As someone who has been closely following the cryptocurrency market for years now, I find it intriguing to see how the landscape is constantly evolving.

As another seven days have flown by, it’s time once more to delve into the most significant happenings that influenced the crypto world over the past week. Last week’s discussion centered on BlackRock achieving a notable achievement, ETH ETF approvals, fresh launches in DeFi, and regulatory hurdles. However, this week offers a brand-new array of topics brimming with intrigue, which we simply can’t ignore!

So, let’s see what happened last week in crypto and discuss the latest cryptocurrency news.

Top Cryptocurrency News

1. Spot Ethereum ETFs Started Trading on the US Market

Summary

Spot Ethereum ETFs were approved by the SEC and started trading on July 23 in the US.

Details

Trade for the first Ethereum-based exchange-traded funds (ETFs) began on July 23, 2024, at 9:30 AM Eastern Standard Time (EST). The US Securities and Exchange Commission had approved the necessary documentation (S-1 filings), enabling eight different issuers to list their Ethereum ETF products.

On July 23, eight exchange-traded funds (ETFs) became available to users. These include Grayscale Ethereum Mini Trust (NYSE: ETH), Grayscale Ethereum Trust (NYSE: ETHE), Franklin Ethereum ETF (CBOE EZET), VanEck Ethereum ETF (CBOE: ETHV), Bitwise Ethereum ETF (NYSE: ETHW), 21Shares Core Ethereum ETF (CBOE: CETH), Fidelity Ethereum Fund (CBOE: FETH), and iShare Ethereum Trust (NASDAQ: ETHA). Additionally, there is the Invesco Galaxy Ethereum ETF (CBOE: QETH) on the list.

Source: The Block

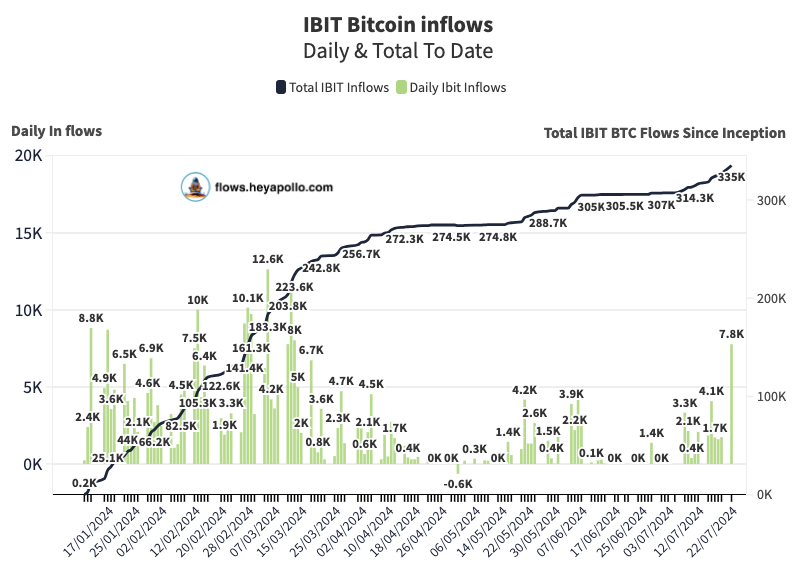

2. The BlackRock Bitcoin ETF Recorded the Biggest Inflow Since March

Summary

BlackRock’s BTC ETF reached a new milestone on July 22, when it had daily inflows of $523 million.

Details

On Monday, July 22, 2024, the Bitcoin spot exchange-traded fund (ETF) managed by BlackRock saw its largest single-day inflow in more than four months, with around $523 million being poured into the iShares Bitcoin Trust ETF (IBIT).

Following a prosperous day, the IBIT Bitcoin ETF’s assets under management (AUM) swelled to an impressive 333,000, translating to around $22 billion in total value.

Source: Cointelegraph

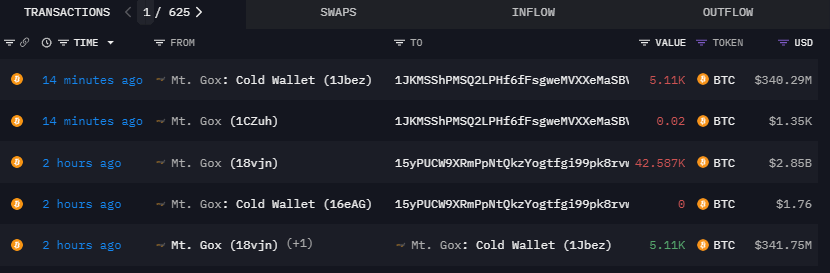

3. Mt. Gox Registered $3.2 Billion in Outflows in Two Hours

Summary

Mount Gox transferred approximately $3.2 billion in Bitcoin to two unidentified wallets, following their creditor repayment procedure.

Details

As a seasoned cryptocurrency investor with over a decade of experience in the digital asset market, I find the recent movements of the Mt. Gox exchange to be both intriguing and concerning. Having lost a significant portion of my investments in previous exchange hacks, I have always kept a watchful eye on the comings and goings of major players in the industry.

Over the past few transactions, approximately $3.2 billion worth of Bitcoin was transferred to two new addresses. This brings the total amount transferred to creditors since July 16 to an impressive $12 billion.

Source: FX Street

Top Crypto News – Markets

4. Nansen Launched an Ether ETF Analytics Dashboard

Summary

Financial analysis tool provider Nansen recently unveiled a complimentary dashboard for tracking Ethereum Exchange-Traded Funds (ETFs). This resource is designed to support investors in navigating the freshly introduced ETH ETFs.

Details

Nansen, a leading blockchain analysis company, has unveiled the inaugural Ethereum ETF (Exchange-Traded Fund) analytics interface. This innovative tool allows investors and cryptocurrency enthusiasts to track newly introduced Ethereum ETFs effortlessly. The user-friendly dashboard offers real-time insights into crucial data associated with the Ethereum exchange-traded funds, providing traders with a concise summary of these funds’ key details.

As a dedicated researcher delving into the dynamic world of cryptocurrency, I eagerly anticipate the launch of Nansen’s innovative dashboard, designed explicitly for investors navigating the recently authorized Ethereum Exchange-Traded Funds (ETFs). This groundbreaking tool promises to equip us with essential analytical resources, empowering us to traverse this new investment landscape with confidence and precision.

Source: The Crypto Times

Top Crypto News – DeFi

5. Gate.io Will Wind Down Services for Japan-based Customers

Summary

Gate.io has decided to cease its activities within Japan, following compliance directives issued by their governing authority.

Details

In simple terms, Gate.io, a well-known cryptocurrency exchange, has shared that it will cease operations for its Japanese users starting from a date mentioned on July 22nd. This decision stems from certain regulatory compliance requirements requested by the financial authorities of Japan. The platform plans to help these affected Japanese customers transfer their assets to another suitable platform.

Starting on July 22, Gate.io has stopped accepting new registrations from Japanese customers and plans to phase out additional services for them as well.

Source: Cointelegraph

6. Vitalik Buterin Introduced Circle STARKs for Blockchain Efficiency

Summary

Vitalik Buterin unveiled a fresh system designed to enhance both security and productivity.

Details

Vitalik Buterin, one of Ethereum’s co-founders, unveiled a novel cryptographic method known as Circle STARKs. The goal is to enhance both the security and efficiency of blockchain systems. By using smaller fields in cryptography, Circle STARKs will boost speed and decrease computational expenses without jeopardizing network safety.

Source: CryptoNews

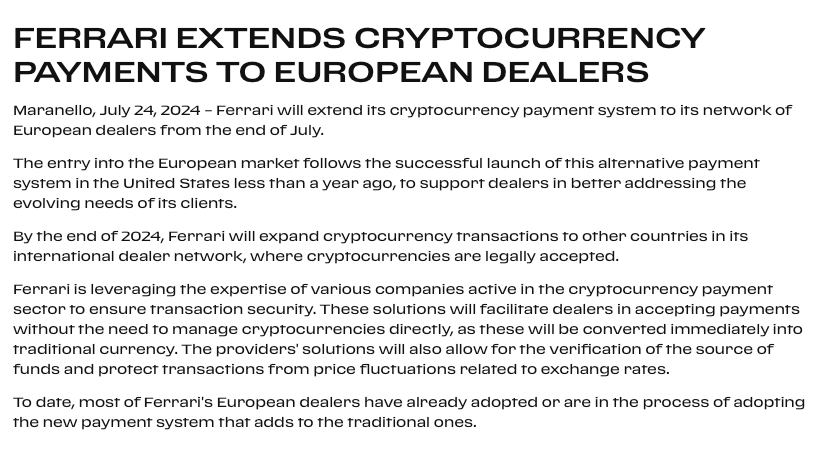

7. Ferrari Will Launch Crypto Payments in Europe

Summary

Ferrari has revealed plans to broaden its cryptocurrency payment options across Europe, following positive results from its implementation in the United States.

Details

Ferrari, a renowned Italian luxury sports car brand, has unveiled intentions to implement a cryptocurrency payment method across Europe by July’s close. Furthermore, they intend to expand their cryptocurrency transaction choices at their worldwide dealerships by the end of 2024.

On July 24, 2024, as stated in a public announcement, Ferrari plans to collaborate with several cryptocurrency payment providers to enhance transaction security and empower dealers to receive payments, bypassing direct management of digital assets.

Source: CryptoPotato

8. BitFlyer Acquired FTX Japan

Summary

Through a recent acquisition, BitFlyer has taken over FTX Japan. Their aim is not just to expand their services in Japan, but globally as well. This growth includes the introduction of Spot Exchange Traded Funds (ETFs), which they plan to launch in the near future.

Details

In simpler terms, well-known Japanese cryptocurrency exchange, BitFlyer, declared that it has purchased FTX Japan. This move makes FTX Japan a subsidiary of BitFlyer and part of its strategic plan to expand its services and venture into the world of spot Exchange Traded Funds (ETFs). From August 26 onwards, FTX Japan will operate under the BitFlyer Holdings banner.

Based on statements from BitFlyer, the cryptocurrency exchange plans to grow within Japan, with a commitment to providing sophisticated services and tools tailored for Japanese crypto users, enhancing their experience in the realm of cryptocurrencies.

Source: Cryptopolitan

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-07-31 01:01