Ah, the world of Bitcoin ETFs, where fortunes can change faster than a wizard can read a spell book! Just when one thought they’d seen it all, lo and behold, a hefty $221 million decided it wanted to frolic with ARKB and FBTC, while poor Ether ETFs slumped dramatically, clutching their $51 million outflow like a rejected magical potion. 🪄💸

Bitcoin ETFs: From Dust to Dollars!

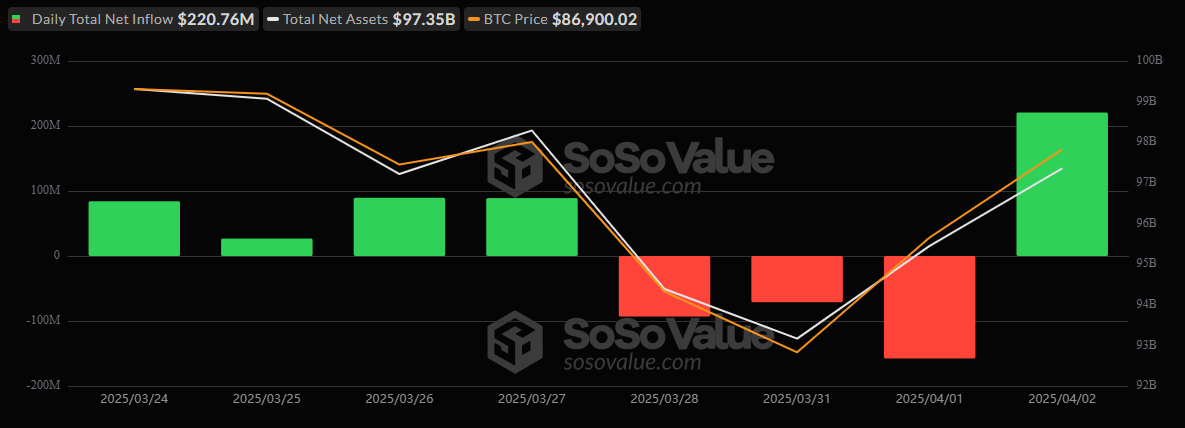

After a brief but embarrassing three-day hiatus where Bitcoin exchange-traded funds (ETFs) decided to go on an outflow binge, they bounced back with the force of a caffeinated troll on Wednesday, April 2. In an impressive show of ‘take that,’ they reeled in a whopping $220.76 million—because apparently, everyone missed Bitcoin a little too much. 📈✨

This magnificent comeback can be largely attributed to the sprightly Ark 21Shares’ ARKB, which cheerfully caught $130.15 million in its nets, while Fidelity’s FBTC added a bit of its own fairy dust with $118.79 million. Even with Blackrock’s IBIT trying its best to disappear with a stellar $115.87 million exit, the general vibe was fully upbeat, like a bard on a good day. 🎉

Other friendly ETFs joined the revelry as well, with Grayscale’s BTC joyfully adding $34.28 million, and Bitwise’s BITB bringing an extra $33.38 million to the feast. Franklin’s EZBC, like the underdog hero, scrapped together $10.01 million, while Vaneck’s HODL and Valkyrie’s BRRR rounded up the festivities with a shy $7.33 million and $2.69 million. Who knew the support staff could be so generous? 🍕😄

By the close of trade, Bitcoin ETFs boasted a whopping trading volume of $2.51 billion, as assets magically rebounded to $97.35 billion. Take that, negativity! 💪

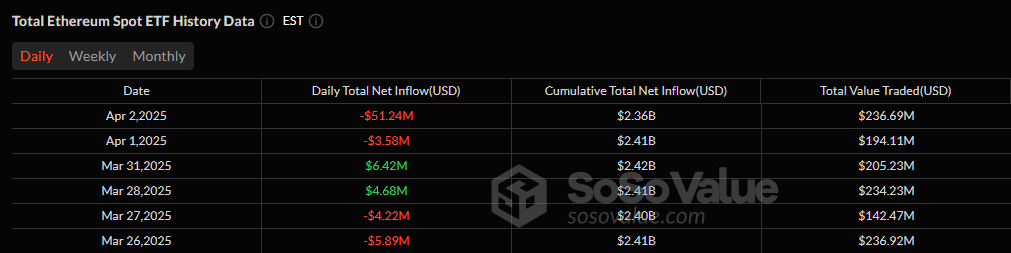

Now, in the not-so-charmed corner of the kingdom, we have the Ether ETFs, who, it seems, have been on a bit of a downer, with a sob-worthy $51.24 million outflow. Grayscale’s ETH fund led this tragic parade, waving goodbye to $31.08 million, while Blackrock’s ETHA managed to lose $20.17 million, in a truly grand exit – worthy of a Shakespearean play! 🎭

The remaining ether ETFs, bless their stagnant hearts, exhibited no remarkable activity of their own. Trading volume for the ethers dragged themselves to $236.69 million, as net assets dipped down to an embarrassing $6.49 billion. One wonders if they cried into their pillows last night… 😢💤

As markets chew over these whimsical inflows and outflows, the big question looms like a particularly cantankerous goat: can Bitcoin ETFs keep their sparkle and pizzazz, or will the Ether ETFs stage a dramatic comeback worthy of the finest tales ever told? 🍿🎇

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

2025-04-03 14:57