- Tether has reached a new all time high in market cap.

- USDT value hit $119.14 billion after a 40.68% surge.

As a seasoned analyst with over a decade of experience in the ever-evolving world of cryptocurrencies, I’ve seen my fair share of market highs and lows. However, the recent surge in Tether’s (USDT) market cap to an all-time high is nothing short of impressive.

Over the past year, stablecoins have experienced exponential growth. The stablecoin market cap has recently hit a historical high of $172.151 billion.

Tether hits a new all-time high

As a researcher immersed in the dynamic world of digital currencies, I’ve noticed an impressive upward trend in the stablecoin market, with Tether’s USDT standing out as the clear leader. This cryptocurrency has consistently shown robust growth, reaching unprecedented heights in terms of market capitalization, marking a new all-time high for Tether.

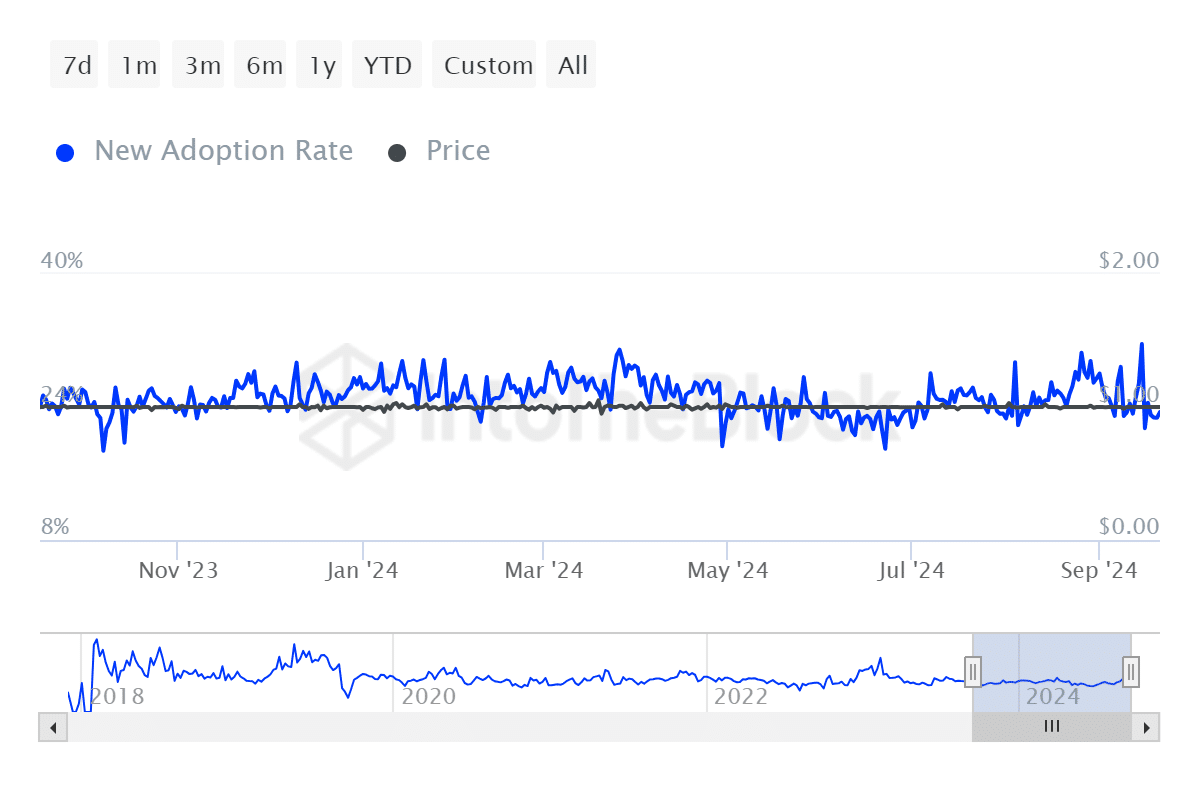

According to IntoTheBlock’s observations, they noted a significant evolution in the stablecoin sector. They subsequently posted about this on their official platform.

The market capitalization of Tether has hit an unprecedented peak, approaching a staggering $120 billion in U.S. Dollar tether (USDT) value.

Currently, the market capitalization of Tether stands at approximately $119.14 billion. This represents a substantial increase of 40.68% compared to this time last year. Over the past twelve months, Tether’s market cap has significantly risen from around $84.69 billion to its current value of $119 billion.

Compared to its nearest competitor, Circle’s USDC stablecoin, this growth currently boasts a market capitalization that is approximately $83.3 billion greater. Over the past year, USDC has also witnessed substantial growth, reaching a market cap of around $35 billion.

What’s driving USDT’s growth

In my role as an analyst, I find myself pondering over the key elements propelling Tether’s USDT to reach an all-time high in market capitalization.

According to AMBCrypto’s analysis, various market conditions are setting Tether for more growth.

Initially, the usage of Tether has significantly grown during the last year. Specifically, the usage rate climbed up from as little as 18% to 31% within this timeframe.

It seems that many people, organizations, and regular traders often choose USDT (Tether) over other types of stablecoins. This widespread preference among users could lead to even greater expansion for Tether in the future.

Moreover, while the stablecoin market offers various options, USDT has proven to be widely used in trading pairs. This dominance is evident through its control over other stablecoins in the market.

Based on Defillama’s findings, the influence of USDT has risen to 69.22%. This means that USDT is extensively employed in trading pairs across exchanges, and a larger dominance indicates greater market liquidity.

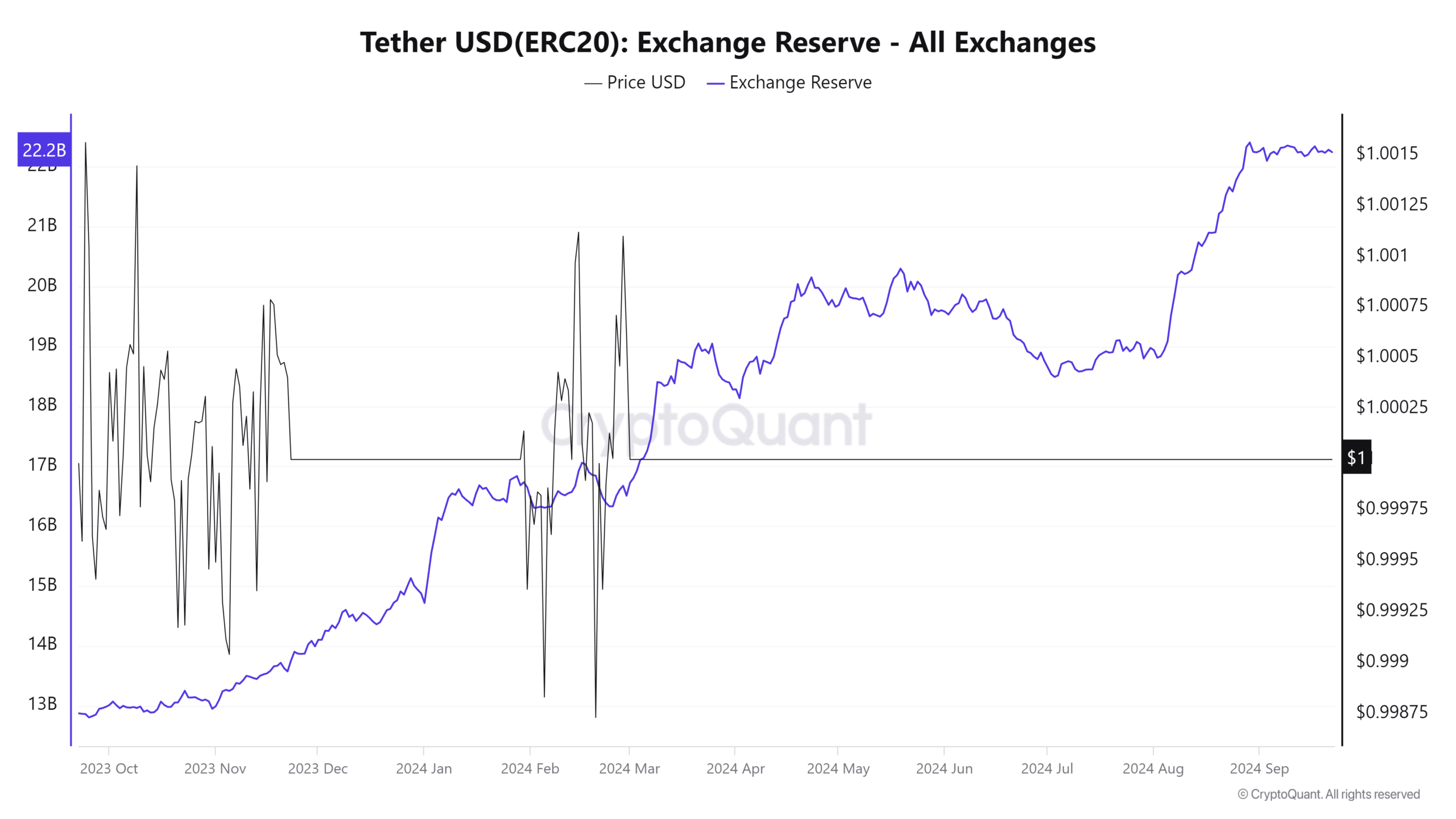

Over the past year, there’s been a significant increase in USDT being held by exchanges due to its expanding market capitalization. This suggests a rise in usage and acceptance, much like what was previously noted.

The fact that USDT is readily available on exchanges implies that many users tend to utilize it more for purchasing and various trading actions as opposed to other stablecoins, suggesting high demand and usage.

To summarize, Tether’s market capitalization reaching an all-time high indicates growing preference for USDT during trading transactions. This trend suggests that the crypto market is moving towards stablecoins as a preferred form of value storage for many cryptocurrency users.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- The Battle Royale That Started It All Has Never Been More Profitable

- Everything Jax Taylor & Brittany Cartwright Said About Their Breakup

- ANKR PREDICTION. ANKR cryptocurrency

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- EastEnders’ Balvinder Sopal hopes for Suki and Ash reconciliation: ‘Needs to happen’

2024-09-22 23:03