- Cryptocurrency seemed to be nearing a potential rally as it approached a key bullish confluence zone on the chart

- Metrics such as buy volume sustained bullish momentum, despite recent declines

As a seasoned crypto investor with battle scars from the 2017 bull run and the subsequent bear market, I find myself cautiously optimistic about TAO‘s current situation. The double pattern formation and sustained bullish momentum, as indicated by the Parabolic SAR and Chaikin Money Flow, are encouraging signs that TAO might be gearing up for a rebound. However, it’s not time to pop the champagne just yet.

Despite a 22.01% dip in TAO’s value over the last week and a 5.24% decrease on the daily scale, it hasn’t fully plunged into a downward trend. The selling pressure hasn’t completely overwhelmed the market, suggesting that there might be an upcoming recovery.

Actually, it appears that the bearish outlook may be diminishing according to AMBCrypto’s assessment, suggesting that TAO could soon pick up a bullish momentum again.

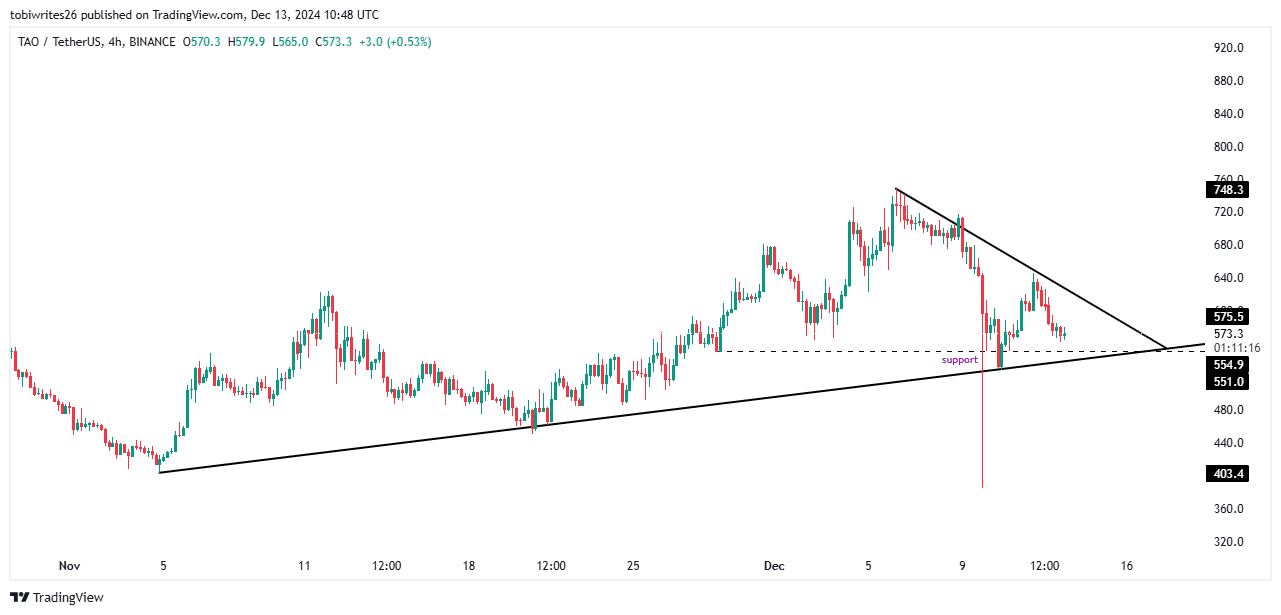

Double pattern formation and a potential bounce for TAO

Currently, TAO is moving in a favorable upward trend, but this phase ends when it surpasses its upper boundary, breaking through the resistance line.

After this point, it’s probable that TAO will see a minor dip down towards the $551.00 mark. This area is significant because it could give the push for an uptrend. It also lines up with the support of a bullish symmetrical pattern in which TAO has been moving.

If TAO experiences a strong surge from its current level, it might ascend to unprecedented levels, possibly reaching a maximum of $748 in accordance with the bullish trend’s growing strength.

Bullish momentum remains strong for TAO

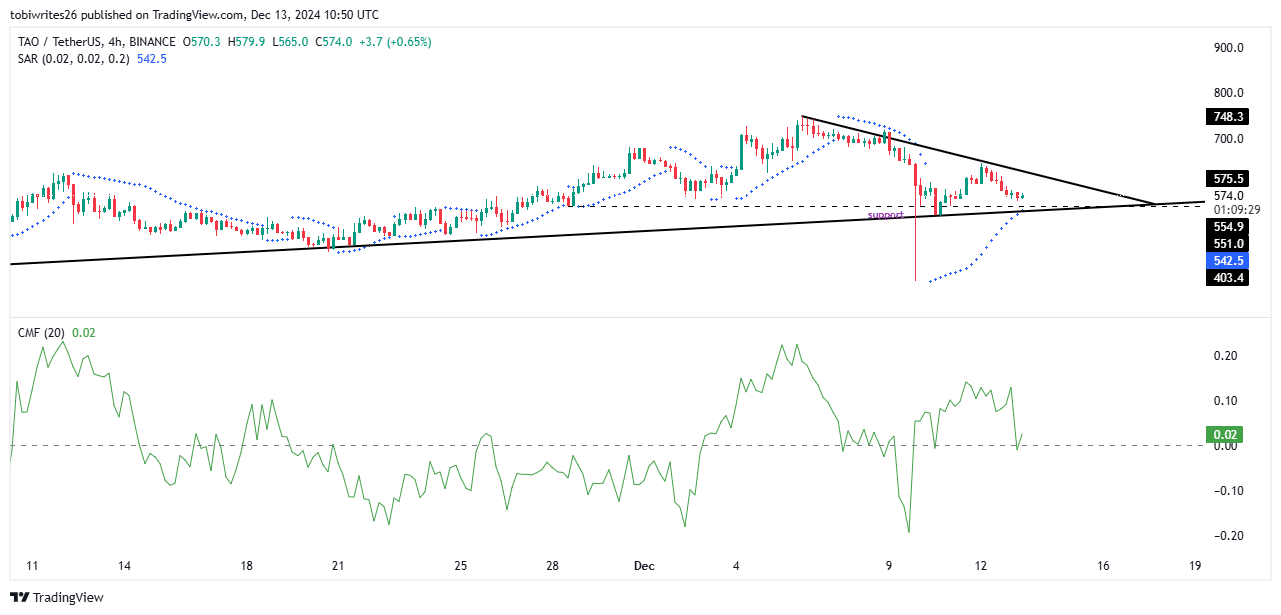

Despite TAO experiencing a downtrend lately, the Parabolic SAR (Stop and Reverse) indicator has maintained a bullish stance during this phase, as its points have persistently fallen beneath the asset’s price level.

In simpler terms, the Parabolic SAR (Stop and Reverse) serves as a tool for predicting market trends and probable turning points. During a falling trend, it marks dots above the price level, while during a rising trend, it places them below the price level.

Over a period, the consistent appearance of dots underneath the falling price suggested continuous buying, which could boost TAO’s price and potentially lift the asset above its current value.

In other words, the Chaikin Money Flow (CMF) shows that the market has been primarily driven by buyers, supporting a positive or bullish trend.

As a crypto investor, I’ve noticed an encouraging development in my technical analysis. The Chaikin Money Flow (CMF) line has bounced back from the zero level and climbed up to 0.03. At the same time, the Uptick Line is maintaining its dominance. This pattern implies that TAO might be on track to sustain its upward trend.

Gradual re-entry into the market for TAO

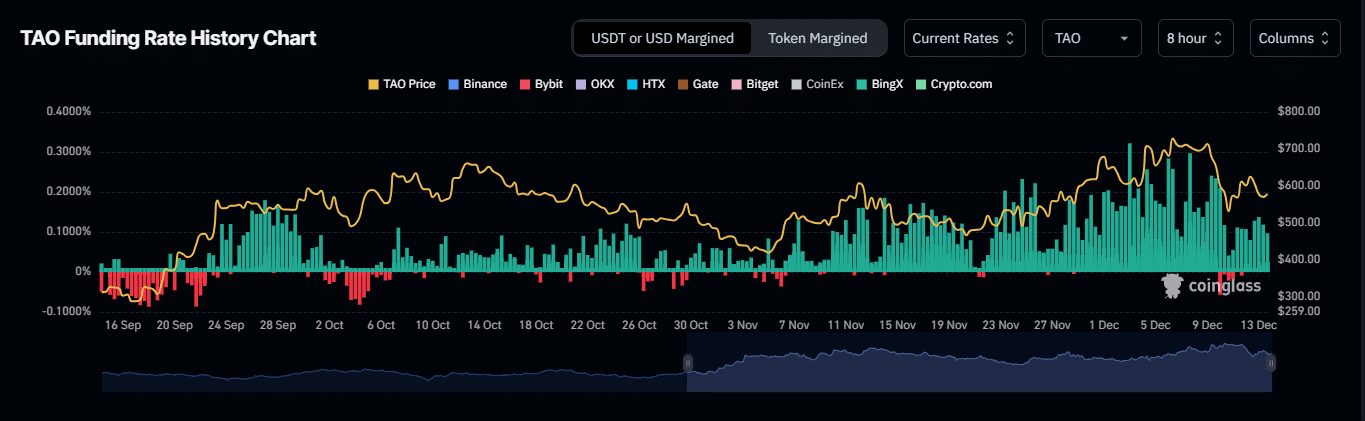

TAO’s bullish run is not fully established yet though, as market participants are gradually re-entering the market. Two key metrics—Open Interest and the Funding Rate—highlighted this trend.

The quantity of outstanding derivative agreements that haven’t been settled yet, used to spot the most influential group in the market, increased by 0.25%. This uptick now amounts to a total of approximately $230.37 million.

As a crypto investor, I noticed that the price surge aligns well with the increasing Funding Rate, currently standing at 0.0168% on the 8-hour chart, suggesting a positive trend in the market.

This suggests continuous purchase actions by bulls, keeping the market steady, potentially leading to an increase in TAO’s price during the upcoming trading periods.

Read More

2024-12-14 09:14