it appears to show a steady increase in optimistic attitudes, going beyond 1.10 in recent trading periods. This suggests that more buy orders are being placed than sell orders – a clear indication of robust buying interest and a favorable market forecast for TAO.

The green bars appear to emphasize a rise in buy-side control, particularly from November 27th onwards – Coinciding with an increase in the price of TAO.

Earlier this week, periods where the value dropped below 1.0 represented a short-term pause. Contrarily, the extended period of high activity indicates that traders could be preparing for potential price increases at this moment.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Flight Lands Safely After Dodging Departing Plane at Same Runway

2024-11-30 13:12