- In the aftermath of LINK‘s recent descent, a mere 24.96% of its holders find solace in profit, while a staggering 74.74% wallow in the depths of despair.

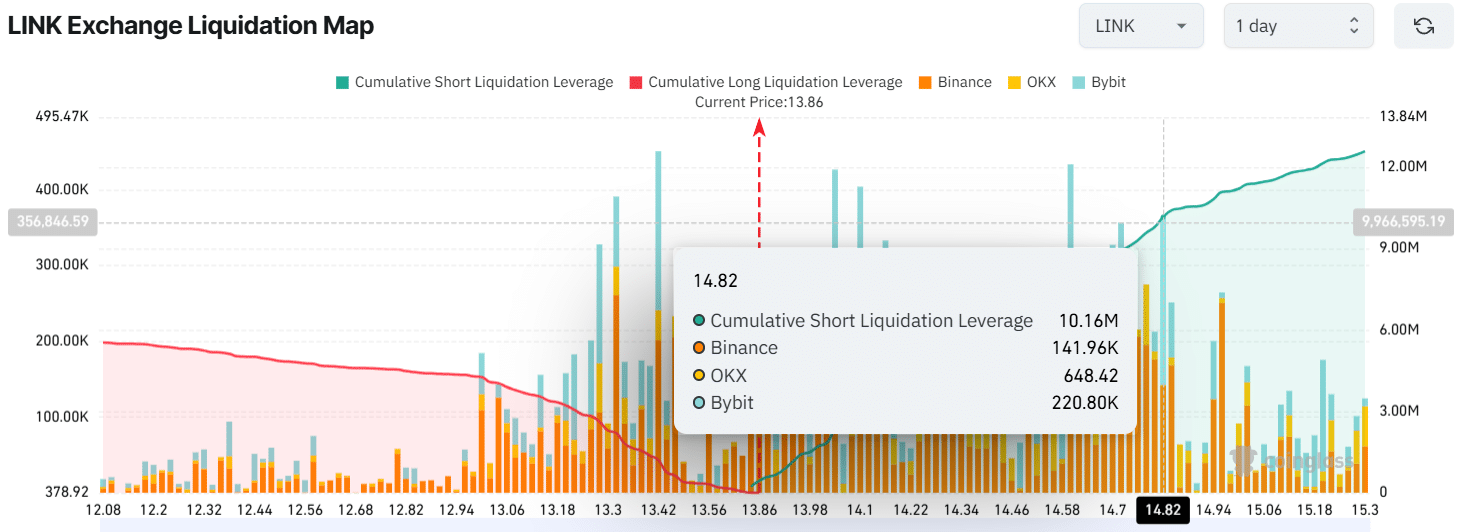

- Alas, intraday traders may have succumbed to the siren call of over-leverage, navigating treacherous waters at $13 on the low end and $14.82 on the high.

Ah, how the mighty have fallen! Following a steep 12% fall, Chainlink’s precious token bid adieu to that once-cherished support level of $14.85, a resting place for over 17,000 hopeful investors who had amassed an impressive 73.5 million LINK tokens like moths to a flame.

Yet, as the fates would have it, these holdings now shimmer ominously in the crimson light of loss, as revealed by the ever-watchful sages at IntoTheBlock.

75% of LINK investors see red

With a wretched farewell to the $14.85 sanctuary, LINK now braves further drops on the merciless charts. At this moment, the crypto flounders near $13.80, a disheartening decline of 12% in a mere 24 hours.

Moreover, in an equally tragic twist, its trading volume has dwindled by 15%, signaling a gallant retreat from investors and traders alike, reminiscent of soldiers fleeing from the battlefield.

Thus, in this bleak landscape, only 24.96% of LINK’s admirers remain in the land of profit, while a woeful 74.74% languish in the shadows of loss.

Chainlink (LINK) price action and key levels

According to the enigmatic musings of AMBCrypto’s analysts, LINK appears poised for yet more sorrowful descent following its breakout from a meager three-day respite between $15.85 and $14.85.

Should the asset close a daily candle beneath the $13.80 threshold, there exists a rather sinister chance it could tumble another 10% to graze the ominous $12.20 mark in the near foggy future.

Thanks to this relentless drop, LINK has seemingly become apprehensive of breaching the 200 Exponential Moving Average (EMA) on the daily scale, signaling it may be caught in a downtrend’s cruel embrace.

One mustn’t forget that the 200 EMA serves as an oracle, guiding fortunes toward uptrends or downtrends alike.

Intraday traders’ bearish nature

The pinnacle of evidence regarding the altcoin’s mournful outlook lies in the sheer dominance of intraday traders, with their short positions multiplying alarmingly, revealing a collective belief that the crypto’s phoenix-like rise is not imminent.

According to the wise sages at Coinglass, $14.82 stands as the weak foundation where traders clinging to short positions have amassed nearly $10.16 million worth of gloomy prospects. Meanwhile, those brave souls daring to go long appear exhausted, trapped at $13 with a meager $4.26 million clinging to hope.

These over-leveraged positions reveal the raw nature of market sentiment. As fate would have it, short traders may well expedite the descent to $13 or lower, liquidating the dreams of long holders without a second thought.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Cynthia Erivo’s Grammys Ring: Engagement or Just Accessory?

2025-02-28 16:12