-

Despite clarifications from Tether, the market sentiment was bullish following the $1 billion USDT minting.

USDT market continues to grow with signs that it could drive BTC price higher.

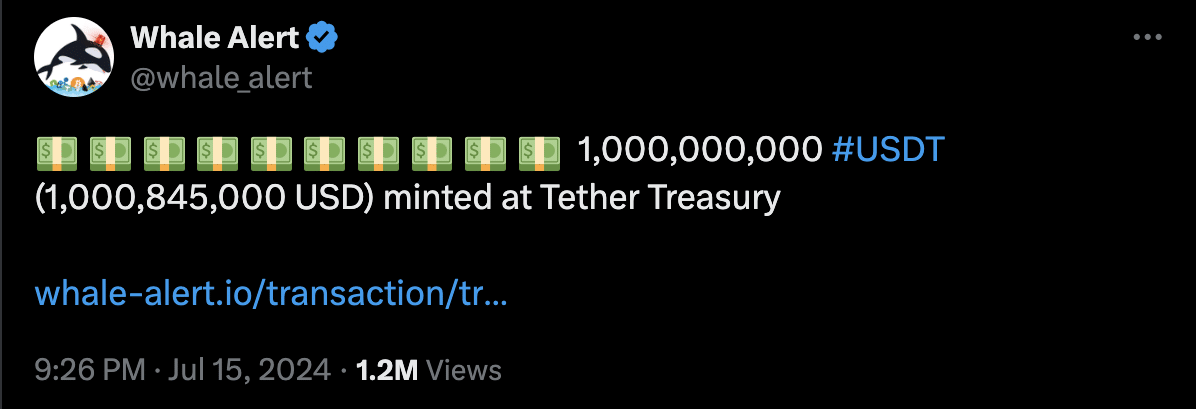

As a seasoned crypto investor with several years of experience under my belt, I have witnessed numerous market developments that have shaped the crypto landscape. The recent USDT minting by Tether, which saw $1 billion worth of stablecoins being minted on July 15, was an event that caught my attention for several reasons.

On July 15th, Tether, the stablecoin issuer, revealed that they had produced approximately one billion dollars’ worth of USDT tokens through their treasury. This announcement sparked significant reaction within the cryptocurrency sphere, with some interpreting it as an indication of a bull market.

No, the coins are not for the bulls

The lack of surprise at the reception considered that the earlier issuance of USDT boosted purchasing power. Typically, crypto prices surge a few weeks following significant developments.

Paolo Ardoino, CEO of Tether, swiftly put rumors to rest. He clarified that the stablecoins in question had not yet been released into circulation. Rather, they were minted specifically for use in chain swaps as an inventory.

Ardoino stated,

“Important Announcement: $1.1 billion worth of USDT is being restocked on the Tron Blockchain. This transaction, which has been approved, hasn’t yet been distributed. The funds are earmarked for use in inventory for upcoming issuance requests and exchange conversions.”

Market participants’ unphased remarks indicated a continued bullish outlook, while intriguing, the market’s optimistic attitude appears to have influenced price movements.

On the day when USDT coins were generated, the price of Bitcoin [BTC] hovered approximately around $60,200. However, at the current moment of reporting, Bitcoin has experienced an uptick in value and is being traded at $65,254.

USDT’s market cap continues to put the bull market in the spotlight

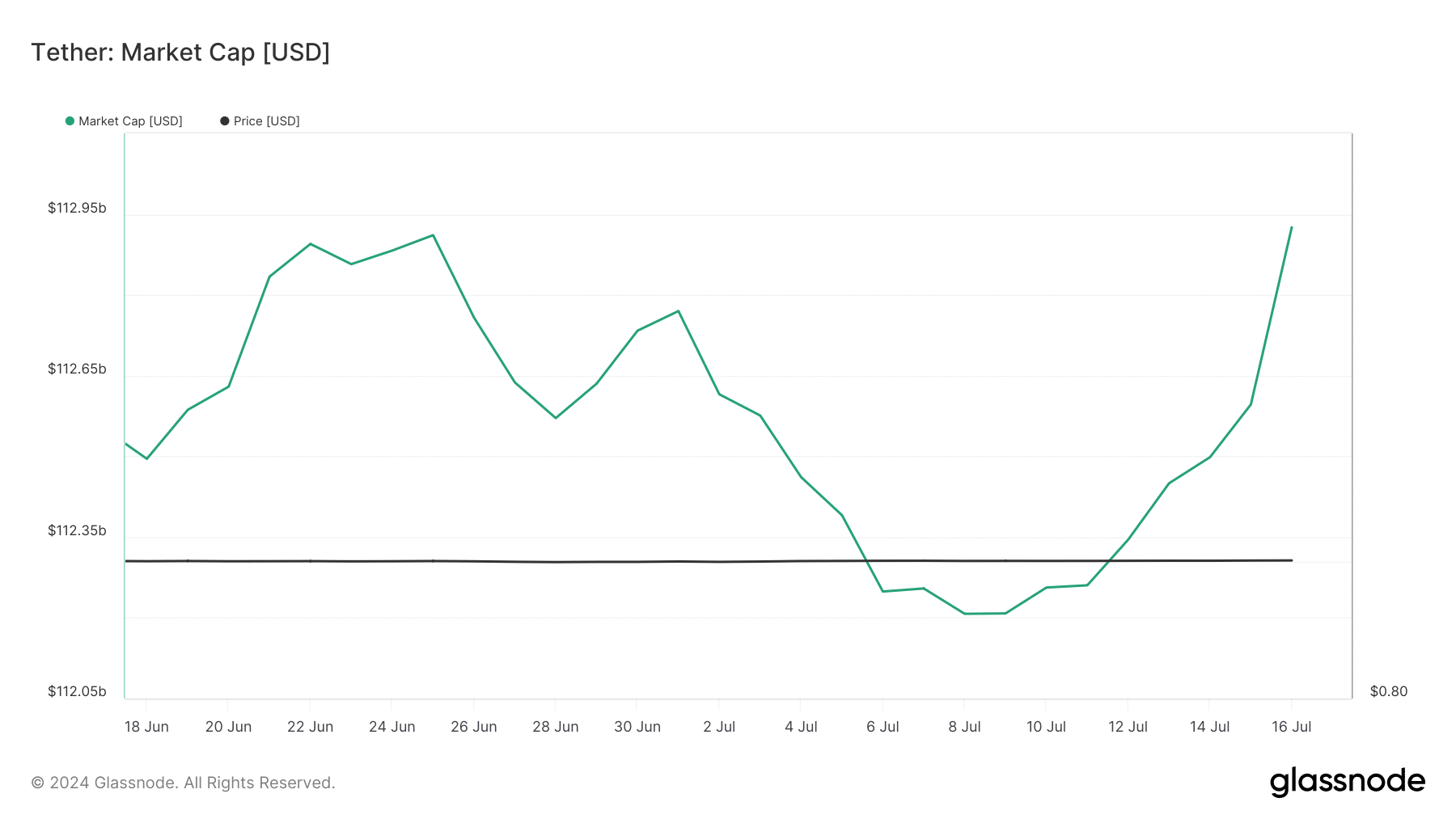

Based on market capitalization, AMBCrypto observed that USDT’s value had grown since July 9th. At that point in time, its market cap stood at $112.20 billion. However, the current market cap is now $112.92 billion as of this moment.

The market capitalization of a cryptocurrency is calculated by multiplying its current price by the number of coins in circulation. However, US Dollar Tether (USDT) maintains a fixed value relative to the US dollar. As a result, while new USDT tokens are continually minted, an equivalent amount of older USDT tokens also circulates, ensuring stability.

It was similarly clear from Justin Sun’s post on July 16th. Sun, the founder of the Tron (TRX) network, stated that they had produced stablecoins amounting to sixty billion dollars according to his declaration.

As an analyst, I’m excited to report that the circulation supply of TRON USDT has reached an impressive milestone, surpassing the $60 billion mark. This achievement makes TRON the first blockchain network to host a single stablecoin with such a substantial value.

Among all stablecoins, Tether’s version has garnered the greatest interest and demand, surpassing other contenders to reach this significant achievement. Consequently, there is a strong likelihood that the desire for USDT will continue to grow in the near future.

Realistic or not, here’s USDT’s market cap in BTC terms

Should the current trend continue, cryptocurrency prices could experience a significant upward surge, surpassing recent highs.

If Bitcoin reaches its all-time high again, it’s possible that altcoins may do the same.

Read More

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Cynthia Erivo’s Grammys Ring: Engagement or Just Accessory?

- PGA Tour 2K25 – Everything You Need to Know

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

2024-07-18 10:17