- Global markets face turmoil, with cryptocurrencies and major stock indices experiencing severe declines.

- Arthur Hayes predicted that Japan’s yen fluctuations could boost cryptocurrencies.

As a seasoned crypto investor with over two decades of experience navigating global financial turbulence, I find myself standing at the crossroads of uncertainty and opportunity amidst this global bear market. The recent events have brought back memories of the 2008 financial crisis, where I learned that every downturn is an excellent time to reassess one’s portfolio and invest wisely for the future.

On August 5th, a significant shockwave swept through the world economy, causing many markets, such as Japan’s, to experience a serious decline.

In simpler terms, the change in market conditions significantly affected cryptocurrencies. Bitcoin [BTC] and various other digital currencies saw a significant drop – more than ten percent – due to increased caution among investors.

This dramatic decline in the crypto sector mirrored the broader financial instability.

In my analysis as a researcher, I’ve observed a staggering decline in Japan’s Nikkei index, which represents one of the steepest drops in recent decades. Similarly, European stock markets have taken a significant hit, recording their poorest performance in a span of two years.

Meanwhile, the Bombay Stock Exchange in India closed with a drop of over 2,000 points.

Neil Newman, the strategy head at Astris Advisory in Tokyo, voiced his worries about the matter to CNN.

“The incident was reminiscent of a collision. The atmosphere carried an odor reminiscent of 1987. Today was incessantly challenging. It was peculiar as there was no recuperation bounce at the close of the day, a phenomenon typically observed due to short-term hedging.”

Adding to the fray was, Andrew Lokenauth, who said,

What’s behind the global bear market?

It’s being discussed that the unrest in American financial sectors might have an impact on Japan’s economy.

In simpler terms, if you’re not already aware, the anticipated decision by the Federal Reserve regarding possible interest rate reductions in September is causing increased market turbulence. This instability has led to a broad selling off of stocks across various sectors.

Shedding light on the same, Japanese Central Bank Governor Kazuo Ueda said,

As a crypto investor, if the economic conditions and market trends align with our forecasts, I will persistently adjust my investment strategies to accommodate higher returns by increasing my crypto holdings.

A declining Yen could benefit Bitcoin

It’s worth noting that Arthur Hayes, a co-founder of BitMEX, offered an interesting viewpoint when suggesting that changes in the value of the yen might impact both technology stock prices and the relationship between U.S. debts.

Additionally, he suggests that should U.S. policy makers react to Japan’s interest rate adjustments in the manner he expects, such actions might potentially boost the cryptocurrency market.

As a crypto investor, I’ve observed that Hayes often links Japan’s economic shifts with cryptocurrency market fluctuations. In fact, I recall reading an insightful piece of his called ‘Easy Button,’ where he pointed out such connections.

“It seems reasonable to play The Chemical Brothers’ ‘Push the Button’ when the USDJPY pair significantly increases, reaching around 200.”

“The term ‘Chemical Brothers’ signifies the United States and Japan, whereas ‘Push the Button’ symbolizes the act of printing money or injecting liquidity into an economy.”

In this context, Hayes forecasted that a depreciation of the Japanese yen might instigate monetary disputes between Japan and China. Such tensions could prompt the United States to respond by lowering the value of its own currency, the U.S. dollar.

This could boost dollar-based assets and possibly spark a crypto boom.

What’s the present data telling us?

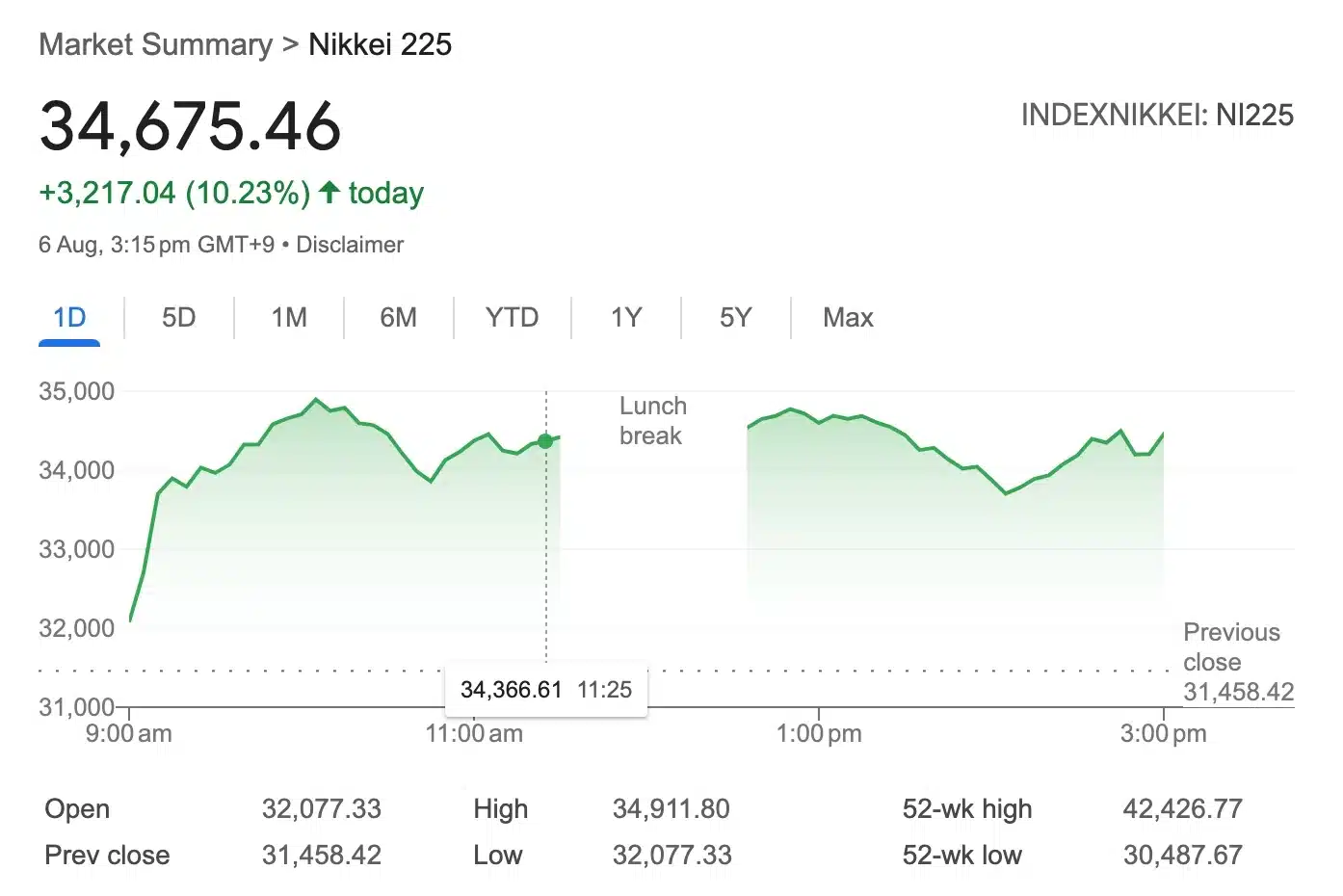

Currently, the Nikkei 225 is bouncing back strongly, increasing more than 10% only one day after suffering its steepest two-day decline ever recorded.

As a crypto investor, I’ve noticed an impressive surge in the global cryptocurrency market recently. The market capitalization has spiked significantly, reaching a staggering $1.95 trillion – that’s a 4.86% jump in just a day, according to CoinMarketCap.

These sudden changes emphasize the present instability within the economy, since financial markets are adjusting to potential Federal Reserve actions regarding interest rates.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-08-06 20:08