This article provides information about transaction fees in cryptocurrencies and discusses different types of transaction fees such as gas fees, trading fees, network fees, and withdrawal fees. It also offers strategies to help users reduce their transaction fees, including using centralized exchanges, utilizing Layer 2 solutions, avoiding peak trading times, and opting for lower priority transactions. The article mentions Nano and IOTA as examples of cryptocurrencies with no or very low transaction fees. Additionally, it suggests comparing the fee structures of different exchanges to find the cheapest options and considering any discounts they offer. Overall, the article aims to help users navigate the world of cryptocurrency transfers and minimize their transaction fees for optimal investment strategies.

In the realm of investments, it’s important to be aware that for every trade you conduct, there is a required fee you need to cover.

Additionally, you’re aware that some cryptocurrencies enable you to bypass or minimize transaction fees. However, you’re unsure which specific cryptocurrencies provide this benefit.

In this article, we’re happy to guide you through the most affordable cryptocurrencies suitable for transfer transactions. Let’s explore together!

Finding the Cheapest Crypto to Transfer to Your Wallet: Why It Matters?

Transferring cryptocurrencies may involve paying a fee, much like a service charge. The cost of this fee can fluctuate based on the specific type of cryptocurrency and the chosen transfer method.

If you’re new to cryptocurrencies or only dealing with small transactions, the fees can eat up a significant portion of your funds. Discovering an affordable method for transferring crypto will enable you to retain more of your hard-earned assets. This is particularly important for novice investors.

As a crypto investor, I recognize the significance of transaction fees when it comes to making everyday purchases with cryptocurrencies. For instance, if the fee for transferring funds is excessively high, using crypto for buying a simple coffee might not be cost-effective. However, by identifying more affordable transfer methods, we can make crypto a more practical choice for our daily transactions.

When considering crypto transfers, keep in mind that cost isn’t the only factor. For instance, what is the desired transfer speed? Cheaper options may take more time. Safety and security are essential too; ensure your cryptocurrency remains protected during the transaction. Lastly, consider the reliability of the transfer method to avoid potential issues.

Briefly, saving on crypto transfers by opting for affordable methods is beneficial. However, swiftness, security, and dependability are crucial aspects to consider as well. Allow us to guide you towards the most optimal solutions that strike a balance between cost-effectiveness and these essential features.

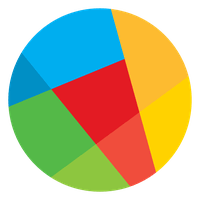

Coindoo’s Picks on Top 10 Cheapest Crypto to Transfer in 2024 and Beyond: In a Nutshell

As aanalyst, I’ve compiled a list of our ten standout projects. These projects have gained recognition for their ability to process transactions with minimal fees, all while ensuring efficient validation.

de inserat tabel word

Top 10 Cheapest Crypto to Transfer in 2024 and Beyond

1. IOTA

- Transaction Fee: 0$

- Current TPS (Transactions Per Second): 1000 TPS

- Market cap (May 28, 2024): $735M

At present, among the cryptocurrencies available, IOTA stands out as the most economical option for transactions due to its unique underlying technology. In contrast to conventional blockchain networks that necessitate miners and their accompanying fees, IOTA employs a novel distributed ledger system called Tangle.

As a crypto investor, I can tell you that this innovative system allows for a communal approach to securing the network. When I initiate a transaction, instead of paying fees to miners for verification, I am also responsible for validating two other transactions. This community-driven effort maintains network security collectively without relying on traditional miners and their associated transaction fees.

Iota’s fee-free design is perfectly suited for microtransactions in the IoT era, where numerous connected devices will be exchanging data and value. Furthermore, Iota’s Tangle technology boasts remarkable scalability, ensuring swift transaction processing even as the network expands.

Iota, equipped with distinctive technology and boasting no transaction fees, is an excellent option for those seeking to transfer or receive cryptocurrency without incurring any costs.

2. Stellar (XLM)

- Transaction Fee: 0.00001$

- Current TPS (Transactions Per Second): 1000 TPS

- Market cap (May 28, 2024): $3.1B

Thanks for the clarification!

Stellar achieves its affordability through a unique system called the Stellar Consensus Protocol (SCP). This protocol allows for fast transaction confirmation times, usually within seconds, while still maintaining a secure and decentralized network. Essentially, SCP works by having trusted network members verify transactions, keeping things efficient without compromising security.

Stellar stands out not just for its affordable fees, but also for its commitment to promoting financial inclusion through cryptocurrencies. The goal is to make this technology accessible to all, including those who are unable to use traditional banking services. By offering remarkably low transaction fees and swift transfer speeds, Stellar enables individuals around the globe to engage in the digital economy, irrespective of their location or financial history.

3. Ripple (XRP)

- Transaction Fee: $0.0011

- Current TPS (Transactions Per Second): 3400 TPS

- Market cap (May 28, 2024): $29.1B

XRP, which was launched in 2012, boasts a rich history and a distinct function: enabling swift cross-border transactions. Its emphasis on practical uses and well-established technology makes it an attractive option for those seeking affordable cryptocurrency solutions for money transfers.

XRP’s efficiency stems from its distinct architecture. It runs on the independent XRP Ledger, a blockchain different from Bitcoin, and employs the Ripple Protocol Consensus Algorithm (RPCA) in place of energy-consuming mining. This alternative approach enables swift transaction validations, usually within seconds, contrasting traditional bank transfers that may take days.

Among its advantages, XRP transactions stand out for their speed and exceptionally low fees, at around $0.0011. This cost-effectiveness makes XRP an excellent choice for small value transfers and microtransactions, particularly appealing in emerging markets where mobile payments are gaining popularity. However, it’s essential to acknowledge that some critics within the crypto community question XRP’s level of decentralization due to a significant portion of its supply being controlled by Ripple, the company responsible for its development.

As a financial analyst, I recognize the validity of the concerns surrounding XRP. However, I also cannot ignore its established presence in the market, its emphasis on speed and affordability, and its customized design for cross-border payments. These factors make XRP a compelling option for those looking for a practical and cost-effective solution to transfer value internationally.

4. Monero (XMR)

- Transaction Fee: $0.0014

- Current TPS (Transactions Per Second): 1700 TPS

- Market cap (May 28, 2024): $2.6B

In contrast to many other cryptocurrencies where security and privacy come with substantial costs, Monero (XMR) manages to deliver these features affordably.

As a Monero analyst, I can explain that this cryptocurrency prioritizes anonymity in its design. It employs sophisticated technologies such as Ring Confidential Transactions (RingCT) and Ring Signatures to conceal transaction details. Consequently, the sender’s address, recipient’s address, and the transaction amount are all shielded from public view, ensuring a significant level of confidentiality for each user involved in a Monero transaction.

As a researcher studying the cryptocurrency landscape, I’ve noticed that Monero prioritizes user privacy to an extent that makes transactions difficult for external parties to trace or analyze, which could potentially reduce fraud risks and bolster security. Unlike some other privacy-centric coins, Monero doesn’t demand high transaction fees. Instead, the cost of conducting crypto transactions on this platform is quite low, with fees typically amounting to just $0.00014.

Monero (XMR) offers a number of advantages over traditional financial systems when it comes to cryptocurrency transactions. For instance, it eliminates extra fees such as wire transfer charges, holding periods, or clearing costs. Consequently, Monero is an uncomplicated and cost-effective choice for those who value affordability alongside privacy in their crypto transactions.

5. Solana (SOL)

- Transaction Fee: 0.00025$

- Current TPS (Transactions Per Second): 2323 TPS

- Market cap (May 28, 2024): $74.8B

Based on our findings, Solana is an excellent alternative. Its cost-effective design for cryptocurrency transfers sets it apart.

In contrast to certain blockchains that feature elevated and unpredictable transaction fees, Solana boasts remarkably affordable and stable costs. On average, transferring Solana (SOL) tokens, custom SPL tokens developed on Solana’s platform, or even NFTs incurs an insignificant fee of approximately $0.00025. This attribute makes Solana a tempting choice for users deterred by the high fees on other more costly networks such as Ethereum.

Solana’s affordability isn’t mere marketing hype. As a high-performance blockchain, it boasts an innovative design that handles thousands of transactions per second while maintaining remarkably low fees. This is made possible through the integration of Proof-of-History and Proof-of-Stake consensus mechanisms. These mechanisms streamline the process and secure the network, leading to an average transaction completion time of just 2.5 seconds with minimal fees attached.

As a researcher examining the blockchain landscape, I’m consistently impressed by Solana’s unique value proposition. With its impressive speed and affordability, Solana emerges as a compelling choice for both developers and users. For developers, this combination enables the creation of intricate decentralized applications (dApps) without being hindered by exorbitant gas fees. Conversely, for users, they can enjoy the advantages of blockchain technology without facing significant financial barriers.

6. TRON (TRX)

- Transaction Fee: $0.000005

- Current TPS (Transactions Per Second): 2000 TPS

- Market cap (May 28, 2024): $9.6B

One alternative worth considering if your priority is minimal transaction fees is TRON. This platform operates using a Delegated Proof-of-Stake (DPoS) consensus algorithm, which streamlines transaction processing and keeps costs low.

The efficiency of TRON results in noticeably smaller transaction fees compared to Ethereum. Consequently, TRON is a preferred option for users actively dealing with stablecoins such as USDT (Tether).

As a analyst, I would express it this way: While the quantity of decentralized applications (dApps) on TRON is not as extensive as certain competitors, it remains a compelling choice for those looking to delve into the cost-effective realm of DeFi and other blockchain functionalities.

TRON’s emphasis on content sharing and entertainment may not resonate with all users. Nevertheless, its trailblazing methods and extremely affordable transaction costs make TRON a compelling choice for those seeking affordability and ease of access in the burgeoning realm of decentralized finance.

7. ReddCoin (RDD)

- Transaction Fee: $0.000005

- Current TPS (Transactions Per Second): 5 TPS

- Market cap (May 28, 2024): $2.4M

ReddCoin (RDD) stands out on our list for its focus on social interactions and microtransactions.

As a crypto investor, I’d describe ReddCoin as a digital currency specifically designed to facilitate social transactions with ease and affordability. Its primary goal is to streamline and lower the cost of carrying out small online transactions, particularly when tipping content creators. The coin’s exceptionally low transaction fees make it an attractive choice for sending small tips and donations without worrying about hefty costs.

ReddCoin utilizes a distinct consensus mechanism called Proof of Stake Velocity (PoSV), which is more energy-efficient and eco-friendly than the Proof of Work (PoW) systems used by many other cryptocurrencies. With PoSV, users are incentivized to keep and active their RDD coins within the network. This not only enhances security and agreement but also decreases the computational demands linked to PoW.

As a researcher exploring digital currencies, I’ve come across ReddCoin, which sets itself apart by concentrating on social media and microtransactions. With nearly negligible transaction fees and swift confirmation times, it provides an alluring option for individuals looking to transfer value within dynamic online communities and popular social platforms.

Although ReddCoin boasts lower transaction fees than the cryptocurrencies we’ve examined before, its modest market value and scant popularity led to a ranking of seventh place.

8. Dogecoin (DOGE)

- Transaction Fee: $0.04

- Current TPS (Transactions Per Second): 33 TPS

- Market cap (May 28, 2024): $23.7B

Dogecoin (DOGE), which emerged from a casual meme in 2013 featuring a Shiba Inu dog, has transformed into a noteworthy cryptocurrency boasting a passionate community. Despite its humorous beginnings, Dogecoin presents significant advantages to its users, particularly regarding transaction fees.

Transacting with DOGE comes with an average fee as low as roughly $0.04, making it an economical choice for frequent, small-scale transactions. This affordability is augmented by Dogecoin’s swift transaction speed, which usually takes around a minute. Consequently, Dogecoin emerges as a practical solution for everyday activities such as online tipping, donations, and microtransactions due to its low fees and quick transfer times.

As a researcher studying cryptocurrencies, I must emphasize that Dogecoin’s transaction fees can change based on network activity. In busy periods, these fees may rise above average, though they have never reached the $1 mark historically. For individuals who prioritize minimal fees at all times, it might be worth considering alternative options from this list.

9. Litecoin (LTC)

- Transaction Fee: $0.03-$0.04

- Current TPS (Transactions Per Second): 50 TPS

- Market cap (May 28, 2024): $6.2B

Launched in 2011, Litecoin is among the early cryptocurrencies that still holds its ground when it comes to affordably priced transactions. The average cost for sending Litecoin ranges from $0.03 to $0.04, placing it as one of the top cryptos known for their minimal transaction fees.

Litecoin boasts confirmation times averaging approximately 2.5 minutes, making it an effective choice for day-to-day transactions. Be it buying goods online or transferring funds to friends, Litecoin guarantees swift and affordable transactions.

As a crypto investor, I’ve noticed that some newer digital currencies come with added functionalities such as smart contracts. However, I find myself drawn to Litecoin due to its unwavering commitment to its primary strength – enabling swift and affordable peer-to-peer transactions. The concentration on this core feature, coupled with its well-established position within the cryptocurrency market, makes Litecoin an alluring option for numerous users like myself.

10. Nano (XNO)

- Crypto Transaction Fee: $0

- Current TPS (Transactions Per Second): 1000 TPS

- Market cap (May 28, 2024): $165M

As an analyst, I would highlight Nano (XNO) as one of our preferred options due to its innovative transaction fee model. Unlike many other cryptocurrencies, Nano does not charge any fees for transactions. Established in 2015, initially known as RaiBlocks, Nano places a strong emphasis on efficiency above all else.

Nano employs a distinctive design called Directed Acyclic Graph (DAG) which sets it apart from many other cryptocurrencies. In contrast to typical blockchains where miners are essential for transaction validation and typically result in fees, Nano functions without the need for miners. As a result, Nano delivers immediate settlements free of charge, making it notably quicker and more cost-effective than most digital currencies.

Although Nano’s groundbreaking technology sets it apart in the crypto world, its relatively recent entry has prevented it from garnering the same level of acceptance and market value as more seasoned digital currencies. Despite the advantages Nano brings to the table, its limited adoption translates into a smaller market capitalization compared to its well-established counterparts.

For those who value swift and affordable cryptocurrency transactions, Nano is an intriguing choice despite its limited usage. If your priority is sending and receiving funds instantaneously with zero transaction fees, the unique fee-less structure of Nano merits further investigation.

What Are Transaction Fees in Crypto?

In the realm of cryptocurrencies, users incur charges whenever they transfer digital assets between wallets or engage in trading activities, be it through centralized or decentralized platforms. These fees are referred to as transaction costs.

Transaction fees play a crucial role by rewarding miners and validators for their efforts in maintaining and securing the blockchain network. Essentially, these fees facilitate the smooth processing of transactions and help fortify the network’s stability and dependability.

Different Types of Crypto Transaction Fees

In the world of cryptocurrencies, various kinds of charges exist. Among them are gas fees, trading fees, network fees, and withdrawal fees. Grasping the essence of these fees and the circumstances under which they arise is essential for efficiently controlling your expenses.

Gas Fees

On Ethereum and other blockchain networks, there are particular fees known as gas fees. These charges serve to compensate miners for their work in verifying and executing transactions. The cost of these fees can change depending on network congestion and the intricacy of the transaction at hand. Basic transfer tasks typically result in smaller gas fees, whereas engaging in more intricate dealings with smart contracts entails higher costs.

Trading Fees

Cryptocurrency exchanges levy trading fees whenever users conduct buy or sell transactions for digital assets. These fees usually represent a percentage of the transaction value and can vary between different platforms. Notably, exchanges such as Coinbase grant discounted fees to high-volume traders or those who transact using the exchange’s native token.

Network Fees

Transaction costs, often referred to as network fees, are charges levied by blockchain networks to ensure their security and optimal performance. For instance, Bitcoin’s network fee serves as remuneration for miners, incentivizing them to process transactions using their computational resources and add them to the blockchain. Solana is known for having relatively low network fees among other blockchains.

Exchange Withdrawal Fees

When moving funds from a cryptocurrency exchange to an external wallet or traditional banking system, users may incur withdrawal fees. The amount of these charges can significantly differ among exchanges and is contingent upon the type of cryptocurrency being taken out. Certain platforms provide incentives, such as reduced fees for large transactions or using particular digital currencies.

How to Reduce Cryptocurrency Transaction Fees?

As a researcher in the crypto sphere, I understand that minimizing transaction fees can be a complex task, particularly for newcomers. Here’s a straightforward approach to help you reduce your expenses:

Use Centralized Exchanges

Centralized exchanges (CEX) tend to have less expensive transaction costs than their decentralized counterparts. Certain exchanges go as far as waiving fees for specific cryptocurrencies. Furthermore, several platforms offer discounts: trading fees can be reduced by 10% using promo codes, and holding a certain quantity of the exchange’s native tokens grants you this benefit.

Utilize Layer 2 Solutions

One way to rephrase this statement in a more conversational tone could be: Layer 2 networks are built with the goal of enhancing the capacity and economy of blockchain transactions. By implementing Layer 2 solutions, you can experience noticeable fee reductions without compromising the security of the underlying main blockchain.

Avoid Peak Trading Times

During times of heavy network usage and market instability, transaction fees tend to increase. To save on costs, consider holding off on asset transfers during such periods. Keep an eye on network congestion and schedule your transactions during less busy hours to take advantage of reduced fees.

Opt for Lower Priority Transactions

As an analyst, I’d describe it this way: Some digital wallets, including MetaMask, provide the flexibility to adjust the priority or speed of transactions. Selecting a lower priority level will decrease transaction fees at the expense of longer processing times. This alternative is particularly suitable for those who are not pressed for time and aim to minimize expenses.

FAQs

What is the Cheapest Crypto to Transfer?

IOTA boasts low-cost transfer transactions due to its innovative Tangle technology, which usually eliminates the need for fees.

Are There Any Cryptos with No Transaction Fees?

Certainly!

Where Can You Trade the Cheapest Crypto to Transfer?

Centralized cryptocurrency exchanges, such as Binance, Coinbase, and Kraken, are popular choices due to their relatively lower transaction fees compared to decentralized platforms. These exchanges are renowned for their competitive fee structures, allowing users to save on trading costs. To maximize these savings, carefully compare the fee structures of various exchanges and take advantage of any discounts they may offer. By doing so, you can begin trading with minimal transaction fees right away.

Are There Other Ways I Can Have Zero Transaction Fees?

During promotional periods on specific exchanges, you can transact without any fees by entering the given code. Furthermore, some trading platforms waive fees when you conduct transactions using their native tokens or reach a certain trading volume.

Conclusion

Mastering cryptocurrency transfers might seem intimidating at first, but by acquiring the necessary knowledge, you can effectively reduce transaction costs and enhance your investment plan.

In this piece, we’ve shared information about affordably priced cryptocurrencies for transferring funds. Our choices were meticulously made after examining the fee structures of numerous initiatives. We took into account elements like network productivity, adaptability, and user incentives in our evaluation process.

Utilizing these findings, you have the ability to make astute choices and achieve optimal profits in the cryptocurrency sector. Best of luck with your transactions!

Read More

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Grammys Pay Emotional Tribute to Liam Payne in First Honorary Performance

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

2024-06-14 17:19