-

Terraform Labs gave the community the latest update on its bankruptcy hearings

Both LUNA, LUNC reacted positively to the news

As a researcher who has been closely monitoring the crypto landscape since its inception, I’ve seen my fair share of ups and downs, but the Terraform Labs saga is one that stands out. The collapse of Terra’s ecosystem was a shock to many, myself included. But now, with the Chapter 11 bankruptcy hearings on the horizon, there’s a glimmer of hope for Terraform Labs and its investors.

As an analyst, I’m preparing to attend the Chapter 11 bankruptcy hearing scheduled for mid-September 2024, which Terraform Labs initiated after seeking protection in January 2024. This step came following the devastating collapse of the Terra LUNA ecosystem in 2022. The demise was primarily triggered by the implosion of Terra’s algorithmic stablecoin, UST, leading to substantial financial losses for investors and a barrage of legal disputes for Terraform Labs.

This was first revealed by Terra itself, via its X account yesterday.

In this case, a beneficial decision would enable Terraform Labs to reshape and regroup the different components supporting the Terra system. Such a reorganization might offer a route for the firm to streamline its functions and possibly renew parts of the Terra network.

By the deadline set for August 21st, 2024, creditors involved in the bankruptcy process are required to submit their Proof of Crypto Loss forms. This step is essential as it helps assess the company’s debts and distributes any recovered assets fairly among creditors, which include both individual retail investors and institutional players who were impacted by the firm’s collapse.

All the legal challenges…

In June 2024, Terraform Labs and Do Kwon agreed to a $4.7 billion settlement with the U.S. Securities and Exchange Commission (SEC). As part of this agreement, the company is prohibited from participating in the cryptocurrency market.

Additionally, it’s worth noting that a court decision in June also permitted the restart of a suspension bridge for shuttles. This action facilitated the redemption of wrapped assets within the Terra Classic network. These updates offered some comfort to investors who were in a state of uncertainty post the ecosystem’s downfall.

1. The ongoing bankruptcy process underscores the difficulties that businesses encounter in the swiftly changing world of cryptocurrencies. The predicament of Terraform Labs serves as a stark reminder of the risks inherent in algorithmic stablecoins and emphasizes the need for stricter regulatory supervision within the sector.

Observers throughout the cryptocurrency world will keenly follow the decision made in the Chapter 11 hearing, as it may establish a pattern for resolving similar situations in the future.

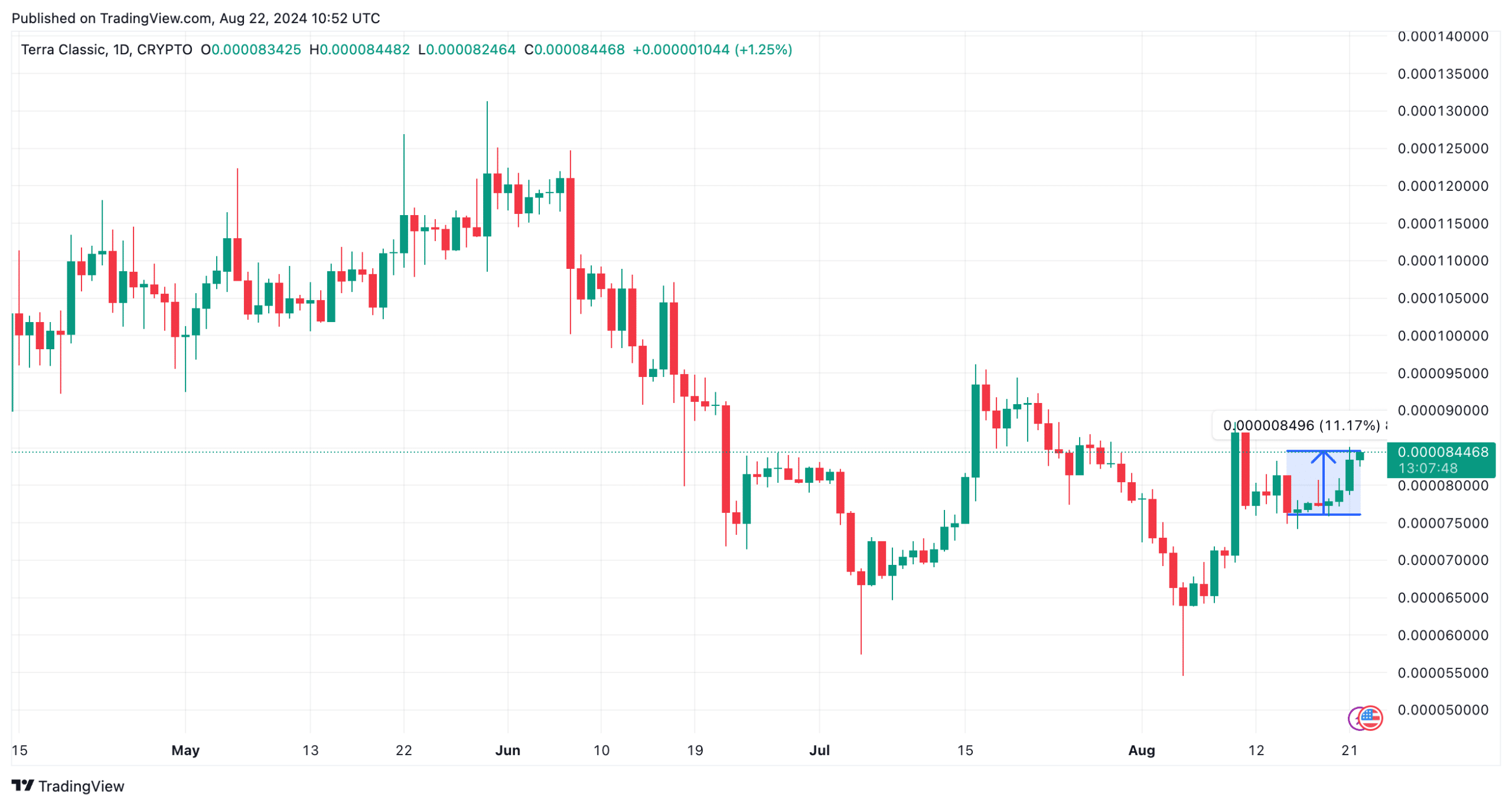

Just as anticipated, the central crypto tokens responded to the previously mentioned news as well.

In the 24 hours following the announcement of the update, LUNA saw a boost of nearly 4%. Similarly, Terra LUNA Classic (LUNC) experienced an increase of more than 5%, trading at $0.000084 at the moment of reporting.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-08-22 20:39