On the fateful day of July 24, 2025, the great specter of Bitcoin floated languidly at $118,438, its market cap a staggering $2.35 trillion, while a trading volume of $53.99 billion twirled about in a most exaggerated fashion. Our dear cryptocurrency, ever the diva, indulged its psyche in an intraday price range of $117,422 to $119,197—a curious dance of consolidation near its lofty, historical summits.

Bitcoin

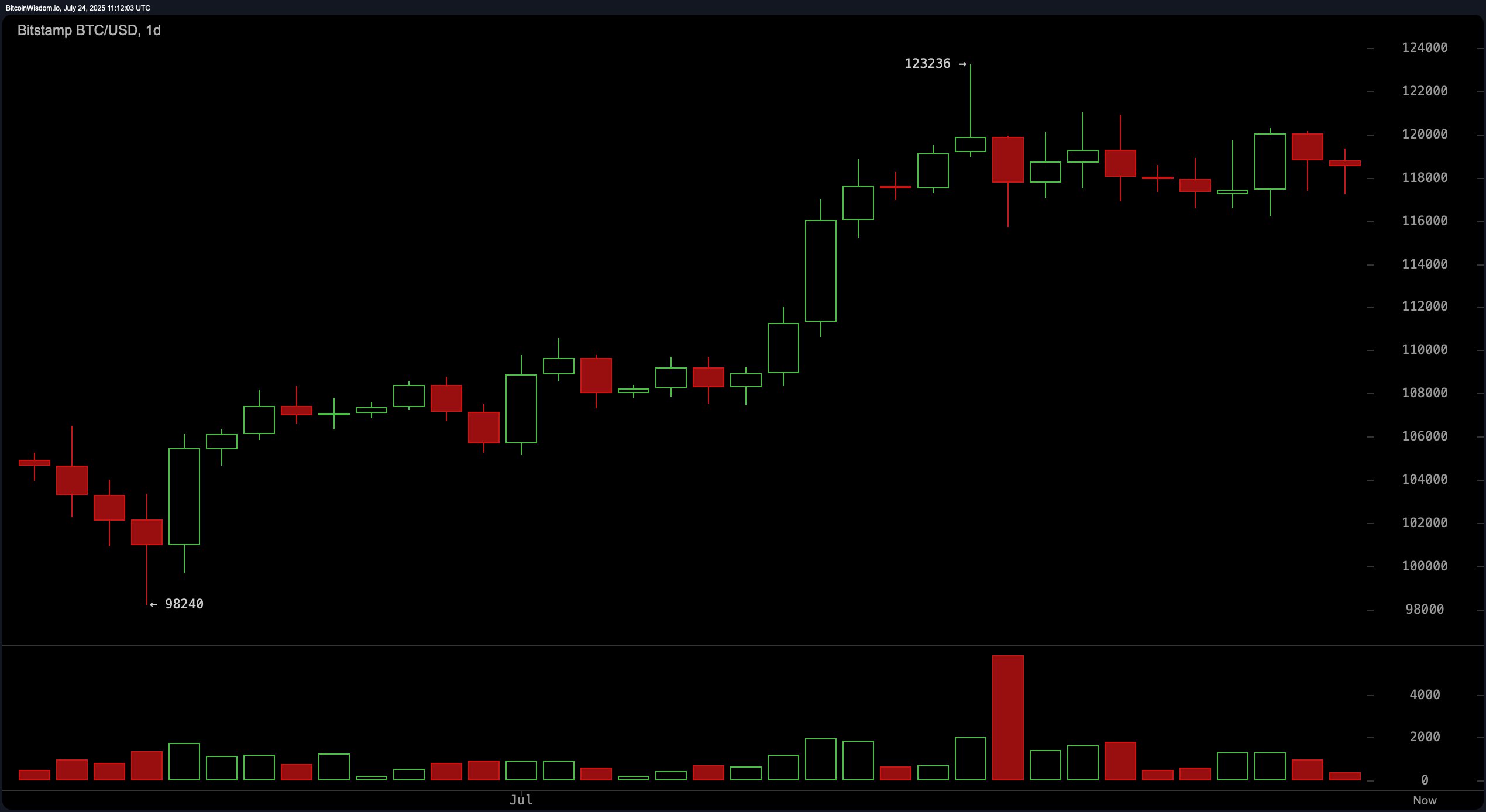

Behold, the daily chart! Here, bitcoin remains ensconced in a delightful uptrend, albeit with a flirtation into that mundane phase of consolidation. Its formation, a beguiling combination of a rising wedge or, if one prefers, a bull flag—both rather suggestive of continuation yet riddled with doubts about the bullish spirit, like a thespian forgetting their lines. Key support twinkles between $116,000 and $117,000, while resistance—a formidable foe—lingers at $123,000. Ah, the technical bias rests like a sleepy cat, neutral to slightly bullish, with traders twiddling their thumbs, awaiting either a grand breakout or a catastrophic breakdown to determine the next thrilling episode in this grand tale.

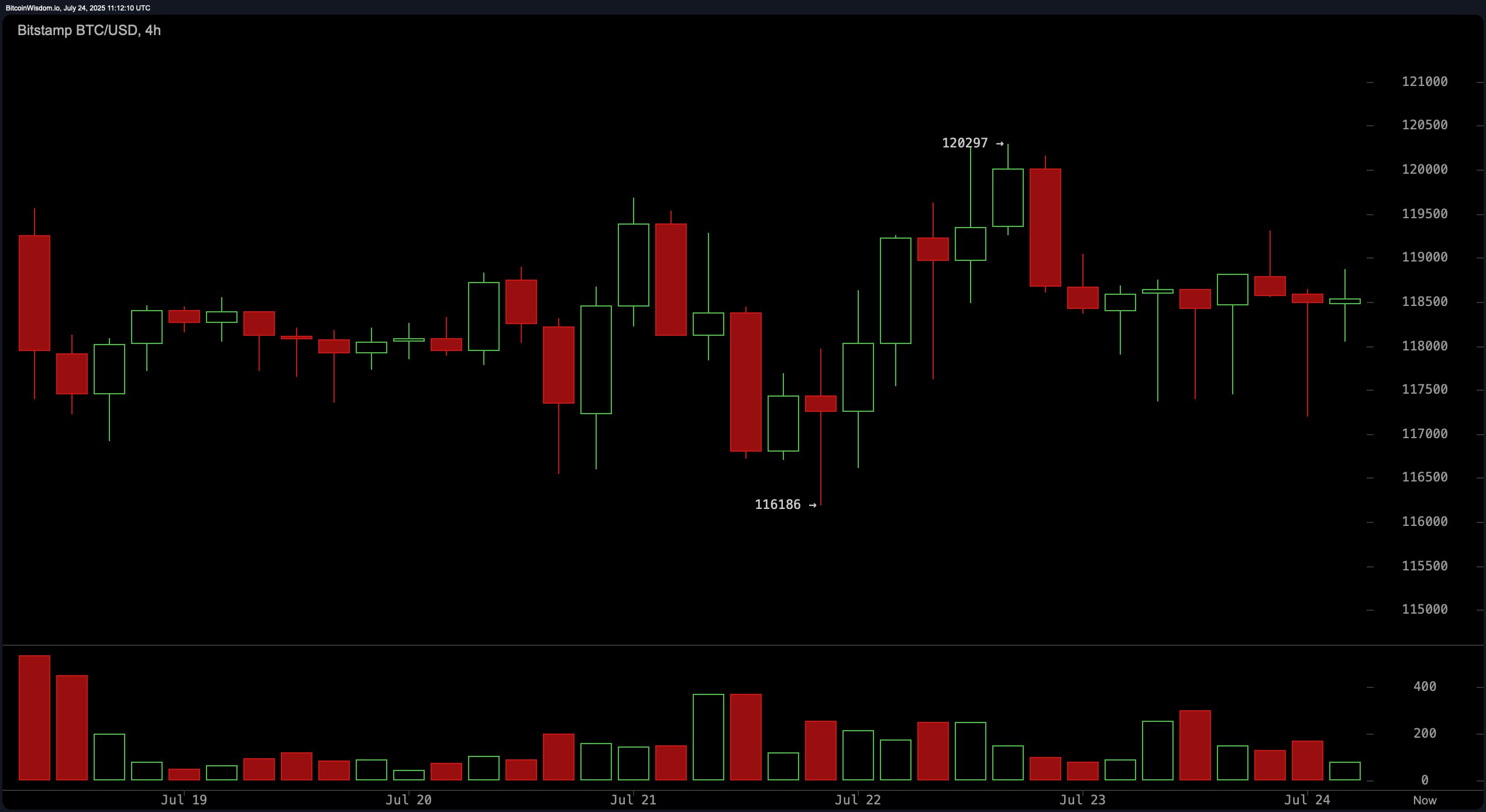

The 4-hour chart unveils bitcoin ensnared within a horizontal range—an ennui-inducing $116,000 to $120,000—with pesky rejections at the upper band suggesting buyer fatigue. Alas, a waltz of declining volume on bullish candles signals waning demand, perhaps a siren song of exhaustion. Furthermore, a ghostly head and shoulders pattern lurks like a bad plot twist, hinting at a possible reversal should the support at the neckline stumble. The immediate resistance, a mischievous sprite, flits about at $120,297, while swing low support robustly clings to $116,186. Traders, dear pilgrims of the market, are urged to keep a keen eye on the $116,000 level—a breakdown here could send the bullish optimists spiraling into despair.

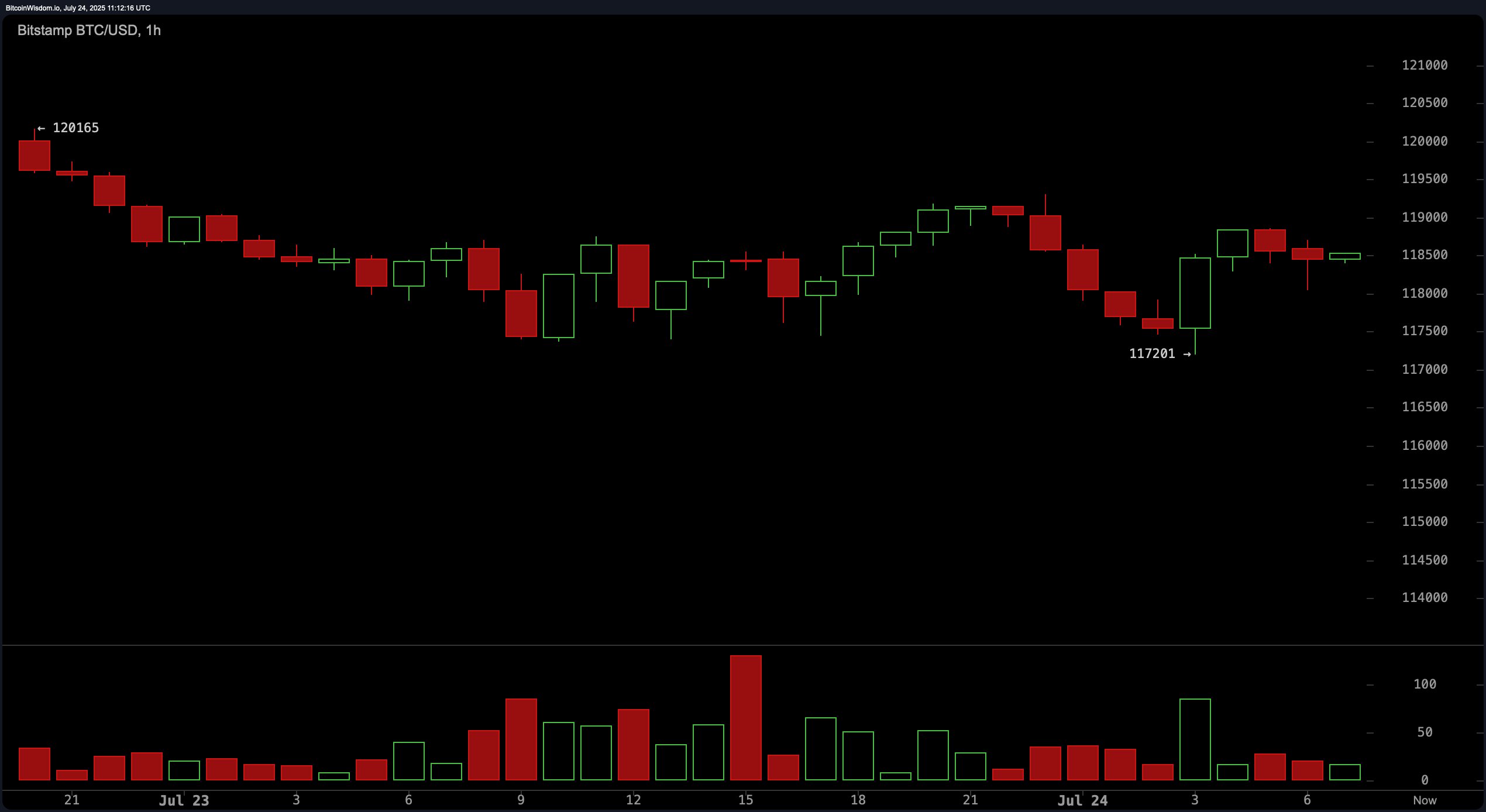

Short-term price antics on the 1-hour BTC/USD chart suggest a slight bearish bias, with lower highs grumbling and resistance yawning at $119,000. A fleeting higher low at $117,201 offers a dash of hope, yet the overall trend wobbles with a palpable weakness amid those fiery red candles. This little drama aligns itself with a descending triangle or a bearish flag, both delivering a rather dreary prognosis unless the buyers muster the courage to reclaim $119,000 with gusto.

Oscillator readings present an indecisive tableau, knitting a mixed technical tapestry. The relative strength index (RSI) twirls about at 63, while the Stochastic oscillator flutters at 61—an eclectic gathering of indicators, trapped in neutral limbo. However, the momentum oscillator shouts bearishness with a reading of −1,411, a rather unsavory twist further echoed by the MACD at 2,738. These dissonances signal a lurking weakness in bullish bravado, even as the price clings to its glamorous highs.

On the contrary, moving averages roguishly support the uptrend, with each notable average—both exponential moving averages (EMAs) and simple moving averages (SMAs) across all periods dignifying themselves—bestowing a bullish kiss. The shortest of short-term measures, like the 10-period EMA at $117,989 and SMA at $118,377, are synchronized with current price antics, suggesting that brief support remains intact. As for the longer-term EMAs and SMAs, from 50 to 200 periods—they serenely affirm the overall bullish narrative, cementing Bitcoin’s enduring strength through the whims of time. Crazy as it is, these bearish pressures are but minor ripples against an undercurrent of upward momentum—unless, of course, the critical support levels succumb to a dramatic collapse.

Bull Verdict:

Despite the murky waters of short-term consolidation and those finicky oscillator signals, the alignment of moving averages in a steadfast bullish formation suggests Bitcoin remains poised upon a critical precipice. A breakout beyond $123,000, particularly with volume bursting forth like confetti, could rejuvenate bulls and set Bitcoin aloft toward dizzying heights, solidifying the current phase as a scintillating interlude in an ongoing saga.

Bear Verdict:

Even while Bitcoin flirts tantalizingly near its pinnacles, fading volume, those moody short-term patterns, and ominous sell signals—from the momentum and MACD oscillators—portend a potential downturn. Should the $116,000 support succumb to inevitable forces, the shadows of a deeper correction loom ominously, making prudence the best ally for traders navigating these perilous waters until clarity brandishes its bright light once more.

Read More

- Best Controller Settings for ARC Raiders

- ‘Crime 101’ Ending, Explained

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- The Best Members of the Flash Family

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Battlefield 6 Season 2 Update Is Live, Here Are the Full Patch Notes

- The Strongest Dragons in House of the Dragon, Ranked

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Dan Da Dan Chapter 226 Release Date & Where to Read

- 7 Best Animated Horror TV Shows

2025-07-24 14:57