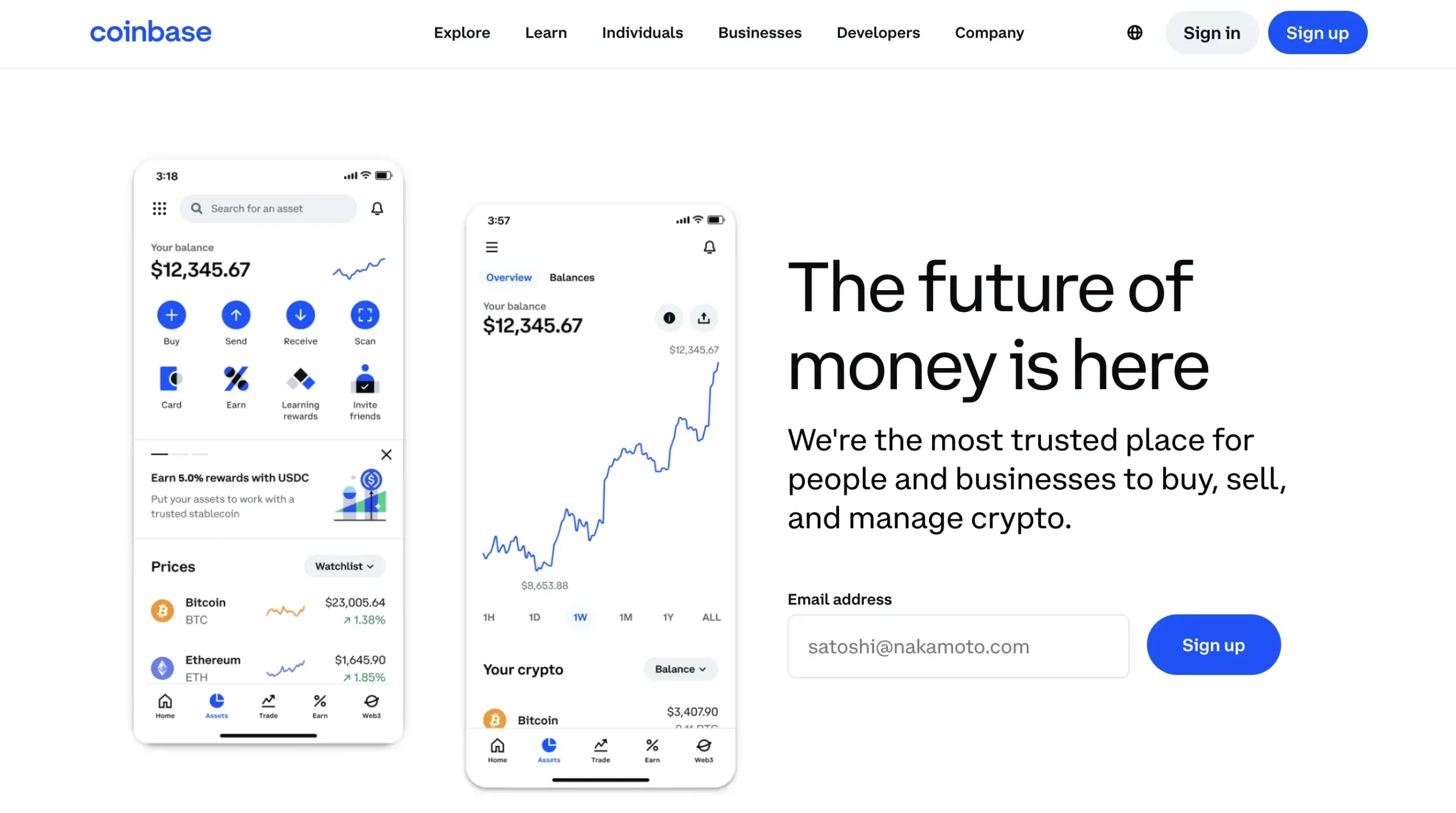

As someone who has navigated the complex world of digital currencies for years now, I can confidently say that opening a Coinbase Business account is a significant step towards embracing the future of finance.

Are you thinking about expanding your business into crypto? You’re in the right place!

Establishing a business account on Coinbase offers an excellent starting point, whether you aim to receive cryptocurrency transactions for your products or services via Coinbase Commerce, or oversee your corporation’s investment portfolio.

For example, Coinbase Commerce makes integrating crypto payments into your business effortless, allowing you to accept digital currencies. If you’re just curious about what crypto can offer, the business account gives you the tools to explore and grow.

This handbook covers essential information regarding managing a business account, complete with a comprehensive tutorial that walks you through setting it up efficiently, so you can get started immediately.

It’s easier than you think, and we’re here to walk you through it.

What is a Coinbase Business Account?

A Coinbase business account is ideal for businesses using cryptocurrency in their operations. It offers advanced features like institutional investing and trading tools, which go beyond what a private account (personal account) can offer. With this account, your company can securely buy, sell, and store crypto while keeping business and personal funds separate for easier management.

Additionally, connecting your business bank accounts allows for smoother transactions when it comes to purchasing cryptocurrency or withdrawing funds, streamlining the process overall.

Furthermore, one business account opens new doors to Coinbase businesses:

- Coinbase Commerce;

- Coinbase Prime;

- Coinbase Exchange;

- Coinbase International Exchange;

Keep in mind, you’re welcome to establish your business account on both our main Coinbase platform as well as the advanced Coinbase Pro platform.

For novice users, the standard Coinbase account provides a suitable starting point. However, upgrading to a Coinbase Pro account offers reduced fees, enhanced trading functionalities, and additional business-friendly features.

Coinbase Business Account Pros

Before you open a business account, it is essential to understand the pros and cons of such an account to better prepare your business for it.

1. Tailored Solutions

In my exploration, I’ve noticed that Coinbase provides a variety of business-focused solutions designed to help you overcome challenges in your operations. For instance, Coinbase Commerce is utilized for seamless cryptocurrency payment processing, while Coinbase Prime serves as a robust brokerage platform.

The Exchange facilitates the institutional investment for any cryptocurrency spot exchange that is under regulation. On the other hand, the Global Exchange provides access to Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), Solana (SOL), and Avalanche (AVAX) perpetual futures contracts.

It’s also worth noting that institutional investment is one of the most common applications for a business account.

2. Security Features

In the realm of cryptocurrency trading, robust security measures are essential. To that end, the Coinbase business account provides an extra layer of protection through two-step verification, highly secure digital wallets, and a host of other sophisticated security tools.

3. Lower Fees

If you wish to open a business account, we recommend going with Coinbase Pro, which offers lower costs. For many businesses, getting some of the best price reductions could be the starting point to trade cryptocurrencies.

4. Personal Accounts Vs. Business Accounts

One key advantage lies in the separation of personal and business transactions, which streamlines expense monitoring. This allows businesses to effortlessly keep tabs on cryptocurrency payments and effectively oversee their cryptocurrency trading operations.

5. Gain Access to Advanced Trading Options

From my perspective as an analyst, I’d like to highlight that our business account provides enhanced trading features that go beyond what we’ve previously discussed. This means that businesses can embark on their cryptocurrency ventures from the ground up and scale their operations efficiently.

Coinbase Business Account Cons

Concerning potential issues with operating such a business account, one significant challenge lies in the onboarding and verification process since setting it up may require a considerable amount of time due to legal and registration formalities that the business must comply with.

Coinbase Business Registration Documents

Beyond this, businesses should also present evidence of their operational status, such as a business registration certificate, along with documents verifying their active business operations. Furthermore, they need to connect either their bank accounts or credit/debit cards for any required transactions.

Required information:

- Legal Entity Name;

- Country and State of Incorporation;

- Place of Operation;

- Business Type;

- Business Description;

- Number of Employees Globally;

- Fund Assets Under Management;

Coinbase Business Account: Minimum Balance Requirement

To maintain adequate activity on your business account with Coinbase exchange, it’s necessary to keep a minimum balance of $1,000. This demonstrates that your company possesses sufficient funds for trading cryptocurrencies.

Other Types of Coinbase Accounts

Additionally, Coinbase offers different kinds of accounts tailored to diverse requirements. Whether you’re a newcomer in the world of cryptocurrency or a company seeking sophisticated tools, there’s a suitable account for you.

Let’s take a look at the different options available and what they bring to the table.

Individual Accounts:

Coinbase App:

- Fees: Completely free to use.

- Availability: Available on the web, mobile app, and through API.

- Supported Currencies: Major cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

- Best for: Beginners or casual traders who want to do basic things like spot trading or staking.

Coinbase Advanced:

- Fees: Free to use.

- Availability: Accessible on the web, mobile app, and API.

- Supported Currencies: Offers spot trading, perpetual futures, and staking for a wide range of popular cryptocurrencies.

- Best for: Experienced traders who need more advanced tools like perpetual futures and U.S.-regulated futures.

Coinbase One:

- Fees: $29.99/month subscription.

- Availability: Web and mobile app.

- Supported Currencies: Major cryptocurrencies for trading and staking.

- Best for: Traders who want zero trading fees, increased staking rewards, and priority customer support. It is also great for those who trade frequently and want to save on fees while accessing premium features.

Business Accounts:

Coinbase Prime:

- Fees: $1,000 onboarding cost.

- Availability: Available on the web, mobile app, and API.

- Supported Currencies: Allows spot trading, financing, and staking in major cryptocurrencies.

- Best for: Institutions or high-net-worth businesses that want advanced investment tools and secure custody options.

Coinbase Exchange:

- Fees: $1,000 onboarding cost.

- Availability: Accessible on the web and API.

- Supported Currencies: Primarily for spot trading in major cryptocurrencies.

- Best for: Market makers and liquidity providers who need professional-level trading features.

Coinbase International Exchange:

- Fees: Free to use.

- Availability: API-only.

- Supported Currencies: Supports spot and perpetual futures trading in BTC, ETH, and other major currencies for institutions outside the U.S.

- Best for: International institutions needing access to futures contracts outside U.S. regulations.

Coinbase For Small Businesses

As a researcher exploring digital transactions, I’ve found that utilizing Coinbase for cryptocurrency transactions presents significant advantages, especially for smaller enterprises. The Coinbase Commerce platform makes it effortless for these businesses to receive cryptocurrency payments, thereby broadening their payment methods and potentially increasing their customer reach.

Setting up Coinbase Commerce is straightforward and only requires an email to start. There are no setup fees, and the platform charges a reasonable 1% per transaction. This makes it appealing for small businesses, especially those looking to avoid common issues like chargebacks.

This platform seamlessly connects with well-known online marketplaces such as Shopify and WooCommerce, requiring minimal technical proficiency for accessibility. Furthermore, Coinbase provides an Application Programming Interface (API) for businesses desiring tailored solutions, enabling developers to incorporate cryptocurrency transactions directly into their websites or applications.

With a strong emphasis on security, Coinbase Commerce utilizes safeguards such as two-step verification and multi-key wallet systems to ensure the safety of transactions and assets.

Although some users mention that Coinbase Commerce doesn’t offer in-person transaction support via mobile point-of-sale systems, it continues to be a favored and streamlined option for online enterprises seeking to handle cryptocurrency payments.

How to Create a Coinbase Business Account

Setting up a Coinbase Business Account could necessitate providing additional details compared to a regular account, but by adhering to these guidelines, you’ll find the process streamlined.

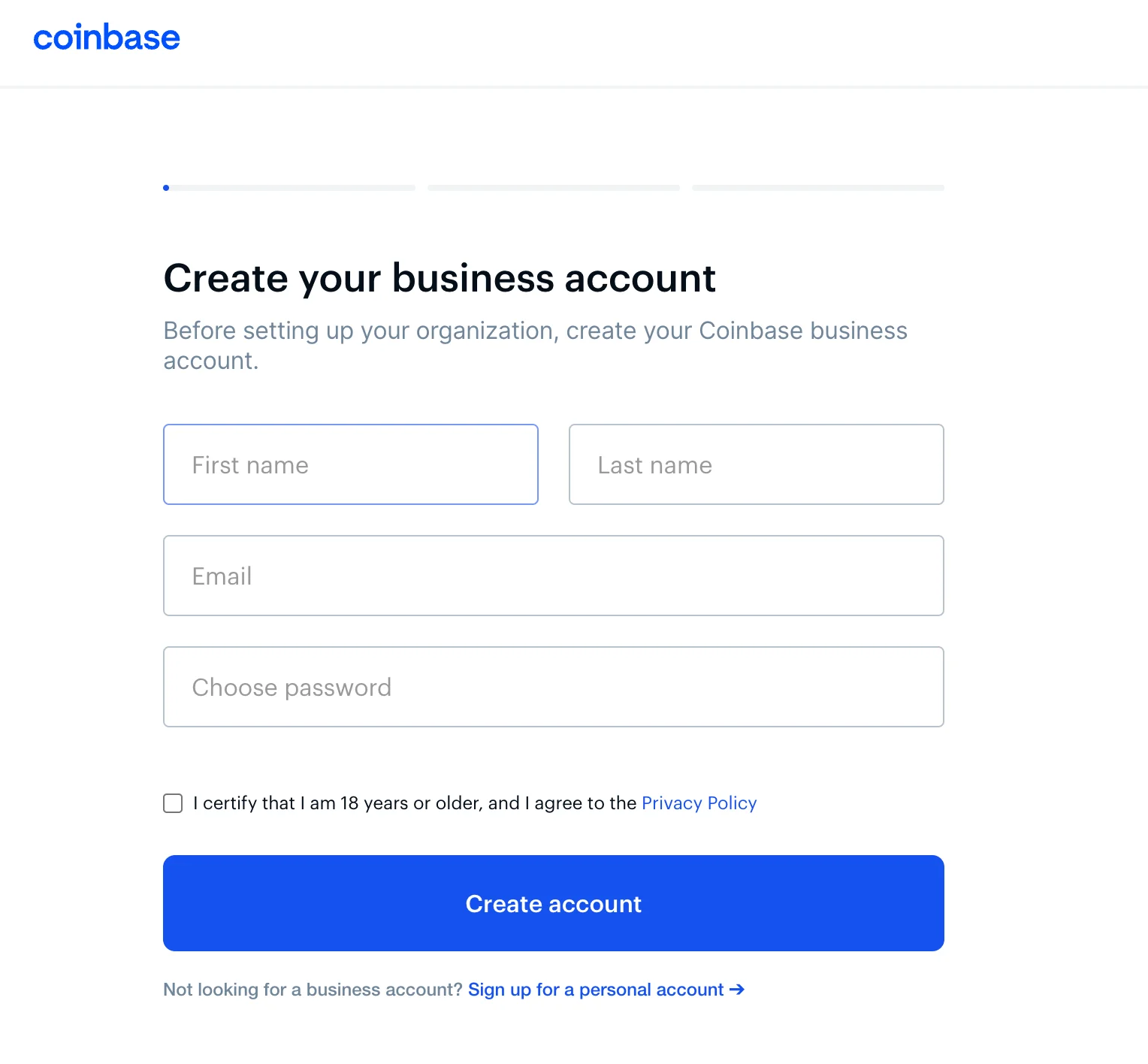

Step 1: Create Your Business Account

Navigate to coinbase.com and hit the ‘Sign Up’ button. Next, select the ‘Business Account’ option, then enter essential information like your first name, last name, email address, and a preferred password. Once you’ve done that, head over to your inbox to confirm your email by following the provided instructions.

Step 2: Set up Two-Factor Authentication (2FA)

As a responsible crypto investor, I strongly recommend securing your account with two-factor authentication for enhanced protection. To do this, kindly provide your business phone number so you can receive a verification code via SMS. Once the code arrives, simply input it to continue the process. This additional step will boost the security of your valuable investments.

Step 3: Create Your Organization

In this step, you must enter the legal entity name, which is simply your official company name.

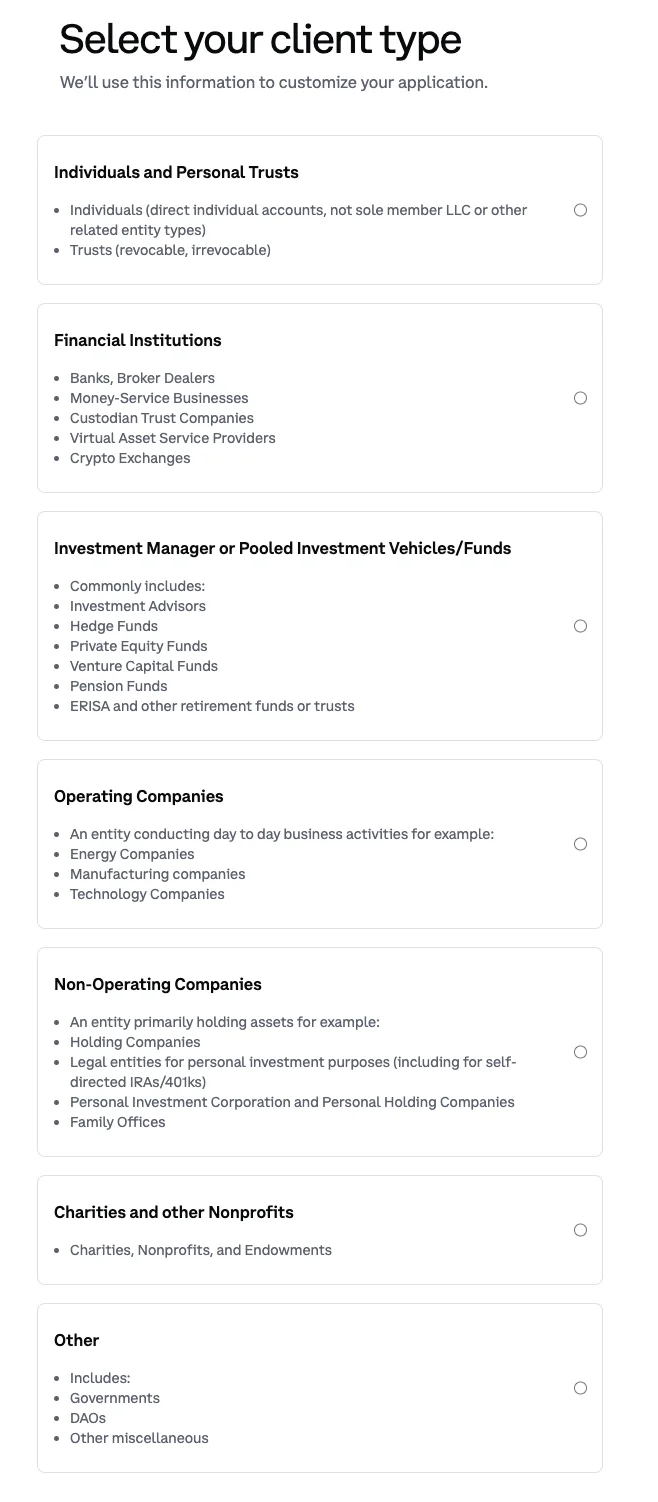

Step 4: Select Your Client Type

Currently, could you kindly pick the category of business that you are involved with? We’ll provide choices like non-governmental organization, cooperative, company, and so on. Please select the one that aligns most closely with your business, as depicted in the image provided.

Step 5: Additional Legal Entity Details

In this section, it’s essential to share additional details about your business so that we can tailor your account to suit your specific requirements. Utilizing this information, Coinbase will offer you suitable services, such as the Coinbase Commerce platform we previously talked about. To clarify, this process involves:

- Entity type: Choose the category your business falls under, such as non-profit or corporation.

- Anticipated monthly activity: Select an estimate of your monthly crypto activity.

- Top 5 country selection: Choose up to 5 countries where your business will primarily operate.

- Funding sources: Select all sources that will be used to fund your Coinbase business account. Based on this information and regulatory policies, Coinbase will determine if your account can be opened, and if you are eligible, you’ll provide additional contact details to complete your business profile.

Step 6: Business Verification

For this phase, please present precise business records along with the necessary information about duly authorized individuals. Here’s what needs to be submitted:

- Operational details such as the nature of your business;

- Tax and billing information;

- Authorized applicant contact details: This includes the authorized person’s name, job title, email address, date of birth, ID type, and LinkedIn URL.

Additionally, upload the necessary business documents:

- Business registration certificate;

- Proof of business address.

Here are a few essential documents you might need, as they can vary based on your specific business type. For comprehensive information, please refer to the detailed guidelines provided on the official Coinbase website.

- Articles/Memorandum of Association;

- Authorized Representative List;

- Constitution;

- Proof of Entities Operating Address;

- Shareholders/Members Register;

- Source of Funds.

Step 7: Application Review

After you’ve handed in all required papers, your application will move into the evaluation phase. You can monitor its progress by logging into your account and looking at the “Application” section. The status might display as submitted, under review, in progress, or approved.

FAQ

What is the difference between Coinbase Business and Personal?

The Coinbase business account allows your business entity to buy, sell, and store cryptocurrency, compared to the individual account, enabling you to do the same, but with your cryptos.

What Are the Advantages of Coinbase Business Account

Here are five benefits of the Coinbase business account:

- Tailored Solutions and products;

- Security Features;

- Lower Fees;

- Segregation between the personal accounts and the professional ones;

- Gain Access to Advanced Trading Options;

What Coinbase Business Account Offers?

Coinbase business accounts provide businesses with multiple options to engage in the crypto market using diverse Coinbase services tailored for various business needs. Therefore, companies can opt for Coinbase Commerce, Prime, Standard Exchange, or International Exchange based on their requirements.

In Conclusion

By completing this step-by-step walkthrough, we trust that it assisted in overcoming some challenges you might have faced along the way.

As an analyst, I can attest that establishing a Coinbase business account provides my company with unparalleled financial opportunities. Regardless of our specific business objectives – whether it’s accepting digital currency payments, optimizing investments, or delving into the crypto trading market – Coinbase offers a comprehensive array of business-focused tools to facilitate these pursuits.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-10-23 15:44