What to Know:

- Texas buying bitcoin via an ETF signals growing state-level comfort with regulated BTC exposure, but it primarily benefits long-term, low-beta allocators.

- As institutions choose ETFs, crypto-native investors may look one layer deeper, into Bitcoin Layer 2 infrastructure, for higher potential upside.

- Bitcoin still struggles with low throughput, variable fees, and limited programmability, keeping most complex DeFi and gaming activity on alternative smart contract chains.

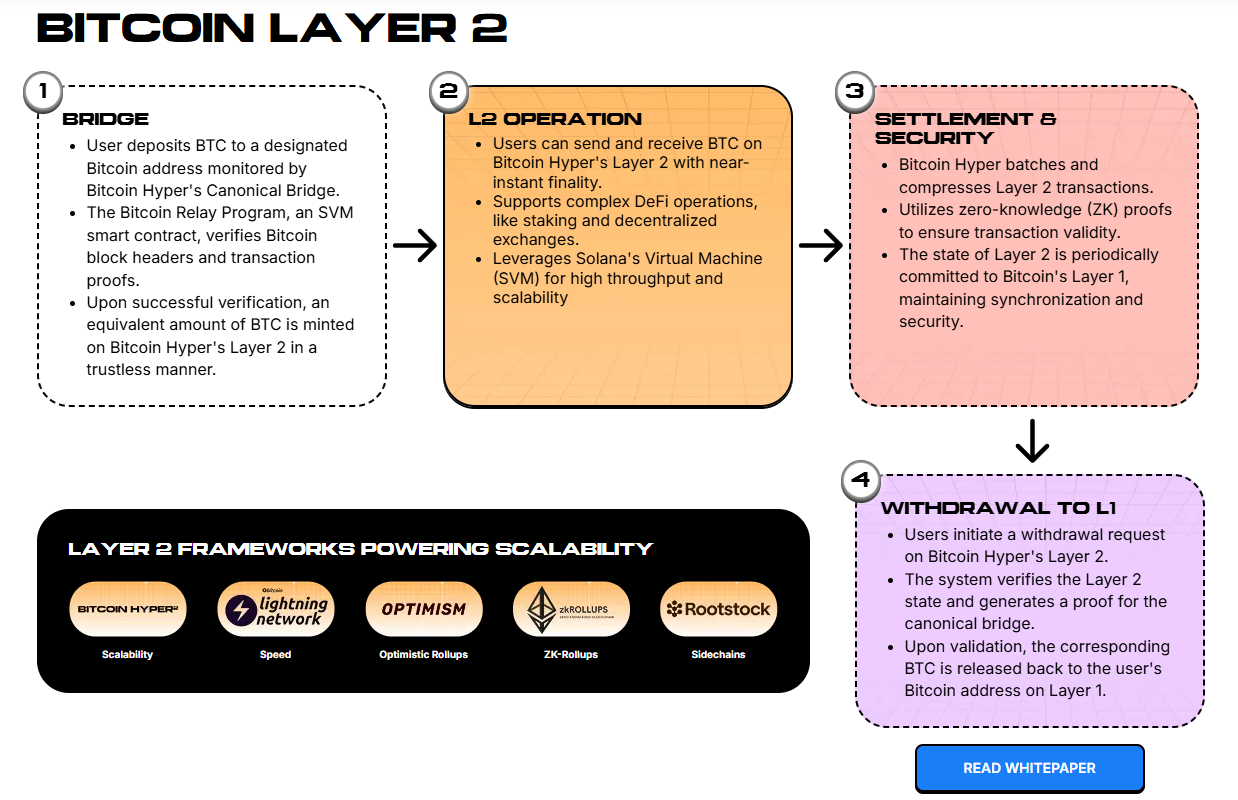

- Bitcoin Hyper aims to solve this by bringing SVM-based, high-throughput smart contracts to a Bitcoin-secured Layer 2, targeting payments, DeFi, NFTs, and gaming.

Ah, Texas. The state that likes everything big – including its Bitcoin investments. The Lone Star State has just become the first US state to buy bitcoin, but hold on, not through some cold wallet. Nope, it went with BlackRock’s spot $BTC ETF. Because, of course, when you’re Texas, you don’t do things halfway. 😉

For the institutional crowd, this is like getting the VIP pass to the Bitcoin party: clean regulatory rails, audited custody, and Bitcoin exposure that fits oh-so-nicely into a traditional portfolio. 🍾

Now, as for you, dear retail investor, don’t get too excited. ETFs don’t exactly bring the fireworks. You’ll get price tracking, sure, but don’t expect any of that juicy yield, leverage, or early-stage asymmetry. 🥱

But let’s not be too glum about it. When a sovereign-scale buyer like Texas jumps into the game via an ETF, it underscores Bitcoin as a macro asset. But here’s the thing – it also sends smaller investors scrambling to figure out where the next big upside is hiding.

Enter Bitcoin infrastructure plays – and guess what? Bitcoin Hyper is here, ready to fill in the gaps. Bye-bye slow confirmation times, high fees, and those pesky limitations on scripting. 👋

While everyone else is busy celebrating Texas’s move as a win for institutional Bitcoin adoption, crypto-native circles are already having a different conversation. They’re asking: if institutions are happy with ETFs, why not take a step closer to the action? Let’s dive into Bitcoin Layer 2s like Bitcoin Hyper, where the risk is high but so is the potential for a massive upside. 🔥

Why State-Level Bitcoin Adoption Highlights Layer 2’s Gap

Texas opting for a BlackRock ETF isn’t exactly a revelation. Institutions want Bitcoin exposure without dealing with the hassle of on-chain friction. But here’s the rub: Bitcoin’s base layer still only handles about 7 transactions per second, with confirmation times that feel like an eternity and fees that spike like your blood pressure when you check the mempools. 💀

That performance gap is where Bitcoin Layer 2 projects are racing to fix things. And boy, are they getting creative!

Whether it’s pure payments, EVM-sidechains, or new rollup-style architectures, the competition is heating up. But here comes Bitcoin Hyper, strutting in like it owns the place. It’s using the Solana Virtual Machine (SVM) to handle high-frequency, Solana-style workloads, but with the solid security of Bitcoin. 🍾

Why Bitcoin Hyper Is on Investors’ Radar Now

While many Bitcoin Layer 2 projects lean on the Ethereum Virtual Machine (EVM), Bitcoin Hyper does things differently. It integrates the Solana Virtual Machine so developers can deploy high-throughput Rust smart contracts on a Bitcoin-secured stack. 💪

Under the hood, Bitcoin Hyper uses a modular approach. Bitcoin L1 serves as the security anchor, while a trusted sequencer orders and executes transactions off-chain before anchoring them back to Bitcoin. Talk about smooth operation!

This design allows sub-second finality, low-cost swaps, lending, gaming, and NFT trades wrapped in $BTC, all while benefiting from Bitcoin’s base-layer trust. 💥

Now, let’s talk numbers. The Bitcoin Hyper presale has already raised a cool $28.5 million, with tokens going for $0.013335. Someone’s betting big on this Bitcoin-native SVM chain capturing meaningful DeFi and dApp flows. And it looks like they’re not wrong. 📈

If Bitcoin continues its institutionalization through ETFs, the next big growth play might just be infrastructure that makes Bitcoin more than just a passive asset. That’s the bet behind $HYPER: users will want fast swaps, lending, staking, and gaming – all in BTC terms, not just passive exposure. 🎮

Want in? Learn more about Bitcoin Hyper or join the $HYPER presale.

This article is for informational purposes only and does not constitute financial, investment, or trading advice; always do your own research.

Authored by Aaron Walker for NewsBTC – https://www.newsbtc.com/news/texas-bitcoin-etf-vs-bitcoin-hyper-layer-2

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Gold Rate Forecast

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Best Werewolf Movies (October 2025)

- Best Controller Settings for ARC Raiders

- Uncovering Hidden Order: AI Spots Phase Transitions in Complex Systems

- 10 Movies That Were Secretly Sequels

- Meet the cast of Mighty Nein: Every Critical Role character explained

2025-11-26 21:12