- TAPSWAP is poised to break above the upper line of its descending triangle.

- If it succeeds and buying pressure climbs, it may extend its rally.

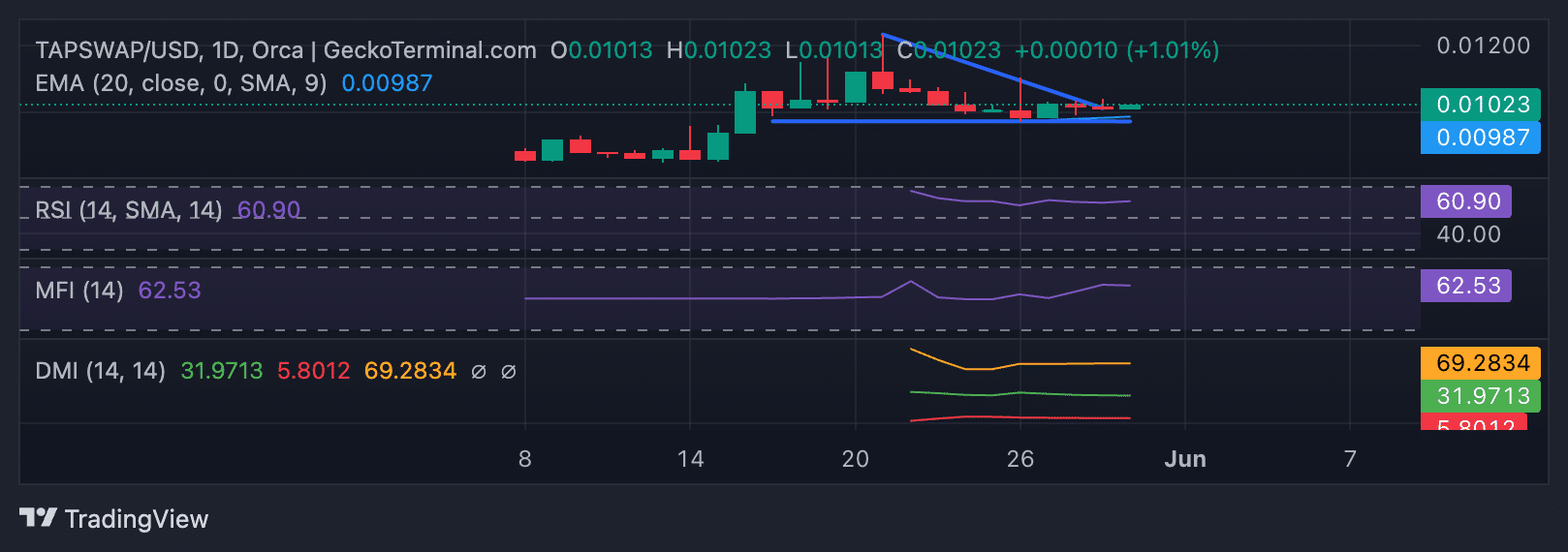

As an experienced technical analyst, I believe that TapSwap (TAPSWAP) is showing signs of a potential breakout above the upper line of its descending triangle. This bullish signal could indicate that buying pressure is overpowering selling activity and may extend the rally if successful. However, it’s important to note that bearish sentiment remains present in the market.

As an analyst, I would interpret the current market situation of TapSwap (TAPSWAP) as follows: The stock has been forming a descending triangle pattern within an uptrend, which is typically seen as a bearish setup. However, the fact that it’s trying to break out of this pattern could indicate a decrease in selling pressure and potentially a shift in market sentiment towards buying. This could be a sign of a potential reversal or continuation of the uptrend.

If an asset breaks above the upper boundary of a descending triangle, this is a positive sign. This indicates that buying forces are stronger than the selling forces, which had been causing the triangle’s formation.

Based on AMBCrypto’s analysis, the technical indicators of the token suggest a potential upward break beyond the triangle’s upper boundary.

Based on the analysis of TAPSWAP’s token metrics, both its Relative Strength Index (RSI) and Money Flow Index (MFI) indicate a strong demand from market participants fueling its recent price surge.

As a crypto investor, I’d interpret this as: At the current moment, the Relative Strength Index (RSI) and Money Flow Index (MFI) of the TAPSWAP token stand at 60.90 and 62.53 respectively. These figures indicate a strong preference among TAPSWAP traders for accumulating tokens rather than selling for profits.

Additionally, the Directional Movement Index (DMI) data from TAPSWAP indicated continued strength in the position. At the current moment, the positive directional index was superior to the negative index on the chart.

As an analyst, I would interpret the current trend in these market lines as suggesting a predominantly upward price movement recently. Such a pattern implies that the bulls may be in charge, potentially driving the price even higher.

TAPSWAP price prediction shows bears are around

Despite the positive momentum TAPSWAP has experienced lately due to genuine demand, a pessimistic outlook prevails within its market. An examination of its Chaikin Money Flow (CMF) revealed that it remained below zero, with a current value of -0.37 at the present moment.

Is your portfolio green? Check the TapSwap Profit Calculator

A asset’s Capital Market Function (CMF) quantifies the inflow and outflow of funds in its market. If this figure falls short of zero, it indicates a net withdrawal of funds by token traders, signaling market vulnerability.

At present, the Parabolic SAR dots on TAPSWAP signaled bearish sentiment as they sat above the asset’s current price. This indicator is a popular choice among traders for determining trend tendencies and possible price shifts.

When its dots are above the asset’s price, the bears are deemed to be in control.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-05-31 03:03