As someone who has dipped my toes into the ever-evolving world of cryptocurrency, I can confidently say that yield farming has been an exciting and profitable journey for me. It’s not just about making money; it’s about being part of this groundbreaking movement that is reshaping the financial landscape.

For those who are familiar with the world of cryptocurrency and might be more seasoned in this field, you likely already understand this; however, for those who may be new to it all, yield farming was a significant factor that contributed to the explosion of Decentralized Finance (DeFi) in 2020.

Although these DeFi yield farm platforms might not be widely recognized at present, they remain an excellent means of generating passive income. In this article, we’ll guide you through the top 10 DeFi yield farming platforms that can help boost your earnings.

The Best Crypto Yield Farming Platforms

1. Uniswap – The Best DeFi Yield Farming Platform Overall

Uniswap is our top pick for the best yield farming platform, and it’s easy to see why.

On the Ethereum blockchain, Uniswap stands out as a widely-used decentralized exchange (DEX). It offers an effortless experience for users, allowing them to easily swap tokens and contribute liquidity.

Rather than following the conventional method of trades through intermediary exchanges and their order books, Uniswap operates on an Automated Market Maker (AMM) model. This allows users to exchange tokens instantly, all while bypassing any need for a third party.

Contribute your tokens to Uniswap’s liquidity pools, and you’ll earn a portion of the trading fees relative to how much you’ve invested.

Additionally, Uniswap compensates its users by providing them with its administrative token, UNI. This extra reward makes it even more appealing for you to get involved and contribute your thoughts on the direction of the platform’s future choices.

Uniswap Supported Chains

Uniswap offers its services across various blockchain platforms such as Ethereum, Arbitrum, Celo, BNB Smart Chain, Binance‘s Base, Blast, ZK Sync, Zora, and Avalanche. This means users have a wide range of opportunities when it comes to supplying liquidity.

Pros of Uniswap

- It’s a fully decentralized exchange without the need for an order book.

- Users can create liquidity pools for any trading pair they like.

- Backed by a strong community and dedicated development team.

- Uniswap V3 allows users to customize liquidity pools for better capital efficiency.

- No need to open an account to start using it.

Cons of Uniswap

-

It is not the best option for beginners due to its complexity.

Only supports ETH tokens, limiting the variety of assets.

Gas fees on Ethereum can sometimes be relatively high.

2. Aave – Best for ETH-Based Tokens Yield Farming

Aave is a lending and borrowing service that operates independently (decentralized) using the Ethereum blockchain. This platform takes the second spot on our list. Users can lend and borrow different digital currencies, all without the need for approval or trust.

As a crypto investor, I contribute my digital assets to liquidity pools to generate passive income through interest earnings. Simultaneously, these pools serve as collateral for borrowers who seek to acquire other cryptocurrencies on loan.

Yield farming on Aave operates by contributing assets to its “money market” pools, which then earn interest and extra incentives. By depositing assets, users receive tokens symbolizing their ownership stake within the pool, and these tokens increase in worth as interest accumulates over time.

In addition to compensating liquidity providers, Aave distributes governance tokens like AAVE, providing additional motivations for active participation.

Aave Supported Chains

The leading supported chains are Ethereum, Polygon, Avalanche, Arbitrum, and Optimism.

Pros of AAVE

- Provides lower-risk options for lending and borrowing assets on the blockchain.

- Has a long-standing reputation and track record in DeFi.

- Introduced unique features like flash loans, allowing users to borrow without collateral.

- The Aave community controls the protocol’s future through the governance token AAVE.

Cons of AAVE

- Flash loans have been exploited in the past.

- It is not the most accessible platform for beginners to navigate.

- Loans must be over-collateralized, which can limit borrowing flexibility.

3. SushiSwap – Best for Its Community-Driven Model

SushiSwap represents a Decentralized Finance (DeFi) platform specialized in yield farming, which initially derived from Uniswap. However, it stands out by providing additional benefits and rewards to those who contribute as liquidity providers.

On SushiSwap, yield farming means depositing your tokens into liquidity pools. This allows users to collect SUSHI tokens, which are the native governance and utility tokens of the platform.

Apart from collecting trading fees, Liquidity Providers are also rewarded with SUSHI tokens, distributed daily as incentives to boost engagement.

As a keen analyst, I’d like to highlight one distinctive feature that sets SushiSwap apart from Uniswap: the decentralized governance structure driven by the community. This means that those who hold SUSHI tokens have a say in shaping the platform’s future through voting on proposals and changes, empowering users to play an active role in its growth and development.

Besides sushi, SushiSwap broadens its services by incorporating elements such as decentralized loaning and borrowing via the Kashi Lending Platform.

SushiSwap Supported Chains

SushiSwap supports seven chains, including Ethereum, Polygon, Optimism, and Base.

Pros of SushiSwap

- Strong focus on community involvement since its launch.

- Users who stake SUSHI tokens earn a share of the trading fees.

- SushiSwap provides additional DeFi services like lending, borrowing, and a launchpad for new projects.

Cons of SushiSwap

- As a fork of Uniswap V2, it lacks many unique features.

- High costs when using the platform on Ethereum.

4. PancakeSwap – Best for BNB-Based Tokens Yield Farming

PancakeSwap represents a decentralized finance (DeFi) farming platform constructed on the Binance Smart Chain (BSC). Unlike DeFi platforms built on Ethereum, it presents a quicker transaction process and reduced costs for its users, making it an appealing option to Ethereum-based DEXs.

PancakeSwap functions much like other Automated Liquidity Providing (ALP) systems. It enables people to exchange BEP-20 tokens and contribute to the liquidity of pools, ensuring smooth transactions.

Farming on PancakeSwap means putting your tokens into shared pools to collect Pancake’s native token, CAKE. By depositing different BEP-20 tokens in PancakeSwap’s liquidity pools, users can gather CAKE rewards which they can use for voting on platform decisions, adding liquidity, or trading within the platform.

PancakeSwap Supported Chains

BNB Smart Chain, Arbitrum, opBNB, and Base.

Pros of PancakeSwap

-

Best yield farming crypto platform for BNB Chain tokens.

No account registrations are needed.

Cons of PancakeSwap

-

Only supports BNB Chain-based tokens.

5. Curve Finance – Best for Stablecoin Yield Farming

As a researcher delving into the world of decentralized finance (DeFi), I’ve come across Curve Finance – a platform tailored towards yield farming with an emphasis on stablecoin trading. It’s designed to deliver efficient, cost-effective transactions for pairs such as DAI, USDC, and USDT by leveraging advanced liquidity pools and algorithms. In simpler terms, it’s all about making trading of these stablecoins smooth and affordable.

Yield farming on Curve Finance involves users contributing stablecoins to the platform’s pools instead of ordinary savings accounts. This contribution grants them liquidity provider (LP) tokens, which represent their share of the pooled assets. These LP tokens then produce income from trading fees and rewards in CRV, the native governance token of Curve Finance. The more users participate, the more enticing it becomes due to these fee and reward incentives.

Curve Finance Supported Chains

On various platforms, such as Ethereum, Arbitrum, Aurora, Avalanche, Fantom, Harmony, Optimism, Polygon, xDai, and Moonbeam, you can find the decentralized finance service known as Curve Finance.

Pros of Curve Finance

- It specializes in stablecoins and wrapped assets, making it ideal for those focused on farming on stablecoin yield.

- Great for people seeking low-slippage trading in stable assets.

Cons of Curve Finance

- Has faced security issues, including hacks, due to code vulnerabilities.

- It can be complex for beginners to navigate and use effectively.

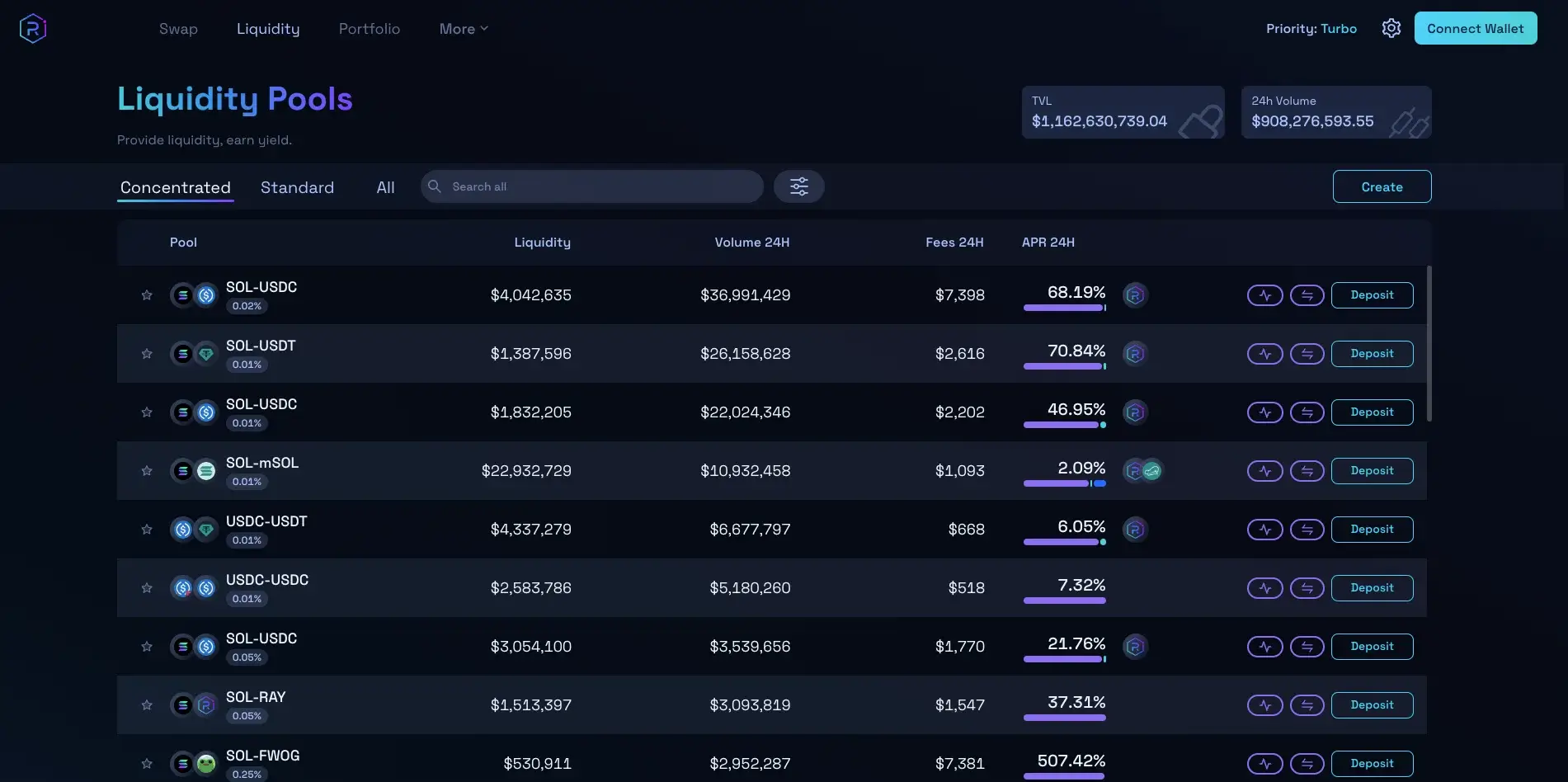

6. Raydium – The Best Solana-Based DEX with High APYs and Deep Liquidity

Raydium stands as a Decentralized Finance (DeFi) and yield farming hub, established upon the robust Solana blockchain. The advantageous nature of Solana’s network is renowned for swift transactions and affordable charges.

As a researcher delving into the world of Solana-based tokens, I’ve come to appreciate Raydium as a top-tier platform. Its streamlined trading system and the extensive liquidity it offers for these tokens truly set it apart from others in the field.

Raydium boasts among the top Annual Percentage Yields (APYs) available in the market, and various liquidity pairs offer more than double the typical return.

Raydium Supported Chains

Raydium supports any tokens on the Solana blockchain.

Pros of Raydium

-

Fast transaction times thanks to the Solana blockchain.

Offers deep liquidity for popular SOL pairs.

High APYs, with some pairs offering returns over 100%.

Well-established within the Solana ecosystem.

Cons of Raydium

- Less liquidity for less popular or newer token pairs.

- Not as beginner-friendly due to its more advanced DeFi features.

6. Yearn Finance – Best for Automated Yield Optimization

Yearn Finance serves as a DeFi platform, aiming to offer users optimal yields through yield farming. Established by Andre Cronje, it streamlines the process by combining liquidity from various DeFi projects and strategically investing it in locations that promise the maximum returns.

Yearn Finance’s yield farming operates by placing funds into smart contract-based vaults. These vaults automatically invest your money in the most profitable DeFi (Decentralized Finance) opportunities, such as providing liquidity, lending, or borrowing. Users can choose vaults that align with their risk tolerance and investment objectives. Upon deposit, you receive tokens symbolizing your ownership stake within the vault, which increases in value as the vault accrues returns over time.

Furthermore, Yearn Finance shares its management token, YFI, among contributors, enabling them to guide the course of the platform.

Yearn Finance Supported Chains

Yearn Finance can be found operating across several blockchain networks, such as Ethereum, Arbitrum, Optimism, Polygon, and Fantom.

Pros of Yearn Finance

- Automatically optimizes yield farming to get the best returns.

- Easy to use, no need to manually switch between platforms.

- Helps maximize profits with minimal effort.

- Users can participate in platform governance with YFI tokens.

Cons of Yearn Finance

- Has been hacked before, which increases risk.

- No insurance fund to protect against losses from hacks.

- The limited supply of YFI tokens makes governance participation harder for new users.

The Best Yield Farming Alternatives in 2024

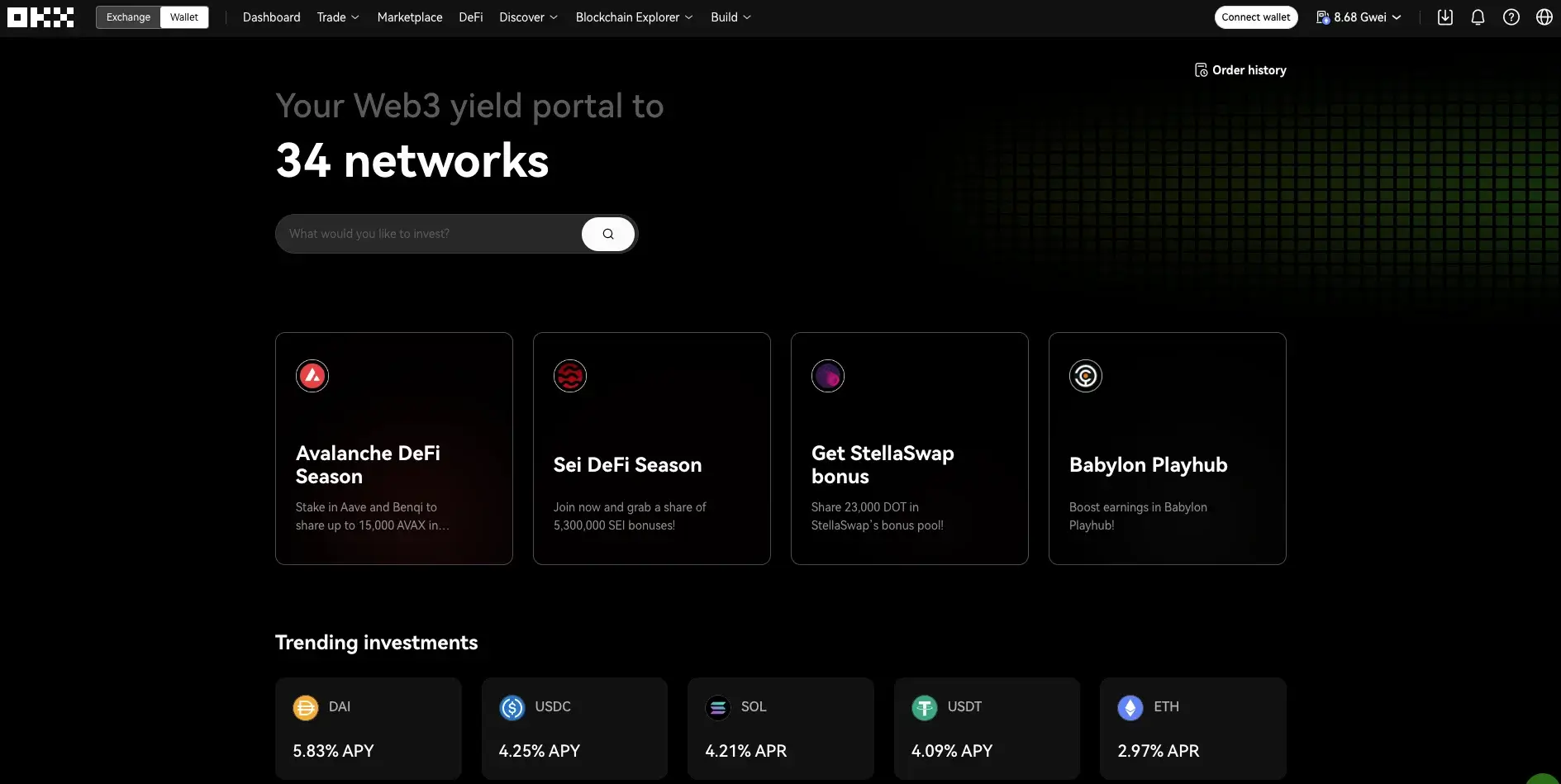

1. OKX – Best Alternative to DeFi Yield Farming Overall

A great alternative choice for DeFi yield farming we recommend is the OKX platform, focusing particularly on its DeFi yield farming segment.

Apart from being recognized primarily for its low-cost spot and derivative trading, OKX provides a comprehensive crypto environment, which makes it an excellent choice for users seeking convenience in one platform. Furthermore, it boasts a mature DeFi yield farming feature that includes staking and interest accounts. The returns can fluctuate as with any such platform, but OKX offers yields of up to 30% on stablecoins.

This tool simplifies the process by itself scouring multiple platforms to find the highest returns, thus eliminating the need for users to manually compare different platforms. It’s designed with ease of use in mind, allowing investors to search for tokens, and then filter their results based on network type, specific cryptocurrency, or incentive structure.

On top of yield farming, OKX offers a staking service for individuals aiming to earn passive income without involving themselves in liquidity provision. Staking allows users to lock up a single token for each contract, unlike yield farming which requires token pairs.

The platform also provides fixed-income accounts that appeal to investors who want predictable returns.

OKX Supported Chains

Standing apart, OKX’s DeFi Aggregator gathers yield farming possibilities across 34 different blockchain networks, such as Ethereum, Bitcoin, Sui, IOST, Polkadot, and Base.

Pros of OKX

- Simple to use.

- Access to verified, reliable yield farming pairs.

- No gas or transaction fees.

- Offers yield farming, staking, and interest-earning options.

- Attractive APYs.

- Flexible yield farming pools with various options.

- Supports multiple blockchain networks.

- Strong reputation in the crypto industry.

Cons of OKX

-

Fewer cryptocurrencies and trading pairs than some competitors.

Limited to ETH-based coins for yield farming.

2. CoinEx – Best Alternative to DeFi Yield Farming for Its High-Yield AMM Farming

CoinEx is a relatively smaller cryptocurrency exchange, yet it provides various avenues for generating passive income. Apart from common features such as staking, savings accounts, and lending, users can also contribute to the liquidity of their markets, functioning in a manner akin to Decentralized Exchanges (DEXs).

CoinEx provides attractive returns, such as a 6.65% Annual Percentage Yield (APY) on USDT deposits, a 1.98% APY for ETH staking, and a daily interest rate of 0.05% for USDT lending. In certain liquidity pairs, the returns from its AMM (Automated Market Maker) service can be extraordinarily high, with some yields reaching multiples of hundreds or even thousands of percent APY.

The average yield farming return on CoinEx is around 25.82% APY, with the platform supporting over 1,000 AMM markets.

CoinEx Supported Coins

Thousands of crypto assets and stablecoins are supported.

Pros of CoinEx

- Ideal for those looking to use AMM without dealing with DeFi platforms.

- Offers a wide variety of investment options.

- User-friendly platform, even for newcomers.

Cons of CoinEx

- APY rates can fluctuate significantly over time.

- Your funds are not stored in your wallet, which may not suit users wanting total control.

3. Binance – Best Alternative to DeFi Yield Farming Based on Its Versatility

Among other DeFi yield farming crypto platforms, Binance ranks as one of our top three alternatives. Although it’s mainly recognized as the biggest global cryptocurrency exchange, Binance provides a multitude of services beyond that, making it an excellent choice for individuals looking for a flexible and versatile platform.

Apart from boasting a large marketplace with over 1,600 markets and 800 different cryptocurrencies, Binance also offers multiple methods for generating passive income. These include the ability to stake Ethereum and open savings accounts that yield interest on numerous digital currencies.

On Binance, while they might not delve deeply into conventional DeFi yield farming, they offer a variety of flexible and fixed interest-earning contracts as an alternative. By staking their coins or stablecoins, users can secure competitive returns, with potential annual yields reaching as high as 25% on certain cryptocurrencies and 5.8% on stablecoins.

If you’re looking for dependable, high-return investment options within a robust and trusted environment, Binance could be a great pick for you.

Binance Supported Chains

Binance supports yield farming across a dozen blockchains, including BNB Chain, Polygon, Avalanche, Fantom, Optimism, and Arbitrum.

Pros of Binance

- Large selection of cryptocurrencies and stablecoins for yield farming.

- Offers both flexible and fixed-term yield farming options.

- Highly regulated and trusted platform.

- Competitive yields, especially on stablecoins.

- Simple interface for accessing passive income features.

Cons of Binance

- It is not primarily a yield farming platform.

- Limited yield farming options compared to dedicated DeFi platforms.

- It can be too complex for beginners.

- Lower yield rates on popular assets compared to niche DeFi platforms.

- High yields often require locking assets for extended periods.

Coindoo’s Methodology on Picking the Best Yield Farming Crypto Platforms

In choosing top-notch cryptocurrency platforms for yield farming, we took multiple crucial aspects into account to aid you in making wise choices.

- Security was our top priority. We focused on platforms with audited smart contracts and development teams that had solid reputations, ensuring a safer environment for investments.

- We also examined yield potential by comparing annual percentage yields (APY) across platforms and analyzing tokenomics to confirm the sustainability of the rewards offered.

- Liquidity was another essential factor. Platforms with deep liquidity pools and high trading volumes provided more stable prices and reduced the risk of slippage during trades.

- In terms of user experience, we looked for platforms that were easy to use and accessible, particularly on mobile devices, to offer a smoother and more satisfying experience.

- We also evaluated governance, considering decentralization and strong community involvement as important elements for platform stability and long-term success.

- Eventually, we carefully assessed the risks involved in yield farming, such as impermanent loss and smart contract vulnerabilities.

By examining these risks together with other aspects, we pinpointed the most suitable platforms that boast a superior blend of attractive returns, robust safety measures, and an intuitive interface.

What Is Yield Farming?

Yield farming essentially means putting your cryptocurrency into Decentralized Finance (DeFi) systems or pools of liquidity to get rewards. In other words, you’re offering liquidity or lending your assets to these platforms. As a reward for this service, liquidity providers (LPs) usually receive an annual percentage yield (APY), which is often distributed in real-time.

While yield farming was a major growth driver in the DeFi industry during its peak in 2020, the excitement diminished following the collapse of the TerraUSD stablecoin in 2022. Despite the reduced hype, many still pursue yield farming to generate passive income, though it remains a higher-risk strategy compared to other methods.

Because yield farming in decentralized finance (DeFi) carries high risks, it’s crucial to keep in mind that although substantial rewards are possible, the volatile markets, potential technical weaknesses, and other unknown factors associated with DeFi can make it a risky venture for investments.

How to Use a Yield Farming Platform to Provide Liquidity in General?

To earn passive income via yield farming, follow this straightforward guide for utilizing a yield farming platform, taking PancakeSwap—an automated market maker (AMM)—as an illustration:

1. Choose a Yield Farming Protocol

Begin by choosing a decentralized exchange that features yield farming opportunities. These exchanges make it simpler for you to contribute liquidity to various pools.

2. Access the Liquidity Section

Upon reaching the platform, look for the “Liquidity” area. This is the spot where liquidity contributors (LPs) can place their assets into pools to aid in the smooth execution of trades within the platform.

3. Select Your Assets for Deposit

Select the combinations of cryptocurrencies you prefer to add to a liquidity pool. For instance, opt for BNB and CAKE to contribute to the BNB-CAKE pair’s pool. The funds you deposit will be utilized to facilitate trades between these two digital currencies.

4. Deposit Your Assets and Receive LP Tokens

Once you’ve placed your selected assets, the system will issue you Liquidity Provider (LP) tokens. These tokens symbolize your ownership stake in the liquidity pool and grant you a share of the fees earned from transactions within the pool.

5. Earn Yield Farming Rewards

After that, find the “Farms” section on the platform using your LP tokens. From there, you can deposit your LP tokens into the relevant farm, such as the BNB/CAKE farm, to begin earning rewards from yield farming. These rewards are usually given in the form of additional cryptocurrency that can be collected gradually over time.

6. Governance Tokens as Additional Rewards

On several Decentralized Finance (DeFi) platforms, users are sometimes given governance tokens as part of their rewards. These tokens grant the power to participate in decision-making processes within the platform, and they can frequently be traded on various exchanges, thereby increasing the worth of your yield farming activities.

FAQs

What are Yield Farmers?

Participants engage with Decentralized Finance (DeFi) systems to gain returns by offering liquidity to diverse platforms. Essentially, they loan or deposit their digital currencies to garner interest or benefits, most often derived from the yield farming activity.

Is Yield Farming Profitable?

Yield farming can offer substantial returns, but it’s important to understand that it also carries significant risks.

Conclusion

Yield farming, which was highly sought after during the surge of Decentralized Finance (DeFi) in 2020, continues to be a viable method for generating passive income within the cryptocurrency sector, provided that you’re comfortable with the inherent risks.

As a diligent analyst, I’ve compiled this write-up to guide you towards the leading 10 DeFi platforms for yield farming cryptocurrencies. My intention is to empower you with knowledge that enables smart choices and ultimately boosts your returns.

Read More

2024-10-11 16:51