Alright, folks, gather ’round. So AAVE‘s doing a little dance—more like a belly flop than a graceful pirouette—dropping 23% since July. Yeah, the price is crashing like my hopes at a buffet, but the ecosystem? It’s doing cartwheels!

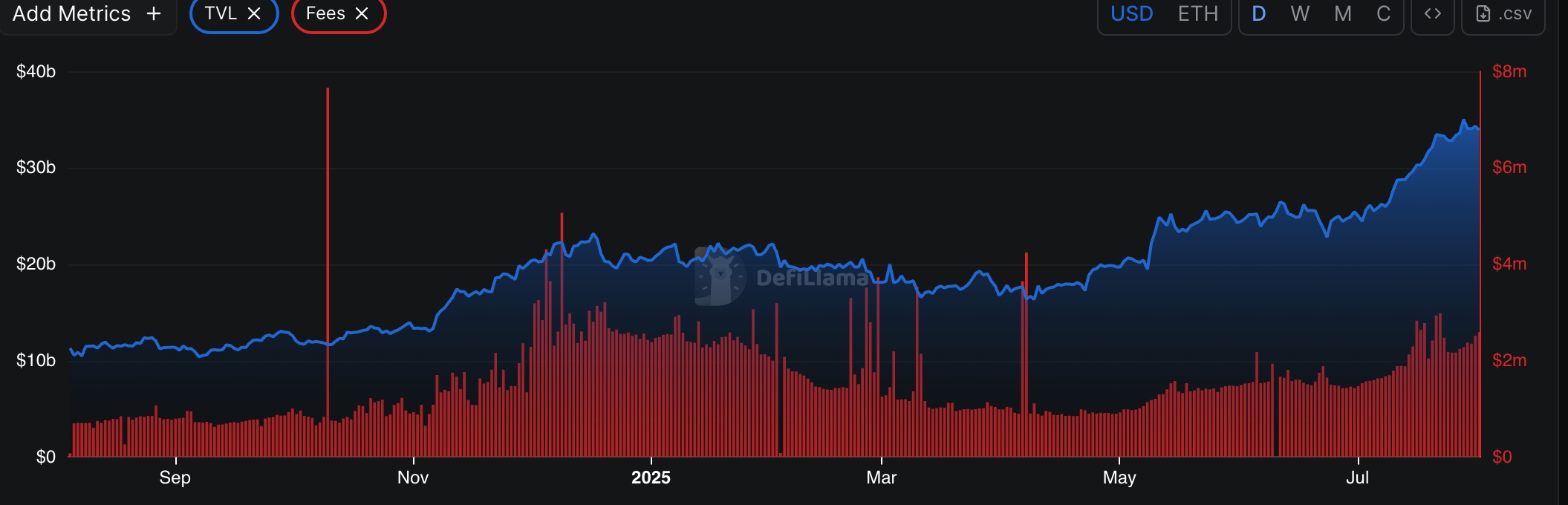

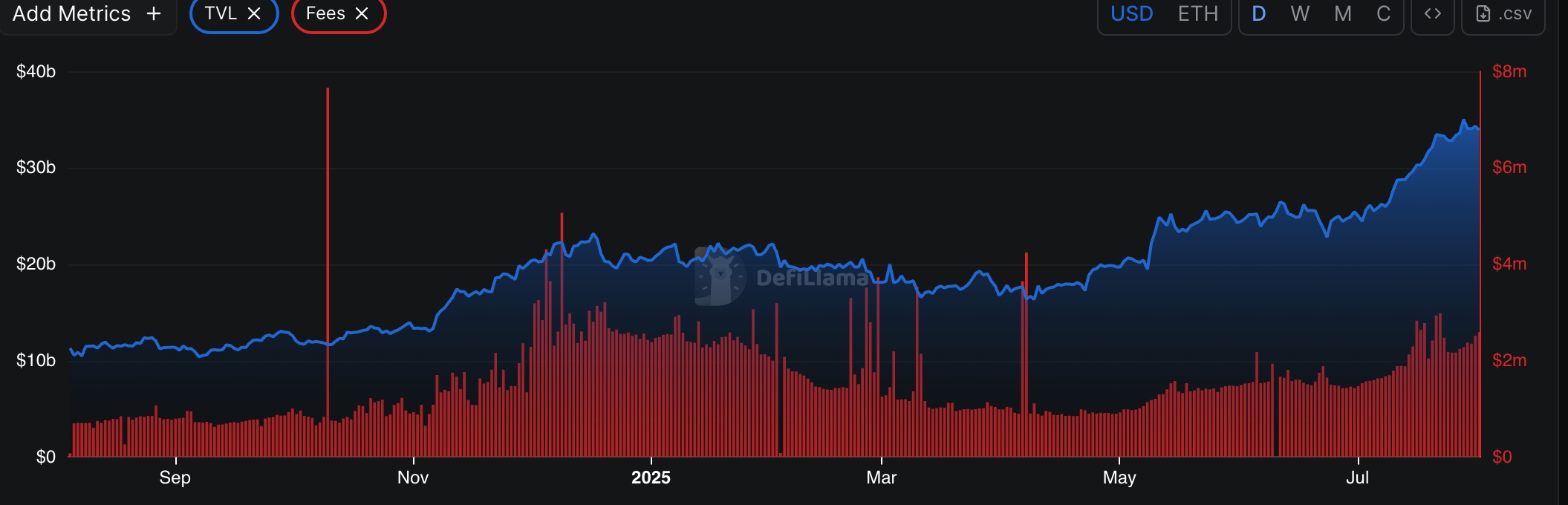

Now, hold onto your hats. Despite the slide, the total value locked is hitting a record—$35 billion! That’s more zeros than my bank account. Starting the year at $21 billion, so basically, they’re doing a magic trick—stuffing more assets into DeFi than I can hide snacks from my diet. And guess what? Ethena (ENA), the new kid on the block, just grew nearly $5 billion. That’s like putting a BOGO sale on digital assets.

Meanwhile, fees and revenue are skyrocketing. Over $783 million in fees in 12 months—that’s right, M-I-L-L-I-O-N. Their annual earnings? $47 million. Revenue? Over $110 million. I mean, if I could make that kind of cash without leaving my couch, I’d be doing handstands. Or at least a lazy wave.

TokenTerminal says deposits shot up 21% in July, active loans up by 25%—to a cool $20.5 billion. Monthly fees and revenue, like a rocket, up 49% and 85%. Basically, AAVE’s making bank, while its price is doing a “how low can you go” routine. The daily chart? A mess—peaked at $337.25, then took a nosedive faster than my New Year’s resolutions. It’s below the 50 and 100-day moving averages, lurking around the $250 line, like a kid hiding from chores. The RSI? Approaching “oversold,” so maybe it’s just tired or playing dead.

Look, unless you’re a glutton for punishment or got an inside scoop, this looks like a classic “buy low, maybe” situation. Or, you know, just watch from the sidelines and pretend you understand what’s going on. Whatever happens, it’s sure more entertaining than my uncle’s annual fish story.

Read More

- How to Get the Bloodfeather Set in Enshrouded

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Gold Rate Forecast

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- Best Thanos Comics (September 2025)

- Goat 2 Release Date Estimate, News & Updates

- Best Controller Settings for ARC Raiders

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

2025-08-01 22:10