- The Root Network surged 20% in one day amid broader market volatility, capturing stakeholders’ attention.

- What led to this extraordinary feat?

As a seasoned crypto investor with over a decade of experience navigating the digital asset landscape, I must admit that the recent 20% surge of The Root Network (TRN) has piqued my interest significantly. What caught my attention wasn’t just the impressive price movement amidst broader market volatility, but rather the unique factors driving this growth.

In the last day, the Root Network (TRN) has been drawing notice due to a number of notable actions, causing its native currency, ROOT, to climb roughly 20%. At this moment, the price stands at around $0.02435.

Analysts at AMBCrypto were intrigued by the outstanding results, even amidst wider market fluctuations, as they delved into the reasons driving this rise.

The surge is rooted in a multichain agenda

An increase in developer engagement on the fundamental network makes it stand out among other tokens that are faltering during Bitcoin‘s dip.

Initially, the combination of Root and Futureverse, along with Gen3 gaming platforms, is igniting the upcoming era of the digital economy. This new phase emphasizes the development of artificial intelligence (AI) in the context of blockchain technology.

As an analyst, I find it’s no wonder that our focus lies on enhancing interoperability within the open metaverse. We’re effectively mapping out a roadmap for the future, paving the way for seamless experiences across various platforms.

Moreover, the collaboration between XRPL (XRP Ledger) and TRN (The Reserve Network) enables XRP to be utilized as the standard digital currency for transactions within TRN’s multi-token transaction fee system.

Additionally, over time, the network has expanded its reach, integrating fresh symbols like ROOT, ASTO, and SYLO for accessing a variety of services.

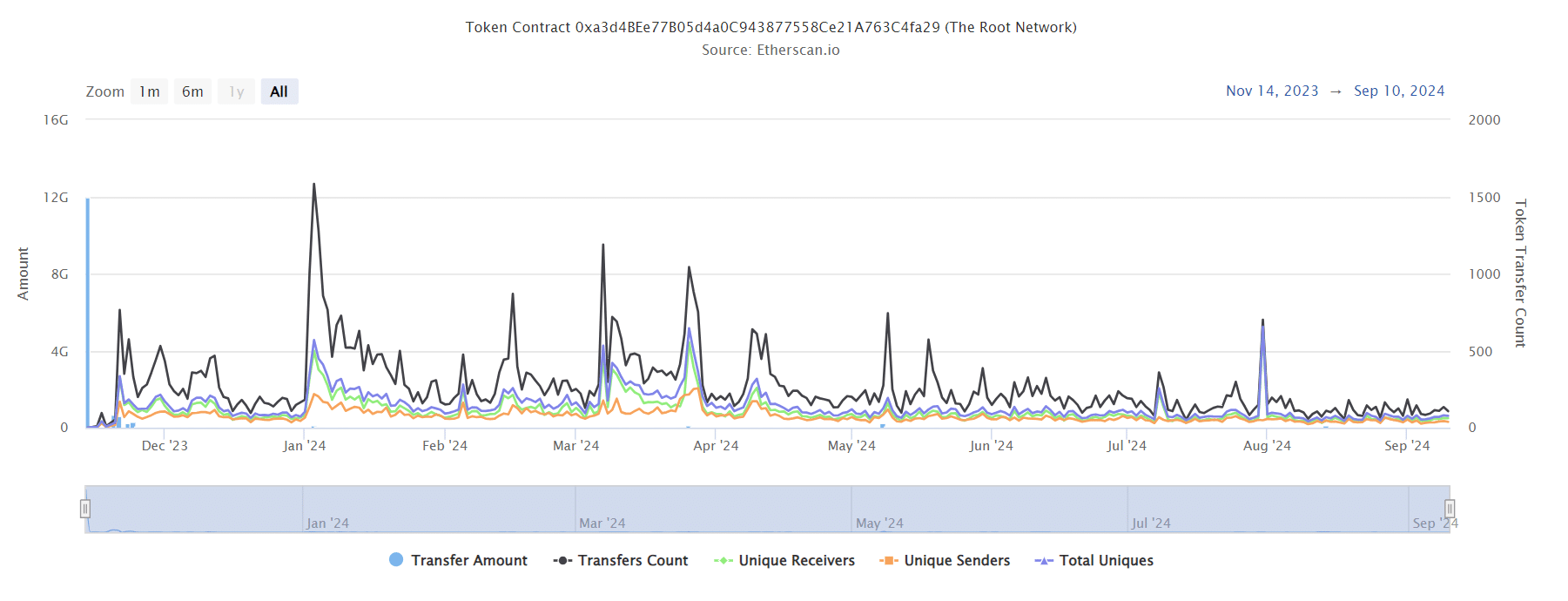

Source : Etherscan

The graph presented demonstrates how these listings influenced ROOT, as its transaction volume spiked to approximately $137 million earlier in the year.

Nevertheless, the pace of activity appears to have decreased significantly, standing at approximately $4.4 million as we speak. Yet, this recent uptick in activity has sparked renewed enthusiasm among investors. However, one may wonder if this momentum will continue.

The Root Network draws new interest

The recent ROOT surge is distinctive, fueled by unique factors rather than Bitcoin’s bullish appeal.

The developers’ numerous innovations within the network have clearly yielded significant rewards.

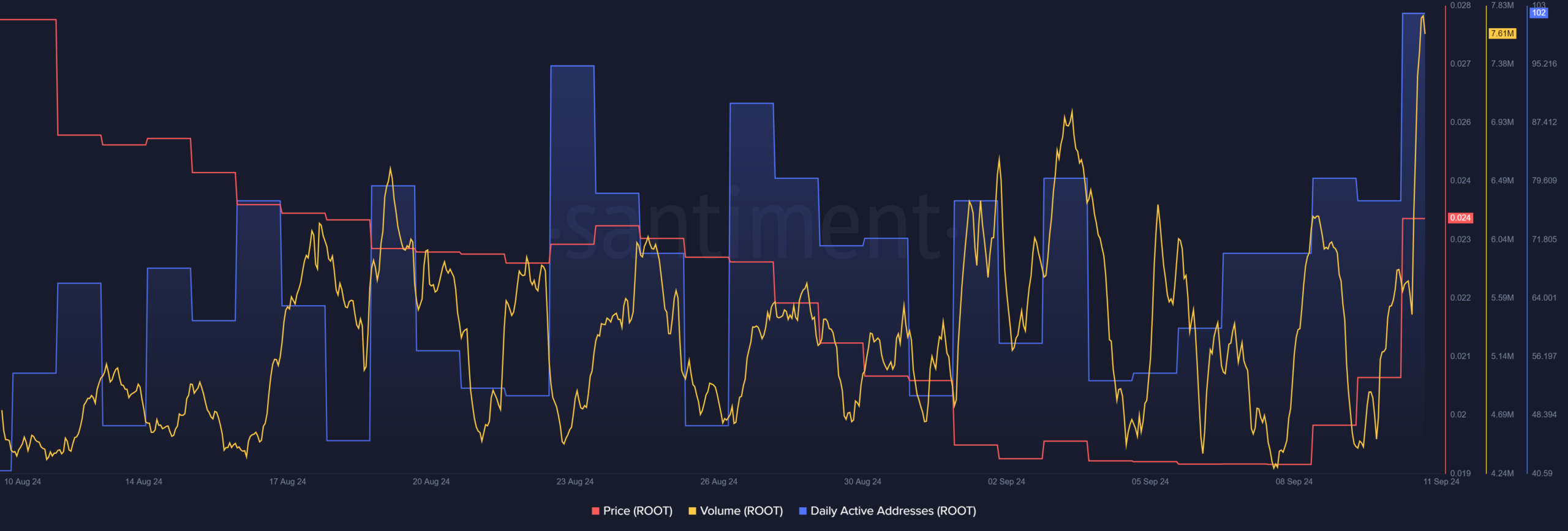

Source : Santiment

It’s clear that the network has been successful in drawing in new participants, as indicated by the significant increase in daily active addresses.

Boosting the positive sentiment, the total volume has bounced back to where it was around mid-August, a time when ROOT reached its peak at $0.027.

Additionally, it might be leveraging Bitcoin’s volatility, setting itself apart through a carefully designed Tokenomic structure.

The model intends to share its 12 million ROOT tokens as incentives among different communities, making the most of its efficient staking features.

In summary, even though the market is experiencing a slump, the foundation of our network has grown an incredibly strong community, as demonstrated by its 20% increase in price.

If the trend persists, ROOT could soon revisit its previous $0.27 peak.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-09-12 05:12