In this splendid age of digital transactions, where the only thing more rampant than the flow of currency is the anxiety over payment fraud and data breaches, we find ourselves in a delightful quandary. Enter payment tokenization, the dashing hero of our tale, gallantly replacing sensitive payment details with whimsically generated tokens, thus thwarting the dastardly cyber villains lurking in the shadows. 🦸♂️

From the bustling bazaars of e-commerce to the chic salons of mobile payments, businesses across the globe are embracing tokenization with the fervor of a new fashion trend. But pray tell, how does this enchanting process of payment network tokenization unfold, and what whimsical wonders does the future hold? 🎩✨

Key Takeaways:

- Payment tokenization spruces up sensitive payment data with unique tokens, ensuring transactions are as safe as a cat in a sunbeam.

- Businesses are employing tokenization in e-commerce, digital wallets, and POS systems, all in the name of protecting consumer data—because who doesn’t love a good cloak-and-dagger act?

- Future advancements in tokenization will waltz hand-in-hand with blockchain, AI security, and DeFi solutions, creating a veritable ball of innovation!

What is Payment Tokenization?

Ah, payment tokenization! A security process that whimsically transforms sensitive payment information—like credit card numbers—into a unique, randomly generated token. This token, dear reader, is but a stand-in for the original data, allowing transactions to prance about without exposing the actual financial details. 🎭

Unlike its cousin, encryption, which merely dresses data in a coded format that can be reversed with a key, tokenization boldly removes sensitive information from the transaction environment. Even if a hacker were to intercept the token, it would be as useful as a chocolate teapot without the corresponding tokenization system. 🍫☕

The primary purpose of payment tokenization is to enhance security in our digital transactions. When a customer makes a purchase—be it online, in-store, or via a mobile payment app—their credit or debit card details are replaced with a token before being sent off for processing, much like a magician’s disappearing act! 🎩✨

By 2030, major payment networks aim to eliminate manual card entry using tokenization, making digital transactions faster and more secure—because who has time for that nonsense?

How Does Payment Tokenization Work?

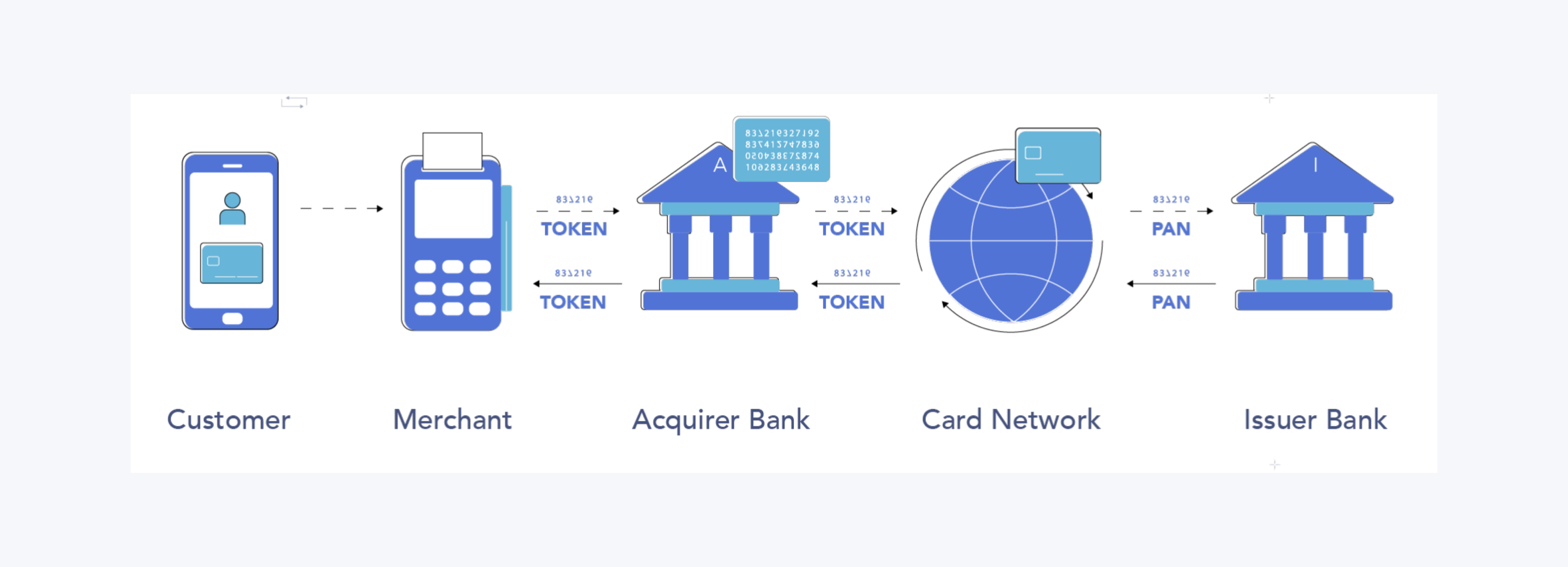

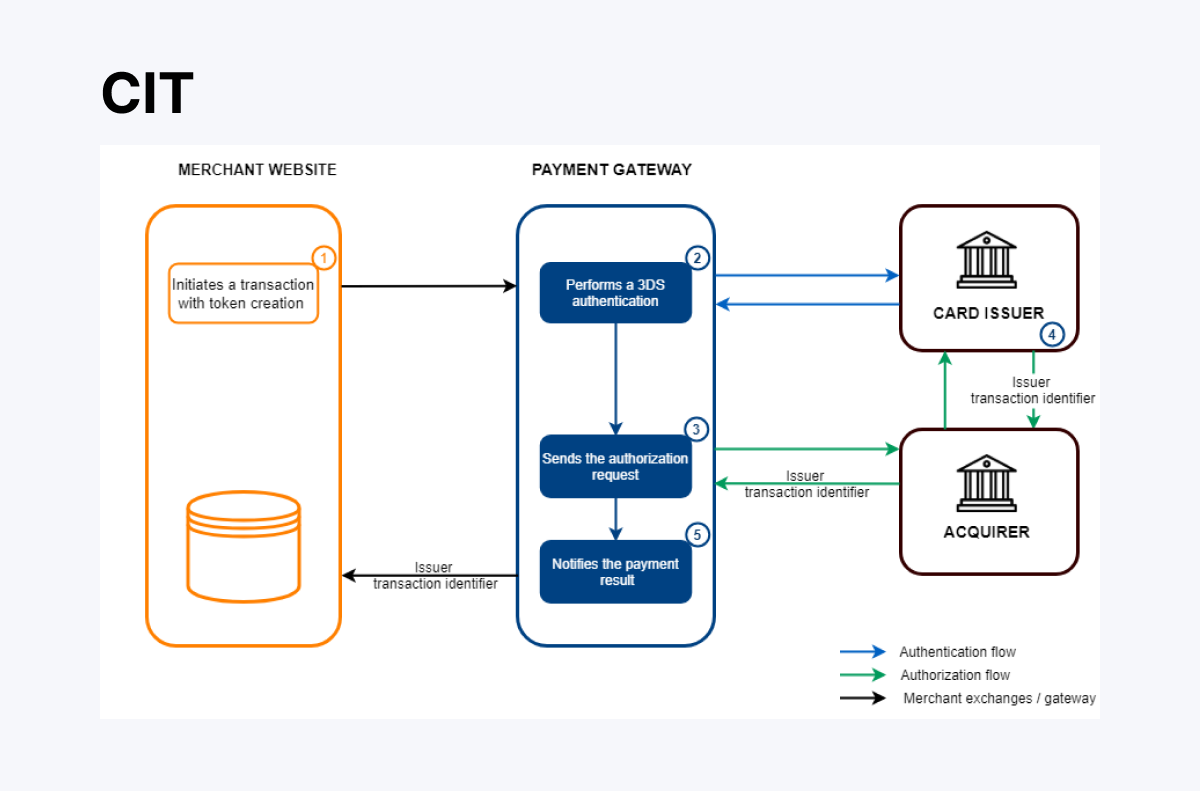

Payment tokenization is a delightful dance, alternating sensitive payment data with a secure, randomly generated token, ensuring transactions are processed safely without exposing actual card details. The process involves several key steps, each more thrilling than the last, to protect financial information and minimize fraud risks. 💃

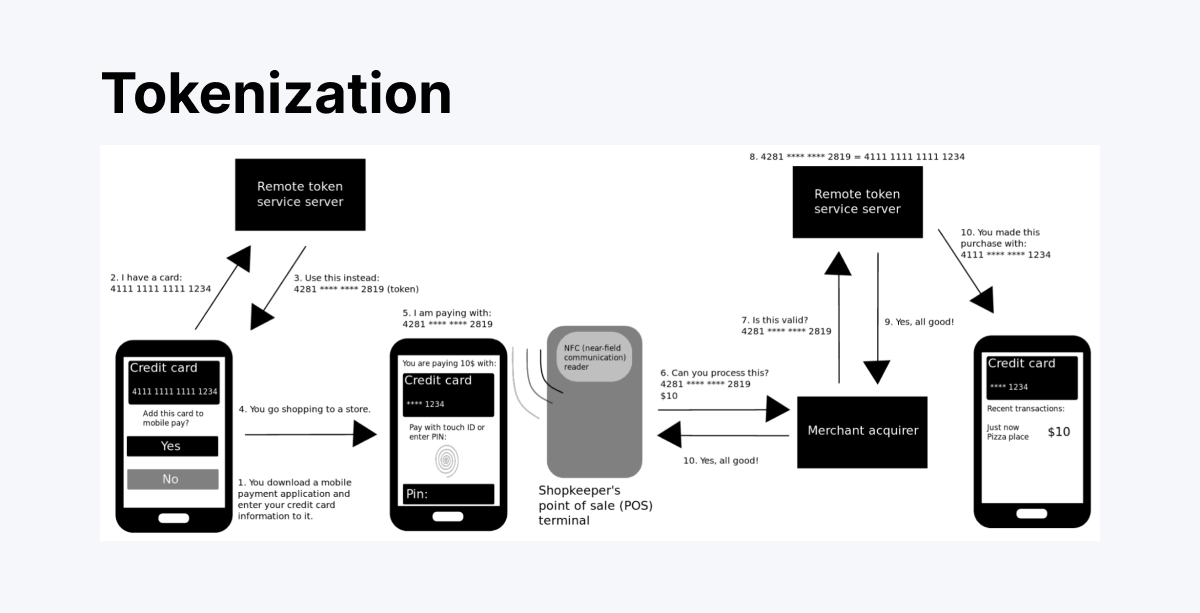

Initiating the Transaction

The grand performance begins when a customer enters their payment details—name, card number, expiration date, and CVV—into the system. Whether the payment is made online, in-store, or via a mobile wallet, the system detects the need to secure this sensitive data before proceeding. The entered payment details are then sent to a tokenization system, typically managed by a payment processor or a specialized service provider, like a backstage crew ensuring the show goes on! 🎭

Generating the Token

The tokenization system generates a unique token, a randomly created sequence of numbers and characters, which refers to the original payment data but has no value outside the system that birthed it. For instance, a card number like 5123 4567 8912 3456 may be replaced with a token such as TKN-8792-ABCD-4501—voilà! 🎉

Read More

- WCT PREDICTION. WCT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Michelle Trachtenberg’s Mysterious Death: The Unanswered Questions

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- Upper Deck’s First DC Annual Trading Cards Are Finally Here

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

2025-02-13 18:11