- Bitcoin’s Accumulation Trend Score was at 0.021.

- This showed that large entities were distributing their holdings or not accumulating more coins.

As a researcher with extensive experience in analyzing Bitcoin’s on-chain data, I believe that the current trend in Bitcoin’s Accumulation Trend Score is concerning. The score being at 0.021 indicates that large entities are distributing their holdings or not accumulating more coins. This could be due to the narrow price movements of Bitcoin in recent weeks and its resistance at the $63,000 level.

As a crypto investor, I’m keeping a close eye on the Accumulation Trend Score of Bitcoin [BTC]. Based on the latest data from Glassnode, this trend was moving towards zero at the time of writing, indicating that larger entities are distributing more coins in the market. This could potentially signal a decrease in buying pressure from smaller investors and a shift in control to larger players. However, it’s important to remember that past trends don’t always indicate future outcomes.

This measurement monitors the behavior of various groups of Bitcoin wallets, distinguishing between those who are purchasing and those who are offloading the cryptocurrency.

When the value approaches one, it signifies that a large number of entities or a substantial segment of the network are amassing Bitcoin.

From my perspective as an analyst, a lower score, such as the current Accumulation Trend Score of 0.021 for Bitcoin (BTC), implies that these entities are more likely distributing or not accumulating cryptocurrencies.

“The approach to reaching this value might be a result of the coin’s limited price fluctuations over the last few weeks. It keeps encountering substantial obstacles at the $63,000 mark.”

Based on the most recent market information from CoinMarketCap, the top cryptocurrency was being traded for approximately $62,003.

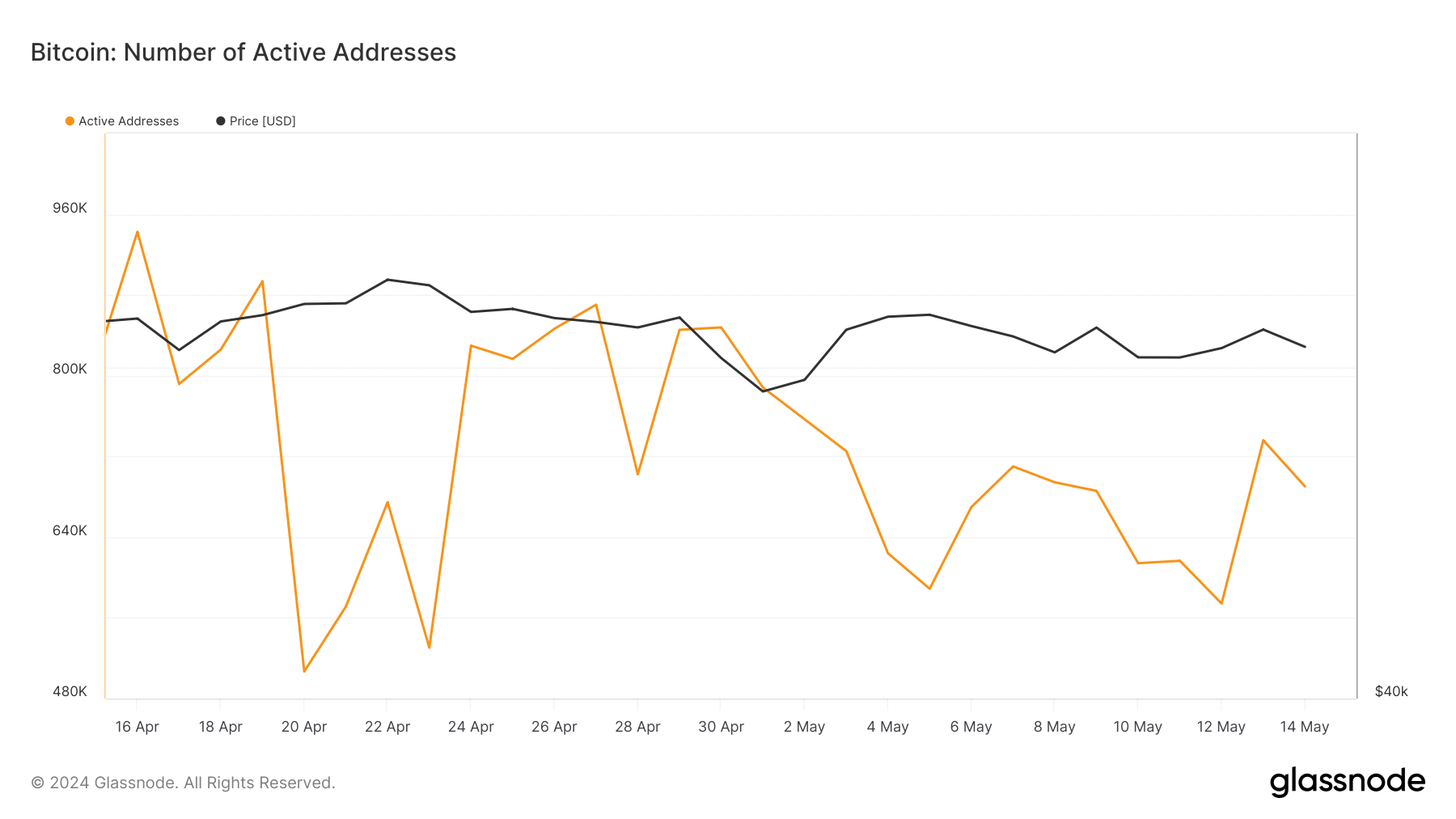

BTC’s on-chain activity in the last month

A look at the transaction data on the Bitcoin blockchain indicates that large Bitcoin wallets have been reducing their holdings, signaling a decrease in accumulation by these whale groups.

Based on Glassnode’s data, the count of distinct wallets holding over 1,000 Bitcoin coins has declined by approximately 0.1% in the past 30 days. Currently, this figure stands at around 211,300 addresses.

As a researcher studying the interaction between whales and the Bitcoin network, I’ve noticed an intriguing trend this fall. The number of whale transactions, or large bitcoin transfers, has decreased noticeably, reflecting a broader downturn in overall network activity.

As a researcher analyzing data from Glassnode, I’ve noticed a significant drop of approximately 27% in the count of unique addresses transacting on the network over the past month.

During the same period, there has been a notable fall in new demand for BTC.

As a researcher examining Bitcoin transactions over the past month, I’ve observed a significant decrease in the number of new unique addresses emerging in on-chain data. Specifically, there has been a 35% reduction in the count of first-time addresses observed during this period.

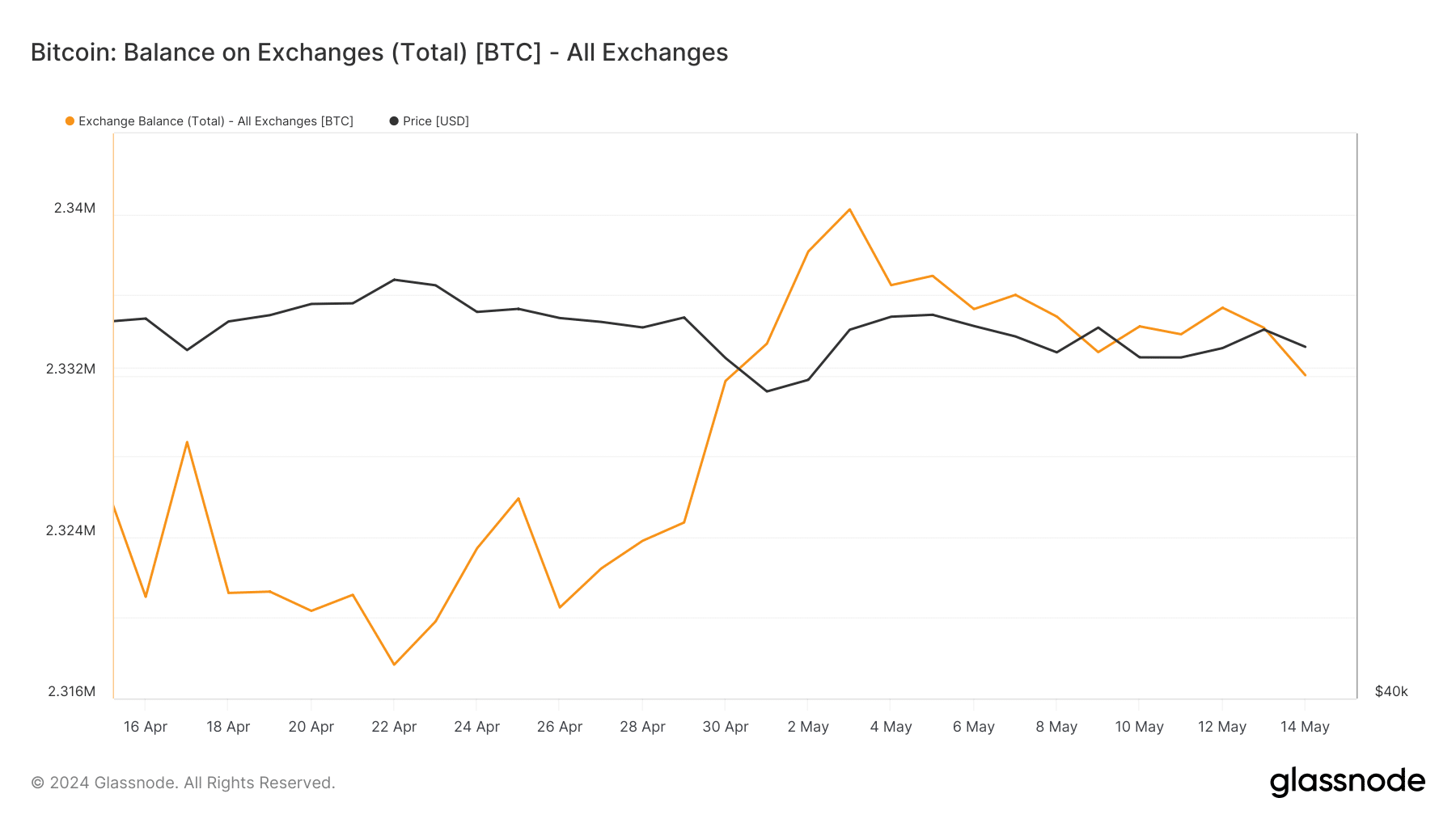

As a researcher studying Bitcoin transactions, I’ve noticed an intriguing trend. The number of unique addresses involved in daily Bitcoin trades has decreased. However, the quantity of coins transferred to cryptocurrency exchanges has significantly increased. This could indicate various things such as investors selling off their Bitcoins or a larger influx of new users entering the market through these exchanges. Further investigation is needed to fully understand the implications behind this data.

At press time, 2.33 million BTC were held on exchange addresses, growing by 1% in the last month.

Read Bitcoin’s [BTC] Price Prediction 2024-25

When BTC’s exchange reserve climbs this way, it suggests a hike in the coin’s sell-offs.

If the broader market keeps building momentum without BTC drawing significant new interest, it might be difficult for Bitcoin bulls to surpass the $63,000 resistance mark in the near future.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-05-15 15:04