- This is not a drill! 🐳 Whales have gone wild on Bitcoin, pouring billions into the market. 💰

- But hold your 🐎! There’s a mixed bag of signals out there, hinting at a battle between bulls and bears. 👻

So, here’s the tea, folks: Bitcoin [BTC] whales have been on a shopping spree lately, buying up 22,000 BTC worth a cool $2.24 billion in the last 72 hours. 🤑 That’s like a horde of digital Vikings raiding a treasure chest! ⚔️

With Bitcoin currently chilling at $105,275.37 and up 3.78%, this whale activity is like a beacon of hope for bulls. 📈 It’s like they’re saying, “We believe in this digital gold, and we’re ready to fork over the dough!”

Bitcoin’s Price Action: Ready for a Bull Ride?

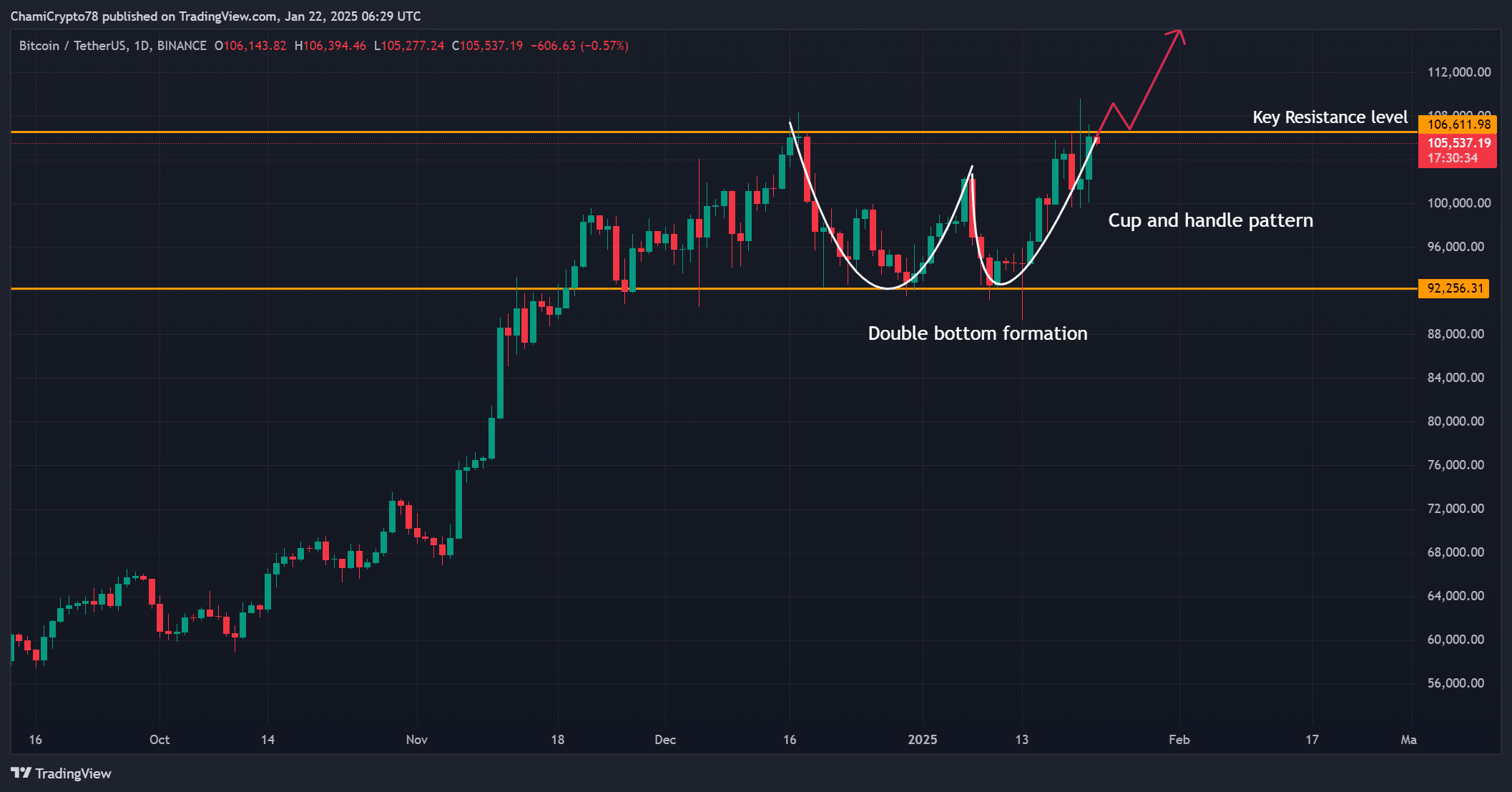

Take a gander at the Bitcoin price chart. It’s like a kid with a fresh crayon, doodling a perfect cup and handle formation. ☕ And you know what that means? A potential bullish breakout! 🚀

It’s like Bitcoin is saying, “Move aside, bears! I’m about to charge headfirst towards $110,000!” ⚡️ But hold your virtual horses, matey. If the price can’t hold its ground above $106,600, we might have a bit of a pullback. 📉 So, don’t go betting the farm just yet!

BTC’s Active Addresses: A Network Party!

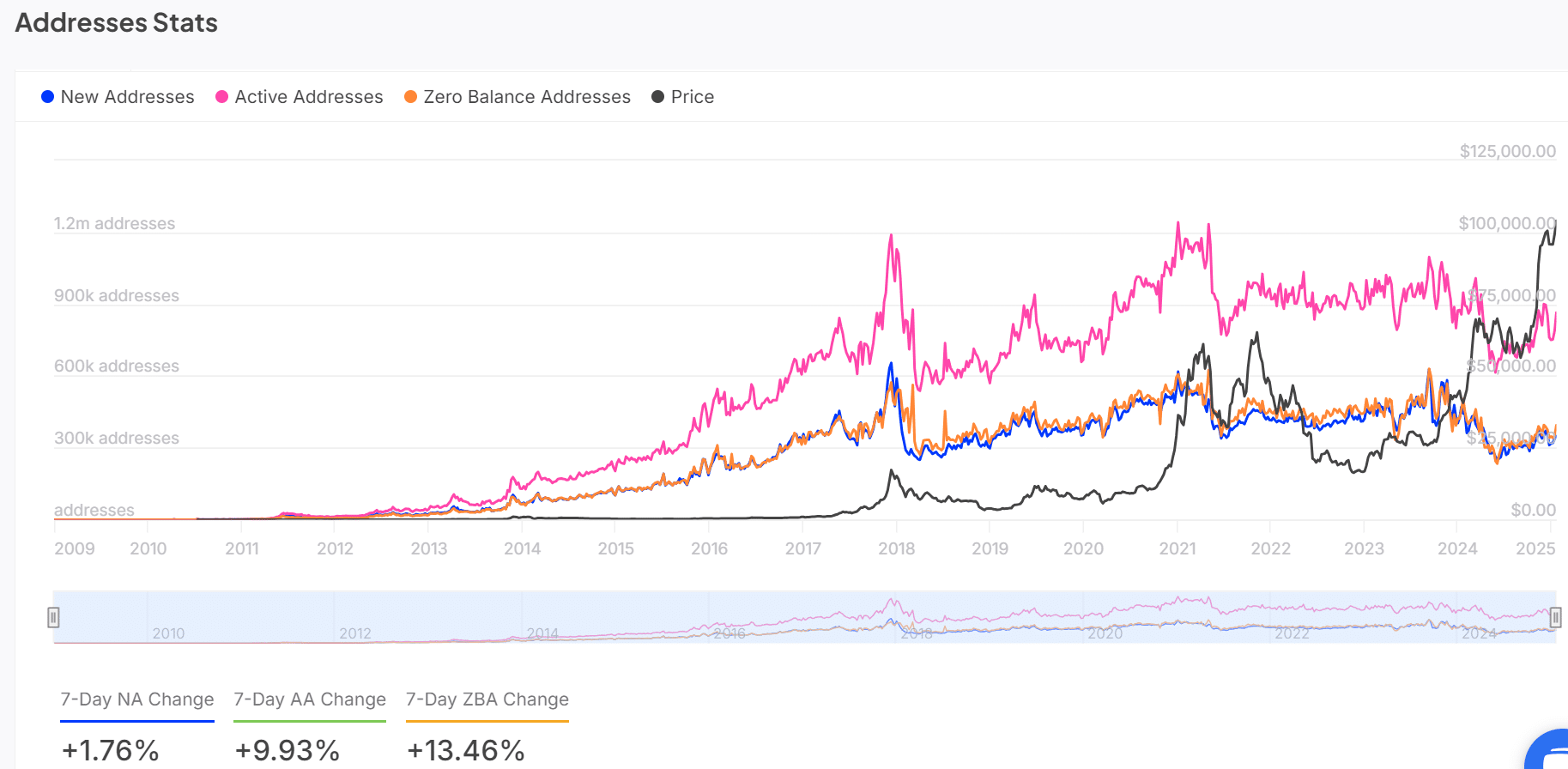

Bitcoin’s network is like a bustling metropolis, with active addresses jumping by 9.93% in the past week. 🌆 That’s like a bunch of new folks joining the party and saying, “Hey, we want a piece of that digital pie!”

Not only that, but the number of new addresses has also increased by 1.76%, showing that fresh blood is pouring into the Bitcoin ecosystem. 🩸 This is like a swarm of curious bees buzzing around a hive of sweet, sweet crypto nectar.

Exchange Whale Ratio: A Tale of Caution

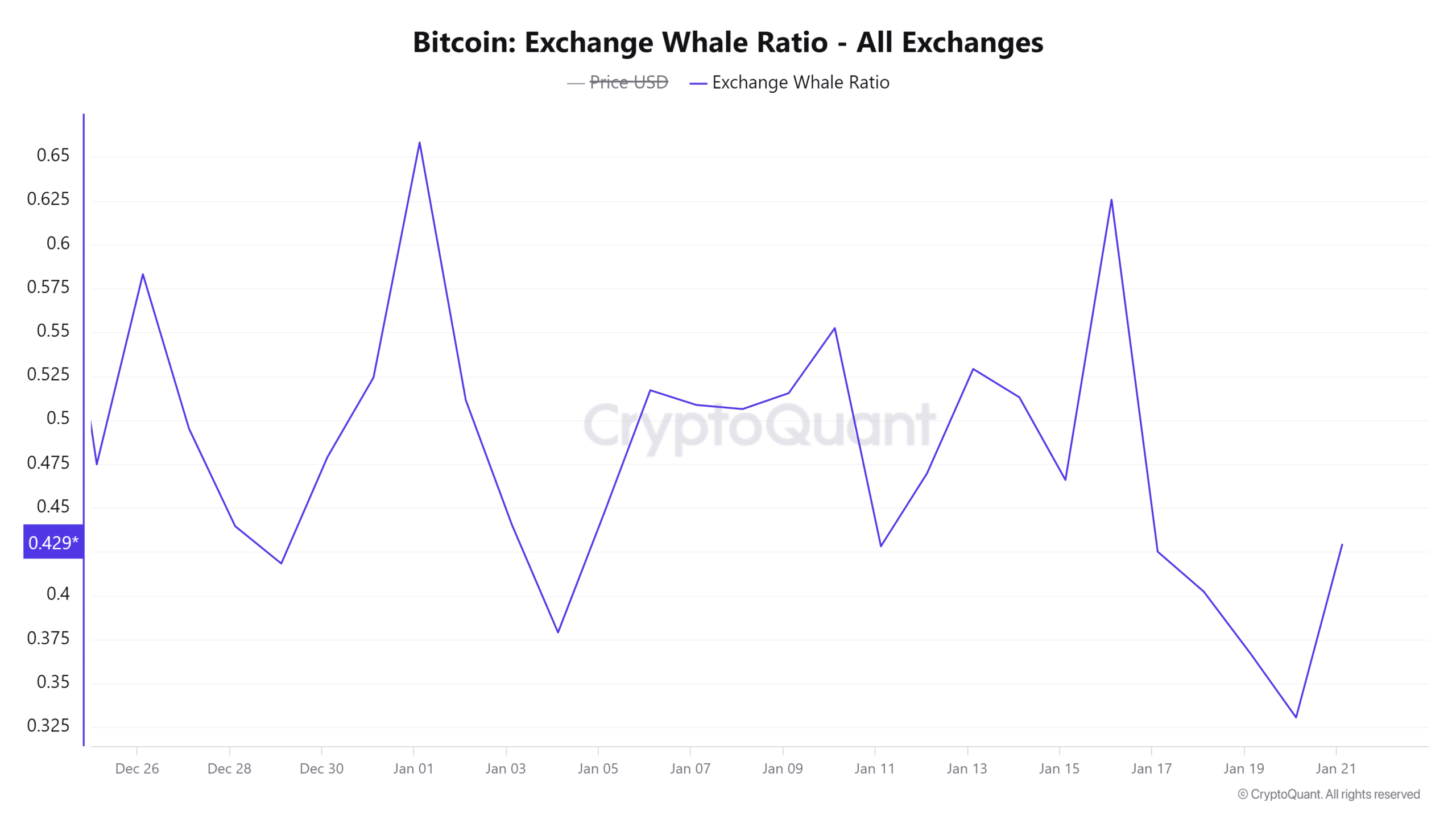

Now, let’s talk about the Exchange Whale Ratio. It’s like a barometer of whale behavior, showing us how they’re feeling about the market. 🤔 Currently, it’s sitting at 0.96, which is a slight increase.

What does this mean? Well, it means whales are still buying, but some of them are also sending their Bitcoin to exchanges. That could be a sign of profit-taking or hedging their bets. 💰 It’s like they’re thinking, “I’m holding on to some, but I’m also keeping an eye on the exits.” 🏃

BTC Liquidations: A Market Tug-of-War

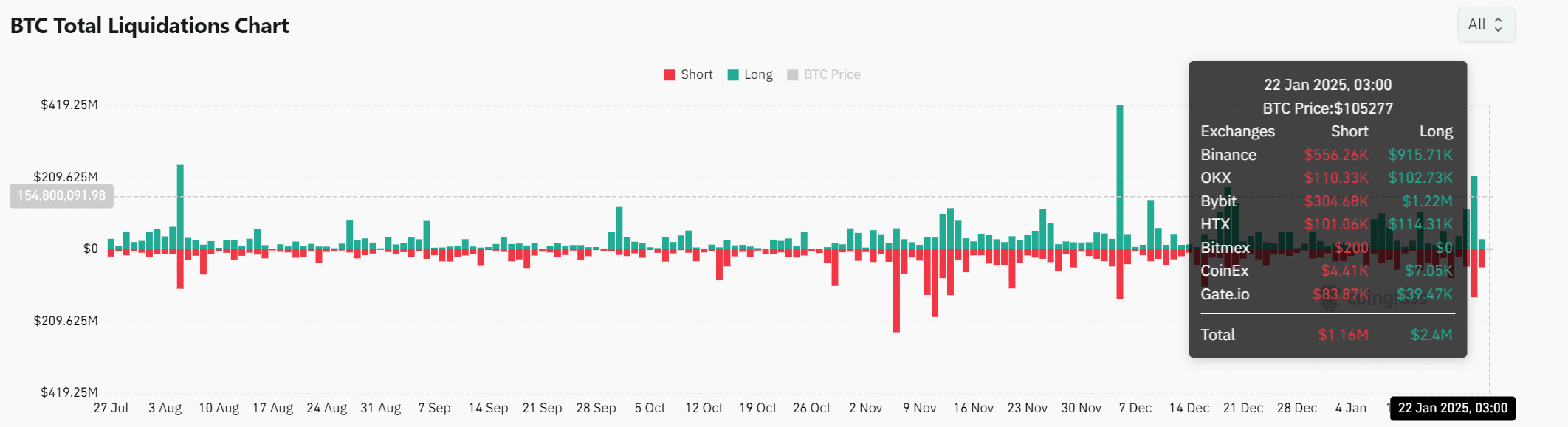

When it comes to Bitcoin liquidations in the past 24 hours, it’s like a tug-of-war between bulls and bears. ⚖️ Long positions worth $2.4 million were liquidated, but so were $1.16 million in shorts.

This balance shows that the market is still undecided. It’s like the bulls are charging forward, but the bears are holding their ground. Who will emerge victorious? Well, only time will tell.

Read Bitcoin’s [BTC] Price Prediction 2025–2026

So, will the $2.24 billion whale action push Bitcoin past $110,000? Well, it’s like a celestial dance between the stars and the planets. 🪐 The technicals, network activity, and whale accumulation suggest a potential breakout. But the cautious exchange activity and liquidation trends hint at some market hesitation.

If BTC can stay the course and keep the bears at bay, a move beyond $110,000 looks like a real possibility. So, buckle up, folks, and enjoy the ride! 🎢

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2025-01-22 15:03